Having bad credit can be a nightmare. If your credit is making it impossible to get new loans or even impairing your search for an apartment or job, then wiping your credit history clean might sound like the perfect solution.

Read on to learn whether it’s possible to erase your credit report and what the best approaches are to get rid of the negative information that’s bringing down your credit score.

Table of Contents

Can you completely erase your credit history?

No, unfortunately, it’s impossible to completely erase your credit history, and you can’t pay the credit bureaus to restart with a new credit report.

If you have a lot of negative information on your credit file, the thought of getting a fresh start might be appealing, but the credit bureaus that create your report don’t offer any way to do this.

Will declaring bankruptcy wipe your credit history clean?

No, the idea that declaring bankruptcy will wipe your credit history is a pervasive credit myth. Although you can get your outstanding debts deferred or discharged in bankruptcy (making it possible to clear debts that you’d never have been able to pay off), it doesn’t remove any items from your credit report at all.

In fact, not only does bankruptcy not clear your credit history, it will be recorded on your credit report itself. Bankruptcy is one of the most damaging marks you can receive, so you should be prepared for a drop in your credit score—not an improvement.

All of this might sound grim, but there’s still hope. It might not be possible to start completely fresh with a blank credit report, but you can still try to remove the items that are bringing your score down the most.

Try the 5 methods below to clear items from your credit report without declaring bankruptcy.

1. Dispute negative marks on your credit report

If the derogatory marks on your credit report are errors—for instance, if the credit bureaus or your lender confused you with someone else—then the good news is that you can dispute the items in your credit history to get them erased.

Disputes can also work for accurate negative items, although this is less likely to succeed. Your chances will be better if you’re trying to erase very old marks or debts that have been transferred between multiple debt collection agencies, because your debt collector might have lost track of the documentation proving that you actually owe the debt.

You’ll need to submit a separate dispute for each negative mark you want to remove and contact each credit bureau separately. Use the template below to create your dispute letter.

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

What happens after you send your letter?

The credit bureaus will have 30 days to resolve the dispute. If they can’t verify that the information is correct, they’ll have to erase it from your credit history in accordance with the Fair Credit Reporting Act (FCRA). 1

You can find the contact information for the three main credit bureaus in the table below:

Where to send your dispute letter

| Experian | Equifax | TransUnion | |

|---|---|---|---|

| Where to send your dispute letter | Experian P.O. Box 4500 Allen, TX 75013 | Equifax P.O. Box 740256 Atlanta, GA 30374-0256 | TransUnion Consumer Solutions P.O. Box 2000 Chester, PA 19016-2000 |

| What you’ll need to send | |||

| Dispute online | Experian's online dispute form | Equifax’s online dispute form | TransUnion’s online dispute form |

2. Ask for a goodwill deletion

If you have good relationships with your creditors, then you may be able to talk them into clearing your credit history of delinquencies and late payments by sending them what’s known as a goodwill letter.

This method is a long shot, but it costs nothing to try, which makes this one of several ways to wipe your credit clean for free. Create your letter using this template:

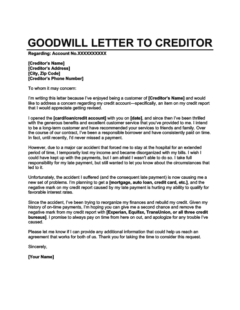

Goodwill Letter to Creditor

Use this goodwill letter template to ask for a goodwill deletion from one of your creditors. Remember to customize it to your circumstances for the best possible chance of success.

When you ask for a goodwill deletion, you’ll need to explain to your lenders why you fell behind on your payments and how the black marks on your credit history are negatively affecting your life.

You should also reassure them that you take your debt obligations seriously and that you won’t make the same mistake again.

3. Negotiate pay for delete

It’s possible to pay to wipe a black mark from your credit report through a process known as pay for delete.

Creditors and debt collectors don’t usually advertise this, but they have the power to “unreport” negative entries in your credit history, such as delinquencies and late payments.

To get them to do this, you offer to pay an old (and overdue) debt that you otherwise wouldn’t have paid.

This approach is particularly effective for removing collection accounts from your credit report. All you need to do is find out what debt collection agency you owe money to and send them a pay-for-delete letter.

Pay for Delete Letter to Collector

Use this pay for delete letter template to ask a debt collection agency to remove a collection account from your credit report. Pay for delete works best on old debts in collection, so this is the scenario the strategy is most suited to.

You can either offer to pay the debt in full or propose pay for delete as part of a debt settlement offer during your negotiations with debt collectors.

4. Sign up for a credit-wipe service

If you don’t have any luck with the approaches mentioned above for removing negative items on your own, then consider hiring a credit repair professional or collections removal expert.

A credit repair expert may be able to scrub your credit clean by putting pressure on your creditors, debt collectors, and the credit bureaus.

As you’d expect, this method costs money. In many cases, credit repair companies operate on a subscription model, which means that the costs of credit repair are calculated on a monthly basis. You can expect to pay between $50–$100 per month, and credit repair often takes up to 6 months, so make sure your budget can accommodate this before you commit.

You should also be wary of scammers. Legitimate credit repair companies will be upfront that there’s no guarantee about whether credit repair will work (it’s ultimately up to the credit bureaus and your creditors), and they shouldn’t ask for large fees upfront. If they do, look for a different company.

Avoid credit repair companies selling credit privacy numbers (CPNs)

Some credit repair companies advertise that they can magically erase your bad credit if you buy a credit privacy number (CPN) or Individual Taxpayer Identification Number (ITIN). This is illegal. 2 In fact, using a CPN or new Social Security number to erase your credit history illegally could land you in federal prison. 3

5. Wait it out

Your final option for wiping your credit history clean is to stop using credit and wait for all the negative entries to fall off your credit report on their own. As mentioned, this will take 7 years for most negative items and 10+ years for certain types of bankruptcy (chapters 7, 11, 12, and 13). 1 4

While this might not be the most appealing option if you want to erase your bad credit instantly, it’s the easiest one, since you won’t need to file credit disputes, negotiate with debt collectors, or hire a credit repair expert. All you need is patience.

Alternative ways to fix your credit

Instead of trying to wipe your credit history completely clean, you can fix your credit by enriching your credit file with positive information to balance out the negative marks.

This will show future lenders that you’ve learned from your mistakes and can be trusted with credit cards and loans in the future.

To fix your credit, start by doing the following:

Get current on your credit accounts

Even if you can’t wipe your credit history clean, you take steps to prevent further damage in the future. Start by catching up on any missed payments you have and setting up a repayment plan if you can’t afford to get current.

Get out of debt

Use tried-and-tested approaches for getting out of debt, such as the debt snowball method and avalanche method. Prioritize getting out of credit card debt, as it tends to be high-interest and hard to pay off. If you can’t pay, ask your creditors whether they offer any hardship programs, and explore ways to deal with debt collectors when you can’t pay.

Use credit-building tools

Even if you have a bad credit score, you can counter bad credit by getting a secured credit card or credit-builder loan, becoming an authorized user on someone else’s credit card, or using a service like Experian Boost to add everyday bills to your credit reports.

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Secured Overall | 300–669 | $0 | Cashback Match | ||

| No Credit Check | 300–669 | $35 | |||

| Beginners | 300–669 | $25 | |||

| No Annual Fee | 300–669 | $0 | |||

| Bad Credit | 300–669 | $49 | |||

| Rebuilding Credit | 300–669 | $0 | |||

Monitor your credit

Monitor your progress in rebuilding your credit by checking your credit reports and credit scores regularly. You can get your free credit reports from AnnualCreditReport.com and get your credit score from FICO, the credit bureaus (Equifax, Experian, and TransUnion), or a third-party credit monitoring company.

Don’t worry if you can’t completely wipe your credit clean. Rebuilding your credit takes time, but you’ll eventually get back on track as long as you take steps to fix problems with your credit history, educate yourself about how credit works, and ask for help when you need it.

Takeaway: You may be able to wipe your credit clean, but it’ll take time and effort, and there’s no guarantee of success.

- The main ways to erase items in your credit history are filing a credit dispute, requesting a goodwill adjustment, negotiating pay for delete, or hiring a credit repair company.

- You can also stop using credit and wait for your credit history to be wiped clean automatically, which will usually happen after 7–10 years.

- To avoid jail time, never try to erase your credit history illegally using a credit privacy number, Individual Taxpayer Identification Number, or new Social Security number.

- As an alternative to erasing your credit history, consider taking steps to fix your credit by working with your current creditors and adding positive information to your credit reports.