Bad credit is more than just a low credit score or troubled credit history—it’s a black stain on all your credit applications that signals to lenders that you can’t be trusted. It can even affect other areas of your life, such as your search for a job or apartment.

Thankfully, no one has to settle for poor credit. There are steps you can begin taking right now to achieve a good credit score and get access to the loan offers and terms you deserve.

Table of Contents

- 1. Check your credit report and dispute any errors you find

- 2. Negotiate with your creditors to remove negative items from your credit report

- 3. Get a credit-builder loan

- 4. Pay down your current debts (especially on your credit cards)

- 5. Add positive information to your credit file

- 6. Get help fixing especially bad credit

- 7. Practice good credit habits going forward

1. Check your credit report and dispute any errors you find

Mistakes on your credit report can pull your score down significantly, and getting them removed can immediately undo the damage. For instance, one study found that 5% of consumers’ credit scores increased by more than 25 points after a bureau removed an error on their report. 1

For this reason, it’s important to check your credit reports from the three nationwide credit bureaus (Equifax, Experian, and TransUnion) at least once per year for errors. 2

Get a free copy of your credit report from the credit bureaus

You can usually visit AnnualCreditReport.com to download one free copy of your credit report from each of the bureaus every year. However, in response to the COVID-19 pandemic, the bureaus are offering free weekly credit reports until the end of 2022.

To dispute errors on your credit report, write a letter to the credit bureau that produced it explaining why you think they made a mistake. If you can, include evidence to support your claim (e.g., if you have a late payment, look to see if you have bank records proving that you actually paid it on time).

Generally, the bureau will be required to investigate your claim within 30 days. They’ll remove the negative items from your credit report if they can’t verify them. 3

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

If you think the error might have originated with your original creditor instead of the credit bureaus, you should also send them a dispute letter as well.

Illegitimate credit inquiries and late payments are likely to have originated with your creditor, whereas cases of mistaken identity (someone else’s accounts getting reported as your own) are more likely to be an error on the credit bureau’s part.

2. Negotiate with your creditors to remove negative items from your credit report

The method described above is a good way to remove genuine errors from your credit report. However, while creditors and other data-furnishing companies are obligated to remove inaccurate items once you dispute them, they’re under no obligation to remove accurate derogatory marks.

With that said, there are a couple of ways you may be able to convince your creditors to remove them. It’s not a sure thing, but it’s possible, at least if you’re willing to spend some time negotiating.

Send a goodwill letter

It’s sometimes possible to get a creditor to remove a negative mark from your credit report as an act of compassion.

If you had good reasons for missing payments on the credit account in question (e.g., unexpected medical expenses that left you financially struggling), you may be able to appeal to their sense of decency and persuade them to “unreport” the negative marks by sending something called a goodwill letter. For this to work, you need to have already caught up on the missed payments on the account.

Use the template below to create your letter. Remember to be polite and explain your circumstances clearly.

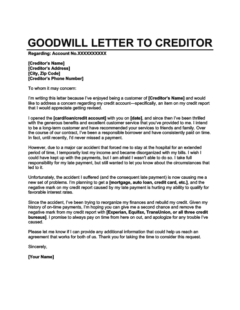

Goodwill Letter to Creditor

Use this goodwill letter template to ask for a goodwill deletion from one of your creditors. Remember to customize it to your circumstances for the best possible chance of success.

Try pay for delete

Pay for delete is a credit repair strategy that can clear negative marks associated with debts that you still owe. Essentially, you offer to pay off the debt in question in exchange for the data furnisher clearing your credit report of the associated negative mark.

People often use this tactic when negotiating with debt collectors, but you can also try it on your creditors. For this to work, you’ll need to send whoever owns your debt (i.e., your original creditor or a debt collection agency) a pay-for-delete letter.

Use the template below to create your letter if you’re dealing with a debt in collection:

Pay for Delete Letter to Collector

Use this pay for delete letter template to ask a debt collection agency to remove a collection account from your credit report. Pay for delete works best on old debts in collection, so this is the scenario the strategy is most suited to.

You don’t necessarily need to have lots of money to try pay for delete. If you can’t afford to fully pay off the debt, then you can also negotiate pay for delete as part of a debt settlement.

3. Get a credit-builder loan

You may already be aware of one major dilemma that comes with having less-than-stellar credit: it can be pretty difficult to start over by opening new credit accounts. Thankfully, credit-builder loans were developed as a solution to this problem.

If you’re in a good financial position (meaning you’re not struggling to get out of debt), then taking out a credit-builder loan is a good way to showcase your ability to keep up with your bills.

These loans often have minimal or no credit score requirements. Your payments will be reported to the credit bureaus. Over time, this gives you the chance to build up a record of responsible credit use, which will boost your credit score.

It’s worth noting that, unlike other loans, credit-builder loans don’t actually give you access to cash. In fact, you won’t technically be borrowing any money at all. Instead, you’ll receive your own money (i.e., the loan payments), but only at the end of the repayment period.

In many ways, a credit-builder loan is like a savings account that you regularly deposit money into (but one that boosts your credit every time you do).

4. Pay down your current debts (especially on your credit cards)

In general, the less outstanding debt you have on your credit cards, the higher your credit score will be.

The percentage of your available credit that you’re using is known as your credit utilization rate. Both of the major credit scoring models (FICO and VantageScore) put a lot of emphasis on your credit utilization during the credit score calculation process. This makes it a key area to target when trying to fix your credit.

As the illustration below shows, many experts recommend using under 30% of your available credit, although a single-digit utilization rate is even better. 4

Credit Card Spending Thresholds

If high credit card balances are dragging your credit score down, then you should explore these solutions for lowering your credit utilization ratio:

- Spend less on your credit cards: Lowering your credit card balances (or paying off your credit cards entirely) will usually increase your credit score.

- Increase your credit limit: If you regularly need to use a lot of credit, consider asking your card issuer to increase your credit limit. Getting a credit increase can help your credit by reducing your utilization rate, even if your actual balance (the amount you owe) stays the same.

- Open a new credit card: Similarly, you can open a new credit card to increase your available credit and reduce your utilization rate. (However, doing so may have mixed results; it will also lower the length of your credit history, temporarily damaging your score.)

- Take out a debt consolidation loan: Using a debt consolidation loan to consolidate your credit card debt will bring the utilization rate down to 0% on each card. However, debt consolidation may not work if you have a bad credit score since you’ll probably find it difficult to qualify for a loan with acceptable terms.

5. Add positive information to your credit file

Fixing your credit isn’t just about dealing with negative marks in your credit history. In addition to doing damage control, you should be exploring ways to enrich your credit file with positive information.

Here are a couple of ways to counter negative items with a positive credit history:

- Become an authorized user: If you have a family member who has good credit, consider asking them if they’ll add you as an authorized user on their credit card. Being an authorized user can raise your credit score immediately by adding the primary cardholder’s full payment history to your credit report.

- Self-report your bill payments: Consider signing up for Experian Boost to get your payments toward your regular bills (like utilities, your cell phone service, and streaming services) added to your credit report. You can also get credit for rent payments using a service like RentReporters or Rental Kharma.

Boost your credit for FREE with the bills you're already paying

Boost your credit for FREE with the bills you're already paying

- Experian Credit Report and FICO® Score updated every 30 days on sign in

- Instantly increase your credit scores for FREE with Experian Boost™

- Daily Experian credit monitoring and alerts

6. Get help fixing especially bad credit

If you’re feeling overwhelmed, ask for help. Here are some people and organizations that may be able to help you fix your credit:

Your creditors

Always be honest with your creditors when you’re struggling. If you have a good reason for falling behind on bill payments, they may be willing to adjust your repayment terms to prevent further damage to your credit or even erase negative marks you already have.

Credit counselors

Credit counseling is a service provided by dedicated credit counseling agencies, which are often run as nonprofits. This service, which is also known as debt counseling, won’t undo damage to your credit, but it can help you prevent credit problems down the line.

Credit counseling agencies can provide you with the information and resources you need to gain control over your finances. They can even enroll you in a type of program known as debt management that will help you get out of credit card debt.

Credit repair companies

If you’re feeling overwhelmed, you can hire a professional credit repair company. While they probably won’t be able to erase valid negative information or turn a bad credit score into a good score overnight, credit repair companies can save you time (and stress) by filing disputes and negotiating with creditors for you.

However, credit repair companies do come with downsides, most significantly that they can’t do anything that you can’t do on your own. It’s possible to remove negative items from your credit report yourself, and the cost of credit repair can get pretty high.

Never pay a credit repair company upfront

According to the Credit Repair Organizations Act (CROA), credit repair is only legal if the company provides a service before they request payment. Avoid companies that require payment upfront because they might be trying to scam you.

7. Practice good credit habits going forward

The only way to ensure that your credit stays fixed in the long term is to practice good financial habits. This includes understanding how different actions can impact your credit score and making sure you adopt good credit behaviors.

Establish a good payment history

Your payment history is the single most important factor affecting your credit score. It has the power to both hurt and help. While a single 30-day late payment could knock more than 80 points off your FICO score, several months of on-time payments can also lead to a gradual increase in your score. 5

Consistency is key for improving your credit score. Follow these tips to build and maintain a good payment history:

- Be proactive: If you think you might miss an upcoming bill payment, contact your lender as soon as possible. They might be willing to reduce the minimum payment required or postpone the due date. After all, they don’t benefit from you falling behind on payments any more than you do.

- Don’t give up if you miss a payment due date: Lenders generally don’t report late payments to the bureaus until they’re 30 days or more overdue. 6 This means that if you miss a payment but you catch up on it quickly enough, it won’t hurt your credit score (although there may be other consequences, like late fees).

- Set up autopay: If you haven’t done so already, consider automating your bill payments. This will benefit you in two ways: by ensuring you never miss a payment due date and by removing the stress of having to remember to pay and manually submit your payments.

Only open new credit accounts when you need them

Although adding new information to your credit file is an important part of rebuilding your credit, you should only apply for new loans or credit cards you really need. Taking on new debt obligations always comes with risks, and you want to avoid having those accounts work against you by making it difficult to manage all your bills.

In addition, applying for new credit may actually cause a temporary drop in your credit score by triggering a hard inquiry and lowering the average age of your credit accounts. 7

Be patient

If your credit isn’t in good shape but you want access to a new line of credit right now, it can be tempting to look at loans and credit cards for bad credit. However, you should be cautious with these offers. They often come with high interest rates and unfavorable terms, which could cost you more money and make it harder to pay your bills.

To avoid getting trapped in a cycle of debt and putting your credit at risk, it’s best to do what you can to improve your credit score right now and wait until your credit score has recovered before you open new credit accounts.

How long does it take to fix your credit?

The amount of time it’ll take to fix your credit depends on the severity of the negative items that are on your credit report. In general, the amount of time it takes to repair your credit is greater after more severe credit damage.

Although most negative items remain on your credit reports for up to 7 years (10 years in the case of certain bankruptcies), their effects diminish over time. Typically, most derogatory items won’t have much effect on your credit score after 2 years. 8

This means that if you avoid incurring further negative marks, your score will gradually increase over time, and you’ll eventually be able to enjoy all the benefits of having a good credit score.

Takeaway: Fixing your credit may take time, but it's worthwhile for access to the benefits of good credit.

- You can fix your credit right now by disputing errors on your credit report, asking creditors to remove negative marks, lowering your credit utilization rate, and adding positive information to your credit file.

- Other ways to fix your credit include taking out a credit-builder loan and getting professional help from a qualified credit counselor or credit repair company.

- To establish and maintain good credit in the long term, always pay your bills on time, keep your old credit accounts open, and only open new accounts when you need them.

- How long it'll take to fix bad credit depends on your credit history, how badly your credit was damaged, and how long it's been since your credit score dropped.