Having debts in collections is many people’s worst nightmare. Collections can stay on your credit report for many years and drag down your credit score, and in extreme cases, debt collectors can even garnish your wages.

The good news is that if you play your cards right, you might be able to get your debt collectors off your back by just making a partial payment. Read on to learn how.

Table of Contents

- 1. Make sure the debt is valid

- 2. Find your leverage

- 3. Don’t let debt collectors violate your rights

- 4. Figure out how much you can afford

- 5. Know how much debt collectors will settle for

- 6. Know what NOT to say

- 7. Get everything in writing

- How to prevent debts from going to collections in the first place

When you completely clear your debts for less money than you actually owe, it’s called a debt settlement. If your debts in collection are putting you in a financial bind, a settlement can be a lifesaver, but you’ll have to actively negotiate for one—your debt collector won’t just offer one.

When you deal with your debt collectors, use these 7 negotiation strategies:

1. Make sure the debt is valid

Before you even start negotiating, it’s crucial to check that the debt is actually yours. If it isn’t, you don’t have to pay it at all.

The easiest way to confirm the validity of your debt is by checking your debt validation notice, which the debt collection agency should’ve sent you within 5 days of first contacting you. This notice should have included the following information: 1

- The amount you owe

- The name of your original creditor

- The steps that you can take to dispute the debt if you believe it isn’t yours

If you didn’t receive this information, contact the collector and request it. Inform them that it’s your legal right to receive it and you won’t talk to them until you do.

What to do after receiving your validation notice

After you receive the notice, call your original creditor and confirm that they actually sent your account to the debt collection agency that’s contacting you. You should also take a minute to check that your debt collector is legit. You can do this by looking them up in this list of debt collection agencies.

Once you’ve done that, write back to your debt collector and demand debt verification, which you can do using the template below. This forces your debt collector to provide further evidence that you owe the debt (even more than they had to provide in the validation letter).

If they’re not able to provide this—which can sometimes happen even if your debt is valid, e.g., if they simply lost your paperwork—they’ll have to stop trying to collect the debt, all without you having to pay them a cent.

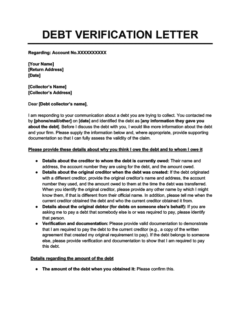

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

2. Find your leverage

If your debt collector is able to verify the debt, you can move forward with negotiating a debt settlement.

You’ll be able to get a better deal if your debt collector thinks you probably won’t pay the debt otherwise. You have more negotiating power if your debt is either:

- Large: If the debt is unusually large, then your debt collector has a lot more to lose if you don’t pay. They also know that it’ll be harder for you to pay it back, so they’ll be more open to negotiating.

- Old: Debt collection agencies are more likely to accept a smaller payment on debts that are at least a few years old. In fact, if the agency owns your debt—meaning they actually bought it from your original creditor—they probably purchased it for a reduced price anyway, as older debts sell for less money. 2

Watch out for the statute of limitations on your debt

If you’re working with an old debt, it’s important to note that there’s a limit to how long debt collectors can legally pursue unpaid debt, known as the statute of limitations on debt.

Once your debt passes the statute of limitations, it becomes time-barred and you can no longer be sued over it.

You’ll have far more leverage if you’re negotiating with debt collectors over debt that’s about to become time-barred. That’s because they’ll know they’re about to lose the ability to force you to pay anything at all.

Be very careful not to make any payments until you’ve got the settlement agreement in writing. If your collector asks you to make a “small initial payment” (or even a promise to pay), don’t be fooled. Making even one payment can restart the statute of limitations, which will reduce your leverage for negotiating a settlement and expose you to lawsuits.

If your debt has already passed its statute of limitations, you don’t have to pay

Because your debt collector has no way to compel you to pay time-barred debt, it’s entirely up to you whether you want to pay it. If you do decide to pay up, try to get something in exchange, such as your collector agreeing to remove the collection account from your credit report (a practice known as pay for delete).

3. Don’t let debt collectors violate your rights

When you negotiate with debt collectors, they can get pushy or aggressive. It’s important to know what your rights are so that you can avoid being manipulated and stop them from doing anything illegal.

Familiarize yourself with your federal rights under the Fair Debt Collection Practices Act (FDCPA). 1 Per the FDCPA:

- Debt collection harassment is illegal: Harassment by debt collectors is defined as incessant phone calls or calls at inconvenient times (by default, that means between 9 pm and 8 am).

- Debt collectors can’t contact you over disputed debts: If you send a debt verification letter disputing your debt within 30 days of receiving your debt validation notice, debt collectors are required to stop contacting you until they provide proof that you owe the debt.

- You can tell debt collectors to stop contacting you: If you tell debt collectors in writing to stop communicating with you, they must comply.

- You can’t be charged added fees: Debt collection agencies aren’t allowed to ask you to pay more than the amount specified in your contract with your original creditor. (However, they can raise your debt’s interest rate if your contract allows it.)

4. Figure out how much you can afford

Before proposing a debt settlement to your debt collector, review your budget. Needless to say, offering more than you can afford will make matters worse.

To start, review your monthly take-home pay and expenses to determine how much you can afford to pay each month. Make sure that getting out of debt won’t cause you to fall behind on your other bills.

If you need help budgeting or coming up with an affordable repayment plan to pitch to your debt collectors, you can get professional credit counseling (you can probably get an initial consultation for free).

There are special rules on debt collection during the COVID-19 pandemic

Some state and city governments have introduced new rules to protect debtors during the COVID-19 pandemic. For example, in New York City, you can request a temporary pause on debt collection efforts. 3 Some states have also protected COVID stimulus checks from garnishment and paused foreclosures, evictions, and utility shutoffs. 4

5. Know how much debt collectors will settle for

Most debt collectors will settle for around 50% of the full amount you owe, and some may agree to even less. 5

The exact amount your debt collector will accept depends on the size and age of your debt—as mentioned, debt collectors are usually more flexible when it comes to older and larger debts.

Your initial offer should be on the low side. For instance, you might offer to pay 20%–25% of the debt you owe. Explain your financial situation to your debt collector and tell them this is the only way you can repay your debt. They’ll try to talk you up, and hopefully you’ll eventually settle on something that’s acceptable to both sides.

If your debt collector won’t accept a partial payment, you can also try to negotiate for a manageable repayment plan (i.e., paying in installments over time).

Note that if you’re not confident in your ability to negotiate, there are third-party debt settlement companies out there that can help you, although they cost money.

6. Know what NOT to say

Never provide sensitive personal or financial information (e.g., your Social Security number or bank account details) to anyone contacting you about a debt until you’ve verified that the debt collector is legit. Unfortunately, debt collection scams are common, and they can quickly destroy your finances.

Even if you’re sure that your debt collector isn’t a scammer, watch what you say. Never admit that you owe the debt or agree to make any payments until you’ve worked out a concrete agreement specifying what you’ll get in return.

7. Get everything in writing

Sometimes when you negotiate a debt settlement, your debt collector won’t hold up their end of the bargain. To protect yourself, make sure that you get written proof of any agreement you’ve made before you make a single payment.

The written agreement should specify all the promises they’ve made, such as that they’ll cease their collection efforts and forgive the remaining debt after you’ve paid up. Once you have the agreement in writing, you can finally start paying.

How to prevent debts from going to collections in the first place

To avoid having to go through the whole process of negotiating with debt collectors all over again, take steps to make sure that none of your other debts end up in collections in the future.

Following these tips will stop your future debts from going to collections:

- Always stay current on your bills: Make sure to pay your bills on time, and catch up on any past-due debts you have as soon as possible to prevent them from being charged off and sent to collectors.

- Communicate with your creditors: Be open and honest with your lenders, and let them know as soon as possible if you have any concerns that you won’t be able to pay them on time. They’ll probably be willing to offer some kind of payment plan of their own.

- Budget wisely: To ensure that you can cover all of your debts, create a monthly budget and keep track of your expenses. It’s a good idea to also prepare an emergency fund so that you can cover any unexpected expenses without having to borrow money.

If your debts are sent to collections again, remember that you have options. To avoid lawsuits, never ignore your debt collectors. Instead, exercise your rights by demanding debt verification and use the negotiation tips above to win yourself the best possible outcome for your debts.

Takeaway: You can negotiate with debt collectors to get them to settle for less or agree to an affordable repayment plan.

- Make sure to verify that the debt collector is legit and that the debt is really yours before you start negotiating with debt collectors.

- Before beginning negotiations, assess your budget and make a realistic repayment or settlement proposal that you can commit to.

- Take advantage of any leverage you have, such as the age of your debt. Debt collectors will be more willing to accept your settlement offer if they think you won’t pay otherwise.

- Make sure you understand your debt collection rights, and get any agreements you make with the debt collection agency in writing before you make any payments.

- Once you’ve resolved your current collection accounts, make sure to practice good financial habits to prevent future debts from being sent to collections.