If you care about your credit score and you’ve been reading into how credit works, then chances are you’ve heard of credit utilization. It has a major influence on your credit score and your ability to get new loans and credit cards—but what exactly is a credit utilization rate, and why is it so important?

Table of Contents

What is credit utilization?

Your credit utilization rate (also known as your debt-to-credit ratio) represents how much of your credit limit you’re actually using. Credit utilization isn’t used for installment loans (like auto loans or mortgages), but it is used for credit cards and other revolving credit accounts.

Your credit utilization ratio is one of the biggest factors that go into calculating your credit score because it shows how well you can manage your debts and resist the urge to use money just because it’s there.

What is a good credit card utilization rate?

In general, a good credit utilization rate is one that’s in the single digits. Many experts recommend keeping your credit utilization percentage below 30%, but VantageScore claims that under 10% is ideal, and FICO has reported that people with the best FICO scores have an average utilization rate of 6%. 1 2

How does credit utilization work?

You have two types of credit utilization—an overall credit utilization rate across all of your revolving credit accounts and an individual credit utilization rate for each account. Some credit scoring models consider the credit utilization ratio on each of your credit card accounts in addition to your overall credit utilization ratio. 3

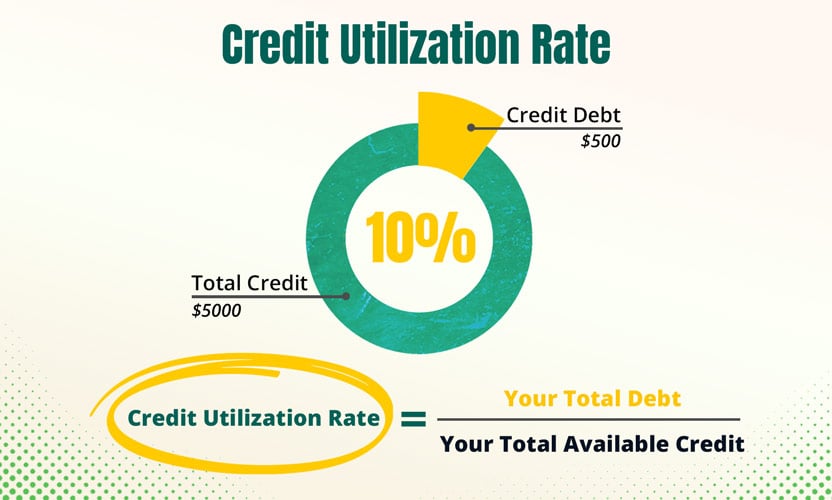

However, regardless of which model you’re using, you calculate your credit utilization rate the same way.

How to calculate your credit utilization

Your credit utilization ratio is calculated using a very simple formula:

Credit utilization = balance / credit limit

To calculate your credit utilization rate, all you need to do is follow these steps:

- Add up the credit card balances on each of your revolving accounts to get your total credit balance

- Add up the credit limits for each of your revolving accounts to get your total credit limit

- Divide your total credit card balance by your total credit limit

- Multiply the result by 100 to make it a percentage

How does credit utilization affect your credit score?

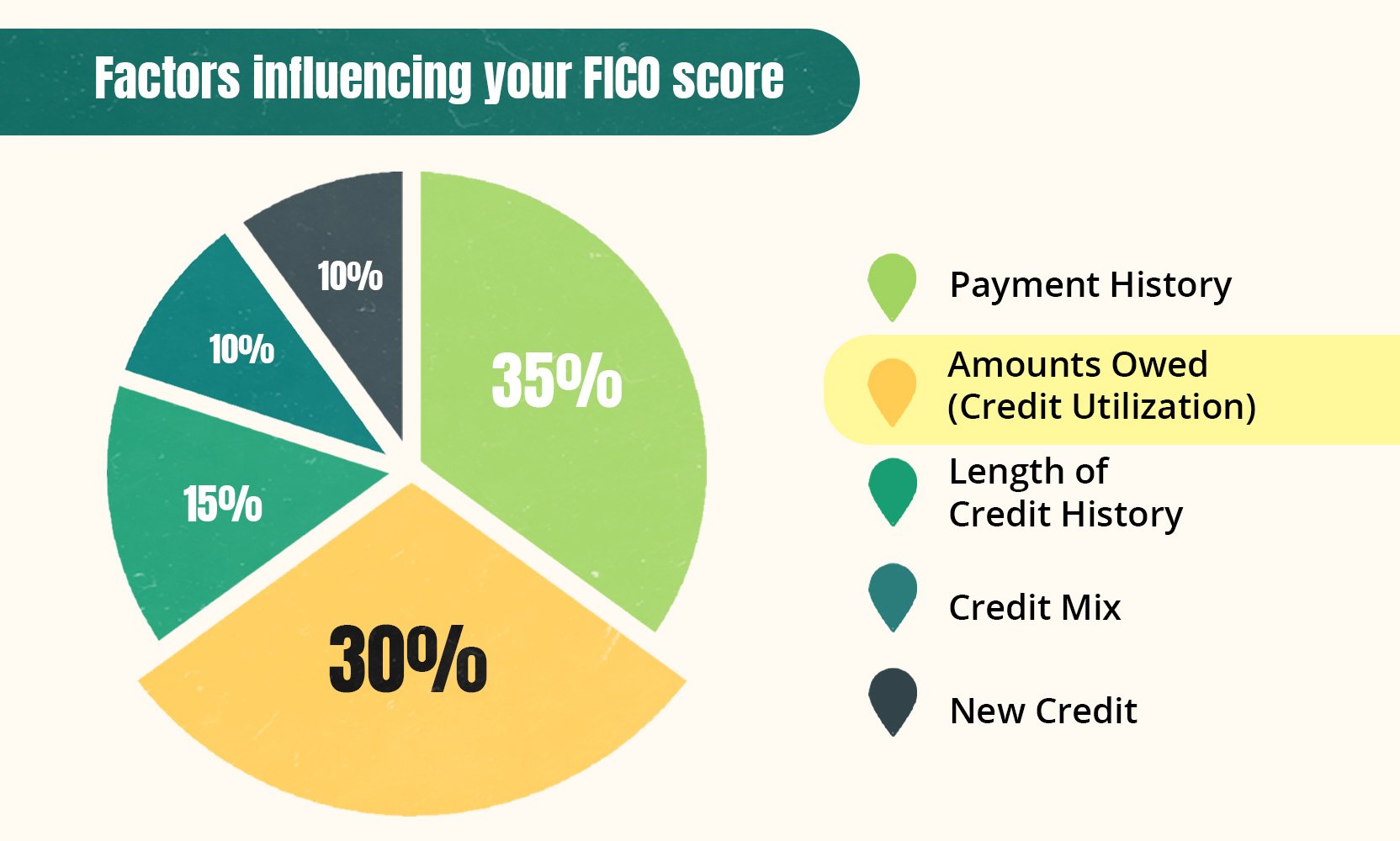

One of the differences between FICO and VantageScore is how they weight your credit utilization rate. Nevertheless, credit utilization is one of the most influential factors contributing to your credit score in any major credit scoring model.

How Credit Utilization Affects Your FICO Score

How Credit Utilization Affects Your VantageScore

Constantly overusing a credit line can result in a bad credit score and seriously limit your access to new credit. If you plan on applying for a new credit card, auto loan, or mortgage in the near future, then you’ll do yourself a huge favor by first working to improve your credit score. One of the easiest ways to start is to reduce your credit utilization.

Why you should pay your full credit card balance

It's a myth that you should leave a small balance on your credit card to prove that you’re actively using it. In most cases, your account balance is already on your credit report by the time your credit card payments are due. 4 Paying off your credit card balances could also help your credit score because FICO and VantageScore reward consumers who have fewer accounts with a balance. 3 5

How to lower your credit utilization

There are several ways you can reduce your credit card utilization rate. Here are five insider tips to get you started.

1. Lower your spending

The most obvious way to get a low credit utilization rate is to reduce your spending. Setting a budget can help you identify areas you can cut back on. You can also avoid overusing your credit card by using a debit card or paying in cash for day-to-day expenses.

2. Pay your bills early

The best time to pay your credit card bill is usually before your credit card issuer reports your balance to the credit bureaus because it means that a zero balance will appear on your credit reports.

It’s not always possible to know when your credit card company will report your balance to the credit bureaus, but they usually do so every month on the statement date (the day they charge you for the previous billing cycle). 6

You can try contacting your credit card issuer to find out the exact date that they report to each credit bureau, but it’s possible that they’ll keep the details of their credit-reporting process confidential.

3. Request a higher credit limit

If your expenses make it difficult for you to keep your utilization rate low, you can try contacting your card issuer and asking them to raise your credit limit. Requesting a credit limit increase will help your credit by reducing your utilization rate without requiring you to change your spending habits.

To get approved for a higher credit limit, you’ll probably need a reasonably good credit score and a credit history that shows you’re a responsible borrower who pays their bills on time.

4. Open new accounts

The number of credit cards you have determines your overall credit limit. This means that getting a new credit card will lower credit utilization rate by increasing the amount of available credit you have. It can also strengthen your payment history over time (assuming you don’t make any late payments).

However, bear in mind that opening a new credit card will lower your credit score in the short term by causing the following negative events:

- A hard inquiry: Credit applications appear as hard inquiries on your credit report. Hard inquiries take a few points off your credit score, and having too many can be a sign to lenders that you’re in financial distress.

- A drop in the average age of your accounts: The length of your credit history is an important factor influencing your credit scores because it shows whether you can manage your debts in the long term. Adding a new account will bring down the average age of your accounts and make you seem higher risk.

If you’re thinking about opening a new credit card account to lower your credit utilization rate, then start by checking out these credit cards, which you can get even if you have poor credit or an insufficient credit history:

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Bad Credit Overall | 300–669 | $0 | Cashback Match | ||

| Secured | 300–669 | $0 | |||

| Unsecured (No Deposit) | 300–669 | $0 | |||

| No Interest | 300–669 | $0 | |||

| No Credit Check | 300–669 | $35 | |||

| No Fees | 300–669 | $0 | |||

| High Credit Limit | 300–669 | $39 ($0 for the first year if you set up autopay) | |||

| Rewards | 300–669 | $0 | |||

| Building Credit | 580–739 | $0 | |||

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Secured Overall | 300–669 | $0 | Cashback Match | ||

| No Credit Check | 300–669 | $35 | |||

| Beginners | 300–669 | $25 | |||

| No Annual Fee | 300–669 | $0 | |||

| Bad Credit | 300–669 | $49 | |||

| Rebuilding Credit | 300–669 | $0 | |||

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Secured | 300–669 | $0 | Cashback Match | ||

| Unsecured (No Deposit) | 300–669 | $39 ($0 for the first year if you set up autopay) | |||

| Beginners | 300–669 | $49 | |||

| Students | 580–739 | $0 | Cashback match | ||

| No Annual Fee | 300–669 | $0 | |||

| High Approval Odds | 300–669 | $35 | |||

| Building Credit | 300–669 | $0 | |||

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| No Credit Overall | 300–669 | $0 | Cashback Match | ||

| Starters | 300–669 | $49 | |||

| Students | 580–739 | $0 | Cashback match | ||

| No Credit Check | 300–669 | $35 | |||

| No Annual Fee | 300–669 | $0 | |||

| Unsecured (No Deposit) | 300–669 | $75 for the first year ($48 after) | |||

| High Credit Limit | 300–669 | $39 ($0 for the first year if you set up autopay) | |||

| Instant Approval | 300–669 | $75–$99 the first year, then $99 annually | |||

| Beginners | 300–669 | $0 | |||

5. Keep old or unused accounts open

You might think that you should close your old accounts, like your beginner’s credit card from back in the day, but doing so will reduce your total available credit. This drop will raise your utilization rate and hurt your credit score.

Instead of closing your old accounts, use them occasionally (every few months) so that your creditors keep them open.

Takeaway: Try to keep your credit utilization rate low

- Your credit utilization is the amount you owe on your revolving credit accounts relative to the total amount of available credit you have.

- Your credit utilization rate can be calculated for each individual account or across all of your revolving accounts. Both contribute to your score.

- In many credit scoring models, the ideal credit utilization rate is between 1% and 10%. If that’s not a realistic goal, try to keep it below 30%.

- To lower your credit utilization rate, try to increase your credit limits, curtail your spending, and avoid closing old and unused accounts.