Unless you have the highest possible credit score of 850 (which only 1.31% of borrowers do), there are ways you can improve your score. 1 Giving your credit a boost can make your life easier and unlock exciting benefits, like exclusive credit card deals, cards with 0% APRs, and even lower interest rates on any loans you already have.

Find out how to take the next step in your financial journey by increasing your credit score and achieving optimal credit health.

Table of Contents

1. Check your credit score and credit report

If you want to optimize your credit health, the first thing you should do is check your credit reports to find out which factors you should prioritize improving. You can request your credit reports for free from all three credit bureaus at AnnualCreditReport.com.

Note that you’ll need to take separate steps to check your credit score because it probably won’t be included in your credit report.

When looking over your credit file, keep an eye out for these problems:

- Outstanding debts that you still have to pay

- Errors (e.g., inaccurate balances, payment dates, or account opening dates)

- Accounts with high balances

- Accounts that don’t even belong to you

- Negative marks like delinquencies or collections

All of the issues above are fixable. By following the steps outlined in this article, you may be able to improve your credit score by changing the information shown on your credit reports.

Dispute errors on your credit report

If you spot mistakes on your credit report, it’s possible that your score is lower than it actually should be. Thankfully, this is one of the easiest credit problems to fix, and you can quickly improve your score by simply disputing information on your credit report with the three major credit bureaus.

To start, use the dispute letter template below and send it to the credit bureau publishing the item you want removed:

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

You can technically send in disputes for every negative item on your credit report. However, if you’re trying to remove accurate negative marks, your dispute will probably be rejected.

After you’ve sent your dispute letter, the credit bureau will investigate your case. If they find your dispute to be valid or are unable to confirm the accuracy of the information you’re disputing, then they’ll remove the information from your credit report within 30 days.2

If you suspect that the mistake originated with your original creditor (meaning they reported something to the bureaus that wasn’t correct) then you should send a dispute letter to them as well.

2. Use rapid score-boosting strategies

Hit the ground running by using tried-and-tested techniques to quickly raise your credit score and build up a good credit history. Starting off with these simple and easy methods will get you quick results, boost your motivation, and put you in a prime position to further improve your credit:

- Add rent and utilities to your credit report: Signing up for Experian Boost or a rent-reporting service can rapidly improve your credit score by allowing you to build credit from paying rent and other bills.

- Become an authorized user: Piggyback off a family member’s credit by having them add you as an authorized user to their credit card account. Your credit report will then show their entire payment history, which will be a major plus for your credit (assuming they always pay their credit card bill on time).

These strategies improve your credit score by adding positive information to your credit reports. As such, they’re fundamental approaches to building credit fast, and they’ll be most effective if you have a thin credit file or you’re building credit for the first time.

Although these approaches can certainly help if you mainly want to repair damaged credit, other methods (outlined below) may get you quicker and more satisfying results.

What makes up a good credit score

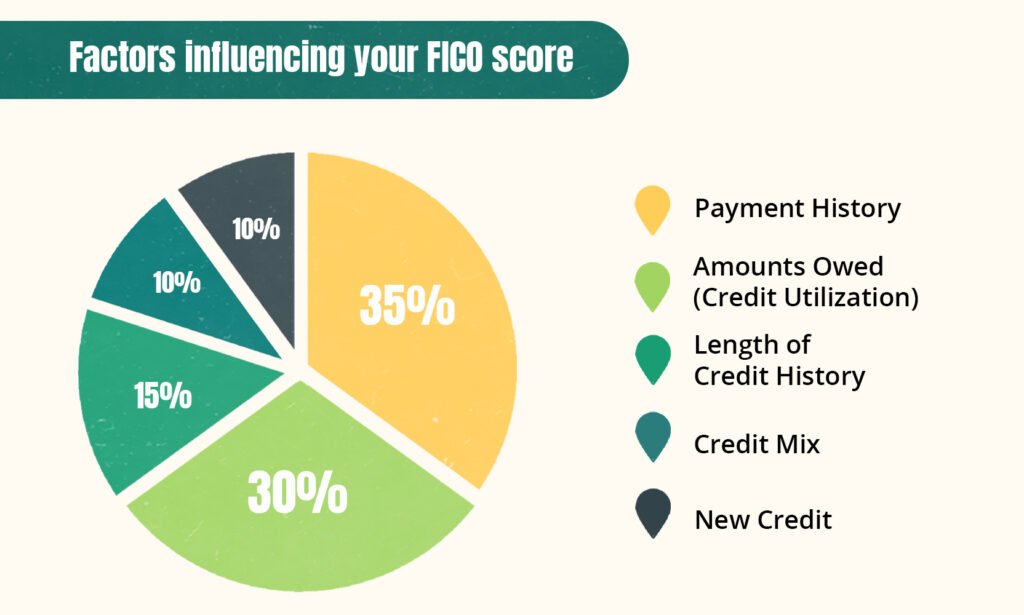

Getting a good credit score is a lot easier if you know what good credit looks like. Credit scores are an estimate of your creditworthiness, or how reliable lenders think you are, and FICO and VantageScore take five main factors into account when calculating your credit score:

- Payment history: How well you pay your bills.

- Credit utilization: How much credit you’re using.

- Length of credit history: How long you’ve had your credit accounts.

- New credit: How many new accounts you’ve recently applied for or opened.

- Credit mix: Whether you have a good variety of different types of credit

How Credit Scores Are Calculated

3. Strengthen your payment history

Payment history is the most important factor contributing to your credit score, which makes it a key area to focus your credit improvement efforts. Even just following the tips below can make a huge difference to your credit score:

- Pay off collections: Having a debt sent to collections can do major damage to your credit, but paying off the collection account can raise your credit score by completely reversing this damage. However, note that this only applies to newer credit scoring models (like FICO 9, VantageScore 3.0, and VantageScore 4.0), which not all lenders use.

- Remove derogatory marks: Derogatory marks are the main cause of a bad credit score. To remove negative marks from your credit report by yourself, you can negotiate a pay-for-delete agreement or goodwill deletion with debt collectors or your creditor. This is one of the best ways to fix your credit quickly if it’s suffered damage.

- Pay all your bills on time: A single late payment can drop your score by 80+ points and stain your credit report for up to 7 years. 3 By contrast, paying all your bills on time is the most effective and reliable way to establish a good credit score in the long term.

It also goes without saying that if you have any past-due accounts, you should catch up on your payments as soon as possible. Late payments seriously hurt your credit score, and the damage gets worse the longer the debt goes unpaid. 4

How to manage your bill payments

You can avoid missing payments by scheduling reminders for yourself. If paying manually is a hassle and you’re confident that you’ll always have enough money in your bank account to pay your bills, you can also set up autopay.

Bear in mind that if you’re just a few days late on a payment, you may be able to avoid damage to your credit by catching up as soon as possible. Creditors don’t report late payments to the credit bureaus until they’re at least 30 days overdue. 5

If you’re financially struggling and you’re worried you’ll start missing payments, contact your credit card issuer immediately. They may be able to offer debt-relief options or even modify your repayment schedule to help you avoid falling behind.

Ask for help if you can't get out of credit card debt

Credit card debt doesn't just hurt your credit score—it also takes a toll on your finances and overall quality of life. If you’re struggling to get out of credit card debt on your own, consider asking your credit card company if they offer hardship programs, seeking out credit counseling, or even enrolling in a debt management plan.

4. Use less of your available credit

An increase in spending on credit cards is one of the most common reasons for a drop in your credit score. This is because the percentage of available credit you’re using (i.e., your credit utilization rate) is a key credit scoring factor.

There are two main ways to improve your credit score by reducing your credit utilization rate:

- Lower your credit card balances: Keep the balance on each of your credit cards as low as possible while keeping your accounts active, and never let the amount of credit you’re using reach 30% of your credit limit. If you can keep your utilization rate in the single digits, that’s even better. 6

- Ask for higher credit limits: Increasing your credit card limit will reduce your credit utilization ratio and quickly improve your credit score, as long as your spending habits don’t change. Credit card companies may increase your spending limit automatically, but you can also ask them for a higher credit limit on your own.

Improve Your Credit Score by Spending Less on Credit Cards

You can also instantly increase the amount of available credit you have by opening a new credit card account. However, opening new accounts negatively impacts your credit score in the short term, so this isn’t the best approach if you want to improve your credit score fast.

5. Diversify your credit profile

Credit scoring models reward you for having experience with a variety of different types of credit. This diversity in your credit file accounts for only a small fraction of your credit score, but boosting your mix of credit accounts can help you bump up a fair or good score into the excellent credit score range.

Generally speaking, your score will be higher if you have a mix of the following two types of credit:

- Installment accounts: Installment loans are fixed amounts of money that you receive and repay in installments (fixed payments at regular intervals). Common examples include auto loans, mortgages, home equity loans, and student loans.

- Revolving accounts: A revolving credit account is one that allows you to repeatedly withdraw funds up to a certain limit. Common examples include credit cards, store cards, and home equity lines of credit.

If you only have one type of credit account in your credit file, then you’ll probably need to open a new account to improve your credit mix. However, never go into debt just for the sake of building credit. Moreover, bear in mind that since opening new accounts temporarily hurts your credit, this approach will really only improve your credit score in the long term.

Opening new accounts may slow your progress

If you have a short credit history, opening new credit accounts can strengthen your credit profile. However, if you have a thick credit file, it'll do a bit of short-term damage by reducing the average age of your credit accounts—not to mention the small drop from hard inquiries. Nevertheless, your credit will still improve in the long run if you're careful about repaying your debts.

6. Be patient and stay dedicated

Lastly, patience is key to achieving excellent credit. Even if your credit score doesn’t dramatically increase at first, keep practicing good credit habits and you’re bound to eventually reap all the benefits of good credit.

As you work to improve your credit, make sure you’re not doing anything that might undo your good work. Follow these tips to stay on track:

- Think carefully before applying for new credit: As mentioned, new credit applications temporarily hurt your credit score, and the damage can add up. To minimize your applications and the risk of rejection, carefully review lender requirements and consider getting prequalified before you submit a formal application.

- Keep your credit cards open: Closing a credit card account will hurt your credit score by reducing the amount of credit you have available to you. Keep credit card accounts open for as long as possible so they keep positively contributing to your credit score.

How long does it take to improve your credit score?

How quickly your credit score will go up depends on several factors, such as your credit history, what your current credit score is, and what negative items you have on your credit report (if any).

The timeline for improving your credit score also depends on whether you’re simply trying to give your score a little boost or shooting for a more ambitious goal, such as building your credit in the long run. Long-term strategies obviously take more time to pay off, but their effects are ultimately greater.

In general, if you’re building credit when you have none, you can achieve a decent credit score in around six months. If you’re rebuilding your credit after damaging it (e.g., through bankruptcy), it may take several years to really recover.

Ultimately, everyone’s credit improvement journey looks a little different, and you shouldn’t get discouraged if it’s taking you a while to get the credit score you want. By following the steps above, you’re destined for success.

Takeaway: You can improve your credit score quickly, but good habits are crucial for achieving good credit in the long run.

- The first step in improving your credit score is reviewing your credit reports and checking your credit score to find out where you stand and where to focus your efforts.

- Making sure you have a good payment history and low balances is the most effective way to improve your credit score.

- Strive for a good mix of revolving and installment accounts, but beware that opening new accounts lowers your credit score by triggering hard inquiries and lowering your average account age.

- The amount of time it’ll take to improve your credit score depends on your credit history, what you hope to achieve, and what approaches you take.