What Is the Tomo Credit Card?

The Tomo Credit Card is a charge card from TomoCredit. A charge card is a credit card that doesn’t let you carry a balance. To continue using a charge card, you must pay off the full balance at the end of each billing cycle.

How Does the Tomo Credit Card Work?

The Tomo Credit Card works by:

- Assessing your application on factors other than your credit score (e.g., your income)

- Granting you a credit limit between $100–$10,000

- Allowing you to make purchases up to your credit limit with the card

- Automatically withdrawing your statement balance from your linked bank account every 7 days

- Freezing your card if you’re unable to pay your balance by the due date

Quick Review

The Tomo Credit Card has many advantages and disadvantages, depending on what you’re looking for in a credit card. Here’s what you should consider when deciding whether or not to apply:

- No credit check required: One of the biggest draws of the Tomo Credit Card is that it doesn’t require a credit check to qualify for the card. That means borrowers with no credit or negative marks on their credit histories can still get the card. However, TomoCredit uses a native algorithm to assess your application, which considers factors such as your income and regular expenses. So qualifying for the card is still not guaranteed.

- No fees or APR: The Tomo Credit Card doesn’t charge fees or even interest. This is unusual for a credit card, but it’s possible because of Tomo’s unique billing system. As credit card debt plagues many borrowers today, escaping interest charges can be a huge perk.

- Weekly repayment schedule: The Tomo Credit Card’s repayment system is either a pro or a con, depending on your needs. Your balance will be automatically withdrawn from your linked bank account every week, so you can’t carry a balance and pay it off over time. This saves you from paying interest, but it also might put financial pressure on you if you can’t afford to pay your bill by the end of the 7-day billing cycle.

- No consistent rewards: The Tomo Credit Card previously earned 1% cash back on every purchase, but now offers no consistent rewards. Instead, you can occasionally get cash back through promotions offered by Tomo, as well as certain subscription and service credits (like a $5 credit for Lyft rides).

Pros & Cons

Pros:

- No fees or APR

- No security deposit requirement

- No credit check requirement

- Reporting to all three major credit bureaus

- Benefits including cell phone insurance

- Occasional rewards and credits

Cons:

- You can’t carry a balance

- A bank account must be linked

- Inflexible payment schedule

- No balance transfers

- No cash advances

Who Is the Tomo Credit Card Best For?

You should get the Tomo Credit Card if you’re trying to build credit and have a steady enough income to keep up with the 7-day billing cycle. In particular, there are four main groups of people we think would benefit the most from this card:

- High-income credit rebuilders: If your credit is in bad shape but your finances are good and you don’t want to put down a deposit on a secured credit card, then getting the Tomo Card could be a good solution to get your credit back on track.

- Non-US citizens: You don’t need a Social Security number to apply for the Tomo Credit Card—instead, you can apply with just an Individual Taxpayer Identification Number (ITIN). This, combined with the lack of a credit check, make the card ideal for recent immigrants working in the US.

- Young adults looking to establish credit: As long as you get a low credit limit that won’t put your finances at risk, the Tomo Credit Card’s unique billing approach can help you develop good credit habits as a newbie, like making frequent and full-balance payments.

- Retirees: If you’ve got a stale credit file with no credit history because you’ve long stopped using credit, it can be difficult to get back into the game. The Tomo Card offers a rare opportunity to start building credit again while potentially getting access to a decent credit line without having to pay any fees or interest.

If you’ve already got an excellent credit score or you don’t have a stable enough income to maintain weekly repayments, we recommend you explore other options.

Rates & Fees

Fees

Fees:

The Tomo Card has no fees whatsoever. Considering the lack of interest charges and wide availability to people of all credit backgrounds, this is an exceptional characteristic that makes the Tomo Card well worth getting.

- Annual fee: $0

- Late payment fee: $0

- Foreign transaction fee: $0

Note that, although there are no late payment fees, you should still pay your bills on time. If you don’t pay off your balance at the end of each week, Tomo will freeze your account temporarily so that you can’t use your card until you’re caught up. Your credit may also suffer.

Interest Rates

APR:

With the Tomo Credit Card, you’ll never be charged any interest, since it’s technically a charge card. This can give you some peace of mind if you’ve struggled to get out of credit card debt in the past, but there’s one drawback: you can’t use the card for balance transfers or cash advances.

With most credit cards, you can carry a balance from month to month. The issuer charges interest on the balance you leave unpaid.

If you have a credit card that allows you to carry a balance from one billing cycle to another, the yearly rate of interest you’ll pay is called the APR (annual percentage rate). However, the Tomo Credit Card does not allow you to carry a balance, so it doesn’t charge interest.

Rewards

Rewards:

The Tomo Credit Card doesn’t come with any guaranteed rewards. Although you may be able to get cash back on select purchases as part of certain promotional offers, this card shouldn’t be your first choice if you want to earn rewards for purchases.

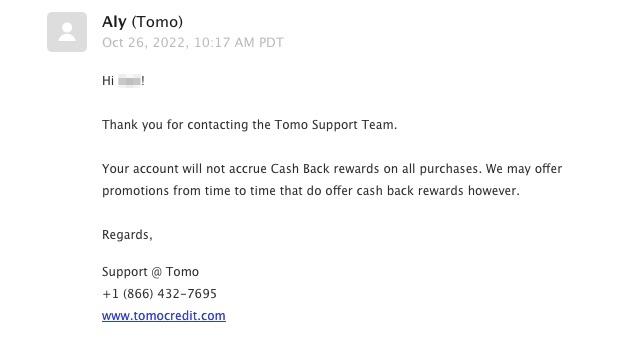

The Tomo Credit Card does not have a cashback rewards rate. It previously offered 1% cash back on every purchase—a claim that’s still prevalent online. However, a customer service representative confirmed that the card now only offers occasional rewards on select promotions.

Credits

In lieu of regular rewards, the Tomo Credit Card offers credits and discounts with certain merchants. For example, you can get:

- DashPass: Free 3 months subscription of DashPass, and $5 off each month

- HelloFresh: Discounts on your first 5 boxes of HelloFresh (equivalent to $90) plus free shipping

- ShopRunner: Free 2-Day shipping and free returns with ShopRunner

- Lyft: A $5 Lyft credit when you take 3 rides

Credit Limit

Credit Limit:

Tomo bases initial credit lines on your income rather than your credit history, which can work to your advantage if you have bad credit and a high income. In other cases, this can work against you, as credit limits can be as low as $100.

The Tomo Credit Card offers initial credit limits of $100–$10,000. Credit limit increases are also available. The Tomo website says that you can achieve a credit limit of $10,000 over time based on periodic account reviews.

Benefits

The Tomo Credit Card has fairly extensive benefits for a credit card with no credit score requirements, including World Elite Mastercard® benefits and other perks.

| Benefit | What It Means |

|---|---|

| Free credit scores | Tomo’s customer service team told us that they’ve recently started offering free credit scores, although it’s unclear whether they’re FICO credit scores or VantageScore credit scores. |

| Cell phone protection | Insurance on your phone for up to $1,000 in case it’s stolen or damaged. |

| Concierge service | A complimentary service to help you with tasks like booking dinner or event reservations and locating hard-to-find items such as tickets for a sold-out show. |

| Luxury hotel and resorts portfolio | Access to a selection of luxury accommodation properties where you can get extra perks like complimentary breakfasts, free Wi-Fi, or discounts on hotel spa services. |

| Lowest hotel rate guarantee | If you use the Mastercard® Travel and Lifestyle Services program (either online or through an authorized program agent) to book a hotel room but you later find a cheaper deal, you’ll normally be eligible for a refund of the price difference. |

| Priceless cities | An online collection of experiences curated exclusively for Mastercard® customers in cities around the world—wellness retreats, concerts, dining, museums, art events, and much more. |

| Zero fraud liability | The card issuer won’t hold you responsible for transactions you didn’t authorize. |

| Mastercard® ID theft protection | TransUnion credit report monitoring and dark web monitoring to check for misuse of your personal information (e.g., your Social Security number and your credit or debit card information). |

| 24-hour assistance if your card is lost or stolen | Access to an emergency phone line you can use to report your card lost or stolen and request emergency card replacement or emergency cash advances. |

| Exclusive discounts | Exclusive offers on ride-sharing, online shopping, food delivery, and more. |

Tomo Credit Card Limitations

There are limits to how much you can use your Tomo Credit Card. We contacted TomoCredit and confirmed that these limits are as follows:

- Number of purchases allowed per day: 20

- Value of purchases allowed per day: $5,000

- Number of purchases allowed over 4 days: 40

- Value of purchases allowed over 4 days: $10,000

- Value of purchases allowed per month: $20,000

- Value of purchases allowed per year: $240,000

Building Credit with a Tomo Credit Card

Credit Reporting

Credit Reporting:

Your Tomo Credit Card account will show up on all three of your credit reports because the card issuer reports to every major credit reporting agency. This is a major perk if you plan on using the card to build or rebuild your credit.

Credit reporting is an important part of credit building, as your credit report is based on the information your lenders send to the credit bureaus. Fortunately, the Tomo Credit Card reports to all three major credit bureaus—Experian, Equifax, and TransUnion—every month.

Tips for Building Credit

The Tomo Credit Card is an excellent card for building credit due to the card issuer’s comprehensive credit reporting policy. However, you’ll need to take a few steps to ensure you stay on the right track:

- Keep your account current: Since the Tomo Credit Card requires very frequent payments (once every 7 days), you have many more opportunities to make either on-time or late payments than you would with a typical credit card.

- Use only a small fraction of your credit line: Maintaining a low balance is crucial to achieving a good credit utilization rate, which is a major credit scoring factor. The card’s short billing cycle should make this easier, as long as you don’t charge too much to your Tomo Card each week.

- Keep your account open: Keeping your Tomo Card active in the long term will allow your credit score to benefit from a long credit history and a large credit line (if you qualify for Tomo’s periodic credit limit increases). By contrast, closing your Tomo account could hurt your credit.

The Tomo card offers a rare opportunity to access an unsecured credit line without any credit check. As long as you meet the card issuer’s other requirements, it offers an excellent opportunity to build credit for the first time or recover from major credit issues in your past. All you need to do is use your card responsibly.

How to Get a Tomo Credit Card

Credit Score Needed

Tomo doesn’t perform a credit check when you apply for the Tomo Credit Card. This means there are no credit score requirements, so you don’t have to worry about your credit report sabotaging your application.

Application Requirements

As part of your application, the Tomo Credit Card issuer will evaluate your finances (instead of your credit history). They’ll do this by using the financial history of the bank accounts that you link to the card. They will then decide whether to approve your application and, if so, for what credit limit.

Notably, you don’t even need a Social Security number to apply for the Tomo Credit Card. You can use an ITIN (an Individual Taxpayer Identification Number, which is a number that the tax authorities issue to non-residents of the US for tax purposes), so new immigrants can apply.

How to Apply

Tomo says that it takes only five minutes to apply for a Tomo Credit Card online. You’ll have to provide some basic information, but Tomo won’t perform a hard inquiry (a credit check that’s visible to others viewing your credit report and has a small impact on your credit score).

Comparable Cards

To determine whether the Tomo Credit Card is right for you, take a look at how it measures up against similar credit cards on the market.

Rating Breakdown

Fees

4.7Because the Petal 2 Visa® stays true to its “no fees” name, it scores very highly in this category.

APR

2.2The Petal 2 Visa® has a wide range of interest rates, and less creditworthy borrowers could be hit with high APR.

Rewards

2.5This card has a fairly complicated rewards program, although it’s still one that’s worth having.

Credit Reporting

5.0Petal cards report to all three of the major credit bureaus, so the Petal 2 Visa® ticks all the boxes for building credit.

Credit Limit

5.0The Petal 2 Visa® gives you a credit line of up to $10,000, which is very generous.

Other

We gave the Petal 2 Visa® extra credit for its accessibility, since it accepts applicants with no credit score and applicants without a Social Security number.

|

Annual

Fee

$0 |

Credit

Score

300–669 |

|

Purchase

APR

15.99%–29.99% (variable) |

Rewards

-

All Purchases

1%–1.5% cash back on all eligible purchases (your rate increases to 1.25% after 6 on-time payments, 1.5% after 12 on-time payments)

How the Cards Compare

Although the Petal® 2 Visa® credit card is more like a traditional credit card than the Tomo Credit Card, the two have similarities, such as no fees, credit reporting, and the ability to apply without a credit score.

Because of its greater flexibility as a standard credit card and its cashback rewards (1%–1.5% back on every purchase), the Petal® 2 Visa® is a better choice. However, the Tomo Credit Card is a good alternative if you want to avoid a hard inquiry on your credit report or if you’re worried about getting rejected due to delinquencies on your credit report.

Pros & Cons

Pros

- No annual fee

- No foreign transaction fees

- No late payment fees

- Cashback rewards

- Available to people with no credit score

Cons

- Low rewards rates

- Potentially high APR

- No introductory APR

- No balance transfers or cash advances

Rating Breakdown

Fees

4.9No annual fee and no foreign transaction fees score this card a high rating in the fees department.

APR

2.7Carrying a balance could get costly on this card, given the high purchase APR.

Rewards

4.4Considering it’s a secured card, the Discover it® Secured offers impressive rewards and even a cashback welcome bonus.

Credit Reporting

5.0Discover reports to the major credit bureaus, which can help you build your credit.

Security Deposit

4.0The minimum and maximum security deposit allow a good range of flexibility for you to determine your credit limit.

Other

We adjusted for factors like free credit scores and a fully refundable security deposit.

|

Annual

Fee

$0 |

Credit

Score

300–669 |

|

Deposit

$200–$2,500 |

Purchase

APR

25.99% (variable) |

Rewards

-

Welcome Bonus

Cashback Match earns you a dollar-for-dollar match on your first-year rewards

-

Gas & Restaurants

2% cash back up to $1,000 in combined spending each quarter

-

Everything Else

1% cash back on all eligible purchases

How the Cards Compare

The Discover it® Secured credit card is a secured credit card that we rate very highly because of its low cost and cashback rewards. Like the Tomo Credit Card, it has no annual fee, and reports to the bureaus to help you build credit. However, it has more flexibility than the Tomo Credit Card.

The main drawback of the Discover it® Secured credit card is that it requires a security deposit and will pull your credit history when you apply. If you’re willing to pay some money up front and have your credit checked, the Discover it® Secured will give you much more in the long run, offering rewards and the full functionality of a standard credit card.

Pros & Cons

Pros

- No annual fee

- 2% cash back on gas station and restaurants

- 1% cash back on all other purchases

- Dollar-for-dollar Cashback Match after 12 months

- Free monthly access to FICO score

Cons

- High annual percentage rate (APR)

- Maximum deposit of $2500

- Rewards rates cap out at $1000 per quarter

- High penalty fees

|

Annual

Fee

$0 |

Credit

Score

300–669 |

|

Deposit

$200 |

How the Cards Compare

Like the Tomo Credit Card, the Chime Credit Builder Secured Visa® is an alternative credit card with no fees, no interest, and no credit check required. It’s also similar to the Tomo Credit Card in that you need to have a Chime checking account to get a Chime Credit Builder Secured Visa®.

The Chime credit limit is more flexible, because you can increase your credit limit at will by adding more funds to your deposit. You can also make cash advances with this card. The main drawback is that you’ll need to put down a security deposit to open an account.

Pros & Cons

Pros

- No interest charges

- No annual fee

- No credit check to apply

Cons

- You must open a Chime checking account

- $200 minimum security deposit

- No rewards

Tomo Credit Card FAQs

Is the Tomo Credit Card legit?

The Tomo Credit Card is a legitimate product from TomoCredit, which has been incorporated since 2019 and BBB-accredited since 2021. However, the company has garnered a lot of criticism over the card and accusations of foul play from borrowers and applicants.

There are currently 49 complaints registered against them with the BBB, and 63 reviews that average a rating of 1.25/5 stars. Complaints against the company are largely based on the following accusations:

- Tomo failed to cancel charges and provide provisional credit after borrowers reported their Tomo Credit Cards lost or stolen.

- Tomo rejected borrowers’ applications for the card even though they had proof of adequate income.

- Tomo withdrew money from borrowers’ bank accounts without consent or after the borrower had tried to cancel a payment.

- Tomo canceled borrowers’ Tomo Credit Cards without permission or explanation.

- Tomo’s failure to provide a customer service phone number has made resolving issues with cardholders difficult.

These claims have been levied by individuals online and have not been verified by TomoCredit or the BBB. However, it’s always a good idea to consider other users’ experiences when deciding whether you want to move forward with a specific credit card.

Is the Tomo Credit Card a secured card?

No, the Tomo Credit Card is not a secured card. Secured cards require a security deposit which determines your credit limit. Tomo is unsecured, so you won’t need to pay money upfront to open an account.

Can I use my Tomo Credit Card at an ATM?

No, you cannot use your Tomo Credit Card at an ATM to withdraw funds. This function is known as a cash advance, and it’s not available on Tomo Credit Cards.

Does the Tomo Credit Card charge for foreign transactions?

The Tomo Credit Card allows you to make foreign transactions, and doesn’t charge any fees for doing so.

Many credit cards that allow foreign transactions charge fees equivalent to 1%–3% of the transaction amount, whereas others don’t charge a foreign transaction fee at all. If you travel a lot, fee-free foreign transactions are a great bonus.

Who issues the Tomo Credit Card?

Although the card is a product of TomoCredit, it’s issued by Community Federal Savings Bank.

How does Tomo make money?

Kristy Kim, CEO of TomoCredit, stated in a Reddit AMA that they rely on revenue from interchange fees. Interchange fees are charges paid by merchants when borrowers use their credit card to pay for that merchant’s goods or services. 1

How can I contact Tomo?

If you have questions about the Tomo Credit Card, you can email customer service at [email protected]. They don’t appear to have a phone number, but they do share their location, which likely accepts mail correspondence (although they don’t confirm this):

TomoCredit Inc

535 Mission Street, Floor 14

San Francisco, CA 94105

How we rate our credit cards

Applying for a new credit card is a big decision. That's why FinanceJar's card experts carefully studied the following details of the Tomo Credit Card to determine whether it's a good borrowing option:

- Fees

- Interest Rates

- Rewards

- Qualification Requirements

- Benefits

- Borrowing Terms

These factors, among many others, are part of our 5-star credit card rating methodology for all card categories. Our star ratings are unbiased and independent of our affiliates and advertisers.