If your credit score has taken a hit—whether it’s because you’ve missed payments, some of your bills have been sent to debt collectors, or something else entirely—you’ll naturally want to get back on track as quickly as possible. But what exactly does that mean? In the best-case scenario, how long will it take for your score to recover?

The good news is that, although you won’t be able to fix your credit overnight, you can get your credit back in good standing within 6 months to a few years by adopting the right financial habits.

Table of Contents

How fast can I rebuild my credit?

There isn’t a universal amount of time that it takes to rebuild your credit. Realistically, it’ll probably take you anywhere from a few months to a few years, depending on the events that initially damaged your score.

It won’t take as much time to fix your credit if you only have a single, relatively mild negative item on your credit report. Conversely, if you have several derogatory marks or any very damaging items (like a bankruptcy or collection account), repairing your credit may take significantly longer.

Factors that affect how long it’ll take to rebuild your credit

There are three main factors that determine how long it takes for your credit score to go up.

1. The severity of the damage

As mentioned, when something hurts your credit, the size of the drop in your credit score depends on the severity of the action.

Most actions that hurt your credit score have something to do with paying one of your bills late. As a rule, the later your payment, the more your credit score will suffer and the longer it will take to bounce back.

For example, a 30-day late payment won’t hurt you for as long as a 90-day late payment. Neither is as bad as a charge-off or collection account, which you might get if you go even longer without paying. 1

2. Which components of your credit score were affected

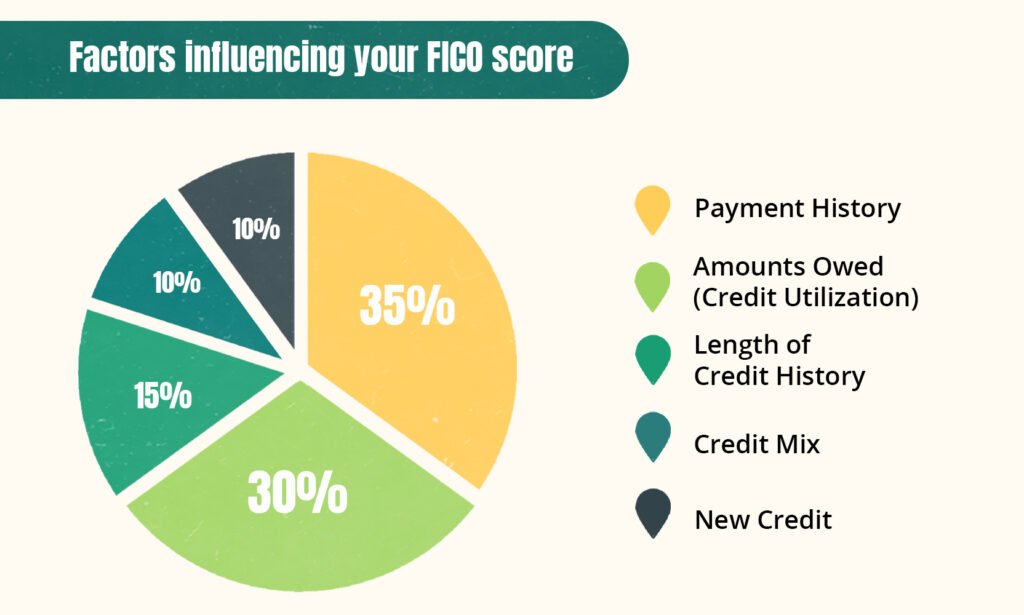

If your credit has been damaged, then it’s probably because something affected one of the five factors involved in the calculation of your credit score:

- Payment history: A record of whether you usually pay your bills on time or not.

- Credit utilization rate: Your debt-to-credit ratio, or the amount of your available credit you’re using.

- Length of credit history: How long you’ve been using credit and the average of your accounts.

- Credit mix: How many different types of credit accounts you have, such as installment loans (e.g., mortgages or student loans) and revolving credit accounts (e.g., credit cards or retail cards).

- New credit: Your recent applications for new credit accounts and the number of hard inquiries you have on your credit report.

These five factors aren’t equally influential. The chart below shows the weighting they’re given in the FICO credit scoring model:

How Different Factors Affect Your FICO Score

When something damages your credit, the factor it affects determines how severe the damage will be.

For example, collections cause major damage to your score because they impact your payment history (which is the most influential factor affecting your credit score, accounting for a full 35%).

On the other hand, hard inquiries only have a minor impact on your credit score because they reflect your search for new credit, which credit scoring models don’t emphasize as much (it determines only 10% of your score).

3. How recently your score dropped

You probably already know that the more derogatory marks you have, the longer it’ll take for your credit score to bounce back from them.

Another important fact to consider is that the impact of negative credit actions diminishes over time. If your score was damaged recently, it will obviously take longer to recover.

Most negative items have minimal impact on your credit score after 2 years. 1 However, they’ll usually stay on your credit reports much longer (most commonly for 7 years), meaning they can still influence how lenders perceive your risk level when you apply for loans and credit cards.

Here’s how long different types of derogatory marks remain on your credit reports:

How Long Negative Marks Stay on Your Credit Report

| Derogatory Mark | Duration on Credit Reports |

|---|---|

| Hard inquiries | 2 years |

| Late payments | 7 years |

| Charge-offs | 7 years |

| Collections | 7 years |

| Settled accounts | 7 years |

| Repossessions | 7 years |

| Foreclosures | 7 years |

| Bankruptcy | 7–10 years |

These credit-reporting limits follow the guidelines set forth in the Fair Credit Reporting Act. Again, even though these marks will remain on your credit report for the full 7–10 years, their effect on your credit score will usually fade after around 2 years.

How to rebuild your credit quickly

To an extent, repairing your credit is just a waiting game—your score will always recover from negative marks eventually, no matter what they are, but in most cases there’s no way to achieve a complete recovery immediately.

However, there are ways to speed up the process. Follow these tips to repair your credit more quickly:

- Check for errors on your credit reports: It’s possible there are mistakes on your credit reports that are bringing your score down. Review copies of your reports, which you can get from all three credit bureaus (Experian, TransUnion, and Equifax) for free at AnnualCreditReport.com, and dispute any credit-reporting errors that you find. You can do this by sending a credit dispute letter to the bureaus.

- Pay all your bills on time: Since your payment history is the most important factor contributing to your credit score, the best thing you can do for your credit is make sure that you pay all your bills on time in the future. This means getting caught up on any payments you’re currently behind on.

- Limit your spending: Avoid maxing out your credit cards, and try to use as little of your available credit as possible to keep your credit utilization ratio low. This will also help you avoid missing payments by overstretching yourself financially.

- Use credit-building tools: You can reestablish a good credit history by getting a credit-builder loan, which is a type of credit account that’s specifically meant for building or repairing credit. You can also sign up for a bill-reporting service like Experian Boost to get credit for the bills you’re already paying, such as rent and utilities.

- Get a secured credit card: A secured credit card is a type of card that you have to put down a security deposit for. This eliminates the risk for your lender, which makes secured cards very easy to get. They’re a good option for building your credit back up when you’ve damaged it to the point that it’s hard to qualify for other cards.

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Secured Overall | 300–669 | $0 | Cashback Match | ||

| No Credit Check | 300–669 | $35 | |||

| Beginners | 300–669 | $25 | |||

| No Annual Fee | 300–669 | $0 | |||

| Bad Credit | 300–669 | $49 | |||

| Rebuilding Credit | 300–669 | $0 | |||

What to do if you’re having problems paying your debts

If you’re struggling to make ends meet, get in touch with your creditors as soon as possible to discuss your options, such as signing up for a hardship program. You can also set up a free consultation with a qualified credit counselor.

If you’re already in debt and you’re worried it will keep damaging your credit, explore the many options you have for getting out of debt. Remember that you’re not alone and that it’s never too late to get on the right track toward achieving good financial health.

Takeaway: Rebuilding your credit can be a long process, but exactly how long it’ll take depends on your credit profile.

- How long it’ll take you to rebuild your credit depends on the type and number of derogatory marks on your credit reports, their severity, and how recent they are.

- Negative credit actions that impact your payment history will take longer to recover from than other actions because payment history is the biggest factor influencing your credit score.

- To start rebuilding your credit, check your credit reports, use credit-building tools, pay all your bills, and limit your spending.

- You can prevent further damage to your credit by practicing good financial behaviors and asking for help if you can’t afford to pay all your bills.