Falling behind on your bills is stressful, and it becomes even more so when collections are added to your credit reports. Collections cause a major drop in your credit score and tarnish your credit history, but that’s not all—they also make it harder to open new lines of credit, such as loans and credit cards.

The good news is that regardless of whether you’ve got a fresh collection that’s just been added to your credit report or collections that you’ve been dealing with for a while, there are ways you can start rebuilding your credit right now.

Table of Contents

6 steps for fixing your credit after getting a collection account

To minimize the damaging effects of your collection accounts and start reestablishing your creditworthiness, follow these steps:

1. Check the validity of your collections

The first thing you should do is request copies of your credit reports from all three credit bureaus (Experian, Equifax, and TransUnion). You can do this online for free at AnnualCreditReport.com.

If any account details are wrong (such as the amount owed or personal details like your name or address), then file a credit dispute with the credit bureau publishing the error. Explain the mistake and provide evidence to support your claim.

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

The credit reporting agency is required to investigate your claim within 30 days and remove the item from your report if it can’t be verified. 1

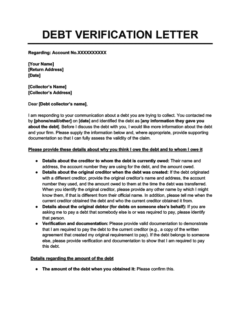

If debt collectors are still trying to get you to pay, then you should also send them a debt verification letter (also known as a dispute letter) asking for proof that you owe the debt. If they can’t provide this information, then they’ll be forced to stop trying to collect the debt. 2

You’ll then be able to use this evidence that the debt is invalid to dispute the collection account with the credit bureaus and have it removed from your credit report.

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

To find the debt collection agency’s contact information, check out this list of major debt collection agencies in the US.

2. Negotiate with debt collectors to delete the collection account

If the collection account is legitimate, you may still be able to get it off your credit report if you can persuade your creditor or debt collector (whoever’s reporting it to the credit bureaus) to delete it.

There are two main approaches to getting collections removed from your credit report:

- Goodwill adjustment: If you’ve paid your collection accounts, you can write a goodwill deletion letter to your creditor or debt collector (whoever owns the debt) asking them to empathize with your situation and remove the collection account as an act of kindness.

- Pay for delete: If you haven’t paid your debt yet, you can try sending your creditor or debt collector a pay for delete letter asking them to remove the collection in exchange for payment.

Alternatively, if you have federal student loans in collections, you may be able to rehabilitate your loans, which will result in the default being automatically removed from your credit report. 3

3. Pay off your collections

If you can’t get the collection account deleted, then an important step in fixing your credit after receiving a collection account is paying it off.

There are several ways to pay collections, but first you should carefully evaluate your financial situation and get a clear idea of what you can afford.

How paying collections will impact your credit score depends on your payment method:

- Full payment: A collection marked “paid in full” won’t hurt your credit as much as an “unpaid” or “settled” account (at least in newer credit scoring models, such as FICO 9, VantageScore 3.0, and VantageScore 4.0). Paying off collections can improve your credit score in these models. 4 5

- Debt settlement: Although settling your debts is better for your credit than leaving them unpaid, a debt settlement is still considered a negative mark and will hurt your credit score more than a fully paid collection account.

It’s also worth noting that how much your score will improve after you pay off collections depends on your credit history. If you have multiple collections on your credit report, then paying just one may not have a massive impact on your credit score.

4. Bring all your other accounts current

Payment history is the most important factor influencing your credit score, so catch up on all of your outstanding debts. Pay particular attention to any that you’ve already missed one or more payments on, as these are the ones that are closest to being charged off and sent to collections.

If you have multiple bills with different due dates, consider setting up autopay with your creditor to simplify your finances and avoid missing payments.

Charge-offs vs collections: what’s the difference?

When you have a debt that’s seriously delinquent (unpaid for around 120–180 days), your creditor may charge it off. 6 This means they’ve written it off as a loss. Next, they may sell or transfer the debt to a debt collection agency. This means that every collection account has been charged off, but not all charge-offs have been sent to collections yet.

5. Start adding positive information to your credit report

The easiest way to get positive information added to your credit report is to open a new credit account. However, this may be hard if you have a bad credit score due to collections and other derogatory items.

Here are some options you have even if you have poor credit:

- Get a secured credit card: You can usually get a secured credit card even if you have a collection account damaging your credit because there’s no minimum credit score requirement for these credit cards. As with unsecured credit cards, you’ll build credit by consistently making timely repayments to your card issuer.

- Get a credit-builder loan: Credit-builder loans are designed to help you build credit, and they have low (or nonexistent) credit score requirements because of their low risk for lenders. Unlike traditional installment loans, you only receive access to the funds you borrow after you’ve made all your payments.

- Become an authorized user: If you have a family member or close friend with a good credit score and payment history, then being added to their credit card account as an authorized user can instantly improve your credit score.

- Report your rent or bill payments: What many people don’t know is that you can immediately boost your credit by self-reporting your payments toward phone bills, rent, utilities, or streaming services. You can either sign up for a paid reporting service or try Experian Boost, which is a free service for adding bill payments to your Experian credit report.

Boost your credit for FREE with the bills you're already paying

Boost your credit for FREE with the bills you're already paying

- Experian Credit Report and FICO® Score updated every 30 days on sign in

- Instantly increase your credit scores for FREE with Experian Boost™

- Daily Experian credit monitoring and alerts

Although applying for new credit can cause a small drop in your credit score in the short term, it will benefit your score in the long run by helping you establish a positive payment history (as long as you pay all your bills on time) and potentially adding to your credit mix, which is the variety of different types of credit accounts you have.

6. Keep your finances in order

Once you’ve taken steps to get out of debt and added positive information to your credit report, adjust your habits to ensure that you can pay all your bills on time in the future. This will prevent late payments (and potentially new charge-offs and collection accounts) from bringing your credit score back down.

Follow these tips to keep your finances (and credit) in good shape:

- Limit your spending on credit cards: Reducing the amount you’re spending on revolving credit accounts (e., credit cards) will boost your credit score in addition to lowering your bill payments. This is because your credit utilization rate (also known as your debt-to-credit ratio) is an influential factor that goes into calculating your credit score.

- Only apply for credit when you need it: If you’re struggling with debt, resist the urge to apply for new credit cards or loans unless they’re credit-building tools. Accumulating more debt will increase your financial burden and put you at risk of missing payments.

- Ask for help if you’re struggling: If you have too much debt or you’re feeling overwhelmed, then try reaching out to your creditors and asking them about their alternative repayment options. You can also get credit counseling at little or no cost. A credit counselor can give your financial advice and resources or even enroll you in a debt management plan.

How long does it take for your credit to recover from collections?

In most cases, collections stay on your credit report for 7 years. The same is true for the majority of negative items. 1 However, even though it’s next to impossible to wipe your credit history clean after collections, their negative effects will diminish over time, and they’ll probably have little to no impact on your credit score after 2 years. 7

The amount of time it’ll take to rebuild your credit after collections depends on several factors, such as your credit history and what other information is in your credit file. Just remember that your credit scores update regularly, so you’ll be able to see results in the long run as long as you remain patient and diligent about rebuilding your credit.

Takeaway: Rebuilding your credit after collections is possible, but it may take time.

- Collections are a serious delinquency that negatively affect your payment history.

- To fix your credit after collections, dispute errors on your credit report, negotiate with your creditors/debt collectors, use credit-building tools, and get your finances in order.

- Paying off your collections can improve your credit score, but only in certain credit scoring models and only if you repay the debt in full.

- Although collections generally take 7 years to fall off your credit report, their damaging effects on your credit scores diminish over time.