Almost everybody’s at least a little familiar with credit cards. In fact, most people in the US have at least one card. 1 However, not everybody understands how these small pieces of plastic actually work—even though many of us use them every day.

Whether you’re new to credit or you’re a long-time cardholder who’s curious about the nuts and bolts of the credit card industry, we’re here to draw back the veil and explain everything you ever wanted to know about how credit cards work, what they’re used for, and what exactly they’re capable of.

Table of Contents

What is a credit card?

A credit card is a tool that allows you to repeatedly borrow money from a bank or financial institution up to a certain credit limit. You then pay back the money you borrowed on a monthly basis.

You don’t need to pay back everything you owe (called your credit card balance) every month, although you do have to make a minimum payment.

Anything that you don’t pay will “revolve” (carry over) into the next month and generate interest (additional charges). For this reason, credit cards are referred to as a type of revolving credit.

What credit cards look like

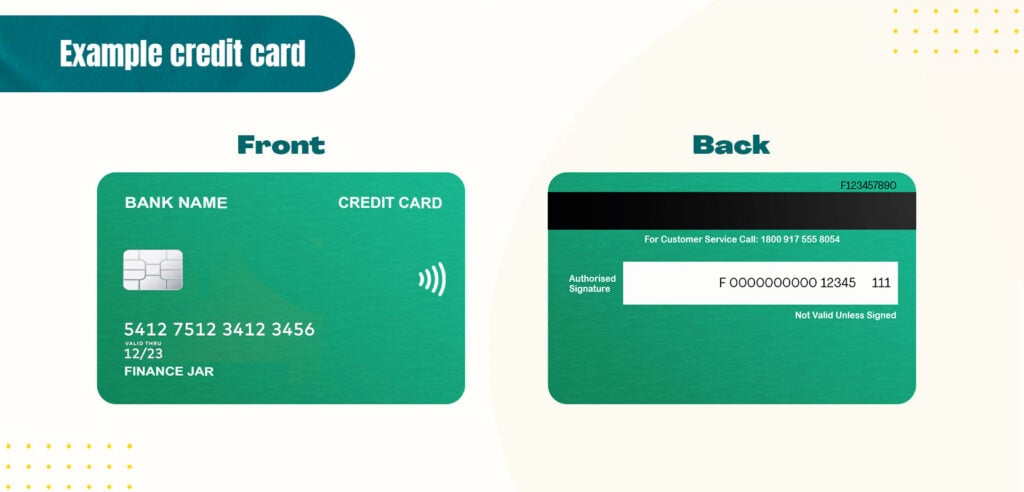

You’ve almost certainly seen a credit card before. Credit cards from different companies all look a bit different—they come in different colors, and information may be located in different places—but all have the same basic form.

Appearance of a Typical Credit Card

What can you use a credit card for?

Credit cards arguably have two main functions:

- Financing everyday purchases: This is what credit cards are mainly for—buying products or services and then paying for them later.

- Building credit or rebuilding credit: Using a credit card regularly and responsibly is a good way to improve your credit score, which lets you get better deals on loans and credit cards in the future.

Secondary uses of credit cards

Many cards also have a variety of other uses:

- Getting cash advances: It’s often possible to get cash from a credit card (e.g., at an ATM). This is referred to as a cash advance.

- Performing balance transfers: Some cards allow this function, which lets you use a new credit card to pay off the debt on an old one. This is a popular way of consolidating debts.

- Getting discounts: Some credit cards provide discounts when you use them for certain purchases, such as meals at particular restaurants.

- Earning rewards: Many credit cards will reward you for using them by letting you earn “points” or cash back on some purchases.

- Accessing other perks: There are also other miscellaneous perks that some cards qualify you for, such as insurance on some of your purchases, or access to airport lounges.

All credit cards can be used to make regular purchases and build your credit, but the other functions vary by card.

What are the major types of credit cards?

You can find a wide variety of credit cards on the market. All credit cards fall into one of two categories:

- Unsecured cards: These are cards that aren’t backed by a credit card security deposit or any other type of collateral. The majority of credit cards fall into this category.

- Secured cards: These are backed by a security deposit which the credit card company can keep if you fail to pay back their debts. The size of your deposit usually determines the card’s credit limit (e.g., if you put down a deposit of $500, you can spend up to $500 on the card). Secured cards are geared toward consumers with poor or limited credit histories.

Beyond that, credit cards can be further broken down into several other categories:

- Student cards: These are designed specifically for students or young adults with a thin credit file (meaning they haven’t been using credit for very long).

- Business cards: These cards are aimed at business owners and are meant to be used for business purchases.

- Rewards cards: These are cards with perks, like cash back, credit card miles, discounts, or membership points. Most rewards credit cards are only available to consumers with good credit scores.

- Travel cards: Cards with perks tailored to frequent travelers, such as frequent flier benefits, travel-related cashback rewards, and no foreign transaction fees.

- Balance transfer cards: Used for paying off debt from other credit cards. These cards often feature 0% APR periods and may waive balance transfer fees (more on what this means below).

- Retail cards: Affiliated with a specific brand or business and only used for purchases from select retailers.

Credit cards can (and often do) fall into more than one category. For instance, most travel cards are also rewards cards.

Do you have to pay to open or maintain a credit card?

Some credit cards are free, whereas others cost money to set up and keep open. Virtually all credit cards come with stipulations that allow the card issuer to charge you money in certain situations.

Credit card companies make money from two types of charges:

1. Credit card fees

Credit cards can come with various fees, some of which may be avoidable, some of which aren’t. You may have to pay:

- A setup fee: This is a one-time fee you may need to pay to open your credit card.

- Annual/monthly fees: Recurring fees you need to pay to keep your account active. Somewhat confusingly, credit card annual fees may be charged on a monthly or yearly basis.

- Transaction fees: These are fees that some card issuers charge to perform certain transactions. Common examples include balance-transfer fees, cash advance fees, and foreign transaction fees. Note that credit cards never charge fees for ordinary purchases, just these special types of transactions.

- Penalty fees: These are charges you’ll face if you mishandle your account, such as credit card late fees.

2. Credit card interest rates

One of the main ways that credit card companies make money is by charging you interest, aka additional charges that apply if you carry a balance from one month to the next.

Your interest will be calculated according to your credit card’s APR. This stands for “annual percentage rate,” the amount of interest your card will rack up if you leave a balance on it for a year. This is also sometimes referred to as your interest rate.

It’s important to note that most credit cards have several APRs, which apply in different circumstances:

- Purchase APR: This is your card’s interest rate for regular transactions, including online and in-store transactions. Most purchases are subject to this interest rate.

- Cash advance APR: This is the interest rate for credit card cash advances and “cash-like purchases”—aka using your card to get anything that’s essentially equivalent to cash, such as a gift card.

- Balance transfer APR: Interest rate for credit card balance transfers, where you use one credit card to pay off the balance on one or more other cards.

- Penalty APR: This is a higher interest rate that your credit card company may apply to all of your purchases as a penalty for being severely late with one of your monthly payments.

- Introductory APR: Low interest rate (often 0%) that only applies for a limited amount of time after you open a credit card account.

It’s possible to get out of paying interest entirely if you commit to paying your credit card off in full every month. If you do that, and if your card has no setup fee and no monthly or annual fees, it’s possible to maintain and use it completely for free.

How do credit card payments work?

You have to pay back any money that you spend on a credit card. This isn’t just an ethical obligation but also a legal one—if you fail to pay off your credit card debt, your creditor may charge off your debt, send it to a debt collection agency, and even take you to court to force you to pay up.

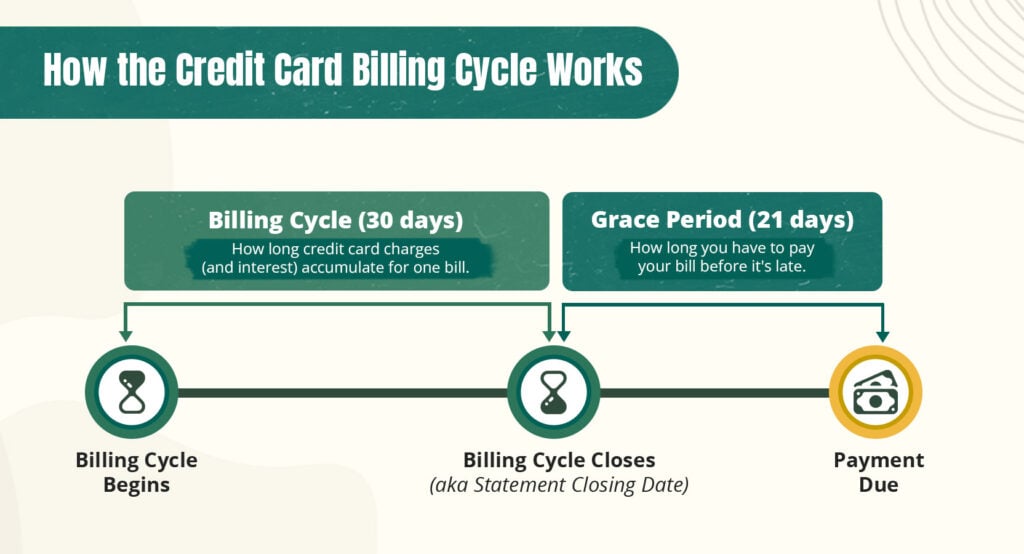

Most people make credit card payments on a monthly basis. This is because credit card billing cycles (the time period during which your charges are all added to a single bill) are usually 28–31 days long.

When you receive a credit card bill, either in the mail or electronically, there are a few key terms you should pay attention to:

- Statement closing date: This is the date marking the end of the previous billing cycle. Your finalized bill is calculated on this date.

- Payment due date: The date your credit card payment is due. This is usually at least 21 days after the statement closing date. 2

- Minimum payment: The minimum amount you need to pay to avoid late fees.

- Statement balance: The full amount you owed on the credit card account at the end of the billing cycle.

Again, you need to make at least your minimum payment by the payment due date. If you pay off your entire statement balance, you’ll also avoid interest charges. Any part of your balance that you don’t pay off will generate interest according to your credit card’s APR.

Overview of the Credit Card Billing Cycle

How do credit cards affect your credit score?

Credit cards, like loans and other credit accounts, affect your credit. They contribute to all five of the main factors that contribute to your credit score:

- Payment history: This is a record of whether you pay your credit card bills on time.

- Credit utilization: How much of your available credit you’re using at any one moment.

- Length of credit history: How long you’ve had your credit card open and how old the credit account is compared to your other ones.

- Credit mix: Whether you have a good balance of credit cards and loans. The more diverse your credit accounts, the better.

- New credit: How recently you opened your credit card account and how many credit applications you’ve submitted in the past couple of years.

Whether a credit card will hurt or help your credit depends on how you use it. In general, if you apply for new credit cards relatively infrequently, use your cards in moderation, and never miss any payments, your credit usage will gradually improve your score.

To learn more, read about how to use a credit card to build credit or even fix a damaged credit score.

How long do credit cards affect your credit?

A credit card account will only impact your credit score when it appears on one of your credit reports. Your creditor may report your account details to one, two, or all three of the credit bureaus that publish your credit reports, or they may choose to report to none at all.

Once your credit card account is closed, it will be removed from your credit report after 7 years (if delinquent) or 10 years (if in good standing) and stop impacting your score. 3 4

How do credit card transactions work?

You can use your credit card to make purchases with any merchant, retailer, individual, or financial institution that’s equipped to process credit card payments.

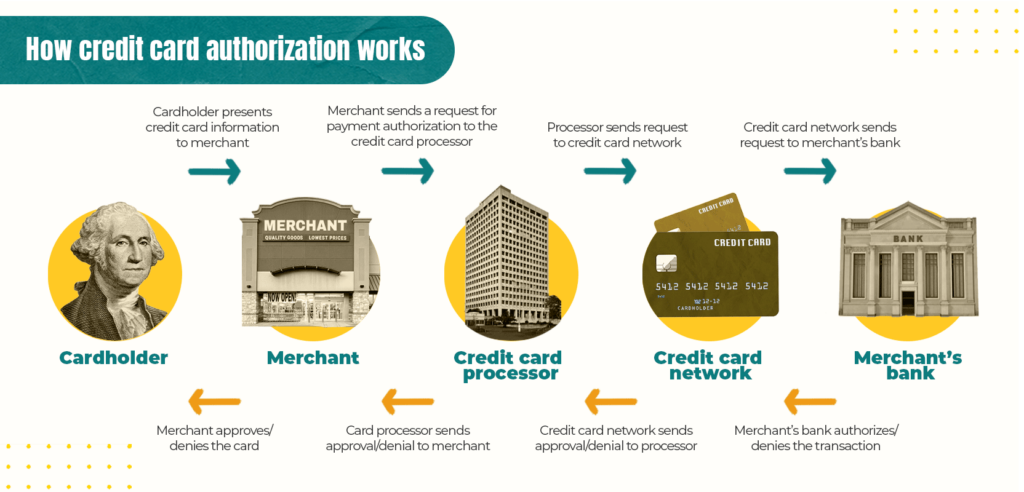

Credit card transactions involve a few different parties:

- Cardholder: Whoever is using the card to perform the transaction (e.g., the primary cardholder or credit card authorized user). Most of the time, this means you.

- Credit card issuer: The bank or financial institution that gave you the credit card (i.e., your creditor).

- Merchant: The store, business, or organization that’s accepting the cardholder’s credit card payment.

- The merchant’s bank: The bank that the merchant uses to accept credit card payments.

- Credit card network: A network that handles communications between merchants (who you make purchases from) and card issuers during credit card transactions. There are four main credit card networks: Visa, Mastercard, American Express, and Discover.

- Credit card processor: A third-party service provider that’s responsible for processing the transaction.

The whole credit card transaction process usually only takes a few seconds. You either submit your card information online or swipe, tap, or insert your card into the point-of-sale device (credit card reader) at a brick-and-mortar store, and then you receive your approval or denial response.

However, what’s going on beneath the surface is more complicated. All of the parties above communicate with each other to authorize, authenticate, and settle the payment.

To give you an idea of how complex credit card transactions are under the hood, take a look at this illustration of how they’re authorized. Although from your perspective, authorization is instant, there are actually many stages in the process, as each company listed above sends information to the next one in line.

Stages of Credit Card Authorization

How to get a credit card

Anybody can get a credit card. As long as you meet the minimum age requirement for opening a credit card account, you can find a company willing to issue you one.

To start using a credit card, follow the steps below:

- Check your credit: Checking your credit score and reviewing your credit reports with each major credit bureau (Equifax, Experian, and TransUnion) will give you an idea of what credit cards you can qualify for and whether you need to fix any issues with your credit before submitting credit card applications.

- Compare credit card offers: Shop around for credit cards that suit your needs and circumstances. Reading credit card reviews will also help you weigh the pros and cons of each card.

- Get prequalified: Applying for prequalification will give you a rough idea of whether you meet the issuer’s requirements without putting your credit at risk. Formal applications cause a drop in your credit score by triggering hard inquiries, whereas prequalification only triggers a soft inquiry, which won’t hurt your credit.

- Submit an application: The last step is to fill out an application for your chosen credit card and submit any supporting documentation you’re asked to provide. You may receive instant approval, or it may take a while for the credit card company to make a decision on your application.

Once you’ve opened a credit card, you’ll see the account appear as a tradeline (active credit account) on your credit report. As soon as you activate your credit card, you’ll be able to use it to make purchases.

How to use a credit card properly

To get the most benefit from being a cardholder, you’ll need to understand how to use your credit card wisely and responsibly.

Follow these tips:

- Always your credit card bills on time: Set up autopay or payment reminders so that you never miss your payment due date. Late payments can do major damage to your credit and trap you in debt due to credit card late fees and growing interest.

- Keep your balance low: Spending only within your means will help you steer clear of credit card debt. Keeping your balance under 10% of your credit limit will also help you maintain an optimal credit score. 5

- Pay beyond the minimum: Although you technically only need to make the minimum payment to keep your credit card account in good standing, you should make a habit of paying your credit card bill in full whenever you can to avoid acquiring too much credit card debt.

- Don’t let your account become inactive: Use your credit card occasionally—at least once every few months. If you stop using your card completely, then your card issuer may stop reporting your account activity to the credit bureaus and even close your account altogether.

FAQs about credit cards

If you’ve still got questions, don’t worry. We’ve answered the most common lingering questions that people have about credit cards below.

When did credit cards come out?

The Diners Club card, which was created in 1950, is widely recognized as the first modern credit card. 6 Businessman Frank McNamara was inspired to design it by a simple problem he had one evening: not having enough cash to cover his dinner bill.

Of course, although credit cards are a relatively modern invention, the concept of lending on credit extends much further back.

How are credit cards made?

Credit cards are made by pressing together multiple layers of polyvinyl chloride (PVC) plastics. 7 During manufacturing, credit cards are often embedded with a security feature, such as a magnetic strip or EMV chip.

Credit cards can be printed using special credit card printers so that they can be issued immediately on-site at banks and financial institutions and manufactured on a large scale.

What type of credit account is a credit card?

As mentioned, credit cards are a type of revolving credit. This is one of the three main types of credit (the other two are installment loans and open credit accounts).

Revolving credit accounts like credit cards allow you to withdraw funds repeatedly up to a set limit with no set repayment period. However, everything you don’t pay “revolves” into the next payment period and generates interest, which is where the name comes from.

Are credit cards a type of money?

No, you can use credit cards to make purchases and perform other monetary transactions, but they’re not classed as a form of money. Instead, they’re a type of credit.

If you have a credit card, do you have to use it?

Depending on your card issuer and the terms of your card agreement, you may need to use your credit card occasionally to prevent the account from becoming inactive.

To find out how often you need to use your credit card to keep the account open, contact your credit card company’s customer service team.

How do credit card companies make money?

Credit cards make money for banks and financial institutions mainly through two main sources of revenue:

- Interest fees and charges

- Usage fees (late fees, foreign exchange fees, etc.)

Interest charges make up roughly 80% of credit card company profits, whereas fees account for approximately 15% of their profits. 1