Medical debt is very common. In 2022, it was estimated that around 23 million Americans had unpaid medical bills, with the amounts they owed ranging from $250 to more than $10,000. 1

If you have hospital bills that have been charged off and sent to a debt collection agency, you’re far from alone. The good news is that, if you’re having trouble paying off your debts, it might be possible to settle them for less money than you owe.

We’ll talk about why paying off medical collections is necessary, the pros and cons of using debt settlement to do so, and what your other options are.

Table of Contents

Should I pay off my medical collections?

Yes, in most cases, you should pay off medical bills in collection. Paying them off has several benefits, including:

- Protecting you from lawsuits: Unless your medical debt is very old (i.e., it’s time-barred debt), you can be sued over it. If the court rules against you, your debt collector can garnish your wages, taking money from you against your will. Paying off your debt eliminates this risk.

- Stopping debt collectors from harassing you: If you have a medical bill in collections, you’ll probably repeatedly get calls from debt collectors. Paying it off is a surefire way to stop them from persistently contacting you.

- Improving your credit score: Medical debts affect your credit score once they’re transferred to debt collectors. Paying them can significantly improve your score, although this isn’t guaranteed. We’ll explain this in more detail below.

- Avoiding additional fees: Medical bills can be subject to interest and late fees if you don’t pay, negotiate, or resolve the balance quickly. 2 Paying off your debts as quickly as possible often means paying less overall.

The upshot is that paying off medical debts in collections has significant benefits for your financial security and overall peace of mind. Of course, it’s often easier said than done, which brings us to debt settlement.

Settling medical debt in collections: how it works

Settling a debt means paying it off for less money than you actually owe. You can do this by negotiating with the debt collector that was hired to collect your debt (or that owns it, if your hospital or clinic sold the debt to them outright).

Settling medical debt has both advantages and disadvantages.

Pros and cons of medical debt settlement

Pros:

- Debt settlement can enable you to pay medical bills that otherwise might be unmanageable.

- You can pursue debt settlement immediately, which means your debt won’t rack up any further fees.

- Settled debts can be better for your credit score than debts in collections.

Cons:

- Debt settlement doesn’t always work—there’s no guarantee your debt collector will agree to your offer.

- Debt settlement still hurts your credit score, although often not as much as unpaid collections.

The second con is particularly crucial. Like collection accounts, settled debts are counted as “negative marks” on your credit report, which means they damage your credit score. In contrast, when you pay off a medical debt in full, it will be completely removed from your credit report.

This in turn means that settling a medical debt isn’t as good for your credit as paying it off in full.

However, if paying in full isn’t a realistic option, settling your medical debt is still much better for your finances (and potentially your credit) than not paying it at all.

How to settle medical collection accounts

If you’ve decided to settle your medical debts in collections, you have two options:

1. Settle the debt yourself

To do this, find out which debt collection agency you owe money to and then contact them. Tell the collector that you can’t afford to pay in full, but you want to arrange a debt settlement. Name the amount you’re able and willing to pay.

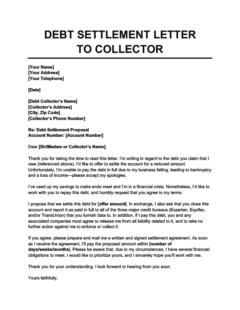

You can create your letter by using the free template provided below.

Debt Settlement Letter to Collector

Use this debt settlement letter template to ask your debt collector to clear a debt for less than you owe. This isn't guaranteed to work, but it's a good option if you simply can't afford to pay the debt in full.

2. Hire a debt settlement company

If contacting your debt collector on your own sounds difficult or intimidating, you can hire a third-party debt settlement company to negotiate on your behalf.

Pursuing this option has its own pros and cons. Hiring a debt settlement company can save you time and hassle, but these companies don’t do anything you can’t do yourself, and they obviously cost money (often 20–25% of either your total debt or the settled debt).

Medical debt settlement scams are also quite common, so be careful. Thoroughly vet whichever company you choose and never agree to work with a company that asks for money upfront (which is illegal). 3

How much should you settle medical debt for?

On average, consumers who pursue debt settlement end up paying less than half of what they originally owed. 4 That means that 50% of your total debt is a reasonable place to open your negotiations.

It’s possible your debt collector will send you a counteroffer, which you can either accept or respond to with further offers of your own. The maximum amount you should settle for obviously depends on your finances and how much you can afford.

Debt collectors are more likely to settle very old medical debts

The older your debt is, the higher your chances are of pursuing a successful settlement. This is because old debts are harder to collect, so debt collection agencies are more willing to compromise on them. After all, from their perspective, getting a partial payment is better than getting nothing.

How settling a medical debt affects your credit

As mentioned, both settled debts and medical collection accounts hurt your credit score. However, settled debts are less damaging than completely unpaid collections.

When you settle a medical debt, you’re essentially replacing a very damaging derogatory mark (a collection account) with a moderately damaging one (a settled debt). This will lead to a partial recovery of your credit score, but not a full one.

As you’d expect, if you can pay in full and completely wipe the negative mark from your credit report, it’s obviously better to do so. However, if that just isn’t a practical option for you given your finances, settling your debt is the next best thing.

Medical collections don’t immediately affect your credit

Unlike other kinds of debt, medical debts don’t show up immediately on your credit report. There’s a grace period of 1 year before they appear. If you pay off your collection during the grace period, the collection account won’t affect your credit score at all (although if you settle the debt, that might still affect your score).

How settled medical collections will affect your credit score in the future

The credit bureaus have recently made several industry-wide changes to make medical debts less damaging to consumer credit scores. For instance, in July 2022, they increased the grace period before medical debts appear on credit reports to 1 full year (formerly it was just 6 months).

On January 1st, 2023, they’ll make a further change: unpaid medical debts that are worth less than $500 will no longer appear on credit reports. 5

These changes are part of an effort to penalize consumers less for medical-related debts. The rationale is that, while going into credit card debt is always a choice, nobody chooses to get sick or injured, so racking up unpayable medical bills doesn’t necessarily indicate that you would be an unreliable borrower when it comes to other types of debt.

Alternatives to settling medical debts in collections

Settling your medical bills is sometimes the right choice, but it’s not your only option. Before committing, see if any of the alternatives below make sense for your situation.

Note that you can pursue all of these methods at any time—either before or after your debt is sent to collections. However, the earlier you act, the better your chances are.

1. Check your original medical bill for errors

Hospitals and clinics have been known to make mistakes. If you were overcharged or sent bills for procedures you didn’t actually undergo, you don’t have to pay them.

To dispute an illegitimate charge with your healthcare provider, contact them and explain why you believe it’s a mistake. To dispute a debt with your debt collector, send them a debt verification letter obligating them to provide evidence that you actually owe the debt.

If your dispute is rejected—which could happen, if your provider and/or collector are convinced you do owe the debt—your final recourse is to hire an attorney and pursue the issue in court. This obviously isn’t something that anybody wants to do, so try to address erroneous charges as soon as you can to increase your odds of success.

2. Check whether your insurance will cover the debt

If you haven’t already done so, see if your health insurance provider will cover some or all of your medical bills. If they will, you might be able to sidestep the whole issue.

As with the first method, this is something you can do even after your debt is sent to collections. In fact, due to special laws concerning the reporting of medical debt, if your insurance pays off a medical collection account, it will be removed from your credit report entirely. This means it will stop affecting your credit score, regardless of what credit scoring model your lender uses. 6

3. Negotiate your bill with your healthcare provider

If you have a (legitimate) bill that you can’t pay, contact your healthcare provider about it and honestly explain your situation. Say that you want to pay what you owe, but you just can’t afford to.

Hospitals and clinics don’t like dealing with debt collectors any more than consumers do. If you show that you’re serious about paying, there’s a good chance they’ll be willing to work out a payment plan with you where you’ll pay down your debt in manageable monthly installments.

They might also reduce your total debt if you can pay the reduced amount upfront, or in cash. 2

4. Hire a medical bill advocate

If you don’t want to deal with your healthcare provider on your own, you can hire a medical bill advocate to do it for you.

A medical bill or patient advocate is a professional who will negotiate your medical bills on your behalf, and who can help you review and even appeal them.

As you’d expect, these experts will charge you a fee for their service. This cost is either an hourly rate or a percentage of the amount they save on your bill. Before you hire a medical bill advocate, make sure that their fee will be outweighed by the money you’ll end up saving.

5. Get a medical credit card

Many healthcare providers offer specific credit cards to help you pay off medical bills. These cards can only be used for healthcare expenses. Like regular credit cards, they have different interest rates and fees that you should consider before applying.

If you end up using a medical credit card, try to get one with a promotional 0% APR period (in which you’ll pay no interest). Try to pay off your bill within the intro period so you don’t get hit with high interest charges after it ends.

Note that if you pay your medical bill with a credit card, you’re not eligible for a payment plan. 2

6. Pay off your debt with a loan

Similarly, if you have a relatively good credit score—which is more likely if your medical collection account hasn’t appeared on your credit report yet—you might also be able to qualify for a personal loan, which you can immediately use to pay off your debt.

Paying with a loan comes with obvious downsides. Obviously, you’ll have to pay back the loan, which might actually cost more money in the long term than paying off your debt normally, depending on your loan’s interest rate.

However, this option can buy you some time and keep the medical collection account off your credit report. Just be sure to only take out a loan you can afford; if you repeatedly miss payments, your loan might also get charged off and lead to a collection account of its own.

Takeaways: You can sometimes settle medical bills in collections, although doing so has certain drawbacks.

- It’s usually a good idea to pay off your medical bills in collections, with the possible exception of debts that have passed the statute of limitations and become time-barred.

- If you can’t afford to pay your debt in full, you can pursue debt settlement.

- Debt settlement can damage your credit score, so it isn't as good as paying in full. However, if your debt is just too steep to completely pay off, debt settlement provides a good alternative.

- If you don’t ask for a debt settlement, you have several other options, including negotiating with your healthcare provider for a payment plan. You can also hire a medical bill advocate to negotiate on your behalf.