Credit is your ability to receive money, goods, or services upfront on the understanding that you’ll pay for them later.

Here’s a deeper look into what exactly credit is, how it works, and what it means for consumers like you.

Table of Contents

What is the definition of credit?

At its heart, credit is really very simple. Any time you borrow money or receive goods or services without paying upfront, you’re using credit.

Credit comes in various forms. For example, there’s a difference between business credit and consumer credit—the former refers to money that a company borrows, and the latter refers to money that individuals borrow.

When you borrow money for your own personal use, regardless of whether you’re buying something as large as a house or as small as a few groceries, you’re using consumer credit.

Examples of credit accounts

When you contact a lender, such as a bank, and apply for money or services, you’re opening something called a “credit account.” Below are some of the most common types of credit accounts:

- Credit cards

- Personal lines of credit

- Store credit cards

- Unsecured loans (e.g., personal loans and student loans)

- Secured loans (e.g., mortgages and auto loans)

- Utility accounts (e.g., water, cable, electricity, or gas)

- In-store financing (i.e., making large purchases and signing up for a payment plan)

What are the three types of credit?

All credit accounts fall into one of three categories. The three types of credit are distinct in terms of how you use and access them and how you repay your debts:

- Revolving credit: Revolving credit accounts are lines of credit that you can repeatedly withdraw from up to a certain limit. You then pay them back, generally on a monthly basis, and they become available for your use again. Any of the money that you don’t pay back “revolves” into the next month and accrues interest. Credit cards are by far the most common type of revolving credit; other examples include store cards and personal lines of credit.

- Installment loans: When you open one of these credit accounts, you obtain a single amount of money in a lump sum and repay it over time by making regular payments, known as “installments,” often on a monthly basis.

- Open credit: These are lines of credit with no set limit that you can repeatedly withdraw from with the expectation that you’ll repay your debt in full at the end of each billing cycle. Common examples include utility and cell phone contracts.

Key credit terms defined

In order to understand how credit works, you need to be familiar with a few key concepts in the credit industry.

What is a credit bureau?

A credit bureau, also known as a consumer credit reporting agency, is a company that collects, stores, and distributes consumer data. The US has many credit bureaus, but three dominate the market:

- Experian

- TransUnion

- Equifax

Credit bureaus are the middlemen between consumers and lenders. When you apply for a credit account, your lender will check your credit records with one or more of these bureaus. Once you actually open the account, they’ll begin providing the bureaus with information about your account and how well you’re managing it.

Credit reporting agencies don’t offer credit themselves. They store your data, and when lenders or other interested parties ask for a review of your credit history, they provide it to them in the form of a credit report.

What is a credit report?

Credit reports are documents that show your credit history. The information contained in your credit reports is used to calculate your credit score. You have three credit reports, one with each of the three main credit bureaus.

Not just anyone can access your credit reports. The credit bureaus only provide credit reports to individuals or businesses who can prove that they have a “permissible purpose” for viewing your credit history.

What information is included on your credit report?

Your credit reports might differ slightly because creditors don’t always report your borrowing activity to every credit bureau, but they all provide the same types of information:

- Your open and closed credit accounts (e.g., loans and credit cards)

- The amount you’ve borrowed

- Your payment history (e.g., any late payments you have)

- Bankruptcies

- Collection accounts (if any of your debts were sent to a debt collection agency)

- Credit inquiries from the past 2 years (i.e., hard inquiries and soft inquiries)

Your credit reports don’t include information about your income, savings or checking account balances, investments, or bank transaction history. They also don’t reveal irrelevant information that could potentially result in rigged credit scores or bias in lending decitions, such as your race, religion, or religious or political views.

You’re entitled to free access to your credit reports

Under federal law, you’re entitled to one free copy of your credit report per year from each credit bureau (currently one free copy per week due to COVID-19). You can request your free credit reports at AnnualCreditReport.com.

What is a credit score?

Your credit score is a three-digit number ranging from the lowest possible credit score of 300 to the highest possible score of 850. A higher credit score indicates that you’re a more reliable borrower.

Your credit score is generated by credit scoring agencies like FICO and VantageScore, which produce different credit scoring “models.” These models attempt to determine your creditworthiness, i.e., how likely you are to repay your debts as agreed.

Factors that affect your credit score

While there are some differences between FICO and VantageScore, both companies calculate your credit score based on the following factors:

- Payment history: This is a record of your payments on your debts, i.e., whether you generally pay on time or you’ve made a lot of late payments.

- Credit utilization: This is the amount of your credit that you’re using. Lower credit use is better for your score.

- Length of credit history: The age of your credit accounts. A longer credit history (with older accounts) is better.

- Credit mix: The variety of the accounts that you have. Both models reward you for having a diverse blend of credit accounts, including both loans and credit cards.

- New credit: A record of whether you’ve applied for any new accounts lately, which can temporarily depress your score.

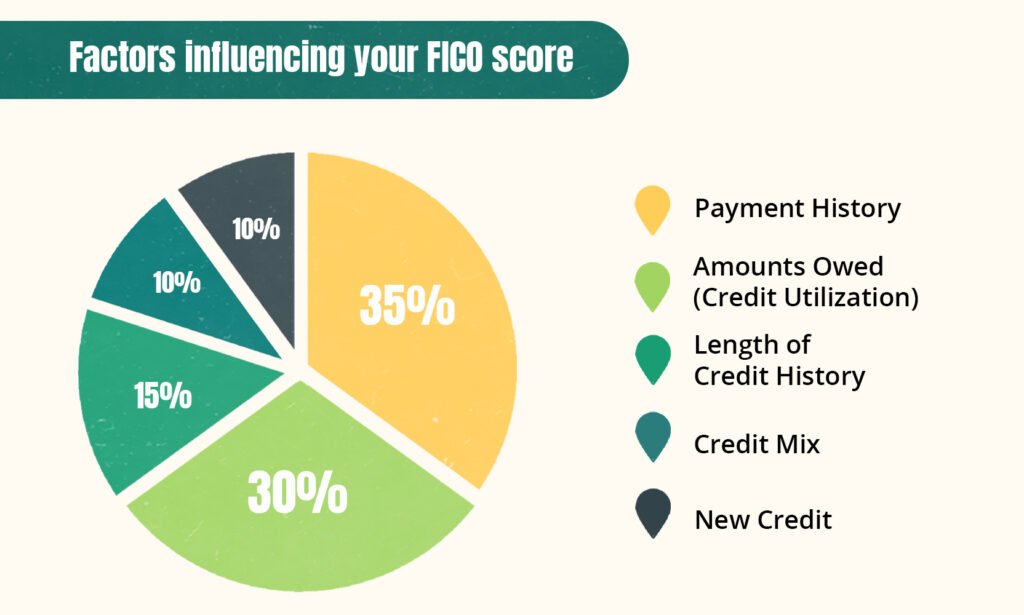

These factors aren’t all equally important. The graph below shows how heavily each is weighted in FICO’s model (which the majority of lenders use).

How FICO Credit Scores Are Calculated

Alternate definitions of credit

The definition of credit can vary slightly depending on the context—the term is used a bit differently in accounting, economics, finance, and banking—but regardless of industry, the general idea is the same: credit represents funds or assets that you access as a borrower (and not an outright owner).

However, people sometimes use the word “credit” in another way: to refer to your general creditworthiness. In other words, they use it as shorthand for “credit score.”

When people refer to building credit, they’re using the word in this second sense. They mean establishing a history of responsible credit use so that you have a good or excellent credit score and can qualify for better credit cards and loans in the future.

Why is it important to have credit?

Credit has obvious benefits. It provides access to funds you otherwise wouldn’t have and the power to make big purchases when you need them rather than after months or years of saving.

However, having an established credit history and a good credit score has other benefits, even if you’re not interested in actually borrowing money.

If you have to undergo a background check of any type (eg., for employment), there’s a good chance that it will include a credit check. You may need a decent credit score to get the following things:

- Apartments

- Utilities or phone contracts with no deposit

- Jobs

- Insurance

- Car rental

Your creditworthiness may also influence the price you get on some of the services listed above (many insurers factor your credit into how much they charge you, for instance).

Benefits of using credit

Opening credit accounts and using them responsibly will allow you to build credit over time. Eventually, you’ll get access to all the benefits of good credit, such as low interest rates, high credit limits, and exclusive credit rewards, such as cash back on credit cards.

Even if you’ve never used credit before, starting to establish credit right now will ensure that you have a strong credit score and credit history when you really need it, such as if you ever decide to take out a mortgage or car loan.

Resources for building good credit

Considering how important credit is, you should take steps to establish your credit history and keep it in good shape.

The strategies you should pursue depend on where you are on your credit-building journey. We’ll explain the tools and methods you should use, depending on whether:

- You’re just starting out: If you’ve never used credit before, don’t worry—everybody starts somewhere. Look into how to build credit when you have none and get your credit off to a good start. If you’re particularly young, you should also read up on the ways teenagers can build credit, since there are special laws that apply to credit use before you turn 21.

- You already have a credit history: Credit-building is a lifelong journey. If you’ve used credit before but still want to improve your credit score, read up on how to build credit at any stage of your life.

- If you have damaged credit: If you’ve struggled in the past and you have a bad credit score, your strategies will be a bit different. Learn how to rebuild your credit and regain a healthy credit score.

Remember that credit building and credit repair can take a long time, but educating yourself about what credit is and how it works will make the process go a lot smoother and help you avoid mistakes that could set back your progress.

Takeaway: Credit is access to funds, assets, or services that you agree to pay for later.

- Lenders, businesses, or service providers may extend you credit. This is based on the assumption that you’ll repay what you’ve borrowed within a specified period.

- There are three types of credit: Revolving credit accounts (e.g., credit cards and store cards), installment loans, and open credit accounts (e.g., utilities or phone service).

- Credit bureaus are companies that store your credit data in the form of credit reports. These credit reports are then used to calculate your credit scores.

- Credit scores are based on various factors reflecting your risk as a borrower, such as your payment history, how much you borrow, and how long you’ve been using credit.

- In addition to extending your buying power, credit may be necessary for getting a job, apartment, utilities (without a deposit), or insurance.