If you’ve been reading up on how companies in the credit industry classify credit scores, you might have been surprised to learn that scores in the “good” range aren’t the best scores you can get. In many scoring models, there’s a category above the good range for people whose credit is truly excellent.

Establishing excellent or exceptional credit isn’t easy, but if you can, it’s well worth doing. It will significantly increase your borrowing power and get you all the benefits of having a top-tier credit score.

Table of Contents

What’s considered excellent credit?

FICO and VantageScore (the two companies that produce credit scoring models) have their own definitions of excellent credit, as do the three main credit bureaus, Experian, Equifax, and TransUnion.

Here’s a look at how each company defines its highest score tier (note that both FICO and VantageScore use a credit score range that runs from 300 to 850):

- FICO: 800–850

- VantageScore: 781–850

- TransUnion: 781–850 (when using the VantageScore 3.0 model) 1

- Equifax: 760–850 2

- Experian: 800–850 (when using FICO Score 8) 3

Lenders use FICO’s models significantly more often than VantageScore’s. 4 This means that in the context of lending decisions, an excellent credit score is generally considered to be a FICO score of 800 or higher, per FICO’s definition.

For context, here are the other score classifications (e.g., “Good,” “Fair,” and “Poor” credit scores) in both credit scoring models:

FICO and VantageScore Scoring Ranges

| FICO/VantageScore Rating | FICO Score Range | VantageScore Range |

|---|---|---|

| Exceptional/Excellent | 800–850 | 781–850 |

| Very Good/Good | 740–799 | 661–780 |

| Good/Fair | 670–739 | 601–660 |

| Fair/Poor | 580–669 | 500–600 |

| Poor/Very Poor | 300–579 | 300–499 |

Good vs. excellent credit: What’s the difference?

A good credit score isn’t the same as an excellent credit score. A good credit score will open up the door to just about any type of credit and will usually get you relatively favorable terms (e.g., low interest rates), but it probably won’t get you the very best offers. For instance, credit cards with lucrative cashback rewards might still be out of reach.

To qualify for the best deals, you’ll need to stand out from the crowd by showing lenders that you go above and beyond to keep your credit in top shape. An excellent credit score will demonstrate that for you.

The line between a good and excellent score is somewhat arbitrary

It’s important to realize that lenders have their own standards for what constitutes excellent credit, and might base their lending decisions on that, not on FICO’s score classifications. It’s possible that your lender will place the threshold at which you’ll qualify for their best cards somewhere different than the 800 mark.

What makes a credit score excellent?

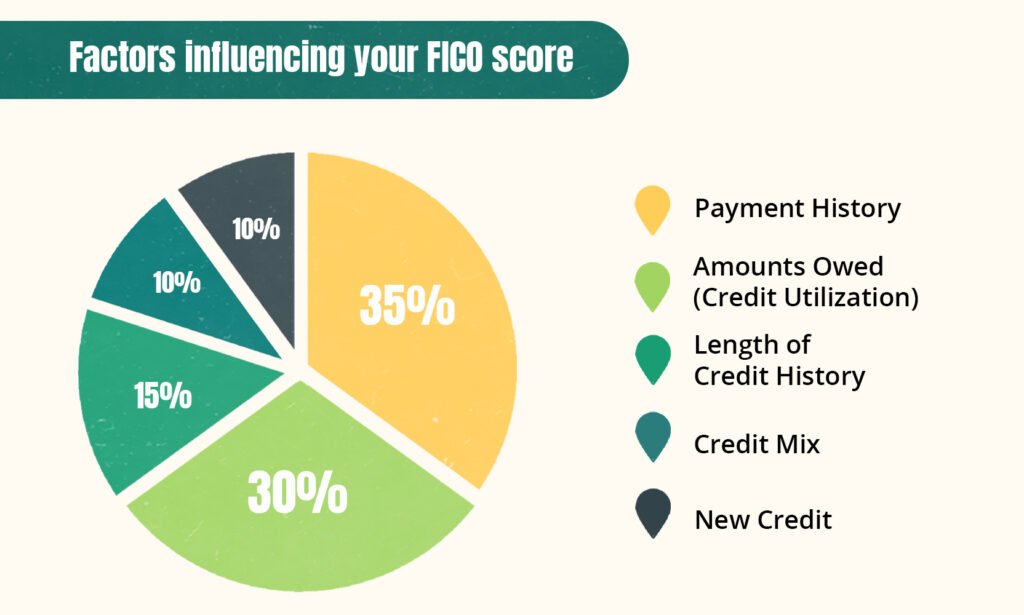

Whether or not you have excellent credit depends on how well you score in the following five categories involved in the calculation of your credit score:

- Payment history: This is the track record of your on-time payments and late payments on all of your credit accounts. To get a good score, you need to always pay your bills on time.

- Credit utilization rate: This is your debt-to-credit ratio (i.e., how much of your available credit you’re using). The scoring models reward you for keeping your spending low (ideally under 10% of your credit limit).

- Length of credit history: How long you’ve had your credit accounts (measured in large part by the average age of your accounts). To get a good score, you should open new accounts relatively infrequently.

- Credit mix: The variety of the different types of credit you use. Maintain a diverse blend of revolving credit accounts (aka credit cards) and installment loans to boost your score.

- New credit: How many applications you’ve submitted recently for new loans and credit cards. Again, if you apply for credit infrequently, it will benefit your score.

If you have an excellent credit score, it suggests that you’re doing very well in each category listed above.

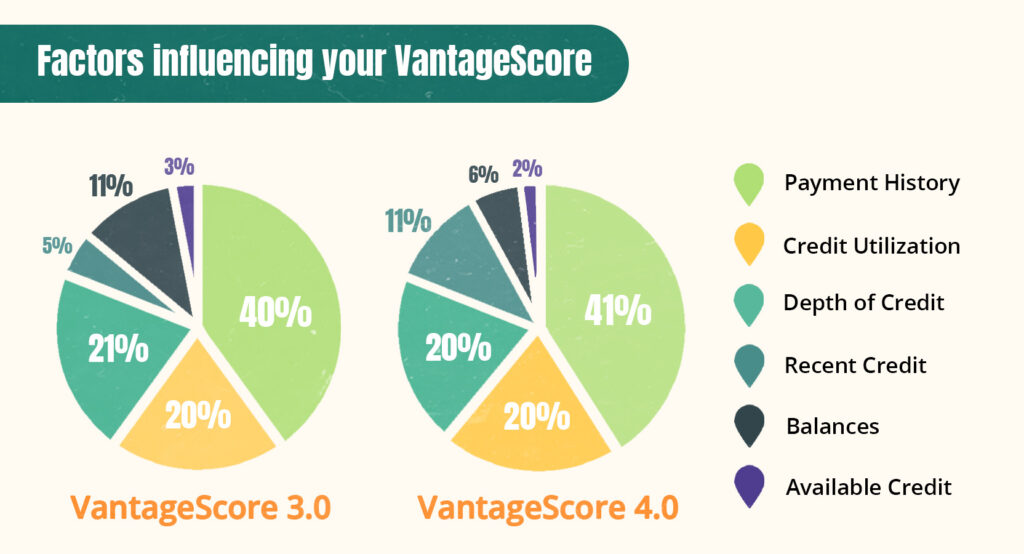

Note that the scoring factors aren’t all equally important; your payment history and credit utilization alone account for more than half of your score in both FICO and VantageScore, so to maintain your excellent score, pay special attention to them.

How Your FICO Score Is Calculated

How Your VantageScore Is Calculated

What’s a perfect credit score (and who has one)?

The highest possible credit score you can get is 850 in every major credit scoring model. Scoring this high is pretty difficult to do. In fact, only 1.6% of Americans had a perfect credit score in 2019. 5

Research shows that people with the best possible credit score have the following things in common: 5

- No missed payments on their credit report

- Low credit utilization ratio (4.1% on average)

- Long credit history (oldest account opened an average of 30 years ago)

This further emphasizes the key role of your payment history, credit utilization, and length of credit history in determining your credit health.

Benefits of having excellent credit

Bumping your credit score up a level from “good” to “excellent” could come with the following benefits:

- Lower interest rates on credit cards and loans (which means money saved)

- Higher loan amounts

- Higher credit limits

- Better credit card rewards, such as cash back or credit card miles

- Lower insurance premiums

- Credit cards with good APRs

It’s worth trying to improve your credit score so that you can take advantage of the benefits of good credit. Getting the boost you need may not be as hard as you think.

How to get an excellent credit score

Whether you’re building credit for the first time, trying to rebuild your credit after a few slip-ups, or looking for some easy credit hacks that’ll give you the small boost you need to push an already-strong credit score over the “excellent” threshold, here are some good places to start:

- Aim for a perfect payment history: Focus on paying all your bills on time, and catch up on any that are overdue. Negotiate with debt collectors or creditors to remove any late payments or collections staining your credit reports.

- Lower your spending on credit cards: Use under 10% of your credit limit on your credit cards and pay your credit card balance in full each month. If you can afford it, paying your credit card bill early can also boost your score.

- Keep your old accounts open: Let your credit accounts age as long as possible. Closed accounts continue to age for a while, but eventually, they’ll fall off your credit report. Having a long credit history is key to achieving and maintaining excellent credit.

- Add alternative data to your credit reports: Use a rental-reporting service or Experian Boost to have everyday bill payments like rent, utilities, and phone bills added to your credit reports. This will give your credit score a quick boost without the need for new credit accounts.

Wherever you are in your credit journey, the important thing to remember is that there really are no shortcuts to achieving excellent credit. However, as long as you’re diligent and responsible when it comes to managing your debts, you can expect to see your credit score gradually increase over time.

Takeaway: Excellent credit is defined as a credit score of 800–850 in FICO models or 781–850 in VantageScore models.

- Excellent credit isn’t the same as good credit. The average American has a good credit score, whereas excellent credit is harder to achieve.

- Whether or not you have an excellent credit score depends on your payment history, credit utilization rate, length of credit history, credit mix, and search for new credit.

- The highest credit score possible is 850, and this score falls in the excellent range. Only 1.6% of Americans have a perfect credit score.

- Having excellent credit comes with several benefits, like lower interest rates, better loan terms, higher credit limits, and greater overall savings on financial products.

- To get an excellent credit score, focus on establishing a strong payment history, long history of managing various debts, and low credit utilization rate.