If you’ve come across the term “payment history” on your credit report or elsewhere, you may be wondering what this is and what it means for your credit.

Your payment history makes up more than a third of your overall credit score—accounting for 35% of your FICO score, for example. It’s a record of whether you’ve made on-time payments for each of your credit accounts, and it’s an important way for lenders to check whether you’re likely to repay your debts on time.

Table of Contents

What is payment history?

Your payment history is a record of the payments you’ve made on your credit cards, loans, and other credit accounts. If you generally pay your bills on time, you’ll have a good payment history, whereas if you frequently miss them or make late payments, you’ll have a bad one.

In the main credit scoring models used by the credit bureaus (FICO and VantageScore), payment history is the factor on your credit report that most strongly influences your credit score. This is because research shows that the way you handled your debts in the past generally predicts how you’ll handle them in the future.

What’s the difference between payment history and credit history?

The difference between payment history and credit history is that payment history makes up only part of your credit history (albeit a major part). Your credit history includes other records that aren’t part of your payment history—for instance, any hard inquiries (credit checks) you’ve undergone.

How can I view my payment history?

You can view your payment history by requesting your credit reports from each of the three main credit bureaus (TransUnion, Equifax, and Experian).

You’re entitled to one free credit report every year from each bureau, which you can get by visiting AnnualCreditReport.com. Although some sites like this are scams, AnnualCreditReport is safe (and is actually authorized by the federal government to provide your credit report).

You can currently get free credit reports once per week

In response to the COVID-19 pandemic, the three credit bureaus have temporarily increased the number of free credit reports you can get from one per year to one per week.

Why is payment history important?

Payment history is important because it’s the most important factor that contributes to your credit score (accounting for 35% of your score in FICO’s model and even more in VantageScore’s). In other words, missing payments or making them late is the single most damaging thing you can do to your credit.

How payment history influences your FICO credit score

The chart below shows how much various factors (including payment history) contribute to your score in the FICO credit scoring models: 1 2 3

How payment history influences your VantageScore credit score

These charts show how payment history (along with the other scoring factors) contribute to your score in the VantageScore models:

Will lenders look at my payment history?

Yes, lenders are likely to look at your payment history. According to FICO, payment history is one of the items that lenders pay close attention to when they conduct credit checks, along with other information like your credit score and how much debt you owe overall.4

How payment history affects your credit score

Because of its high weighting in the main credit scoring models, having a good payment history goes a long way when it comes to building credit and maintaining a good credit score.

Unfortunately, this also means that a single negative mark, such as a late payment, can do a lot of damage to an otherwise blemish-free credit report.

All of the following marks can appear on your credit report and seriously harm your score because they indicate a failure to repay a debt as agreed:

- Late payments

- Charge-offs

- Collections

- Repossessions

- Foreclosures

- Bankruptcies

How do late and missed payments affect my credit score?

The way that late and missed payments affect your credit score depends on how late they were, how many there are, and how recently they occurred.

Recent missed payments bring down your credit score more than old entries do. Moreover, late payments have an increasing impact on your credit score as they progress from 30 to 60 to 90+ days overdue. 5 6

Your credit will also take a harder hit if your credit score was relatively high to begin with.

How many points will missed payments take from my credit score?

How much late and missed payments affect your credit score depends on the scoring model being used, the type of credit account you missed the payment on, and your credit history. Your score could drop by 80–105 points from a single 30-day-late payment or up to 180 points from a 90-day-late payment. 7 6

How long do late and missed payments affect my credit score?

Restoring your credit score after a late payment can take months or years.

FICO has published data indicating that mortgage payments that are late by 30 days can affect your credit score for 9 months to 3 years. Payments that are late by 90+ days can affect your score for up to seven years, with higher scores taking longer to fully recover.8

How long does payment history information stay on my credit report?

Most payment history information stays on your credit report for up to seven years. It’s probably slightly less than seven years (81 months) for your Equifax credit report, whereas it’s exactly seven years (84 months) for your Experian and TransUnion reports.

For example, a late payment will stay on your credit report for seven years from the date of delinquency, and it’ll be visible to lenders during that time. The same goes for most other derogatory items, such as collections and repossessions, although bankruptcies can sometimes be reported for up to 10 years. 9

However, as mentioned, negative information on your payment history will affect your credit score less and less over time. Your score may recover before the negative items drop off your credit report.

How your payment history is calculated

Payment history is calculated by using information that your lender reports to the three major credit bureaus (although they won’t always report everything, and if they do, won’t always report it to all three bureaus).

In general, if you’re current on your bills, your lender will report that credit account to the bureaus as an “account in good standing.” If your bills are overdue, they’ll report it as a late payment.

However, lenders won’t report your payment as late if you miss the due date by a day. You’ll get a 29-day grace period after the payment due date (and some lenders even give you longer). If you pay within this grace period, it’ll be reported as on time; if your payment is after the grace period, it’ll be reported as late. 10

Payment history examples (showing on-time and late payments)

Let’s look at an example of how a credit account (such as a credit card) might appear on your payment history for a period of several years. Assume that this account features a 29-day grace period, as described above.

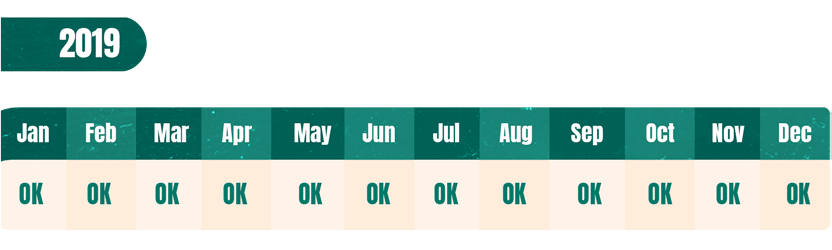

Example 1: All payments were made on time

In 2019, let’s say that every month you paid your bills on time. Your payment history would look something like this (the “OK” marks signify that your account was in good standing):

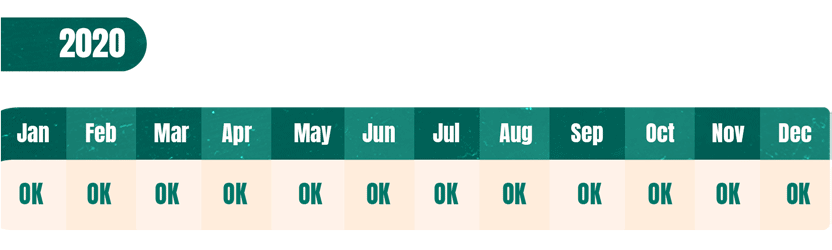

Example 2: Two late payments were paid off in less than 30 days

In 2020, you paid one bill 10 days after the payment due date and another 29 days after the payment due date.

The two payments were technically late, and you might have incurred penalty fees. However, you were still within the 29-day grace period provided by your lender, so your late payments were never reported to the credit bureaus, and your payment history looked the same as in 2019:

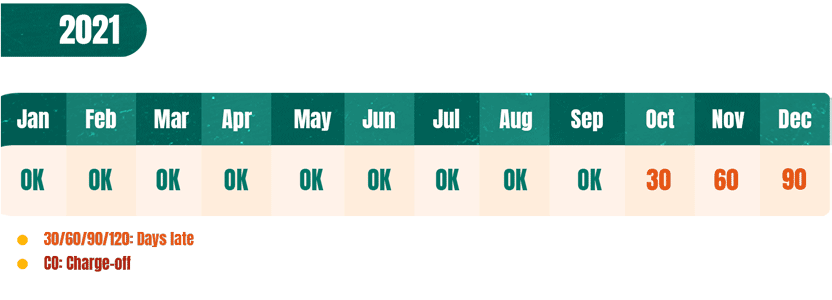

Example 3: A late payment remained unpaid for more than 90 days

In 2021, you ran into financial problems and couldn’t make your payment at all in October. 30 days after the payment due date, your lender reported your late payment to the credit bureaus, who then marked your credit report with “30,” indicating that it was 30 days late.

You weren’t able to pay in November and December either, so your lender reported the payment as 60 days late in November and as 90 days late in December.

Example 4: A 120-day late payment turned into a charge-off

In January of the following year, you still hadn’t paid your outstanding bill, so your payment was reported as 120 days late. After this, your lender decided to charge off the debt and sell it to a debt collection company. In February, “CO” appeared on your payment history, signifying a charge-off.

Will all of my credit accounts show up in my payment history?

Your credit accounts might or might not all show up in your payment history. Whether an account shows up depends on whether that particular lender reports to the bureau that created your report, and on the type of credit account it is.

There are three types of credit accounts that can show up in your payment history:

- Installment loans: These are lump sums that you borrow and repay in installments over a fixed period. Examples include mortgages, auto loans, and student loans.

- Revolving credit: This is money that you can continually access from a single line of credit up to a set limit. If you don’t pay off your balance in full at the end of the month, your remaining debt carries over (revolves) into the next month. Credit cards, home equity lines of credit (HELOCs), and retail accounts are examples of revolving credit.

- Open credit: These consist of services that you receive upfront and must pay for at specified intervals (usually monthly). The most common examples of open credit are utility, internet, cable, and cell phone accounts. Open credit accounts don’t show up on your credit report, but you can sign up for services that will report them to one or more of the credit bureaus, which we describe in more detail below.

As mentioned, any type of credit account (as well as other types of debts, such as hospital bills) can also show up on your payment history if you fail to pay them for a long time and they’re sent to a debt collection agency. These are referred to as collection accounts, and they’re very damaging to your credit score.

Components that make up your payment history

According to FICO, the payment history portion of your FICO score is calculated based on the following factors: 11

- Payment information reported for your credit cards, retail accounts, mortgages, installment loans, and other types of credit accounts.

- The number of your accounts that are in good standing (i.e., paid off or paid as agreed).

- The number of your accounts that have late payments.

- The amounts you owe on delinquent accounts or collections.

- How late your payments currently are or have been in the past.

- How recently your delinquent accounts, collections, or bankruptcies were reported.

- The number of bankruptcies you have (if any). These are the only type of adverse public record that now shows in your credit report, although liens, lawsuits, and wage attachments previously also counted against you.

How to improve your payment history on your credit report

Seeing a sudden drop in your credit score due to a late payment on your credit report can be frustrating. Thankfully, the effects of negative marks always diminish over time if you address them and work toward reestablishing a good payment history.

Take the following steps to improve your credit score:

- Dispute errors on your credit report

- Bring your accounts current

- Pay your bills on time

- Use credit-building tools

Dispute errors on your credit report

If there are negative items on your payment history, it’s possible that they’re errors. Get a copy of your credit report and check it to see if there are any mistakes. A study from 2013 found that one in five Americans had an error on at least one of their credit reports. 12

Check your reports from all three of the major credit bureaus (Equifax, Experian, and TransUnion). If there’s an error on your report, it may have originated with the original creditor, or it may be the fault of the credit bureau that produced the report. You should contact both to dispute the error.

It’s worth doing this even for small errors. Getting a hard inquiry off your credit report, for instance, could add up to 5 points to your credit score. In more extreme cases, getting a very damaging item like a repossession removed from your credit report could earn you 100 points or more.

Bring your accounts current

If you already have overdue accounts, bring your accounts current before you do anything else. Bringing your accounts current means paying off all of your overdue balances.

Note that doing so won’t remove the late payments from your credit reports. Those will still stay on your reports for seven years. However, paying off your debts will protect you from getting any further negative marks.

If you have a good relationship with your creditor and previously had a good payment history, you might be able to remove the late payments you’ve already incurred by sending a goodwill letter to your creditor (which is more likely to work if there were extenuating circumstances). On the other hand, if you have charged off or collection accounts that you haven’t yet paid off, you can try pay for delete.

These strategies won’t always succeed, but there’s no harm in trying.

Pay your bills on time

As mentioned, a single late payment can do a lot of damage to your credit score. Depending on the scoring model, how late the payment is, the type of credit account you missed the payment on, and your credit history, you could lose 80–180 points. 7 6

Needless to say, the best way to protect your payment history is to consistently pay all of your bills going forward. If you previously missed payments because you simply forgot about them, try setting up autopay or payment reminders. On the other hand, if the problem is that you’re financially struggling, then you may need to consider using less credit until your finances improve.

Reach out to your lender or to a credit counselor if you need extra help

If your finances aren’t looking great and you think you might miss a payment, contact your creditor. It’s in their interests to help you pay back your debts instead of allowing you to default, so they may be able to help by establishing a more manageable repayment schedule for you or even reducing your interest rate.

Alternatively, a nonprofit credit counselor can help you manage your debt and figure out a repayment plan. They may also offer you a debt management plan if you need more help fixing your credit (where they negotiate with your lender on your behalf to make your repayments easier).

Beware of scams when you enroll with credit counseling services

Don't use a credit counseling service if they promise to erase your debts overnight, want you to pay large fees upfront, pressure you into a debt management plan without carefully reviewing your credit history, or offer you an employer identification number to apply for credit with instead of your social security number. 13

Consolidate your debts

Debt consolidation lets you reorganize multiple debts such that you’re paying off only one loan with one interest rate (ideally a relatively low one). If you have many debts, the goal is to turn them into a single, larger debt requiring lower payments than you’d otherwise have to make. Doing this simplifies your finances and makes it easier to avoid late payments or other negative items on your payment history. 14

Use credit-building tools

Consider one of the following tools to improve your credit profile and help establish a good track record of on-time payments.

- Experian Boost: If you have a poor payment history, part of the problem might be that many of your payments, such as your rent, cell phone bills, and utility bills, aren’t being reported to the credit bureaus. You can get credit for these by signing up for Experian Boost, or another service (such as LevelCredit) that reports your utility or rent payments to some or all of the main credit bureaus. This can improve your payment history if you usually pay your bills on time.

- Secured credit cards: These credit cards are a great way to improve your payment history without the risk of getting into more debt than you can repay. Secured credit cards require a deposit that your creditor will use as collateral in case your account goes into default. In other respects, secured credit cards function in much the same way as normal credit cards, which means that by using them responsibly, you can build your payment history.

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Secured Overall | 300–669 | $0 | Cashback Match | ||

| No Credit Check | 300–669 | $35 | |||

| Beginners | 300–669 | $25 | |||

| No Annual Fee | 300–669 | $0 | |||

| Bad Credit | 300–669 | $49 | |||

| Rebuilding Credit | 300–669 | $0 | |||

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Bad Credit Overall | 300–669 | $0 | Cashback Match | ||

| Secured | 300–669 | $0 | |||

| Unsecured (No Deposit) | 300–669 | $0 | |||

| No Interest | 300–669 | $0 | |||

| No Credit Check | 300–669 | $35 | |||

| No Fees | 300–669 | $0 | |||

| High Credit Limit | 300–669 | $39 ($0 for the first year if you set up autopay) | |||

| Rewards | 300–669 | $0 | |||

| Building Credit | 580–739 | $0 | |||

- Credit-builder loans: These are also called reverse loans, because you get the loan after you’ve paid it off, not before. When you first take out the loan, it goes into a special bank account that you can’t access right away. You then make regular payments (usually for 6–24 months), which your lender reports to the credit bureaus, helping you to establish a good payment history.

Takeaway: Your payment history is a track record of the payments you’ve made on all your debts

- Your payment history is the most influential factor affecting your credit score. It accounts for 35% of your FICO score and 40%–41%% of your VantageScore credit score.

- There are three types of credit: revolving credit, installment loans, and open credit.

- Revolving and installment credit can affect your payment history both positively and negatively. Open credit accounts generally only affect your payment history negatively (when you miss a payment).

- To improve your payment history, consistently make on-time payments. You can also sign up for autopay, consolidate your debts, or get a secured credit card.

- If you’re struggling to keep on top of your payments, consider getting help from a credit counselor.