You probably know your credit score can affect your ability to open a credit card or finance large purchases, such as a house or a car. This means that before you can begin shopping around, you need to first know how to check your credit.

Checking your credit score is a little more complicated than just checking your credit report (since there’s a difference between credit scores and credit reports). 1

We’ll cover all the ways to check your credit score (both for free and through paid services), why it matters where you get your score from, and why checking your credit score is important.

Table of Contents

Where to get your credit score for free

Not all services that let you check your credit score are free, but many of them are. Here are four sources that’ll easily allow you to get a free credit score.

1. Credit card companies

If you have a credit card, then you may already have free access to your credit score through your card issuer. To find out, check your monthly credit card statement or log in to your bank’s online banking website or app.

Credit Card Companies That Provide Free Credit Scores

| Credit Card Company | Type of Score Provided | Who Can Access |

|---|---|---|

| Discover | FICO® Score 8 | Cardholders |

| Wells Fargo | FICO® Score 9 | Cardholders |

| Citibank | FICO® Bankcard Score 8 | Cardholders |

| Bank of America | FICO® Score 8 | Cardholders |

| American Express | VantageScore 3.0 | Anyone |

| Capital One | VantageScore 3.0 | Anyone |

| Chase | VantageScore 3.0 | Anyone |

2. Credit bureaus

The three credit bureaus are another reliable resource for getting your credit score for free. These data collection agencies use information they’ve amassed from creditors and debt collectors to create your credit reports and calculate your credit score.

Specifically, you can get your credit score for free from Equifax or Experian:

- Equifax Core Credit: Enrollment in the Equifax Core Credit program provides you with a free monthly VantageScore 3.0 credit score.

- Experian: Through Experian, you can check your FICO Score 8 for free.

Surprisingly, the third credit bureau, TransUnion, doesn’t offer free credit scores on their site, but you can get your TransUnion VantageScore from other sources (listed below).

3. Credit scoring websites

Some websites offer free access to your credit score and credit report. Each website updates its information at regular intervals, allowing you to monitor your credit-building progress.

Popular free credit scoring websites include:

- Credit Karma

- NerdWallet

- WalletHub

- Credit.com

All these websites offer basic credit scoring services for free. However, some also provide more advanced services and in-depth credit analysis for a small monthly fee.

Give some thought to what information would make you feel more in control of your finances to decide whether purchasing these extra services would be worthwhile.

4. Nonprofit credit counselors

Credit counseling is a service that helps people get out of debt. Nonprofit credit counseling organizations offer financial advice, and many also offer free resources, including credit scores. 2

To get started, visit the website of the National Foundation for Credit Counseling. They’re a respected nonprofit organization that can connect you to a credit counselor who can provide you with your free credit score.

Once you’ve received your score, consider taking advantage of your counselor’s services by asking about the best ways to protect your credit and budget. While you can access plenty of helpful information online about how to build your credit and manage your finances, customized advice from a knowledgeable professional is particularly valuable.

Paid credit scoring services

Although free credit score services are helpful if you want a quick snapshot of how your credit is doing, paid credit score services sometimes come with additional benefits that (depending on your needs) might be worth paying for.

Below are a few places you can pay to access your credit score (and maybe get a few added perks as well).

FICO

You can get your FICO score straight from FICO at myFICO.com. You can choose between making a one-time purchase or signing up for a subscription plan.

FICO Credit Score Purchase Options

| Product | Description | Price | |

|---|---|---|---|

| One-Time Purchase | 1-bureau credit report | Get your credit report and FICO 8 score from one credit bureau of your choice: Equifax, TransUnion, or Experian | $19.95 |

| 3-bureau credit report | Get your credit report and FICO 8 score from all three credit bureaus | $59.85 | |

| Subscription Plans | Basic | Experian credit report and FICO score, updated every month | $19.95 |

| Advanced | Experian, Equifax, and TransUnion credit reports and FICO scores, updated every 3 months | $29.95 | |

| Premier | Experian, Equifax, and TransUnion credit reports and FICO scores, updated every month | $39.95 |

All of the subscription plans above also come with the following products and services in addition to your FICO credit score: 3

- Industry-specific FICO scores (for mortgages, auto loans, and credit cards)

- $1 million of identity theft insurance coverage

- Credit monitoring

- Credit analysis tools (e.g., FICO score simulator and score analysis)

- Identity restoration services

TransUnion

TransUnion offers a paid credit score subscription service for $29.95/month. This credit score plan comes with the following products and benefits: 4

- VantageScore 3.0 scores

- Credit score simulator

- Personalized debt analysis and credit score trending

- Identity theft insurance

- Instant credit alerts

- Unlimited access to identity theft specialists

- Unlimited credit score and credit report checks

It’s worth repeating that the credit score you’ll get from TransUnion is your VantageScore. This score will give you a general idea of where your credit stands, but it won’t necessarily reflect what future lenders will see when they run a credit check on you because most lenders use FICO scores instead. 5

Credit monitoring companies

In addition to buying your credit score from FICO or TransUnion, you can also look into credit monitoring companies. Credit monitoring is a service that provides regular access to your credit score along with additional perks, like identity theft insurance.

Here are a couple of examples of cheap credit monitoring plans currently on the market:

- IdentityForce: $23.99 per month for their UltraSecure+Credit individual plan.

- PrivacyGuard: $19.99 per month for their Credit Protection plan.

Why do I have different credit scores?

You might already know that you have more than one credit score. You may notice differences in your credit scores if you check your score through multiple companies. This is completely normal and doesn’t mean there’s something wrong with your credit or the method you’re using to check.

There are four reasons why you might see different credit scores:

1. Differences between scoring models

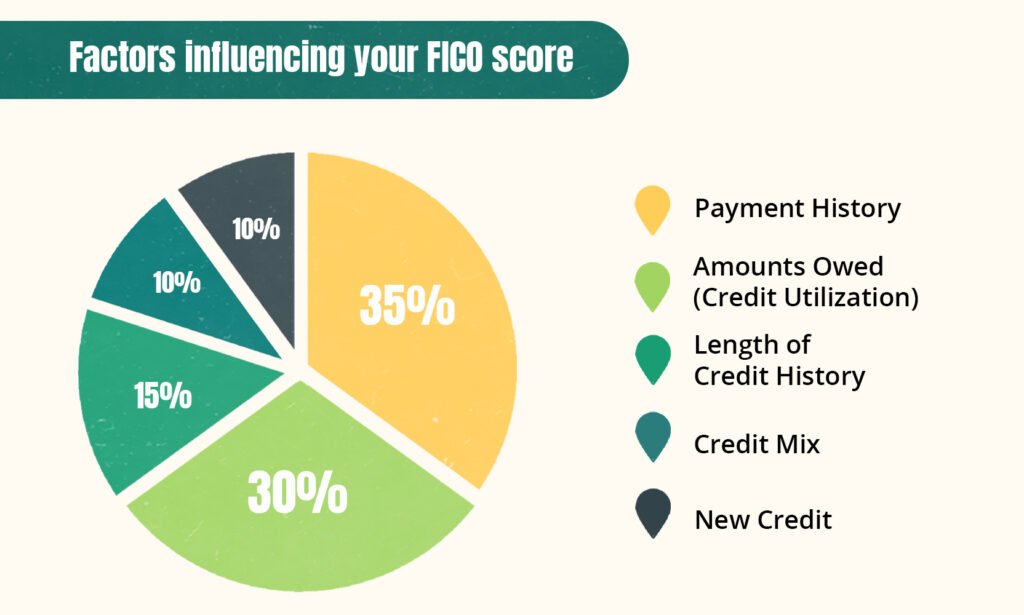

There are two primary credit scoring companies: FICO and VantageScore. Both companies assess more or less the same factors when calculating your credit score, but they categorize and weight these factors differently, which can result in varied credit scores.

Factors that affect your credit score

There are five main factors that affect your credit score:

- Payment history: This is a record of your payments on your various credit accounts (e.g., credit cards) and how responsibly you pay back your debts.

- Credit utilization: The amount of your credit that you’re actively using. A lower amount is better for your score.

- Length of credit history: A record of how long you’ve been using credit for.

- Credit mix: The variety of credit accounts that you have (e.g., credit cards, mortgages, other loans).

- New credit: A record of whether you’ve applied for or opened new credit accounts recently.

FICO Score Factor Weightings

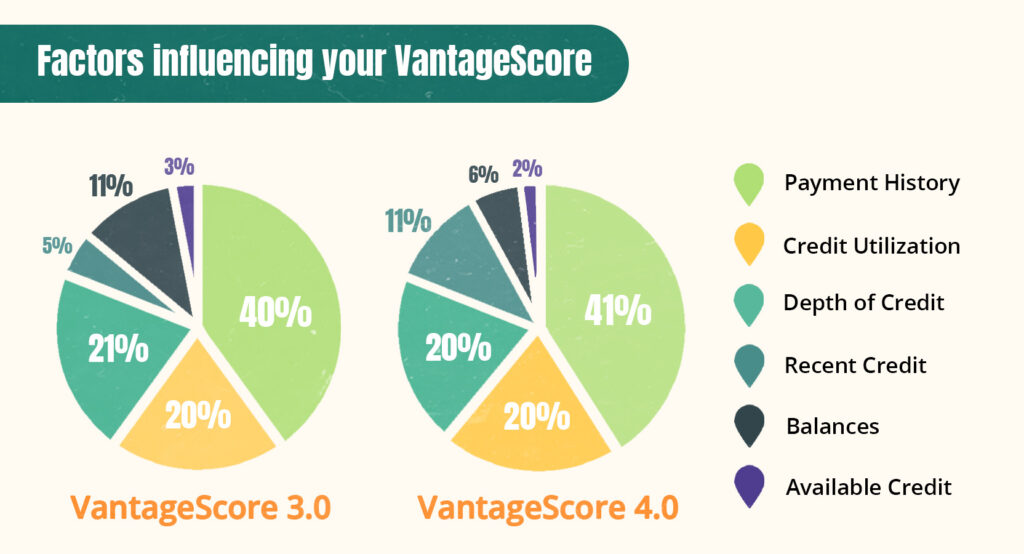

Again, the factors listed above are the ones that are used to create your FICO score. VantageScore looks at more or less the same information, but it weights them differently (and also assigns them different names):

VantageScore Scoring Factors and Weightings

Industry-specific scoring models

It’s also worth noting that FICO has industry-specific models that weight factors differently to make them more useful for lenders in the mortgage, auto loan, or credit card industries. For this reason, your FICO Auto Score will probably differ from your FICO Bankcard Score.

To avoid getting confused by your dozens of different credit scores, always check your score on the same site using the same model version. This will allow you to accurately assess how well you’re managing your credit.

2. Differences across your credit reports

Not only are there different scoring models, but you have a different set of scores corresponding to each credit bureau (all of which produce a different credit report for you).

All three credit bureaus won’t necessarily receive information from all of your creditors. This can impact the consistency of your credit scores because each credit reporting agency will calculate your credit score based on the data they have on file for you.

While most creditors will report account information to at least one credit bureau, they won’t necessarily provide information to all three. (And a minority of creditors might not provide information to any—credit reporting is entirely voluntary.)

3. Credit score fluctuations throughout the month

One of the great (and sometimes not-so-great) things about credit scores is that they’re constantly changing. You may see a different score if you check your credit score at different times of the month.

The frequency with which your credit score is updated depends on the number of credit accounts you have. This is because credit scores are based on the information shown on your credit reports, and your creditors won’t all necessarily update your credit file at the same time.

While it’s completely normal for your credit score to change throughout the month, these changes highlight how important it is to use the same website and model version when monitoring your credit.

4. Credit reporting errors

Everyone makes mistakes—even credit bureaus and creditors. The credit report you get from one of the credit bureaus may contain incorrect or incomplete information, which will ultimately impact your credit score.

Thankfully, you can easily get errors removed from your credit reports for free and stop them from hurting your credit. All you need to do is read up on how to dispute an item on your credit report.

Why it’s important to check your credit score regularly

Knowing your credit score is incredibly important for maintaining control of your finances. It’s like checking the engine on your car or the reviews for your business.

Here are a few reasons why you should check your credit score often.

Get a strong understanding of your credit health

When it comes to improving your credit score, not everyone requires the same strategy. To give just one example, for people with relatively good scores, opening new credit accounts to build credit in the long term is a solid choice.

For other people (those with damaged scores), it’s generally better to pay off existing debts and not think about opening any new accounts. The key is knowing where you stand.

Be prepared for future credit applications

Whether you’re applying for an auto loan, mortgage, credit card, or even financing a very pricey piece of jewelry, you’re going to need to meet the lender’s credit score requirements to get approved. Knowing your credit score will give you an idea of how far (or how close) you are to reaching your financial goals.

Checking your credit score before submitting a credit application is a good way to avoid rejection and minimize damage from unnecessary hard inquiries (which take several points off your credit score).

Spot fraud and identity theft early on

Regularly checking your credit score can tip you off to identity theft before fraudsters can do much damage to your credit and finances.

When you’re in the habit of monitoring your credit, you know whether you’re behind on payments or overspending on your cards. If you notice an unexplained drop in your credit score, you’ll know to check your credit reports, where you’ll be able to identify fraudulent credit activity.

Keep your credit reports error-free

Similar to how sudden and unexplained changes in your credit score can tip you off to identity theft, they can also signal that something’s not quite right with how your credit activity is being reported.

For example, you may see sudden and severe damage to your credit score from collections if a debt collection agency mixed you up with someone else who has a similar name or Social Security number.

Unfortunately, these types of mistakes happen all too often, and many people who don’t regularly check their credit score only realize the mistake once it’s too late and they’re being rejected for an important loan application.

Does checking my credit score lower it?

No, checking your own credit score will never lower it. This is because the credit checks you perform on yourself are soft credit checks (which don’t affect your score). This is in contrast to the hard credit checks (also called hard inquiries) that lenders perform when reviewing your credit applications, which do temporarily lower your score.

Takeaway: You can check your credit score using free scoring services or paid credit monitoring.

- You can check your credit score for free through credit card companies, the credit bureaus, credit scoring companies, or credit counselors.

- Alternatively, you can pay for access to your credit score through FICO, TransUnion, or credit monitoring companies.

- Not all credit scores are the same. When monitoring your credit, make sure you’re checking your score from the same scoring model and credit bureau.

- Regularly monitoring your credit is important for protecting your credit and finances. It allows you to spot identity theft and errors and helps you prepare for credit applications.

- Checking your own credit score won’t hurt your credit. However, your score will drop a few points if a lender checks your credit as part of their credit application review process.