Buying and selling credit tradelines is by no means a new practice, and adding seasoned tradelines to your credit report can raise your credit score substantially in just a few days or weeks. But there’s a right and a wrong way to go about it.

Below, you’ll find insider tips for adding tradelines to your credit file the right way, plus everything you need to know about how tradelines work and how many points they can raise your credit score.

Table of Contents

What is a tradeline?

“Tradeline” (or “trade line”) is a term used in the credit industry to refer to any credit account that’s listed on your credit report. Tradelines come in two varieties, which correspond to the two main types of credit:

- Revolving tradelines: Revolving credit is a type of credit that you can repeatedly use and then pay off each month. Most revolving tradelines are either credit cards or store cards.

- Installment tradelines: Installment loans are credit accounts where you receive a lump sum and then pay it back according to a fixed schedule. Mortgages, auto loans, and student loans are all types of installment tradelines.

Each tradeline is a record of all your activity on a given credit account, including your:

- Payments

- Account opening and closing dates

- Credit limit

- Current balance and available credit

- How long you’ve had the account

How tradelines affect your credit score

Tradelines account for the bulk of the information that shows up on your credit report. As such, they’re the building blocks of your credit score.

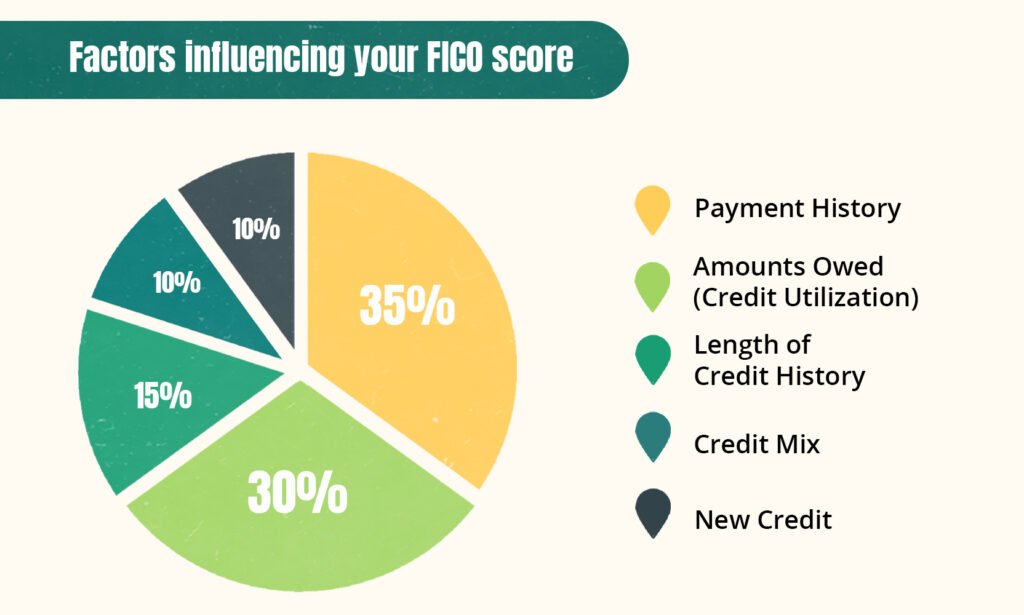

Each tradeline is assessed according to five factors used in the calculation of your credit score:

- Payment history: This tracks whether a tradeline has 100% on-time payments or a history of late payments (or other derogatory marks, such as charge-offs).

- Credit utilization: This tracks how much you’ve borrowed from your lender, especially as compared to your total credit limit on that account.

- Length of credit history: How long you’ve had a particular credit account, the average age of all your tradelines, and how long you’ve had your oldest tradeline.

- Credit mix: Your mix of revolving credit (e.g., credit cards) and installment credit (loans). A diverse blend of accounts is good for your score.

- New credit: How many new tradelines you’ve applied for in the past few months. Applying for new credit temporarily lowers your credit score.

Some of these factors are more important than others, as shown in the graph below.

How Tradelines Contribute to Your Credit Score

Tradelines can affect your credit score in a positive, negative, or neutral way, depending on how they influence the factors above.

To maximize your credit score, you want to have a diverse blend of tradelines with solid payment histories. Having too few tradelines could lead to an insufficient credit history, and having tradelines with derogatory marks could result in a bad credit score.

How many points will adding a tradeline boost your credit score?

Unfortunately, it’s impossible to predict exactly how many points your score will increase by when you add a new tradeline (or whether it will increase at all).

The effect that a tradeline will have on your credit score depends on many factors, including:

- Your current score

- The type of credit account you’re adding

- Whether that tradeline is new or has an established history

- If it has a history, what it shows

In many cases, adding a new account to your credit report will actually hurt your credit score. For example, getting a new $5,000 personal loan added to your credit file could lower your credit score by anywhere from 3 to 35 points. 1

On the other hand, adding a “seasoned” tradeline to your credit file could boost your credit score significantly, especially if you have a thin or nonexistent credit file.

Note that there are both legitimate and illegitimate ways to add established tradelines to your credit report. We’ll cover both below.

How long do tradelines take to appear on your credit report?

New tradelines can take anywhere from just a few days to 45 days to show up on your credit report. Credit reports only update when data furnishing companies (like credit card issuers and other lenders) report new information to the credit bureaus, which most companies only do once every 30–45 days. 2

How long do tradelines stay on your credit report?

Tradelines can stay on your credit report indefinitely as long as they’re open. Once closed, they have a fixed number of years they’ll contribute to your credit history and score—usually 7 years for accounts with negative information and 10 years for accounts in good standing. 3 4

How to add a tradeline to your credit report

Many people who want to know how many points a tradeline can add to your credit score are considering buying a tradeline from a tradeline dealer or a credit repair organization. Although you can buy seasoned tradelines this way, it isn’t a legitimate or safe way to improve your credit score.

There are three main ways to legally and safely add a new credit account to your credit file.

1. Open a new credit account

The most obvious way to add a new tradeline is to just apply for and open a new credit account—either a credit card or a loan. However, if you have poor credit, you may find this difficult to do.

If you have a low credit score or no credit history, consider starting out with one of the credit accounts below, which usually have low credit score requirements:

- Secured credit cards: These are cards that require a credit card security deposit to protect the credit card issuer from loss in case you fail to repay your debt. You can get a secured card with any credit score (or even no credit score at all).

- Credit-builder loans: Like secured cards, just about anyone can get a credit-builder loan. Signing up will add an installment tradeline to your credit file, but unlike a traditional loan, you’ll make payments first and receive the funds later.

- Secured loans: A secured loan is a type of credit account where, in exchange for an installment loan, you put up some form of collateral that your lender can seize or repossess if you go into default. This makes them easier to get than unsecured loans. However, don’t take out a loan like this just to build credit—only borrow money that you actually need. (If you don’t need any, just get a credit-builder loan instead.)

- Retail credit: Retail credit cards or store cards are also usually easier to get than traditional credit cards, and they’ll add a revolving tradeline to your credit report. 5

Again, bear in mind that opening a brand new credit account will likely cause a small drop in your credit score at first. Your credit score will quickly recover, though, and it will improve in the long run as long as you manage the account responsibly.

2. Become an authorized user

Adding an authorized user (AU) tradeline to your credit report can immediately boost your credit score and strengthen your credit history. It’s a free way to rapidly build credit, and it’ll get a seasoned account added to your credit file.

To become a credit card authorized user, just ask a family member or close friend who you trust to add you to their account.

Just make sure the primary cardholder has a good credit score and a strong payment history. Becoming an authorized user can help or hurt your credit score—it depends on how well the primary accountholder manages their payments and spending.

Become an Authorized User to Boost Your Credit Score

3. Sign up for a credit-building service

Many companies offer services specifically to people with poor credit who want to quickly build credit or raise their credit score. Some are free, whereas others cost a small fee.

Depending on the service you sign up for, you’ll get new tradelines added to your credit report in one of the following ways:

- Adding your regular bill payments (e.g., rent, utilities, cell phone and internet plans, or streaming services) to your credit file

- Converting debit card purchases into credit card purchases

- Turning your savings into an installment loan on your credit file

To get started, look through our list of the best credit-building apps currently on the market.

Why buying a tradeline to boost your credit isn’t worth it

Some credit repair companies “sell” tradelines—in effect, they’ll add you as an authorized user to someone else’s account for a fee.

These companies often claim that they’ll be able to raise your credit score by 100+ points in a matter of days. If this sounds too good to be true, it’s because it is.

What these companies won’t tell you is that there’s a catch. Piggybacking credit can be legal, but for-profit piggybacking can put your credit and identity at risk and get you into legal trouble.

Risks of buying tradelines

Never pay for a seasoned tradeline without considering the disadvantages:

- Questionable legality: Tradeline sellers often claim that tradeline buying is legal because you’re just becoming an authorized user. However, the credit bureaus strongly frown on this practice, and Experian cautions that it could be interpreted as bank fraud if you get a new loan using a credit score that doesn’t reflect your actual credit history. 6

- No guaranteed credit score improvement: New tradelines are supposed to improve your score by benefiting your payment history, available credit, and credit age. However, there’s a chance that the primary cardholder will miss a payment or overspend on their credit card (if the account is open) or that the account will be newer and will actually lower your credit age, all of which will hurt your score.

- High cost: Tradelines can cost hundreds or thousands of dollars. Even if your credit score does increase, this just isn’t worth it. You’re better off using any spare cash you have to improve your credit by getting out of debt or opening a secured credit card account.

- Short-lived benefits: Many tradelines for sale are closed or inactive, meaning that the primary cardholder has stopped using the card or shut down the account. In this case, the account could fall off your credit report relatively quickly and stop helping your credit score.

- Risk of identity theft: You put your identity at risk any time you give out personal information like your full name, date of birth, and Social Security number. Tradeline suppliers often require you to provide this information so they can add your name to someone else’s credit account.

The bottom line is that this strategy comes with serious risks. Even if you’re desperate to improve your credit score, it’s best to avoid it.

The good news is that you don’t need to buy a tradeline to fix your credit. There are plenty of perfectly legitimate ways to add new tradelines to your credit report. If you explore these in tandem with some of the other credit hacks for raising your score quickly, you’ll be on your way to a good credit score in no time.

Takeaway: Adding a tradeline to your credit report can build up your credit when done the right way.

- A tradeline is defined as any account on your credit report, and it contains a record of all that account’s information and activity.

- Tradelines are the basis for calculating your credit score, and they can hurt or help your credit score, depending on your starting credit profile and what tradeline you’re adding.

- There are three legitimate ways to acquire tradelines: Open a credit account, become a credit card authorized user for someone you trust, or use a credit-building service.

- Buying seasoned tradelines from a third-party seller is a bad idea. It could get you into legal trouble, cost you hundreds of dollars, hurt your credit, and put your identity at risk.

- The best way to fix or improve your credit is to address the issues in your credit history and take steps to rebuild good credit over time.