It’s no secret that getting evicted can be a nightmare for your finances and personal life. The good news is that being evicted won’t directly affect your credit score. However, the underlying causes of eviction can seriously damage your credit and make it harder to rent an apartment in the future.

Table of Contents

Do evictions show up on your credit report?

No, evictions aren’t included in the information that shows up on your credit reports. Neither are bounced checks, broken leases, property damage, or the other kinds of issues that can come up when you move out of an apartment.

This is because your credit reports contain credit-related information (as their name suggests). Landlords and property management companies aren’t considered creditors and don’t report information to the three main credit bureaus (Experian, Equifax, and TransUnion).

How rental information can show up on your credit report

Although evictions can’t appear on your credit report, it’s possible for your rental payments to show up. This never happens without your consent—you have to opt in, and again, it only applies to your actual payments, not to evictions.

If you sign up for a rent-reporting service like Rental Kharma or RentReporters, then your rent will contribute to the payment history section of your credit report and affect your credit score. This means that making on-time rent payments can help you build credit (and, conversely, late payments can hurt it), but only if you seek out and pay for one of those services.

Do evictions show up on your public record?

Although an eviction won’t show up on your credit report, it may be added to your public records if your landlord files a lawsuit against you. This can happen if you stop paying rent and then ignore your eviction notice.

If your landlord wins their case, you’ll receive a court judgment, which will be included in your public records.

Even if you receive a judgment, it still won’t directly affect your credit score. Judgments no longer appear on credit reports and therefore don’t affect your credit. However, landlords—and creditors—will still be able to see your eviction judgment if they review your public records or purchase a rental history or eviction report from a tenant screening company.

This means that being evicted can still hurt your chances of landing an apartment or qualifying for credit in the future, even though this won’t be reflected in your actual numerical score.

How can an eviction hurt your credit score?

Even though the act of being evicted won’t itself hurt your credit score, the other consequences of failing to pay your rent (which leads to eviction) can damage your credit.

If you owe money to your landlord and they give up on trying to collect it from you, they may transfer or sell your debt to a debt collection agency. If this happens, then the agency will add a collection account to your credit reports.

Collections affect your credit, generally causing a severe drop in your credit score. In extreme cases, your score could drop by up to 100 points, and it probably won’t recover from the damage for several years. To avoid consequences like that, it’s best to always pay your landlord what you owe them, even if you’ve already been evicted.

Types of debts that your landlord may send to collections

Below are tenancy-related debts that your landlord may send to collections:

- Overdue rent

- Repair costs for property damage

- Penalty fees for breaking the lease

- Other fees (e.g., late fees or cleaning fees)

Even if you’ve already been evicted, keep track of your mail to ensure your former landlord isn’t trying to contact you over an outstanding debt. If you believe the debt is illegitimate, you may be able to fight it in court, but you shouldn’t ignore it outright.

What should you do if you have an eviction-related debt in collections?

If you have an account in collections, don’t ignore your debt collectors. It’s best to pay off your collections or negotiate with debt collectors to stop the collections from hurting your credit score.

Alternatively, you can dispute your collections if you believe you don’t actually owe your landlord any money.

We’ll cover this in more detail below.An eviction can indirectly affect your ability to get a mortgage

Because collections can seriously hurt your credit score, eviction can indirectly affect your ability to get a mortgage if you have unpaid debts that your landlord sent to collections. Although the exact credit score required to get a mortgage varies, it’s difficult or impossible to get a mortgage if you have a bad credit score and a credit report with recent collection accounts.

How to deal with eviction and protect your credit

Dealing with eviction is tricky, but there are steps you can take to protect yourself and minimize the damage (both to your credit and your overall financial health).

How to prevent eviction in the first place

Whether you’re currently facing a potential eviction or you’ve dealt with eviction in the past and don’t want it to happen again, these three tips can help you stay on good terms with your landlord and avoid getting evicted:

1. Speak to your landlord if you’re struggling financially

If you’re struggling and think you’ll miss one of your rent payments, contact your landlord and explain your financial situation. This might help you stay on good terms with them.

Most landlords aren’t in the position to simply waive your rent payments (most landlords depend on your payments for cash flow, after all), but in some cases, they might be willing to temporarily lower your rent or at least postpone it.

Remember that the consequences of you failing to pay (e.g., eviction, having to find a new tenant, lawsuits) are time-consuming, stressful and expensive for landlords too. If there’s a way to reach a compromise, many landlords will prefer that.

2. Know where you stand

Before you’re evicted, your landlord will send you either a “curable” eviction notice telling you how you can avoid eviction or an “incurable” notice asking you to move out by a certain date.

- If you receive a curable notice: Your first step should be to contact your landlord and negotiate, as described in the step above. You might be able to stop the eviction.

- If you receive an incurable notice: Unfortunately, if things get to this point, you won’t be able to avoid the eviction. That means it’s time to start doing damage control. Check your finances and see if it’s possible to pay what you still owe (to avoid lawsuits and collection accounts). You should also begin looking for a new apartment.

3. Don’t be afraid to downsize

If you’re struggling to make ends meet, consider finding a more affordable apartment. Your landlord may be willing to let you out of your lease if you find someone else to take over, or they may allow you to sublet your apartment.

If you’re out of cash, you might be tempted to pay your rent with a credit card or a loan, but this is risky, as it can get you trapped in a spiral of debt that you won’t be able to pull yourself out of. Downsizing is usually a better option once things have gotten to that point.

How to rent a new apartment after an eviction

An eviction can seriously limit your options when it comes time to rent another apartment because many landlords will use tenant-screening services to check your rental history and eviction-related court records.

Landlords are more likely to reject your application if you have a prior eviction because they don’t want to take the risk that you’ll fail to pay your rent on time. Many landlords also impose minimum credit score requirements for tenants, so collections from a past landlord could make it harder to meet their credit requirements.

However, there are things you can do to minimize the risk for the landlord and persuade them to rent to you despite your rocky track record as a tenant:

- Find a private landlord (i.e., not a large property management company) that doesn’t run credit or background checks

- Offer to pay a larger security deposit or pay some rent upfront

- Get a close friend or family member with a good credit score and rental history to cosign your lease

How to dispute eviction-related black marks on your record

If your leasing applications are being rejected due to a prior eviction but you’ve never actually been evicted, contact the tenant screening company that’s reporting your eviction. Tell them that the eviction is inaccurate and ask how you can dispute the information in your rental history report.

You can also dispute eviction-related collection accounts on your credit report if they don’t belong to you (for instance, if you believe the credit bureaus confused you with someone with a similar name, which has been known to happen).

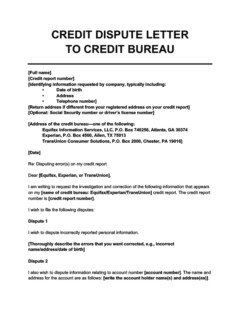

Submit a credit dispute to the relevant credit bureaus (Equifax, Experian, and/or TransUnion) using the dispute letter template below:

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

Be sure to send any relevant supporting documents along with your dispute letter to the credit bureaus. Consider paying a little extra and sending it by certified mail so that you’ll have a return receipt as proof that they’ve received it.

Takeaway: Eviction won’t affect your credit, but not paying your landlord might hurt your score and future apartment prospects.

- Evictions won’t appear on your credit report, but future landlords may see them when checking your credit report or eviction report from a rental screening company.

- If your landlord sues you, an eviction judgment may appear in your public records. It won’t be included in your credit reports, but it may be visible to future landlords.

- If you owe your landlord money (e.g., for unpaid rent or property damage), they may send your debt to a collection agency, which will significantly damage your credit score.

- You can file a credit dispute to remove inaccurate eviction-related collection accounts from your credit report or eviction records from your tenant credit report.

- Even with a prior eviction, you may be able to convince landlords to rent to you. Avoid future evictions by communicating with your landlord when you’re struggling financially.