Building a good credit score can be a long and difficult process. Unfortunately, no one can hack their credit score to the perfect 850 overnight or instantly wipe a bad credit history clean. However, leveraging the right credit hacks can still give your score a quick boost.

Read on to see our top 10 credit hacks and learn how you can use them to improve your credit score fast.

Table of Contents

- 1. Dispute errors on your credit report

- 2. Take control of your payment due dates

- 3. Gamify paying off debt

- 4. Increase your credit limit to lower your utilization rate

- 5. Transfer your balance if you have high-interest debt

- 6. Time your credit card payments just right

- 7. Get a credit builder loan

- 8. Keep your credit cards open (mostly)

- 9. Become an authorized user

- 10. Erase late payments with a goodwill letter

1. Dispute errors on your credit report

Errors and inaccurate information on your credit report can lower your score and raise your interest rates on credit cards and loans. And credit score errors happen more than you might think.

According to a study done by the Federal Trade Commission (FTC), one in five consumers found errors on their credit reports. Review your credit report at least once a year to avoid being among the 20% of people with inaccurate information impacting their credit score.

How to review your credit report for errors

To review your credit report, simply go to AnnualCreditReport.com and download one free report every 12 months from the three main credit bureaus (Equifax, Experian, and TransUnion). 1

If you spot an error, immediately dispute the inaccuracy by following these steps:

- Personalize a credit dispute letter template and send it to the credit bureau that published the report.

- Specify why you think the information is invalid in the letter.

- Attach any proof you have to the letter to support your claim.

Although credit disputes won’t raise your credit score by 100 points overnight, you could still see a dramatic increase within 30–45 days, which is how long the credit bureaus have to investigate and address your claim. 2

2. Take control of your payment due dates

Your payment history is the most important factor determining your credit score, so paying your bills on time is critical. However, managing multiple due dates across different credit accounts can be tricky.

To avoid missing payments, try these strategies:

- Set up automatic payments: You can set up autopay directly with your credit accounts or set a recurring payment through your bank.

- Reschedule your due dates: If you really want to take the hack up a notch, align your payment due dates and set up a recurring payment for the same day every month. To change your payment due dates, you can call your credit issuers directly or use an online account management system.

If you can, try to pay off your cards in full every month instead of just making the minimum payments. Staying out of debt makes it much easier to keep your credit score up.

Set up autopay for your statement closing date

Combine this hack with Hack #6 on this list and set up your recurring payments for your statement closing date instead of your due date to supercharge your credit score boost.

3. Gamify paying off debt

Paying off your debt is the number one action you can take to raise your credit score. But a one-time debt payoff won’t send your credit score through the roof—building good debt-management habits is the real goal if you want a high credit score.

Figuring out how to best manage your current and future debts is a matter of finding the payment method that works for you. First, try to negotiate less credit card debt with your lender. Then, find the best method for paying off debt while sparking your brain’s rewards center. Here are your best options:

Avalanche method

If you have a backlog of debt weighing on your mind, tackle it using the avalanche method. This method prioritizes paying off the debts with the highest interest rates. Doing so can save you big money on interest, and gives you a clear starting point for paying down your debts. Bonus points if you use the money you save on interest to settle your lower-interest accounts. 3

Snowball method

The snowball method targets debts with the lowest interest rates to be paid off first. Doing so is psychologically rewarding, similar to knocking the smallest tasks off your to-do list first.

Note that while this method can be more habit-forming than the avalanche method because it gives you easy wins, it will cost you more money in interest during your debt repayment process. 4

Use a debt-management app

One of the easiest ways to gamify your financial management is to use an app made for that exact purpose. There are tons of apps, both free and paid, that track debt repayment and reward your efforts. Here are just a few of the best ones:

- Tally: Free

- Mint: Free

- Debt Payoff Planner: Free (with ads); $24 for 2 years (no ads)

- Habitica: $5/month

4. Increase your credit limit to lower your utilization rate

The amount of your credit that you’re using—your credit utilization rate—is the second most important factor in your credit score, so gaming your utilization rate should be your next target after managing your payment history.

You can calculate your credit utilization rate using the following equation or our handy calculator:

current balance on your credit cards / available credit = credit utilization rate

You want to get your rate as low as possible. To do this, you can either use less credit (i.e., lower your current balance), or increase your available credit.

To increase your available credit, you can ask your credit card issuer to increase your credit limit on one or more of your cards, or apply for a credit limit increase through your online credit card account.

5. Transfer your balance if you have high-interest debt

If you’re paying down debt across multiple credit cards, some accounts probably have higher interest rates than others. To save yourself money in the long run and make paying off your debts easier, perform a balance transfer.

A balance transfer is a form of debt consolidation in which you transfer debt from multiple credit cards onto a low-interest card. If all of your credit cards are high-interest, consider applying for a dedicated balance-transfer credit card or a card with a 0% APR introductory period.

Only transfer your balance if you plan on paying off your debts

While a balance transfer is a great tool for managing debt, there can be downsides. For example, performing a balance transfer can temporarily harm your credit score. However, the benefits of paying down your balance will far outweigh the negatives of a balance transfer, so use this hack if you’re motivated to pay off your debts.

6. Time your credit card payments just right

Did you know you can improve your credit score based on when you pay your credit card bill? The trick is to pay off your balance before your credit card company reports that billing cycle to the credit bureaus so that your credit utilization stays low.

Most credit card companies report your balance to the bureaus on the statement closing date. This is the last day of your billing cycle and takes place approximately 21 days before your payment due date. 5 6

So rather than waiting for your due date, find out what your statement closing date is and pay your bill before then.

What’s the 15/3 credit hack?

The 15/3 hack is a method you can use to pay your balance before the closing date—once 15 days before and again 3 days before. This ensures your credit issuers only have a small balance to report to the bureaus. However, there isn't proof that paying twice before your closing date is more beneficial for your score than paying once, although it makes money management easier.

7. Get a credit builder loan

A credit builder loan is a loan designed for building credit when you have no credit history or an insufficient credit history. Credit-builder loans are usually for relatively small amounts (e.g., $1,000).

Getting a credit builder loan can benefit your credit score in three ways:

- Boosts your credit mix: Credit mix is one of your credit score’s determining factors. To have a good credit mix, you want a combination of revolving credit and installment loans. If you don’t already have an installment loan (like a mortgage or student loan), get a credit builder loan to diversify your credit history.

- Raise your credit age: The length of your credit history is another factor that plays into your credit score. The older your credit accounts, the better, so paying off a credit-builder loan over time will naturally improve this metric.

- Improve your payment history: The main point of a credit builder loan is to build credit by boosting your payment history. Basically, you pay the loan off over a set period (say, 12 or 24 months). As you pay, the loan provider reports your shining payment history to the bureaus so they can bump up your credit score.

8. Keep your credit cards open (mostly)

Here’s a hack on what not to do if you’re trying to quickly raise your credit score: don’t close your credit cards unless it’s necessary.

Closing a credit card account can hurt your credit score by raising your credit utilization rate. Remember, you want to keep that rate low by having a high credit limit and low balance.

If extenuating circumstances apply––like an exorbitantly high annual fee––closing an account is a reasonable option (so long as you follow steps to close your credit card the right way). However, in general, you should keep your credit accounts open, even if you’re not using them regularly.

Opening new accounts can boost your score in the long term

A FICO analysis found that those with an excellent credit score on average had three open credit cards. 7 If you have fewer cards than that, opening more cards might improve your score in the long term. However, in the short term, the effect will be negative, because opening a new credit card can hurt your score.

9. Become an authorized user

If you have a family member who manages their credit well, consider asking them to add you as an authorized user to one (or more) of their credit accounts. An authorized user is someone who can use another person’s credit account and shares their credit history.

Becoming an authorized user can boost your credit score because it lets you piggyback off the credit of your responsible relative. This is a great hack if you have insufficient credit history or a bad credit score, as it can raise your score quickly and help you establish a credit history. 8

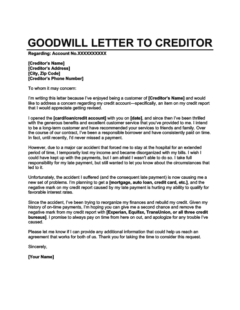

10. Erase late payments with a goodwill letter

A goodwill letter (aka a forgiveness letter) is a letter you write to your creditor asking them to remove negative items, such as late payments, from your credit report. While there’s no guarantee that your creditor will honor your request, there’s no harm in trying.

You can download the goodwill letter template below for free to write your goodwill letter. Be sure to include the following information in your letter:

- Why you missed the payment

- Why your creditor should remove it from your credit report

- How you’ll make sure it won’t happen in the future

Goodwill Letter to Creditor

Use this goodwill letter template to ask for a goodwill deletion from one of your creditors. Remember to customize it to your circumstances for the best possible chance of success.

As we’ve said, building your credit is a lifelong process, and how long it takes your credit score to improve will vary based on your situation. But by using a few of the hacks we outlined above, you should see significant improvement in a matter of months.

Takeaway: Improve your credit score fast by targeting the right areas

- Payment history is the most important factor that affects your credit score. To improve your payment history, strategically manage your debt and put systems in place to make payments at the right time every month.

- The second most important credit score factor is credit utilization. To improve your credit utilization rate, increase your credit limit and pay your balance before the statement closing date.

- Other great tricks for boosting your credit score include becoming an authorized user, applying for a credit builder loan, and checking for and disputing reporting errors.