Credit scores range from the lowest possible credit score of 300 to the highest credit score of 850. While you might expect the average credit score to fall somewhere in the middle of that range, reports indicate that the majority of Americans lie in the higher score ranges.

We’ll break down the latest statistics on the average credit score in the US. Read on to find out how you compare to most Americans, what the average credit score is in your state, and what you can do to improve your score.

Table of Contents

What is the average credit score in the US?

In 2021, the average FICO score was 716, and the average VantageScore credit score was 695. The chart below shows how the nationwide average credit score has changed over the past 5 years.

Credit Score Trends Over Time

It’s clear that credit scores have been on the rise in America for the past few years. FICO scores are also consistently higher than VantageScores, probably because of the small differences between FICO and VantageScore in terms of how they calculate credit scores.

Why are there two average credit scores?

The reason there are different credit scores in the table above is that there are two main credit scoring companies. Fair, Isaac and Company (FICO) is the original credit scoring company, and their scoring models are by far the most commonly used by lenders. 1

VantageScore, on the other hand, is a relatively new company, and it was established by the three main credit bureaus in the US: Equifax, Experian, and TransUnion.

FICO and VantageScore use the same scoring range (300–850) and consider the same scoring factors. However, the models have slightly different ways of defining what counts as a good or bad credit score. See the tables below for their score classifications.

FICO Score Ranges

| Poor | Fair | Good | Very Good | Exceptional |

|---|---|---|---|---|

| 300 to 579 | 580 to 669 | 670 to 739 | 740 to 799 | 800 to 850 |

VantageScore Ranges

| Very Poor | Poor | Fair | Good | Excellent |

|---|---|---|---|---|

| 300 to 499 | 500 to 600 | 601 to 660 | 661 to 780 | 781 to 850 |

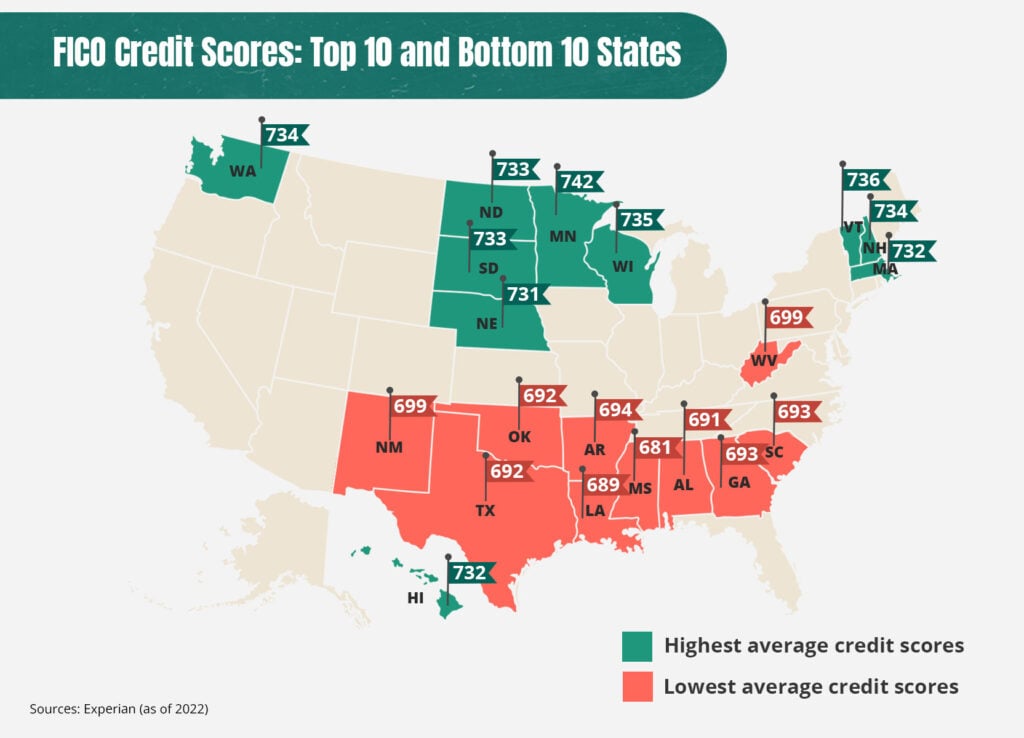

Average credit score by state

Credit score statistics vary widely by state. Data from 2021 show that Minnesota residents have the highest average credit score of 742, and Mississippi residents have the lowest average credit score of 681.

To find out what’s considered a good credit score in your state and how yours compares, take a look at the table below, which ranks each state from the highest to lowest average credit score.

State Credit Score Rankings

| State | Average credit score |

|---|---|

| Minnesota | 742 |

| Vermont | 736 |

| Wisconsin | 735 |

| New Hampshire | 734 |

| Washington | 734 |

| North Dakota | 733 |

| South Dakota | 733 |

Data taken from a survey by Experian. 2

You may also be surprised to learn that average credit scores don’t only vary from state to state. Here are statistics showing how your credit score may be associated with other factors:

Credit score percentiles in the US: what are the most common score ranges?

The average credit score isn’t always the most common credit score. The chart below shows the percentage of people who have credit scores in different score ranges.

FICO Score Distribution in 2021

| Score range | Percentage |

|---|---|

| 300–499 | 3.0% |

| 500–549 | 5.4% |

| 550–599 | 7.1% |

| 600–649 | 9.2% |

| 650–699 | 12.5% |

| 700–749 | 16.4% |

| 750–799 | 23.1% |

| 800–850 | 23.3% |

Data taken from FICO. 3

The statistics above show that the FICO credit scores of most Americans (62.8% of the population) are 700 or higher, and higher credit scores tend to be more common than lower ones.

Don’t worry if your credit score falls into one of the lower ranges. Your credit score will change every time the information in your credit report is updated, and it’s never too late to fix your credit (or begin building credit if you don’t actually have a credit history yet).

How to improve your credit score

Regardless of where you live and what your score is, there are steps you can take right now to improve your credit score so that you can start taking advantage of all the benefits of having good credit:

Check your credit reports for errors

Credit monitoring is crucial for keeping your credit in good shape. Make sure to regularly check your credit reports and dispute any errors you find to keep them from hurting your score. You can access free copies of your credit reports once per year at AnnualCreditReport.com.

Always make on-time payments

Your payment history is the most important factor contributing to your credit score, which means that always paying your bills on time is the most effective way of improving your overall credit profile. Consider setting up autopay or payment reminders to ensure you don’t miss any payments.

Lower your credit utilization rate

Another way to give your credit score a boost is to reduce how much of your overall credit card limit you’re using (known as your credit utilization rate). You can do this by cutting back on your spending, requesting a credit limit increase, or opening a new credit card.

Keep your old credit accounts open

Closing a credit card account will probably cause a drop in your credit score by reducing the total amount of available credit you have. Keeping your accounts open, on the other hand, will benefit your credit by demonstrating your ability to manage your credit over a long period of time.

Use credit-building tools

If you have a bad credit score or an insufficient credit history, consider using credit-building tools like credit-builder loans or secured credit cards. You can also use services that add your phone, internet, or utility bills to your credit report, such as Experian Boost. You can also quickly improve your credit score by becoming an authorized user on someone else’s credit card.

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Secured Overall | 300–669 | $0 | Cashback Match | ||

| No Credit Check | 300–669 | $35 | |||

| Beginners | 300–669 | $25 | |||

| No Annual Fee | 300–669 | $0 | |||

| Bad Credit | 300–669 | $49 | |||

| Rebuilding Credit | 300–669 | $0 | |||

Ultimately, it takes time to build credit, so don’t expect your credit score to increase dramatically overnight.

If your credit report shows that you’ve been paying your bills responsibly, but your score hasn’t been updated to reflect that yet, don’t worry. Your score isn’t everything—lenders also care about the actual items on your credit history.

The best thing you can do is educate yourself about how credit works and take steps to develop good habits when it comes to managing your debts.

Takeaway: Americans have an average FICO credit score of 716, indicating a steady rise over the years.

- In 2021, the average FICO score in the US was 716 and the average VantageScore was 695.

- Average credit scores vary from state to state. Minnesota ranks highest, with an average credit score of 742, and Mississippi ranks lowest, with an average credit score of 681.

- FICO statistics show that higher credit scores are more common, with the largest percentage of people falling into the highest score range (800–850).

- What’s considered an “average” or “good” credit score ultimately depends on where you live and which scoring model you use.

- You can improve your credit score by monitoring your credit reports, paying all your bills on time, reducing your spending on credit cards, and keeping your accounts open.