Table of Contents

When you go long enough without making payments on a debt (e.g., a loan or a credit card debt), your creditor may pass it to a debt collection agency. When this happens, your debt will show up as a collection account on your credit report.

Having debts in collection can be devastating. It puts you at risk of lawsuits, and moreover, collections affect your credit score, often damaging it severely. Fortunately, there are several tricks that can wipe collections off your credit report for good. Choose the method that matches your circumstances.

1. If the debt is invalid: send a dispute letter

Under the Fair Credit Reporting Act (FCRA), you have the right to dispute any information on your credit report, including collections. Just send a dispute letter to the three main credit bureaus (Equifax, TransUnion, and Experian) informing them that you’ve discovered an error on your credit report and ask them to remove it.

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

In addition to filing a credit dispute with the relevant credit bureaus, you should also dispute the debt with the debt collection agency themselves. This is a slightly different process and involves sending a debt verification letter to the collection agency that owns your debt. This gives you another shot at getting the item removed from your credit report.

Where to send your dispute letter

| Experian | Equifax | TransUnion | |

|---|---|---|---|

| Where to send your dispute letter | Experian P.O. Box 4500 Allen, TX 75013 | Equifax P.O. Box 740256 Atlanta, GA 30374-0256 | TransUnion Consumer Solutions P.O. Box 2000 Chester, PA 19016-2000 |

| What you’ll need to send | |||

| Dispute online | Experian's online dispute form | Equifax’s online dispute form | TransUnion’s online dispute form |

Once you’ve filed your dispute, your creditor or collector will have 30–45 days to provide information verifying the account. 1 If the information on record is incorrect or unverifiable, then the credit bureaus are legally obligated to remove it from your credit reports. 2

When is disputing collections on your credit report a good idea?

You can dispute any collection account, even a legitimate one, although you’re more likely to have success if the collection is on your credit report by mistake. Nevertheless, disputing collections won’t hurt your credit, so there’s no real downside to trying.

Here are some examples of cases where your credit dispute is most likely to work:

- Your debt was sent to collections by mistake

- The debt doesn’t belong to you

- The account was removed from your credit report for a valid reason but was mistakenly reinserted later

- A debt collection agency started reporting an old debt as new by changing the account open date

- The charges that were sent to collections were the result of identity theft

- You have a medical collection that should’ve been covered by insurance (in this case, you should use a more tailored sample letter for disputing medical bills on your credit report)

2. If you’ve already paid the debt: ask for a goodwill deletion

If you’re trying to remove a collection account that you’ve already paid, then your best course of action is to send your creditor or debt collector a goodwill deletion letter asking them to remove the legitimate negative mark as an act of goodwill.

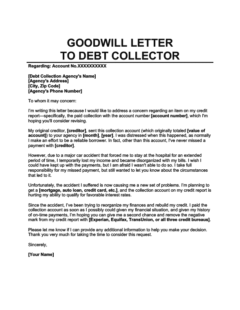

Goodwill Letter to Debt Collector

Use this goodwill letter template to ask for a goodwill deletion from a debt collection agency. Remember to customize it to your circumstances for the best possible chance of success.

Send your letter to whoever owns your debt. If your original creditor transferred it to a debt collector but they still technically own it, send it to your creditor. If they sold your debt, send it to the debt collection agency they sold it to.

Does goodwill deletion actually work?

Creditors and collectors don’t often agree to perform goodwill deletions, but they might consider doing so if your missed payment was the result of extenuating circumstances, such as financial hardship due to medical bills, loss of employment, or divorce.

It helps if your creditor is the one who owns the debt and you were on good terms with them. In this case, you can point out your strong payment history and customer loyalty and explain how you’ll prevent future delinquencies.

When you use goodwill deletion to remove a paid collection from your credit report, you’re following essentially the same process as when you try to remove a closed account in good standing—you’re hoping your creditor will be sympathetic to your situation since you’ve taken ownership of the debt and honored your obligation to repay it.

3. If you haven’t paid the debt yet: send a pay-for-delete letter

If your debt is relatively old and you haven’t paid it yet, then you can try negotiating pay for delete. With this approach, you send a pay-for-delete letter to whoever owns your debt and offer to pay the collection account if they agree to remove it from your credit report.

Pay for Delete Letter to Collector

Use this pay for delete letter template to ask a debt collection agency to remove a collection account from your credit report. Pay for delete works best on old debts in collection, so this is the scenario the strategy is most suited to.

Pay for delete isn’t guaranteed to work, although you’ll have a better chance if it’s an older debt because you’ll have more leverage if your creditor or debt collector believes you probably won’t pay it otherwise.

It’s worth noting that negotiating pay for delete won’t benefit your score in every credit scoring model. Newer models, such as FICO 9, ignore paid collection accounts, meaning that in some cases, paying off your collection account will improve your credit score just as much as having it removed. 3 4

With that said, the majority of lenders still use older FICO and VantageScore models. 5 Moreover, they’ll still be able to see the collection account, regardless of which model they’re using, and might hold it against you.

This means that it’s usually still worth negotiating pay for delete. Although it might not work, there’s no reason not to try—the worst your creditor can do is say no.

Paying off your collections is worth it in newer models

If you do know that your lender uses a new scoring model that ignores paid debts in collections, it can be well-worth paying. In extreme situations, you can expect your credit score to improve by over 100 points when you pay off a collection account.

4. If all else fails: wait for it to fall off your credit report

If the approaches above fail, you may simply have to wait for the collection account to fall off your credit report on its own. Waiting can be frustrating, but by focusing your efforts on rebuilding your credit after collections, you can start improving your credit score before this happens.

How long do collections stay on your credit report?

Collections stay on your credit report for 7 years. Under the Fair Credit Reporting Act, collection accounts must be deleted from your credit report 7 years after the date the debt first became delinquent, at which point they cannot affect your credit score. 2

How long can you be forced to pay collection accounts?

Every debt has a statute of limitations, or a certain length of time that debt collectors can take legal action to force you to pay it. After this, it becomes time-barred debt and you can’t be sued over it anymore.

The statute of limitations on your debt depends on your state or jurisdiction and the type of debt you have, but it’s usually between 3 and 6 years. 6 Once the statute of limitations has passed, debt collectors can still try to get you to pay, but they won’t have any legal recourse and won’t be able to get a court judgment against you.

Leave really old debts alone

The statute of limitations on your debt sometimes begins from the date of your most recent activity on the account. Be very careful to avoid doing anything on an old credit account that might reactivate the debt.

Specifically, refrain from doing any of the following:

- Making any payments

- Acknowledging the debt is yours

- Agreeing to a repayment plan

- Accepting a debt settlement offer

Even the smallest payment could revive debt collection efforts and result in legal action against you, so it’s better to play it safe and only acknowledge the debt if you’re willing to pay the full amount owed.

There’s no legal way to completely erase your credit history.

All negative items on your credit report should be gone in 7–10 years, but it's usually not possible to instantly wipe your credit history before this time. Stay away from credit repair companies that sell tradelines or credit privacy numbers (CPNs) as a “substitute” for your social security number. These practices indicate shady or illegal activity that could get you into trouble.

Should you hire a credit repair company?

If you’re feeling overwhelmed or having trouble making headway with the approaches mentioned above, a credit repair company may be able to save you time and hassle by filing disputes with the credit bureaus and negotiating with debt collectors on your behalf. However, they can’t do anything that you can’t do to remove negative marks on your credit report by yourself.

They won’t necessarily be able to erase accurate negative marks or turn a bad credit score into a good credit score overnight. Carefully weigh the pros and cons of credit repair services before committing to hiring a professional.

If you do decide to hire a credit repair company, be on the lookout for scammers. By law, credit repair companies are not allowed to charge you before they’ve provided you with some sort of service. 7 If they ask for payment upfront, then look for a different company.

Takeaway: Delete collections from your credit report by disputing them or negotiating with your creditor.

- If a collection account is an error or is old and unverifiable, then you can send a dispute letter to your creditor and the credit bureaus to try to get it removed.

- You can also try negotiating with the debt collection agency by sending a goodwill letter (if you’ve paid the debt) or pay-for-delete letter (if you haven’t).

- If these approaches don’t work, then you can try hiring a credit repair company or simply waiting until the collection account comes off your credit report on its own in 7 years.

- The degree to which collections accounts affect your credit score depends on how many you have, how old they are, what type of debt they are, and whether they’ve been paid.