Stains on your credit report can take a serious toll on your life by making it difficult to secure new loans, get good interest rates, or even land an apartment or get a job.

Many people with damaged credit turn to credit repair professionals for help. That isn’t a bad idea, but the costs of professional credit repair can be significant, and the truth is, there’s nothing a credit repair company can do for you that you can’t do for yourself (for free). Read on to learn how to repair your credit on your own.

Table of Contents

Can you remove negative information from your credit report?

Yes, you can sometimes remove negative information from your credit report. It’s relatively easy to do this for information that’s inaccurate, i.e., marks that were added to your report by mistake.

Removing accurate information from your credit report is also possible, but it’s much harder, and there are no guarantees it will work.

How long does negative information normally stay on your credit report?

If you don’t take any steps to remove it, negative information usually stays on your credit report for 7 years, although there are exceptions.

The table below shows how long before different entries and accounts are removed from your credit reports.

Amount of Time Negative Information Can Remain on Your Credit Report

| Negative Item | Credit-Reporting Limit |

|---|---|

| Delinquency | 7 years |

| Late payment | 7 years |

| Charge-off | 7 years |

| Collection account | 7 years |

| Repossession | 7 years |

| Foreclosure | 7 years |

| Chapter 7 bankruptcy | 10 years |

Sources: Fair Credit Reporting Act, Equifax, and TransUnion.

It’s possible to get any of the items listed above removed from your credit report. To do so, you’ll need to get the cooperation of either the credit bureaus that produce your reports or the company that provided the information (known as the “data furnisher”).

As mentioned, you can do this on your own, without hiring outside help. In fact, if you do hire a credit repair company, they’ll follow the exact same process that you’ll use yourself.

We’ll explain the primary methods you can use to remove negative information below.

It’s impossible to erase bad credit overnight

Be patient—fixing your credit can be a long process. Even if you manage to convince your creditors or the credit reporting agencies to wipe your credit history clean, it’ll take time for them to update your records (often around 30–45 days). If repairing your credit ends up requiring multiple rounds of negotiation, it could take even longer.

How to remove negative items before the 7-year limit

If you can’t wait 7 years for derogatory marks to fall off your credit report, then you have three options.

The first method is a reliable way of deleting outright errors from your credit report. If you want to delete legitimate (correct) information, you’ll have to use the second or third method, both of which have a much lower chance of success.

1. File a credit dispute

The most popular way of removing information from your credit reports is to file a credit dispute with the credit bureaus reporting the derogatory items.

If the information turns out to be inaccurate, the credit bureaus are legally obligated to remove it for you.

All you need to do is send a dispute letter to the relevant credit bureaus along with supporting documentation, if you have any.

This documentation could consist of receipts proving that you paid a given debt on time, or personally identifying information that shows the bureaus confused you with someone else (e.g., someone with a similar name or Social Security number, which has been known to happen).

Create your credit dispute letter with the template below:

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

Where to Send Your Dispute Letter

Below you’ll find the mailing addresses of all three credit reporting agencies (TransUnion, Experian, and Equifax). It’s also a good idea to also send a letter to the original creditor or debt collector that reported the information to the credit bureaus.

| Experian | Equifax | TransUnion | |

|---|---|---|---|

| Where to send your dispute letter | Experian P.O. Box 4500 Allen, TX 75013 | Equifax P.O. Box 740256 Atlanta, GA 30374-0256 | TransUnion Consumer Solutions P.O. Box 2000 Chester, PA 19016-2000 |

| What you’ll need to send | |||

| Dispute online | Experian's online dispute form | Equifax’s online dispute form | TransUnion’s online dispute form |

You may have to repeat the process with all three credit bureaus

Unfortunately, if one credit bureau removes information from your credit report, the others don’t necessarily have to. This is because the three credit reporting agencies keep separate records on consumers. Check your credit reports to find out whether you need to go through the same process with the other two credit bureaus.

2. Negotiate pay for delete

If you’re trying to remove a legitimate negative mark, your options are more limited. You’ll need to contact your data furnisher and negotiate with them to remove the item.

If you’re trying to delete information associated with a debt you haven’t yet paid, then you may be able to get your creditor or debt collection agency to remove it in exchange for payment. This method is known as pay for delete.

To negotiate pay for delete, use our free template to write a letter.

Pay for Delete Letter to Collector

Use this pay for delete letter template to ask a debt collection agency to remove a collection account from your credit report. Pay for delete works best on old debts in collection, so this is the scenario the strategy is most suited to.

Send your letter it to your creditor or debt collector (whoever’s name is showing up on your credit report). Watch for their reply, as they might write back with a counter-offer of some type.

You don’t need to negotiate pay for delete for medical collection accounts

Starting from July 1, 2022, all paid medical bills in collections will automatically be removed from consumer credit reports. This means that you can get these collections removed from your credit report before 7 years have passed just by paying them—there’s no negotiation required.

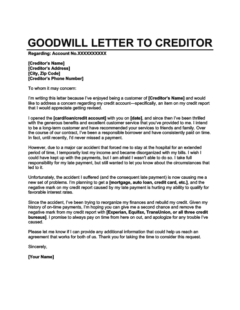

3. Ask for a goodwill deletion

If you’re trying to erase a negative mark on your credit report from a debt you’ve already paid, then you can ask your creditor for a goodwill adjustment. This is a credit-repair approach where you essentially ask your creditor (or a debt collector) to remove negative marks from your credit report as an act of compassion.

It helps if the circumstances leading to the derogatory mark were beyond your control (e.g., loss of income, divorce, or unforeseen medical expenses).

All you need to do is send your creditor a goodwill letter explaining your situation along with any evidence you have to back up your claims.

Goodwill Letter to Creditor

Use this goodwill letter template to ask for a goodwill deletion from one of your creditors. Remember to customize it to your circumstances for the best possible chance of success.

When should you hire a credit repair company to remove items from your credit report?

If you’ve tried to repair your credit yourself using the methods above and they didn’t work, it’s understandable if you’re considering hiring a credit repair company.

This isn’t a bad idea, exactly, but as we said, credit repair companies can’t do anything that you can’t do on your own. Whatever company you hire, they’ll be limited to the same three options described above—and if they’re a legit company, they’ll be completely open with you about that.

When it makes sense to hire a credit repair specialist

There’s really one circumstance in which it makes sense to hire a credit repair company: when you want to keep trying to delete negative items from your credit report, but you don’t want to spend the time to do it yourself.

For example, if your debt collector rejects your first pay for delete offer, it’s still possible that they’ll agree to your second (or third). Similarly, the credit bureaus might refuse to remove the first item that you dispute, but agree to remove a different one if you keep sending letters. A credit repair company can save you from having to go through round after round of negotiations.

In the end, that’s all that credit repair companies do—save you time and energy. If you decide that’s worth spending your money on, that’s a perfectly valid choice. Just make sure you understand that their success rate won’t necessarily be any higher than your own.

Other ways to repair your credit by yourself

If the methods above didn’t work (or if it wasn’t enough to fully repair your credit), don’t worry. Removing negative items from your credit report isn’t the only way to fix your credit.

Here are other ways you can get your credit back on track:

Build up your positive credit history

Adding positive credit activity to your credit report can be just as effective as erasing bad credit. Even with a very bad credit score, you can try the following approaches to start rebuilding your credit:

Get a secured credit card

Unlike an unsecured credit card, secured cards (e., cards that require a security deposit) are low-risk for credit card companies, so they usually come with little to no credit score requirements. This means you can get one even with a tarnished credit history.

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Secured Overall | 300–669 | $0 | Cashback Match | ||

| No Credit Check | 300–669 | $35 | |||

| Beginners | 300–669 | $25 | |||

| No Annual Fee | 300–669 | $0 | |||

| Bad Credit | 300–669 | $49 | |||

| Rebuilding Credit | 300–669 | $0 | |||

Get a credit-builder loan

Credit-builder loans are specifically designed for people with bad credit. As you make payments over time, your positive payment history will counteract any derogatory items on your credit report.

Become an authorized user

If someone with a spotless payment history adds you to their credit card account as an authorized user, your credit file could quickly fill up with positive information as their entire account history is added to your credit reports.

Get credit for rent or utilities

You can counteract the negative marks in your credit report by adding your on-time rent and utility payments. All you need to do is sign up for a rent-reporting service or bill-reporting service like Experian Boost.

Add a consumer statement to your credit report

If you can’t get negative information off your credit report but you feel like the marks are unjust or that they don’t reflect your true creditworthiness, you can add a consumer statement to your credit reports explaining your side of the story.

Your consumer statement will be visible to potential lenders, and it may help counter the damage of delinquencies or other derogatory marks. You can add, modify, or remove a consumer statement at any time.

The statement can be specific to a certain account or refer to your entire credit history. You’ll usually have a choice of different pre-written statements to choose from, or you can write your own up to a certain length (100 words for Experian, 100–200 for TransUnion, and 475 characters for Equifax).

Takeaway: You can remove negative items from your credit report on your own by disputing them or negotiating with your creditors.

- It’s possible to remove information from your credit reports, but it’s usually easier to do with inaccurate information than with valid derogatory marks.

- Most negative information will stay on your credit reports for up to 7 years, although hard inquiries only last for 2 years, and chapter 7 bankruptcies can last for up to 10 years.

- To erase negative items from your credit history, dispute them with the credit bureaus or negotiate pay for delete or a goodwill deletion with your creditor or debt collector.

- Alternatively, you can minimize the damage to your credit from derogatory marks by adding positive information or a consumer statement to your credit reports.

- You can’t erase bad credit overnight. Even getting items deleted from your credit reports can take a month or more.