If your credit is in bad shape, then hiring a credit repair company may seem like your only option. The good news is that it’s not—with a few insider tips, you can also repair your credit absolutely free of charge.

Before you sign up for a credit repair service, it’s important to understand how much credit repair companies charge and what other options you have for repairing your credit on your own.

Table of Contents

Can you hire someone to fix your credit?

Yes, you can hire a credit repair professional to help you fix your credit. When it comes to credit repair, you have two options:

- Hiring a credit repair company: This involves finding a credit repair agency in your area (or online) and signing up for their services. This option costs money.

- DIY credit repair: When you pursue credit repair on your own, you use all the same techniques as a credit repair expert would. This option requires more work, but it’s completely free (except for the cost of paper and postage and other negligible expenses).

Which approach is right for you depends on your budget, the extent of the damage to your credit, and how much time and effort you’re willing to personally invest in repairing it.

Although credit repair does work, professionals can’t do anything you can’t do by yourself. With that said, they can take away some of the stress of credit repair by doing the legwork for you. It’s ultimately your choice whether that’s worth the cost or not.

How much do credit repair companies charge?

The price of credit repair depends on the company you choose and the extent of the services you require. However, the costs often range in the hundreds of dollars.

To give you a general idea, a FinMasters survey of 500 credit repair customers revealed that the majority (51.4%) were charged over $500 in total for credit repair services. 1

In most cases, you’ll pay more for credit repair if you require the company’s services for a longer period of time or you need help fixing multiple problems in your credit history.

Credit repair pricing structures

The cost of professional credit repair services typically breaks down in one of two ways:

- Pay per delete: This is when the company charges you for each error they’re able to remove from your credit report. Prices often start at around $35 per deletion, but they can reach up to $100 or more.

- Subscription: Most companies offer a monthly subscription credit repair package. Prices vary widely depending on the company, but most charge $50 to $100 per month. 2

In addition to charging you for pay-per-delete or subscription services, credit repair agencies may also charge you a one-time fee (also known as a “first-work fee”) to set up your account. They may also charge you a cancellation fee for ending your subscription.

What do credit repair companies do?

Credit repair agencies will often do the following:

- Review your credit reports

- Negotiate with your creditors and debt collectors to delete derogatory marks from your reports

- Dispute items on your credit report with the credit bureaus

- Help you check your credit score

- Write cease and desist letters to debt collectors

- Write letters of recommendation to lenders

Are there restrictions on when credit repair companies can charge you?

Yes, there are restrictions on when credit repair companies are allowed to charge you. Under the Credit Repair Organizations Act (CROA), credit repair companies are not allowed to charge you for services that they haven’t completed yet. 3

If a credit repair company tries to charge you upfront, they’re violating federal law and you should look for a different company.

Signs a credit repair company might be scamming you

There are several red flags you should watch out for when hiring a specialist to avoid credit repair scams. Watch out for companies that:

- Discourage you from contacting the credit bureaus: If a company tells you not to contact the credit bureaus (or review your own credit reports) yourself, it suggests they have something to hide.

- Overpromise: There are no guarantees in credit repair. Ultimately, it’s up to your creditors and debt collectors (and the credit bureaus) whether they’ll remove negative information from your credit report. Credit repair companies can’t guarantee that they’ll be able to delete a particular negative mark—in fact, they can’t guarantee they’ll be able to delete any items at all. If they promise to do so, they’re not being honest with you.

- Pressure you to pay in advance: Again, not only is this unethical, it’s illegal. When it comes to the legality of credit repair, one thing credit repair companies cannot do is charge you upfront.

If the company you’re considering hiring does any of the above, stop working with them immediately. Don’t pay them any money or give them your credit card information.

How to repair your credit for free

If you’re on a budget and you want cheap or free credit repair, then hiring a professional isn’t your best bet. What these companies don’t want you to know is that there are steps you can take by yourself to repair your credit for free.

There are three main credit repair tactics:

File credit disputes

This is the main approach that credit repair companies use to get negative information off of consumer credit reports. The dispute process is designed for removing genuine errors (such as mistakenly reported debts). It can also work on accurate negative items too, but this is rare.

To file a credit dispute, download the template below and tailor it to your circumstances. Next, send it to the credit bureau that’s providing the report with the items you want to remove.

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

The credit bureau will contact the company that originally reported the disputed information (e.g., your bank). If they fail to respond to your dispute within 30 days, then the item you’re disputing will automatically be removed from your credit report. 4

Credit repair companies are known for persistently sending dispute letters in the hopes that eventually your creditor will forget to reply and the mark will be deleted from your credit history. You can do the same thing—although bear in mind that there is a chance the item will be reinserted onto your credit report if it’s later confirmed to be accurate.

You can get your credit reports for free

You’re entitled to one free copy of your credit report every 12 months (currently every week due to COVID-19) from each of the three major credit bureaus: Equifax, Experian, and TransUnion. You can request your free credit reports at AnnualCreditReport.com. You can also get additional reports for no more than $13.50 per copy. 5

Try pay for delete

If you have derogatory marks on your credit report for debts that you haven’t yet paid, then you can use that debt as leverage to convince creditors or debt collectors to erase the associated negative information. This credit repair method is known as pay for delete.

You’ll need to send a pay-for-delete letter, and you may need to negotiate further to come to an agreement on how much you’ll pay. The letter template below is specifically designed for negotiating with debt collectors, which is when this approach is most likely to work:

Pay for Delete Letter to Collector

Use this pay for delete letter template to ask a debt collection agency to remove a collection account from your credit report. Pay for delete works best on old debts in collection, so this is the scenario the strategy is most suited to.

You can also negotiate pay for delete as part of a debt settlement (where your debt collector or creditor agrees to clear your debt for less than the full amount you owe). In either case, getting confirmation of your agreement in writing before you pay is crucial so that the company doesn’t back out after they receive your money.

Send goodwill letters

It’s a long shot, but if your creditors or debt collectors have sympathy for your situation, they may be willing to agree to a goodwill deletion (also known as a goodwill adjustment). In this case, they’ll remove accurate negative marks as an act of compassion (“goodwill”).

For this to work, you’ll need to be on good terms with your creditor. The goodwill letter template below is designed for you to send to your creditors (debt collectors are much less likely to agree to a goodwill deletion). Explain the circumstances that led to your derogatory mark and ask for the mark to be removed.

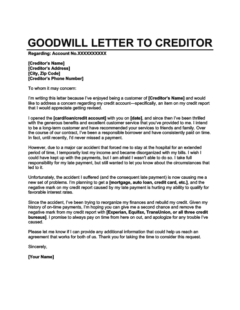

Goodwill Letter to Creditor

Use this goodwill letter template to ask for a goodwill deletion from one of your creditors. Remember to customize it to your circumstances for the best possible chance of success.

Do you need special software to perform DIY credit repair?

Some companies offer credit repair software that makes it easier to create dispute letters and track your ongoing disputes. This software is usually subscription-based.

Credit repair software is generally cheaper than hiring a credit repair specialist, but obviously it’s more expensive than just keeping track of everything on your own (which is free). You can think of it as an intermediate option between the two.

If you have a lot of items on your credit report to dispute, credit repair software can be helpful, but you don’t need it to perform DIY credit repair. It makes things more convenient, but it isn’t necessary.

Is it worth paying for credit repair?

It’s up to you whether or not it’s worth it to pay someone else to fix your credit. As mentioned, you can do all the things that a credit repair company can do—it’ll just take time and effort.

If your credit is severely damaged and your credit report is full of negative information (or if you’re very busy and just don’t have the time to perform DIY credit repair), then hiring a professional might be worth the money.

On the other hand, if your budget is tight, paid credit repair probably won’t be worth it. That’s doubly true if you have a lot of debt (especially credit card debt) that you need to pay off. Unpaid debt can drag your credit score down even further, so getting out of debt should be your first priority.

How fast does credit repair work?

The amount of time required to repair your credit depends on how successful you are at getting negative information removed from your credit report.

Getting negative information deleted sometimes requires months of negotiating. However, once you’re successful, you’ll see an improvement in your score within a month (as soon as the credit bureaus update your reports).

If you aren’t able to delete the negative marks weighing down your score, you’ll have to explore long-term strategies for rebuilding credit (i.e., paying down your debts and waiting for your score to naturally recover).

The time it will take to rebuild your credit also varies depending on your situation, but in general, you can expect to see an improvement in your score within six months and a full recovery within 2 years, provided you don’t incur any further negative marks on your credit report in the intervening time.

Takeaway: Credit repair is free if you do it yourself, but prices vary for professional credit repair services.

- When it comes to credit repair, you have two options: hiring a credit repair company (which costs money) or repairing your credit by yourself (which is free).

- Credit repair companies may charge you for a monthly subscription or for each item they delete from your credit report. They may also charge setup and cancellation fees.

- The cost of professional credit repair varies depending on how many negative items you need removed from your credit report and how long it takes to get them removed.

- You can repair your credit for free on your own by filing credit disputes, negotiating pay for delete, or sending goodwill letters to your creditors.

- You can do anything a credit repair company can do, but professional credit repair may be worth the fees if you can’t or don’t want to repair your credit on your own.