There are plenty of reasons you might need access to a credit card right now. Maybe you want to rent a car, you’re gearing up for a vacation and you want the extra travel protection, or you just need access to quick cash.

Whatever your reason may be, you’ll need to come to terms with the fact that it’ll probably take a couple of weeks or longer to get your new credit card. Here’s what you need to know about the timeline for getting a credit card and what you can do to make the whole process go a lot quicker.

Table of Contents

How long does it take to get approved for a credit card?

Credit card approval can happen instantly, or it can take a few days or even weeks. How long it’ll take to find out the result of your credit card application depends on the credit card company, what kind of credit card you’re applying for, and your credit profile.

Some credit card issuers automatically approve applicants who meet their credit requirements. However, if you’re on the borderline of approval, the credit card issuer may choose to review your information manually to determine whether you qualify. This could take a few days or even weeks.

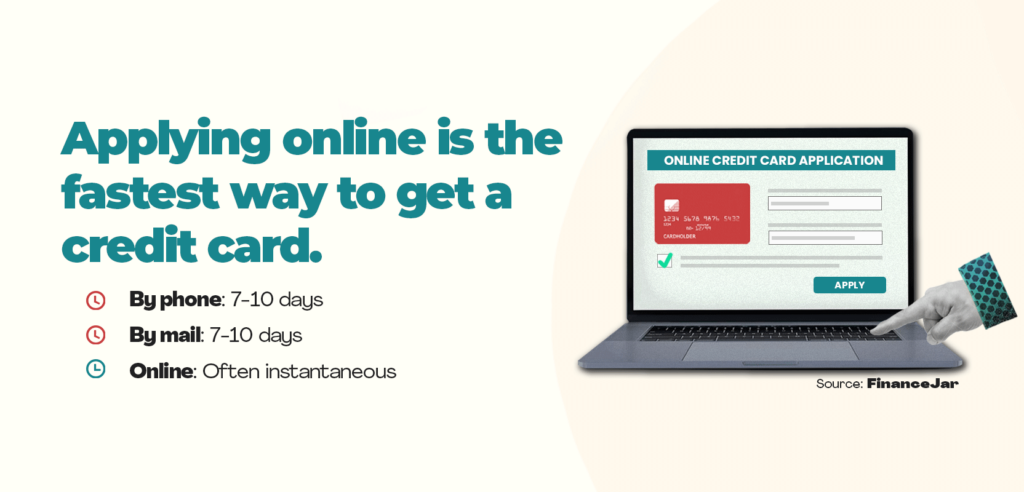

Applying online is the best way to get a new credit card quickly. Credit card applications submitted by mail or over the phone typically take longer to process and have an average wait time of 7–10 business days.

Applying for a Credit Card Online

The good news is you never have to wait more than 30 days to hear back regarding a credit card application. According to the Consumer Financial Protection Bureau, credit card issuers must notify you of their decision on your credit card application within 30 days. 1

Can I get a credit card the same day I apply?

Receiving your credit card the same day you submit your application would be a dream come true, but it’s incredibly unlikely. It usually takes at least a few days for the physical card to be issued and sent to you in the mail.

How long does it take for a credit card to arrive?

Receiving your physical card in the mail usually takes 7–10 business days. However, postal delays for any type of online order are not uncommon, so your card may take longer to arrive. Also bear in mind that some credit card issuers ship their credit cards more quickly than others.

After you submit your credit card application, the application needs to be processed, and then the physical card needs to be manufactured, packaged, and shipped to you. This is a relatively involved process, which is why credit cards can take a long time to arrive.

If you’re in a rush, some credit card issuers offer expedited shipping by request, sometimes even for free.

How long does it take to get a replacement credit card?

Replacement cards typically arrive much faster than new credit cards. You can expect a replacement credit card to arrive within 3–7 business days.

In emergency situations (e.g., your card was lost or stolen right before a big trip), credit card companies may expedite the delivery to just a day or two. However, this service may come with a fee.

Credit Card Shipping Times by Company

| Credit card issuer | New card | Replacement card |

|---|---|---|

| American Express | 7–10 business days | 1–2 days (free next-day shipping) |

| Bank of America | Within 10 business days | 4–6 business days |

| Capital One | 7–10 business days | 4–6 business days |

| Chase | 10–14 business days | 3–5 business days |

| Discover | 7–10 business days | 4–6 business days |

| Wells Fargo | 7–10 business days | 5–7 business days |

If your credit card doesn’t arrive within the card issuer’s estimated timeframe, first check that the card’s mailing address is correct. Next, contact your creditor by phone or online and ask for an update. Many credit card companies also allow you to check your card’s delivery status online.

How to get a credit card as fast as possible

Take these steps to ensure you get your new credit card as quickly as possible.

Figure out what credit card to apply for

To ensure that the credit card application process goes smoothly and quickly, you should:

- Decide whether you want a secured or unsecured card: If you have a fair or poor credit score, it may take a while for credit card companies to review your application for an unsecured credit card because they involve more risk. By contrast, secured credit cards are easier to get.

- Understand the requirements: Every credit card has requirements you’ll need to meet to get approved (such as credit score, income, and employment requirements). These requirements are generally stricter for more exclusive credit cards. Only applying for cards you qualify for will help you get approved more quickly and avoid rejection.

- Know what features you want: Credit cards offer a variety of features (e.g., low APR, no annual fee, or attractive rewards). Think about what you want to get out of a credit card before you start submitting applications. Knowing what you want will save you time shopping around.

If you have the time, it’s best to improve your credit score as much as possible before applying for a credit card. One of the benefits of having good credit is that you get access to credit cards with better terms and higher credit limits.

Get credit card preapproval or prequalification

Many credit card issuers give you the option to fill out your basic information and get prequalified for a credit card. Getting prequalified or preapproved isn’t a guarantee that your credit card application will be accepted, but it’s a sign you stand a fair chance.

To determine if you prequalify for a credit card, the card issuer will run a soft credit check. Unlike a hard credit check, this won’t impact your score. However, if you decide to pursue the preapproved offer and submit an official credit card application, a hard inquiry will appear on your credit report and cause a slight drop in your credit score.

Getting preapproved before submitting an official card application can give you a better understanding of what credit cards you qualify for, save you time shopping around, and lower the risk of rejection.

Explore offers at your current bank

If you already have a credit card, consider applying for another card from the same credit card company. Since they already have all your personal information and solid evidence of your payment history, they may approve you more quickly.

Additionally, some banks are able to give you access to your account details immediately after approval if you already have an account with them (before you receive your physical card). They may also offer added perks that are only available to existing customers, like introductory 0% APRs or extra rewards.

Consider instant-approval credit cards

If you can’t wait a few days to find out whether you’ve been approved for a specific credit card, you may want to look into an instant approval credit card. Your application will be reviewed immediately, and you’ll find out the results within minutes.

The card issuer will permit you conditional approval while they run further credit checks to determine your eligibility.

This type of credit card is usually best for people with an excellent credit score who want to get a credit card faster. However, it’s also possible to find credit cards for bad credit with instant approval, so don’t give up hope if your credit history leaves something to be desired.

Check out instant-use credit cards

Instant-use credit cards (also known as instant access credit cards) allow you to use your new line of credit the moment you’re approved. Rather than having to wait for the physical card to arrive, you’re given a credit card number that you can begin using immediately.

Below are credit cards that you may be able to get an instant card number for after approval:

In addition, many retailers offer store credit cards with instant access to credit that allow you to make purchases with the card right then and there, immediately after you apply.

Once you’ve got your credit card details (e.g., the card number, expiration date, and security code), you can also set up a digital wallet on your phone or another mobile device. Digital wallets are great for making online purchases and shopping at stores that accept contactless payments. Just make sure that your card is fully activated beforehand.

What to do after you get your credit card

Getting a new credit card isn’t the only thing you need to think about. You’ll need to know what steps to take next to start using it and make the most of the benefits it offers.

Here’s what you’ll need to do:

- Activate your card: Before you can use your new credit card, you’ll need to activate it. Credit card activation instructions vary depending on the issuer, but they are almost always listed on the removable sticker that comes with your card.

- Consider setting up mobile banking: Mobile banking apps come with all sorts of benefits, including instant access to your account details at any time and from anywhere. They can also help you explore your credit card rewards and other perks.

- Enroll in autopay: Even if you always pay your bills on time, you can’t go wrong with setting up automatic payments for your credit card, at least for the minimum required monthly payment. This will protect your credit from damage due to late payments.

- Establish a budget: Setting up a budget for yourself will help you avoid overspending. Keeping your credit card balance low will benefit your credit score by allowing you to maintain a low credit utilization rate (the percentage of your credit limit you’re using).

Remember that the better you do at managing your debts, the more credit you’ll be able to access. After a few months, you may be able to increase your credit card limit or even apply for another credit card.

What to do if your credit card application is denied

If your credit card application is denied, the card issuer is required to send you a letter detailing why the application was unsuccessful and which credit report influenced their decision. 2 This will help you understand what steps you can take to boost your chances of approval on your next application.

Here are a few possible reasons why your application was rejected:

- You didn’t meet the credit card’s credit score requirement

- You have an insufficient credit history

- Your income is too low

- Your debt-to-income ratio is too high

- You’re not the minimum age required to get a credit card (18, but additional restrictions apply to applicants under 21)

- You’ve applied for too many credit cards already

The best thing you can do is take a step back and review your credit and financial situation and the requirements for the credit card you applied for. If your credit is the problem, take steps to quickly build your credit (if you’re just starting out) or fix your credit (if it’s been damaged) and then try again in a few months.