Being contacted by debt collectors is stressful, and it’s even more so if you don’t recognize the debt in question.

Creditors often collect debts through third-party debt collection agencies, so a debt collector might be legit even if you’ve never heard of them. However, fraudsters sometimes pose as legitimate collectors.

This type of fraud can seriously hurt your finances and credit, so it’s crucial to confirm the identity of anyone who asks you to pay a debt. To protect your credit and security, don’t send them any money or share your personal information before doing so.

Table of Contents

8 signs that your debt collector is a scammer

Although laws like the Fair Debt Collection Practices Act (FDCPA) have been put in place to protect consumers and stop debt collectors from engaging in deceptive or unfair debt collection practices, scammers still exist.

If someone contacts you claiming that you owe them money, be on the lookout these FDCPA violations and other telltale signs that you might be dealing with a scammer:

1. They don’t give you a debt validation notice

The FDCPA states that debt collectors have to give you something called a “debt validation notice” within 5 days of first contacting you. 1 This notice will contain information about your debt.

Specifically, a debt validation notice must include the following information: 1

- The name of your original creditor

- The amount owed

- Information about your right to dispute the debt (if you dispute a debt in collections, the debt collector will have to obtain verification of the debt)

If you don’t receive a validation notice, it doesn’t necessarily mean you’re being scammed—sometimes debt collectors can be lax about sending these legally required documents—but it’s a significant red flag.

2. They call you incessantly or at odd hours

To protect you from harassment by debt collectors, the FDCPA imposes restrictions on when and how they can contact you. If a debt collector is calling you nonstop or at inconvenient hours (which by default means before 8 a.m. or after 9 p.m. local time), then they’re violating your federal rights, which could be a sign that they’re a scammer. 1

Debt collectors are also required to abide by your request if you tell them not to call you at work, only contact your attorney, or cease communications altogether.

Despite what you may have heard, there’s no special 11-word phrase you need to use for stopping debt collectors—all you need to do is state your request clearly and submit it in writing. If they disobey, then they’re violating your rights, and it could be a sign that they’re a scammer.

The FDCPA applies to debt collectors but not your original creditor

Even though federal law limits when and how debt collectors can contact you, the Fair Debt Collection Practices Act (FDCPA) doesn’t usually apply to creditors. This means that if you have a contract with a lender, credit card company, or landlord, the FDCPA doesn’t restrict how they can contact you to ask for payment.

3. They ask you for sensitive information

Debt collectors generally follow a standard process to verify your identity when they call you. If they ask you to provide private information, they might be a scammer.

Here’s information that a legitimate debt collector may ask you for: 2

- Your full name

- Your address

- Your date of birth or just the month and year you were born

- The last FOUR digits of your Social Security number

Legitimate debt collectors won’t ask you for sensitive financial information like your bank account details, routing number, full Social Security number, or credit card number.

Scammers might use this kind of information for identity theft, so never share it with a debt collector unless you’ve already confirmed that they’re legitimate.

4. They refuse to give you their contact information

Legitimate debt collectors will be able to give you details about their company, including the following information:

- Name

- Mailing address

- Phone number

- Website address

- Email address

Most states also require debt collectors to have a debt collection license, although there are a few outliers. 3 If you live in a state with debt collection licensing, then the company should be able to give you their license number if you ask for it.

5. They don’t have accurate information about you or your debts

A legitimate debt collector should already have plenty of information about you and your debts, including how much you owe, your address, your Social Security number, and your birthday.

For your protection, debt collectors shouldn’t volunteer any of your personal information until they’ve verified your identity. However, if they can’t give you accurate information about your debts, they may be a scammer.

Ask them the name of your original creditor and then compare the information they’ve given you with your account records and the details listed on your credit reports to ensure that the debt collector is legit.

6. They threaten you with criminal charges

Debt collectors are not allowed to threaten to take actions that are illegal or that they don’t intend to carry out. 1 This includes threatening you with criminal charges, since you usually can’t go to jail over debt. 4

Scammers often use scare tactics to pressure you into paying quickly before you realize that the debt isn’t legit. Understanding what debt collectors can and can’t do during the debt collection process can help you spot a scam early on.

It’s also worth noting that for consumer debts, debt collectors also can’t garnish your wages or bank account without a court judgment. The only exception is certain cases when you owe debt to the government (such as unpaid taxes).

7. They threaten to tell others about your debt

The FDCPA strictly prohibits debt collectors from sharing information about your debts with anyone except specially designated individuals (e.g., your legal guardian if you’re a minor, your spouse, or your attorney). 1 Anyone who threatens to tell your friends, family, or coworkers about your debt probably isn’t a legitimate debt collector.

Beyond actively telling other people about your debt, debt collectors aren’t even allowed to send you postcards or letters with markings revealing your debt in any way. They can still contact people you know to try to get in touch with you, but they aren’t allowed to reveal that you owe a debt.

8. They demand a specific type of payment

Scammers will be in a hurry to get money from you before they’re caught, and they’ll usually demand a specific kind of payment that’s difficult to trace. Legit debt collectors, on the other hand, generally offer multiple payment options.

A surefire sign that your debt collector is a scammer is if they say you can only pay by making bank transfer, wiring them money, or by sending them money on a prepaid gift card or cash reload card. These methods are less traceable and make it harder for you to get your money back.

Another indicator that a debt collector is a scammer is that they claim to be from a government agency like the Internal Revenue Service (IRS) but ask you to make your payment by card over the phone. Legit IRS debt collectors will only ask you to make your payment directly to the US Treasury or the IRS at IRS.gov/payments. 5

How to protect yourself from debt collection scams

You can easily stop scammers in their tracks by taking these measures to protect yourself:

Know your rights under the FDCPA

Reviewing your rights under the FDCPA will help you recognize scams early on. Legit debt collectors usually try to avoid violating your rights because if they do, they could end up having to pay you if you sue them.

Use payment methods that offer fraud protection

Avoid using hard-to-trace payment methods, like sending cash or gift cards. It’s notoriously difficult to get your money back if you do this.

Paying by credit card, bank transfer, or wire transfer through a reputable company will give you some degree of protection if you’re scammed. You may be able to get a refund if you contact the company quickly to report the fraud.

Don’t disclose any of your financial information

As mentioned, you should never provide sensitive financial information to someone contacting you about a debt until you’ve verified that they’re a legit debt collector. Debt collectors may ask you questions during identity verification but not about your financial details. Getting you to provide financial information is sometimes part of an identity theft scam.

If a collector has incorrect information, such as an address or phone number you’ve never used, don’t correct them. Instead, you should ask them for their name, the name of the debt collection company, and the company’s contact information.

Be careful about visiting payday loan websites

Scammers often target people who are looking into payday loans or other types of quick credit online or over the phone. Be careful about sharing your personal information online, make sure you read the fine print on any agreements you make, and keep an eye on your bank account and credit card statements for unexpected charges.

Do your research

If a debt collector calls or writes to you, take the following steps to research the company and verify that they’re legitimate:

- Search the company online: Search the company’s name in this list of common debt collection agencies and check out their website. You can also view the company’s profile on the Better Business Bureau (BBB) website to find out more information and read complaints that have been filed against them.

- Call the company back: If a debt collector called you, call them back to see whether the number works and whether they answer with the company name they provided to you. If not, it may be a scam.

- Ask for written confirmation of the debt: After you’re contacted, you should send the debt collector a debt verification letter asking them to confirm the details of your debt in writing. If they’re legit, they’ll either provide evidence of the debt or stop trying to collect it. 1 You can create your letter using the template below.

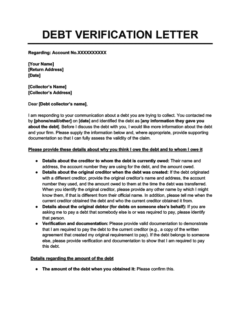

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

Check your credit reports

Regularly checking your credit reports is important for protecting yourself against fraud. Visiting AnnualCreditReport.com is a safe way to request all three of your credit reports from the major credit reporting agencies. You can also ask the credit bureaus directly for your credit reports by visiting the Experian, TransUnion, and Equifax websites.

Although it’s possible that a legit debt collector won’t report your collection account to all three credit bureaus, they’ll usually report to at least one. Seeing the debt in question on your credit report and verifying the debt collection agency’s name and the amount you owe is an easy way to rule out a debt collection scam.

Contact your creditor

Reach out to your original creditor to find out whether they transferred or sold your debt to the debt collector contacting you. Doing so will confirm once and for all whether the debt collector is legit.

A legitimate debt collector will state the name of your creditor in the debt validation letter they initially sent you. If they didn’t send one or you no longer have it, ask for another one so that you can verify the debt with your creditor.

What to do if you’ve been scammed

If you’ve been scammed by someone posing as a debt collector, then you need to immediately follow these five steps:

- Gather evidence: The first step you’ll need to take is gather all records of your contact with the scammers, including emails, receipts, phone numbers, and the name that the scammer used.

- File a police report: Once you’ve gathered all the information you have on the scammers, file a report with your local police.

- Submit a fraud report: Submit a fraud report to your state consumer protection office and the Federal Trade Commission. You can also submit a complaint to the Consumer Financial Protection Bureau (CFPB). If the scammers have access to sensitive personal information, such as your Social Security number, then you should also file an identity theft report at IdentityTheft.gov.

- Place a fraud alert on your credit reports: If the scammers have access to your personal information, then activate a fraud alert with Experian, Equifax, or TransUnion. You only need to contact one company, and they’ll inform the other two.

- Request a refund: Contact the company you paid the scammers through (such as your bank, credit card issuer, or wire-transfer company) and ask if they can refund or reverse the transaction. Include a copy of your police report as evidence.

What to do if your debt collector is legit

If your debts turn out to be genuine, then you should address them as quickly as possible. It’s never a good idea to ignore debt collectors—they may sue you if they think you won’t pay.

Your best bet is to simply pay your collections (unless they’re time-barred debts), but there are also several ways to deal with debt collectors if you can’t pay. They may agree to accept less than the full amount owed (known as debt settlement) or offer you an affordable payment plan.

In extreme cases, you can also file for bankruptcy. This will give you a fresh start financially, but it should be a last resort because of the damage it’ll do to your credit score and the long amount of time bankruptcies can stay on your credit report (7 to 10 years).

Recovering from collections

Unfortunately, paying off your collections won’t always improve your credit score. You may need to take other steps to fix your credit. You could even try an approach to getting collections removed from your credit report altogether.

There are several ways you can rebuild your credit after getting collections, but it might take months or years. Credit repair is a long process, but understanding how credit works and how to avoid common pitfalls is a good place to start.

Takeaway: You can spot debt collection scams by looking out for red flags and taking steps to verify your debts.

- Scammers often use scare tactics to pressure you into paying quickly, but you should never make any payments before verifying their identity and the validity of the debt.

- Legitimate debt collectors usually won’t openly violate the Fair Debt Collection Practices Act (FDCPA), so familiarizing yourself with your rights is a good way to spot scammers.

- Scammers may ask you for sensitive personal or financial information and avoid giving you details about their company.

- Fraudsters may demand immediate payment or require a specific payment method that’s difficult to trace, whereas legit debt collectors will offer you more options.

- If you’ve been scammed, report the scam to the authorities, request a refund on your payment, and place a fraud alert on your credit reports.