If you have a seriously delinquent debt, the company you originally owed money to (e.g., your credit card issuer or bank) might have sold or transferred your debt to a debt buyer or debt collection agency. When this happens, you have to deal with whoever owns your past-due debt instead of your original creditor.

If you think you have a debt in collections but don’t know how to check your records to figure out which debt collection agency you owe and how much you need to pay, there are four easy ways to find out.

Table of Contents

Try these methods to track down debt collectors:

1. Contact your original creditor

The simplest way to find out who owns your debt is to contact your original creditor or account servicer directly. They should be able to provide the name and contact information of the debt collection agency you owe money to.

You might even learn that your debt hasn’t been sent to collections yet. Sometimes there will be a lag between your creditor charging off your debt and sending it off to a collector. In this case, you can just pay your original creditor directly and assume that any debt collectors calling you about the debt are scammers.

If you’re uncertain about how much you owe, you can ask your original lender when you contact them, although they may not be able to discuss the account with you if they no longer own the debt. Alternatively, you can confirm the amount you owe by checking your old billing statements.

Knowing your rights can help you spot debt collection scams

A common sign that you’re dealing with an illegitimate debt collector is that they don’t abide by the Fair Debt Collection Practices Act (FDCPA), which is a federal law that protects consumers from debt collector harassment by regulating what debt collectors can and can’t do. To protect your credit, finances, and identity, make sure to familiarize yourself with these regulations.

2. Review your credit reports

Most debt collection agencies report to at least one of the three main credit bureaus (Experian, TransUnion, and Equifax). For this reason, checking your credit reports is an easy way to find out the name and contact information of the debt collection agency that owns your debt.

You’re entitled to a free copy of your credit report from each of the three main credit bureaus every 12 months (due to the COVID-19 pandemic, they’re currently available every week, up until December 2022). 1 To request copies of your credit reports, visit AnnualCreditReport.com.

There’s no knowing which credit bureau your debt collector will report to, so you might have to check all of your credit reports. Also, bear in mind that collection accounts that are older than 7 years or brand new may not appear on your credit reports. 2

3. Check your voicemail or caller ID

If debt collectors call you and you don’t pick up, they may leave voicemail messages explaining which agency they represent and how to contact them.

If all they say in the voicemail is the company name, search for it in this list of common debt collection agencies to find out everything you need to know about your debt collectors, including whether they’re legit and how to contact them.

Another way to track down the debt collection agency is to get their phone number from the voicemail message or your caller ID and enter it into a search engine. Other people may have posted online about receiving debt collection calls from this number.

4. Wait for them to contact you

If you can’t find any information about the debt collection agency on your own, you still have one other option—wait for them to contact you by phone or mail.

However, when they do get in touch, proceed with caution. Never provide debt collectors with any sensitive information before confirming that they’re not scammers who are posing as debt collectors to try to collect money from you.

If in doubt, ask the debt collectors to send you a debt validation letter. This letter will provide details of your debt, including the name of the original creditor, the amount you owe, and information about your right to dispute the debt. By law, they’re required to provide you with this information within 5 days of first contacting you. 3

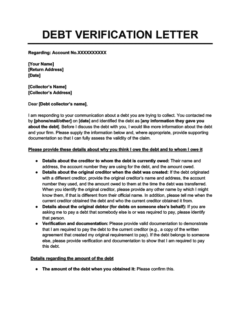

Once you receive this communication, respond with a debt verification letter. Despite the similar names, this is very different from the debt validation notice they’re obligated to send you. This is a letter that forces them to provide further evidence that you owe a debt, which provides additional protection against debt collection scams.

You can create your letter using the template below:

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

What to do after confirming which debt collection agency you owe

Assuming you’re able to identify the agency you owe and it turns out that the debt is legitimate, you’ll need to decide how to proceed. You have a few options:

- Pay off the debt: You may choose to simply pay off your debt in collections. You can either pay a lump sum or negotiate a payment plan with your debt collectors. Paying is obviously a financial hardship, but has several benefits. For example, paying off collections can sometimes improve your credit score and will hopefully give you some peace of mind.

- Negotiate a debt settlement: If you can’t afford to pay the debt collection agency, you can try to get them to agree to a debt settlement (an arrangement where your debt is cleared for less than the full amount you owe). Use a debt settlement letter template to draft your proposal.

- Ignore your debt collectors: Generally, ignoring debt collectors has negative consequences, such as allowing them to garnish your wages or sue you. However, this doesn’t apply to time-barred debts that are past the statute of limitations. If your debt is very old, you can send a written request that they stop all communications with you, and legally, they’ll have to comply. 3

Regardless of which approach you choose, rest assured that there are many ways to rebuild your credit after having a debt sent to collections.

With a little effort, you may even be able to remove the collections from your credit report entirely. Just make sure to monitor your credit so that you always know who’s managing your credit accounts and watch out for debt collection scams.

Takeaway: To find out which debt collection agency owns your debt, ask your original creditor or check your credit reports.

- The most effective way of finding out which debt collection agency owns your debt is simply asking your original creditor who sent it to collections in the first place.

- Debt collection agencies usually report to the three major credit bureaus, so you may be able to see the company’s information in the collections records on your credit reports.

- Check your voicemail or caller ID for information about the debt collection agency that’s pursuing money from you.

- Be wary of debt collection scams. Never share sensitive information with debt collectors before verifying that the company is legit and the debt is valid and belongs to you.

- Once you know which company owns your debt, you can choose to pay off your collections, settle your debt, or ignore your debt collectors (if the debt is time-barred).