If you keep getting calls from debt collectors but you don’t have enough money to pay off your debts, don’t panic. There are several things you can do to get debt collectors off your back and confront your debt head on.

To protect your credit, finances, and peace of mind when you can’t pay, you need to know what to say (and what not to say) to debt collectors, what rights you have, and what your options are for getting out of paying.

Table of Contents

3 ways to get rid of debt collectors without paying

Getting out of paying debt collectors is tricky, but it’s not impossible. Ultimately, you have three options.

1. Dispute the debt collection

You can get debt collectors to stop pursuing payments—at least temporarily—by disputing the debt they’re claiming you have in collections.

To do so, you’ll need to send the debt collection agency a debt verification letter within a 30-day period after they first notify you that they’re collecting your debt (which they should do by sending you a debt validation notice).

You can create a verification letter with the template below.

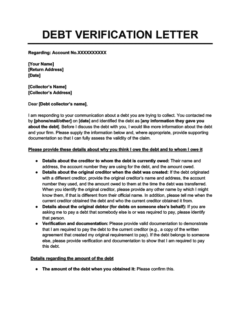

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

As long as you send this letter within that 30-day timeframe, debt collectors won’t be able to ask you for payment until they provide you with proof that you owe the debt, which will give you a temporary reprieve. 1

What’s more, even if the debt is yours, it’s possible they won’t be able to prove it. If your debt collectors can’t properly verify your debt, then you won’t need to pay them anything.

You can ignore debt collectors if your debt is time-barred

Whether or not your debt is valid, if it’s past your state’s statute of limitations, it means it’s time-barred debt and you can no longer be forced to pay. In this case, you can tell debt collectors to stop contacting you, and they must comply. 1 However, if you’re sued, make sure to turn up in court so that you can make your case and avoid losing by default.

2. Negotiate with your debt collectors

If you can’t pay off your debt completely, you might be able to get rid of your debt collectors by paying less than the full amount you owe. This practice is known as debt settlement, and it can get debt collectors out of your life for good, even when you can’t afford to pay off your debts.

Statistics show that on average, people who settle their debts pay less than half of the final amount they owe (after factoring in interest and late fees). 2 All you need to do is send a letter to the debt collection agency with your proposal and wait for their response.

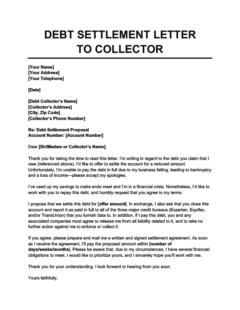

Debt Settlement Letter to Collector

Use this debt settlement letter template to ask your debt collector to clear a debt for less than you owe. This isn't guaranteed to work, but it's a good option if you simply can't afford to pay the debt in full.

Alternatively, if you’re upfront with your debt collectors and tell them that you can’t pay, they may offer you the option to pay in installments over time, which can make paying off your collections feasible.

Negotiating with your debt collector and creating a repayment plan is easier said than done. If you’re struggling, there are non-profit credit counselors that can help you set up a debt management plan.

3. File for bankruptcy

If your debt is valid and your debt collector refuses to negotiate, the only remaining way to get out of paying it is to apply for chapter 7 bankruptcy. This will erase most (if not all) of your debts and give you the chance for a fresh start.

However, bankruptcy is incredibly damaging to your credit, so this should be a last resort. Bankruptcies can stay on your credit report for 7–10 years, and it will be a long time before you’re able to open new lines of credit afterwards.

Other tips for dealing with debt collectors when you can’t pay

In order to fight debt collectors and win, you need to arm yourself with knowledge about how debt collection works and what you should (and shouldn’t) say to them. This will help you avoid accidentally giving them the upper hand or limiting your options down the line.

Assert your rights

You have many rights that protect you from debt collector harassment and abuse. In particular, the Fair Debt Collection Practices Act (FDCPA) is a federal law that imposes restrictions on how debt collectors can go about contacting you.

For example, the FDCPA forbids debt collectors from doing any of the following: 1

- Contact you at an unusual time or place (by default, this is before 8 am or after 9 pm)

- Call you incessantly

- Call you at work if you’ve told them not to

- Threaten you with actions they can’t legally take (such as send you to jail over debt)

- Lie to you

- Tell unauthorized third parties about your debt

- Charge you fees that weren’t included in your contract with your original creditor

If a debt collector is violating your rights, don’t hesitate to report them to the Federal Trade Commission.

Know what NOT to say to debt collectors

To protect your credit, your finances, and your rights, there are certain things that you should never say to debt collectors. One slip-up could make it easier for debt collectors to pressure you into paying or even sue you over the debt.

Avoid doing these things when speaking to debt collectors:

- Sharing additional contact information

- Sharing your banking details

- Acknowledging that the debt is yours

- Agreeing to make a payment

It’s also important that you avoid sharing any personal or financial information (such as your credit card details or Social Security number) until you make sure you’re talking to a legitimate debt collector. Scammers often impersonate collectors to trick people into giving them access to their bank accounts.

Think twice before ignoring debt collectors

As tempting as it may be, simply ignoring debt collectors has major consequences, and it won’t stop them from calling you. If one debt collection agency gives up chasing the debt, they’ll probably sell it to another agency, and so on.

Here are some other things that can happen when you ignore your debt:

- Your debt may grow: Your debt might get much bigger if you don’t pay it. That’s because your debt collector can charge you interest and late fees if your original loan contract permits it. 1

- You could face a lawsuit: If debt collectors think there’s no other way to get you to pay, they may sue you over the debt. If they win, a court judgment could be issued against you, allowing them to garnish your wages (up to 25% of your disposable earnings) or bank funds or even seize your assets (i.e., your personal property). 3

Even when you can’t pay, it’s best to be upfront with debt collectors. Using the tips above instead of hiding will help you maintain control over your financial situation and put your mind at ease.

Takeaway: You can avoid paying off collections by disputing the debt, settling for a smaller amount, or filing for bankruptcy.

- If debt collectors are calling you, it means you have a severely overdue debt.

- To get out of paying off your debt, you can dispute the collection, negotiate a debt settlement, or file for bankruptcy.

- When dealing with debt collectors, remember that you have rights under the Fair Debt Collection Practices Act that protect you from debt collector harassment and abuse.

- Never disclose sensitive information to debt collectors before verifying their identity, and don’t provide them with additional contact information or agree to make any payments.

- It’s best not to ignore debt collectors. If you do, they might sue you, which could give them the right to take money from you against your will.