Table of Contents

What is Quick Collect?

Quick Collect, Inc. (QCI) is a debt collection agency that was founded in 1984. In addition to their headquarters in Portland, OR, they have two offices in Vancouver, WA. 1

As a third-party debt collection agency, Quick Collect pursues payments for overdue debts on behalf of other people and organizations.

Who does Quick Collect collect for?

According to complaints filed on the Better Business Bureau (BBB) website and the company’s responses to these complaints, Quick Collect primarily collects medical debt, although they may also handle other types of consumer debts. 2

If you’re getting calls from Quick Collect or you see their name on your credit report, it could mean that you owe money to one of the following institutions:

- Hospital

- Clinic

- Medical center

- Dental clinic

Is Quick Collect a scam?

No, Quick Collect isn’t a scam. They’re a legitimate debt collection agency, and they’ve been registered with the state of Oregon since 1985. 3

However, just because Quick Collect is a legit company doesn’t mean that they’ll always behave ethically. Like many other debt collection agencies, they’ve faced lawsuits for violating consumer rights. 4 5

You should also be vigilant about scammers posing as Quick Collect representatives to collect money from you. Be sure to verify any debts you’re contacted about before you make any payments by getting in touch with Quick Collect directly using the contact information below.

If you want to remove Quick Collect from your credit report, write to their address: Address: PO Box 55457 Disputing an incorrect entry on your credit report can be stressful and difficult. Consider working with a professional. If a debt collection agent calls you, you should receive written confirmation immediately afterward. If you don’t, it might be a scam. Be especially cautious of anyone asking you to pay a debt that you don’t recognize (or that you believe you already settled), and be sure to ask questions during the call to verify their affiliation with Quick Collect.Quick Collect, Inc. Contact Information

Portland, OR 97238

Phone Number: (800) 252-6322 or (503) 252-0083

Website: www.quickcollectinc.comHow to tell if a debt collection notice from Quick Collect is a scam

Quick Collect may still behave unethically

Even though Quick Collect isn’t a scam, it’s possible they’ll still do something that violates your rights under the Fair Debt Collection Practices Act (FDCPA). Your rights (and how you can enforce them) are outlined further down in this article.

VIDEO: Quick Collect in 2 Minutes—Fix Your Credit Report & Know Your Rights

Medical collections vs. non-medical collections

Quick Collect often deals with medical bill collections. Medical and non-medical collections have some key differences in terms of how the debt is handled by debt collection agencies, the credit bureaus, and the main scoring models.

If you see medical debt on your credit report, there are a few implications you should be aware of:

- Your debt is already more than a year old: Medical institutions usually wait 60–120 days before selling your debt to debt collectors. 6 After that, the credit bureaus wait an additional 1 year before adding the collection account to your report to give you time to make arrangements with your insurance company or set up a payment plan.

- Quick Collect might own your debt: Medical institutions don’t generally report to the credit bureaus. For this reason, the fact that your debt is showing up on your credit report may indicate that it was sold to a company that does report to the bureaus, although it’s possible the medical institution simply hired them as well.

- Medical collections aren’t as harmful to your credit: Although medical bills do affect your credit score if they’re sent to collections, in newer credit scoring models developed by FICO and VantageScore (specifically FICO 9 and VantageScore 4.0), medical collections don’t hurt your credit score as much as non-medical collections. 7 8

Why is Quick Collect calling me?

The reason debt collectors call you is that they believe you have an outstanding debt. When Quick Collect calls, ask them to send a written notice detailing the debt they’re collecting, known as a debt validation letter, if they haven’t already.

In accordance with the FDCPA, all debt collectors are required to send this letter within 5 days of first contacting you. 9 It must contain the following information:

- The amount you owe

- Your name

- A statement informing you of your right to dispute the debt within 30 days of receiving their letter

- A statement informing you that if you dispute the debt in writing, they must mail you evidence of the debt within the 30 days

- A statement informing you that within 30 days after you’ve received the letter, you can send them a written request to provide the name and address of the lender or healthcare provider that sold them the debt

Quick Collect representatives will keep trying to contact you unless you either pay the debt or reach an agreement with them.

However, there are restrictions on how they can go about contacting you.

Restrictions on Quick Collect

The FDCPA protects you from debt collector harassment by making it illegal for debt collectors to do any of the following: 9

- Call you multiple times per day

- Call you at night (before 8 am or after 9 pm, your time)

- Call you at work if you tell them you can’t receive calls at work

- Make automated calls or send pre-recorded messages telling you to make payments

- Contact any third party, including your family, friends, or coworkers, to discuss your debt

- Intimidate you or threaten to harm you, sue you, arrest you, or damage your credit

- Lie about your debt and try to collect more than you owe

- Accuse you of breaking the law or claim that not paying might result in jail time (you can’t go to jail over unpaid debt, unless you owe money to the IRS because you intentionally committed tax fraud)

It’s a good idea to familiarize yourself with your rights by reading the FDCPA and Telephone Consumer Protection Act.

Keep records of letters and phone calls

If you think that Quick Collect may be violating your rights, then it’s a good idea to record your phone calls, save any letters they send you, and keep records of when they’ve contacted you. This will make things much easier if you need to take legal action against them in the future.

Can I sue Quick Collect for harassment?

Yes, you can sue Quick Collect for harassment. If you can show that the debt collection company has violated your rights under the FDCPA, then you can collect $1,000 in statutory damages for each violation as well as payment for any damages that you’ve sustained as a result of their violation.9 Quick Collect will also be required to pay your attorney fees and court costs.

How to file a complaint against Quick Collect

If Quick Collect has violated your rights under the FDCPA or done something illegal, then you can report them to the Federal Trade Commission, the Consumer Financial Protection Bureau, or your state attorney general. From there, you’ll be able to find out whether you can also sue Quick Collect.

Another option is filing a complaint on the Better Business Bureau (BBB) website, but this might not have the outcome you’re hoping for.

Bear in mind that the BBB is actually a private organization that has no affiliation with the US government. They’ll forward your complaint to Quick Collect, but there’s no guarantee that the agency will address it in a satisfactory manner.

What’s more, if your dispute is sent to an arbitrator, then you may give up your right to take Quick Collect to court.

How to get Quick Collect off your credit report

If your credit score is suffering as a result of Quick Collect debt, then don’t worry. You can get medical collections removed from your credit report by following these steps:

- Tell Quick Collect to stop calling you

- Ask your insurance provider to cover your debt

- Send a debt verification letter

- Send a credit dispute letter

- Consider paying the debt

- Negotiate a debt settlement and/or “pay for delete”

- Get help from a credit expert

Everyone should follow the first three steps. The ones after that are situational, and you should follow the ones that are appropriate for your circumstances.

Before you do anything else: Ask Quick Collect to stop calling you

It’s important to keep a paper trail of all your communications with Quick Collect, so make sure to only communicate with them in writing. Make sure to date your letters and send them by certified mail. If you’re not sure where to start, then check out the sample letters provided by the CFPB.

If you ask Quick Collect to stop contacting you altogether, then they’re legally obligated to do so. 9 However, ignoring debt collectors can have negative consequences—in the end, you may get sued, and you may even have your wages garnished. It’s smarter to engage with them tactically to ensure you don’t have to pay, or you get the best deal you can.

If you owe medical debt: Ask your insurance provider to cover it

Unlike other types of debt, medical collections are deleted from your credit report if you pay them. If you can get your health insurance company to pay off the debt that Quick Collect is trying to collect, it will immediately be deleted and will stop affecting your credit score.

This will also happen if you pay off your debt yourself. However, that will obviously cost you, so if your insurance won’t cover the debt, you should probably hold off paying until you explore some of the other options below.

If that doesn’t work: Send a debt verification letter

Sending a debt verification letter asking the collection agency to provide evidence of your debt is one of the quickest and easiest ways of getting rid of a debt item in your credit history. It’s also an easy way of figuring out if the debt collector is a scam agency.

When you send a debt verification letter, third-party collectors like Quick Collect are legally required to show evidence that you have an outstanding debt. If they can’t do that, then they have no choice but to delete it from your records. 10

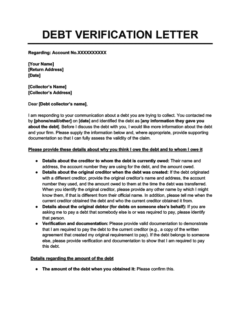

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

Once Quick Collect receives your debt verification letter, they’re also required by law to stop contacting you about your debt until they’ve sent you evidence that you actually owe it. 9

Debt collection agencies sometimes don’t have adequate evidence, whether you owe the listed amount or not. If Quick Collect isn’t able to verify your debt (or if you discover that the debt is more than a few years old), then proceed to the next step.

On the other hand, if it turns out that your debt is both legitimate and recent, then proceed to one of the steps after that, depending on your circumstances.

Don’t confuse debt validation with debt verification

Although the terms are very similar, these are two different things. The debt validation letter is the initial written communication that Quick Collect is legally obligated to send you. You can then reply with a debt verification letter, which requires them to provide evidence of your debt.

If the debt is old or invalid: Send a credit dispute letter to the three credit bureaus

You can write a credit dispute letter to Experian, Equifax, or TransUnion to delete the collection account from your credit report if the debt is an error or it’s past the 7-year credit-reporting limit.

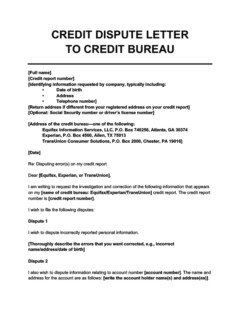

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

When you dispute the item on your credit report, make sure to send along any supporting documentation that you have on hand. Credit bureaus have 30 days to respond to your dispute. If they don’t, then they’re legally obligated to remove the debt item.10

If your debt is invalid or time-barred (meaning it’s passed the statute of limitations on debt in your state), then you can also send Quick Collect a letter telling them to stop contacting you. However, this doesn’t affect the status of your debt, so it’s not a good idea if your debt is still current.

How to tell if your debt is past the statute of limitations

The statute of limitations on most debts is between 3 and 6 years, but this depends on several factors, including the state you live in. The best approach is to check your state attorney general’s website and email their office if the information you’re looking for isn’t available online.

If the debt is recent: Consider paying it

If you still owe the debt and it’s too soon to get it removed from your credit report, you’ll probably have to pay it.

As mentioned, when you pay off a medical debt in collections, it will immediately be removed from your credit report, so this won’t just get the Quick Collect off your back—it will also lead to a complete recovery in your credit score.

If you can’t afford to pay in full: Negotiate for a debt settlement

If your debt is too large to pay off, there’s a chance that Quick Collect will accept less than the full amount you owe (a practice known as debt settlement) in order to minimize their losses. This is more likely the older your debt is, because agencies know that older debts are harder to collect payments for.

Before trying to settle medical collections, you should carefully review your financial situation and come up with a realistic amount to offer. If you want, you can negotiate through a debt settlement agency, but be wary of scammers and avoid companies that charge you large amounts upfront.

Alternatively, you can just speak to someone from Quick Collect over the phone. However, you should make sure to get the agreement in writing before you make any payments.

Bear in mind that debt settlements still hurt your credit score, and like most other negative marks, they’ll remain on your credit report for up to seven years. 11 With that said, lenders will probably look more favorably on a settled debt than a debt in collection.

When you propose a settlement, consider asking for “pay for delete”

You might be able to convince Quick Collect to remove your settled debt from your credit report by sending a pay-for-delete request.

A pay-for-delete letter initiates a negotiation where you agree to pay off your debt, and in return, Quick Collect promises to remove the negative mark on your credit report that’s associated with it.

The first step is to use a pay-for-delete letter template to draft your letter and send it to Quick Collect. It’s very important to get written confirmation that they’ll remove the collection from your credit report once you’re all paid up.

Once you’ve received written confirmation from Quick Collect and paid your debt, you should monitor your credit reports to make sure that they follow through. If the collection account is still on your credit report in a couple of months, then follow up with them and use the letter they sent you to remind them of their obligation.

If you feel overwhelmed: Get help from a credit repair company

If you feel like you might be in over your head, then seek professional assistance from a credit repair expert to remove Quick Collect collection items from your credit report. This can save you time and help you avoid the frustration of trying to remove their negative marks on your own.

Ultimately, most collection accounts will stay on your credit report for 7 years after your first missed payment. Even if you pay off your debt to Quick Collect, it will probably remain on your credit report unless you can persuade the collection agency to remove it.

Learn more about Quick Collect’s impact on your credit score:

- Does paying off collections improve your credit score?

- How many points will my credit score increase after I pay off collections?

- How to rebuild your credit after having a debt sent to collections

Takeaway: Quick Collect is a legitimate debt collection agency

- Quick Collect is a medical debt collection agency, which means they buy debts that medical institutions have charged off.

- Quick Collect isn’t a scam, but you should make sure to avoid scammers by verifying your debts and only making payments once you’re sure they’re legitimate.

- You have rights under the Fair Debt Collection Practices Act that prohibit debt collectors from harassing you. You can sue for harassment, and you won’t need to pay the legal fees if you win.

- There are several ways of removing Quick Collect debt from your credit report, but if these approaches fail, then you should consider seeking advice from a credit repair professional.