Are you wondering how to fend off communications from CBE Group about a debt that you think isn’t legitimate? Well, even if it is a legitimate debt, it’s your right under federal law to ask questions about it that this collection company must answer (and best of all, stop contacting you while they work on a reply!)

Those questions should be sent in the form of a letter, which we provide below as a downloadable template. With good fortune, you may be able to eliminate the debt entirely.

Table of Contents

What is CBE Group?

Founded in 1933 and incorporated in 1985, CBE Group is one of the biggest debt collection agencies in the United States.12 They collect for the government and for businesses in various industries.

CBE Group currently provides the following services:

- Insurance follow-up

- Primary, secondary, and tertiary bad-debt collection

- Default aversion

- Early-out self-pay recovery

- Payment monitoring

- Pre-charge off

- Litigation support

- Pre-disconnect

What is CBE Group inc-former?

“CBE Group inc-former” is one way that CBE Group can appear on your credit report. You might also find debt items from CBE Group listed on your credit report under the following names:

- The CBE Group inc former

- CBE Group Verizon

- CBE collections

Who does CBE Group collect for?

CBE Group collects debts on behalf of the government and companies in various industries, including healthcare, telecommunication, higher education, utility, and retail credit card companies.

CBE Group collects the following types of debt:

- Credit card debt

- Medical bills

- Utility bills (phone, cable, etc.)

- Federal loans

- Student loans

- Tax and other government-related debt

CBE Group and the IRS

CBE Group is one of three companies that have partnered with the Internal Revenue Service (IRS) to collect overdue tax payments from US taxpayers.3 Other companies sometimes falsely claim to be working with the IRS, so you should be on the lookout for scammers.

The following companies are the only private collection agencies currently under contract with the IRS:

- CBE Group

- ConServe

- Coast Professional, Inc.

Although one of CBE Group’s representatives will contact you for debt collection, you should always make your payment directly to the IRS, either electronically or with a check made out to the US Treasury.

Do not make any payments to a non-IRS account. Anyone asking for payment over the phone or requesting that you send money anywhere but directly to the IRS is a scammer.

To verify that your debts are real and that CBE Group is reporting the correct amount, check your records on the IRS website.

Note: Even if CBE Group is collecting taxes that you legitimately owe, your unpaid taxes won’t affect your credit score (unlike other debts that you might owe CBE Group).

CBE Group and the US Department of Education

CBE Group has also established a partnership with the US Department of Education to collect overdue payments for student loans.4 In addition, they collect debt on behalf of universities and colleges.

Student loan debt is one of the most common forms of debt in the US, and it’s many people’s introduction to the world of debt collection. If you’re a student who owes money for a student loan, you have certain rights under the Fair Debt Collection Practices Act (FDCPA) that limit what CBE Group is allowed to do when they try to collect from you.

We cover the restrictions that the FDCPA places on CBE Group in more detail further down in this article.

Is CBE Group a scam?

No, CBE Group isn’t a scam. Because debt collection scams are fairly common, it’s natural to get suspicious and start reading up on CBE lies or scams when they contact you. However, the truth is that CBE Group is a legitimate company that was accredited by the Better Business Bureau in 1992.2

However, you should always be wary of scammers pretending to be collectors from CBE Group. If you’ve been contacted by someone who says that they’re a CBE representative, visit paycbegroup.com to verify that you actually owe the debts they say you do.

How to pay CBE Group (and if you should)

You should only pay a collection agency like CBE Group if you’re certain the debt is yours and you owe it. We highly recommend going through our tips below to determine if you owe the debt, and how to fight it.

If you do owe the debt and wish to begin making repayments, CBE Group’s contact details are below. You’ll need to access CBE Group’s website and go through their account portal to begin.

CBE Group Contact Information

If you want to remove CBE Group from your credit report, write to their address:

Address: PO Box 900

Waterloo, IA 50704

Phone Number: (800) 925-6686

Website: www.cbecompanies.com

Disputing an incorrect entry on your credit report can be stressful and difficult. Consider working with a professional.

If you’re struggling financially and can’t afford to pay this debt collector, you can:

VIDEO: CBE Group in 2 Minutes—Fix Your Credit Report & Know Your Rights

How to stop CBE Group from calling you

CBE Group will call, email, or mail you if they believe you have an unsettled debt. The reason debt collectors like these are calling you is simple—they want to pressure you into paying up.

Unfortunately, CBE Group representatives will keep trying to contact you unless you pay the debt, prove that it doesn’t belong to you, or reach an agreement with them (or with your original creditor). The best way to stop contact from CBE Group is to force them to verify you owe the debt.

How to verify you actually owe CBE Group

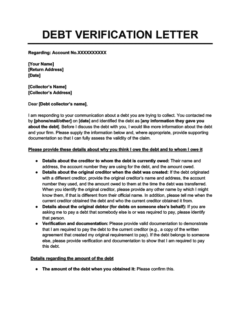

A debt verification letter is a formal request that obligates a debt collector to provide further evidence of a debt. You must send it within 30 days of them first contacting you. Note that CBE Group should have sent you a debt validation letter proving you owe the debt first, as it’s required by law.

Debt Verification Letter

Use this debt verification letter template if CBE Group has contacted you about a debt and you want to dispute it. If you send this within 30 days, they're legally obligated to respond with evidence of the debt and can't contact you until they do.

How to remove CBE Group from your credit report

Collections on your credit report hurt your credit score. You can try the following strategies to remove CBE Group from your credit report:

1. Dispute the debt with all three credit bureaus

If you think that the debt associated with CBE Group on your credit report is illegitimate (e.g., if you paid it on time or it belongs to somebody else), dispute the item on your credit report.

Credit Dispute Letter

If CBE Group is on your credit report by mistake, the credit bureaus have to remove it from your report. Use this credit dispute letter template to file a dispute about CBE Group directly with any of the credit bureaus.

2. Negotiate with CBE Group

Unfortunately, if the debt is legitimate and it’s less than 7 years old, removing CBE Group from your credit report will be very difficult (although not impossible), and you may need to pay up.

If you decide to pay, there are two negotiation strategies you can try as a last-ditch attempt to remove CBE Group from your credit report:

Negotiate Pay for Delete with CBE Group

You might be able to convince CBE Group to remove the negative mark in exchange for paying off the debt with this pay-for-delete letter.

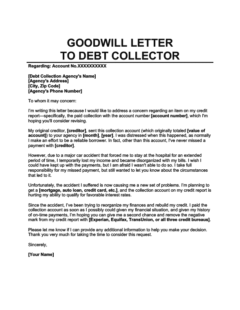

Negotiate a Goodwill Deletion with CBE Group

If you've paid off your debt, send CBE Group a goodwill letter with this template asking them to remove the mark from your credit report as an act of kindness.

3. Wait 7 years for CBE Group to fall off of your credit report

Unfortunately, most collection accounts will stay on your credit report for 7 years after your first missed payment. Even if you pay off your debt to CBE Group, it will remain on your credit report.

What to do if CBE Group harasses you

Unless you tell them not to, CBE Group will keep contacting you until you pay off or settle your debt. However, there are restrictions on how they can go about doing this.

Restrictions on CBE Group

- CBE Group must adhere to the regulations specified in the Fair Debt Collection Practices Act, which bars them from behavior like lying to you or calling you incessantly or at unreasonable hours.

- CBE Group representatives also need to follow the rules set out in the Telephone Consumer Protection Act. It’s a good idea to familiarize yourself with these laws so that you can take action against CBE Group if they do something illegal.

If you believe CBE Group is violating your rights, keep a paper trail. You can:

- Sue CBE Group for harassment and can collect $1,000 in statutory damages for each violation as well as payment for any damages that you’ve sustained as a result of their violation. CBE Group will also have to pay your attorney fees and court costs.

- Report them to the Federal Trade Commission, the Consumer Financial Protection Bureau, or your state attorney general.