Even if you’ve never heard of Ascendium Education Solutions before, you could find yourself in a scary situation where they’re contacting you repeatedly and asking you to pay a debt.

Thankfully, there are steps you can take to get Ascendium to stop calling you and stop damaging your credit. Below you’ll find everything you need to know about Ascendium and your options.

Table of Contents

What is Ascendium?

Ascendium Education Solutions, Inc. is a federal student loan guarantor and the sole subsidiary of Ascendium Education Group. They’re the designated student loan guarantor for Arkansas, Iowa, Minnesota, Montana, North Dakota, Ohio, Puerto Rico, South Dakota, the Virgin Islands, and Wisconsin.

The company was founded in 1967 and is currently based in Madison, WI, although it hasn’t always gone by the name Ascendium. In 2018, Ascendium Education Group was introduced as the new name for the student loan guarantor Great Lakes Higher Education Corporation. 1

Is Ascendium a debt collector?

Ascendium may or may not be considered a debt collector. Ascendium is a loan guarantor, and some courts have ruled that they’re not necessarily required to abide by debt collection laws like the Fair Debt Collection Practices Act (FDCPA). 2

With that said, Ascendium Education Solutions may contact you about missing payments if you have a loan they manage that’s gone into delinquency or default, and they do perform student loan collections on behalf of the federal government.

Is Ascendium a scam or a legitimate company?

Ascendium is a legitimate company that’s entrusted by the US federal government to manage student loan accounts. They hold a membership with ACA International, and they’re accredited by the Better Business Bureau (BBB). 3 4

However, scammers may impersonate Ascendium, so you should always verify the identity of anyone asking you to pay a debt. You can do so by contacting Ascendium Education Solutions directly using the contact information below.

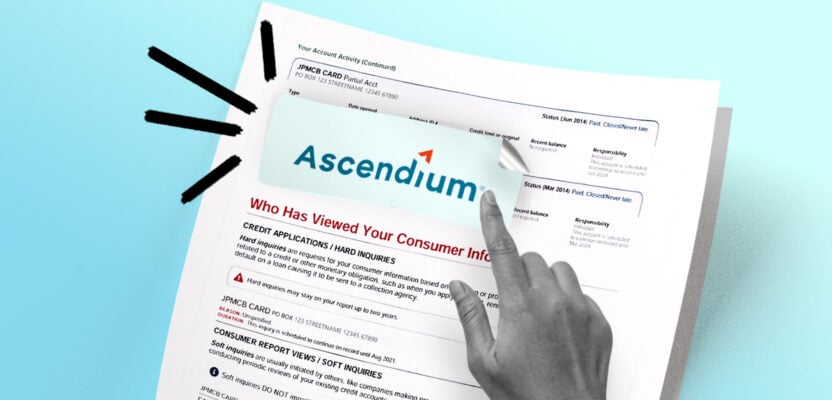

How to stop Ascendium from hurting your credit

If you see a derogatory mark on your credit report from American Web Loan or an account that doesn’t belong to you, you should take steps to stop them from hurting your credit.

Begin by disputing the item on your credit report, which you can do by sending a letter to the relevant credit bureau:

Getting your student loans out of collections

If you have student loans in collections, then you can get them current again through one of the post-default repayment programs available for government loan borrowers:

- Student loan rehabilitation: A special payment plan that removes default marks from your credit report. 5 You just need to make nine consecutive monthly payments within 20 days of the due date over the course of 10 months.

- Student loan consolidation: A program that combines multiple loans into a single Direct Consolidation Loan. With debt consolidation, all of your loans are merged into a single loan with a fixed interest rate and repayment schedule.

Remember that if you’re struggling to make your loan payments to Ascendium, they may offer hardship assistance, and there are plenty of resources available online to help you get out of debt and rebuild your credit after collections.