It’s logical to assume that 0 would be the lowest credit score, but that’s not the case. Most of the widely used credit scoring models have a score range of 300 to 850, which means 300 is the worst credit score you can have.

In reality, most people fall somewhere in the middle, and very few people actually have a credit score as low as 300.

Table of Contents

Can you have a credit score of 0?

No, you can’t have a credit score of 0, no matter how terrible your credit is. As we’ve said, the two major credit scoring companies, FICO and VantageScore, use a credit score range of 300 to 850.

Higher credit scores are better, whereas lower scores can make it difficult to qualify for loans, credit cards, and even services like insurance and utilities.

What is a low FICO score?

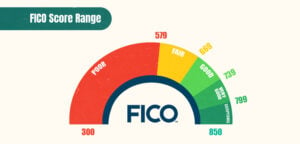

FICO scores that are below 580 are considered low. As you can see in the image below, the lowest credit score range for FICO is from 300 to 579:

What is a low VantageScore credit score?

The lowest credit score range for VantageScore is from 300 to 499:

What causes a very low credit score?

Your credit score is a reflection of your personal credit history, so if yours is low, it suggests you’ve had trouble managing credit in the past.

Here are four of the most common reasons why you might have a bad credit score:

- You have a short credit history: Young adults usually have lower credit scores because they’re just starting out. The length of your credit history contributes to your credit score, and your score might be less than stellar if your credit accounts haven’t gotten the chance to age yet. That said, this effect isn’t major enough to cause your score to drop anywhere near the lowest score of 300—if yours is that low, there are other factors in play.

- You have late payments: Paying your debts on time is crucial because your payment history is the largest factor determining your score, and a single late payment can do a lot of damage to your credit. To avoid accidentally missing a payment, consider setting up autopay or payment reminders.

- You’re using too much credit: Your credit score is also influenced by how much you’re spending on your revolving credit accounts (which are credit accounts that you pay on a monthly basis, like credit cards). The amount that you’re spending is known as your credit utilization rate or debt-to-credit ratio. Try to keep your credit utilization rate as low as possible—at least below 30%, and below 10% if you can.

- You have other negative items on your credit report: In addition to late payments, marks like charge-offs, collection accounts, foreclosures, repossessions, and bankruptcies are also very damaging to your credit score. If your score is anywhere near the lowest possible score of 300, then you probably have several of these on your report.

Disadvantages of having a low credit score

It’s no secret that a low credit score can be an obstacle to healthy finances. Specifically, bad credit can damage your quality of life by making it hard (and more expensive) to access the following essentials.

1. Loans and credit cards

Lenders usually run a credit check when you apply for a new credit account, and they may reject your application or give you a higher interest rate and less favorable terms if you have poor credit.

You may have difficulty getting the following types of credit:

- Credit cards

- Auto loans

- Mortgages

- Personal loans

- Personal lines of credit

- Private student loans

What is the minimum credit score required to get credit?

Lenders set their own credit score requirements, so there’s no universal threshold at which point your credit score is too bad to get new credit.

For instance, there’s no minimum credit score required for a car loan or minimum score required for a mortgage. However, you’ll find it very hard to find a willing lender if your credit score is approaching the lowest score possible.

What’s more, if you do qualify for a loan, chances are the interest rate will be so high that it won’t be worth it. Here’s a look at the benefits of good credit when it comes to loan and credit card interest rates.

Average Loan Rates and APRs by Credit Score Tier

| Credit Score Tier | Avg. Credit Card APR (CFPB) | Avg. Auto Loan Rate (Experian) |

|---|---|---|

| Deep subprime (300-499) | 23.9% | 14.39% |

| Subprime (500-600) | 23.3% | 11.92% |

| Near prime (601-660) | 22.6% | 7.65% |

| Prime (661-780) | 21.0% | 4.68% |

| Super prime (781-850) | 17.5% | 3.65% |

As you can see, borrowers with bad credit scores usually get significantly higher interest rates, which might mean spending thousands of dollars more over the lifetime of a single loan.

2. Insurance

Insurance companies often run credit checks when deciding what to charge you for an insurance policy. They may look at a low credit score as a sign that you’re a high-risk customer and give you a high insurance premium.

This is true for various types of insurance, including life insurance, car insurance, and home insurance. 1

It’s worth noting, however, that the score you’re seeing may be different from what insurance companies will see because they often look at special “credit-based insurance scores,” which are a little different from standard consumer credit scores. A consumer credit score of 300 doesn’t necessarily translate to an insurance credit score of 300.

3. An apartment

Some landlords run credit checks on prospective tenants before agreeing to rent to them. Although there’s no universal minimum credit score required to rent an apartment, many landlords look for a score of at least 640. Very few landlords who run credit checks will rent to someone with a score that’s approaching 300.

If you don’t meet your landlord’s credit score requirements, you might still be able to rent from them by finding a co-applicant or by paying a larger security deposit.

4. A job or promotion

A 2018 report revealed that nearly one-third of employers conduct credit checks on some of their candidates. 2 This is particularly common for financial positions.

Thankfully, unlike lenders, potential (and current) employers can’t see your credit score when they run a credit check on you. 3

However, they’ll see the information on your credit report, including your credit history, personal information, account records, credit inquiries, and public records. If you have a very low score, they’ll probably still be able to tell. 4

What are your credit options with the lowest credit score possible?

If you have a credit score of 300, it will be extremely difficult to qualify for any new credit accounts at all. As you know, most lenders will check your credit when you submit an application for an account, and very few lenders will approve your application with such a low score.

If you do qualify for a credit account (whether it’s a loan or a credit card), your terms will probably be so unfavorable that you’d be better off waiting to apply until your score is better.

However, there is one exception: credit cards that don’t perform a credit check. If you apply for one of these cards, your potential lender won’t check your credit, so they never have to know about your score at all.

All no-credit-check cards are secured, which means you’ll have to pay a security deposit when you open them. However, once you receive your card, you can use it to improve your credit score, and once you’ve proven you’re a responsible borrower, your issuer may let you upgrade to a normal credit card, at which point they’ll refund your deposit.

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Guaranteed Approval | 300–669 | $35 | |||

| Low APR | 300–669 | $49 | |||

| Low Deposit | 300–669 | $0 | |||

| Secured | 300–669 | $0 | |||

| Building Credit | 300–669 | $25 | |||

Takeaway: The lowest possible credit score you can have is 300.

- Standard credit scores range from 300 to 850. It’s impossible to have a credit score outside that range.

- The national average credit score in 2021 was 716 for FICO and 694 for VantageScore.

- A low credit score is caused by negative information in your credit report, such as late payments or collection accounts, excessive spending on credit cards, or bankruptcy.

- Poor credit may prevent you from getting loans, insurance, a rental, or even a job.

- Even if you have the lowest credit score possible, you can rebuild your credit by adopting good financial habits and educating yourself about how credit works.