There’s no denying the massive role that your credit score plays in your life. In addition to determining your eligibility for credit cards and loans, this three-digit number affects your interest rates and even what apartments you can get.

Whether you’ve just checked your score for the first time or you’re trying to improve your credit score in preparation for an upcoming loan application, understanding how your score is calculated will make it easier to manage your credit and finances.

Table of Contents

The 5 factors that make up your credit score

Both of the major credit scoring companies (FICO and VantageScore) take five factors into consideration when calculating your credit score:

- Payment history: Whether you’ve historically paid your bills on time or whether you have a lot of missed or late payments.

- Credit utilization: The amount of your available credit that you’re using.

- New credit: Whether you’ve applied for or opened new credit accounts lately.

- Length of credit history: The amount of time you’ve been using credit and the average age of your credit accounts.

- Credit mix: The variety of the types of credit accounts that you have.

There are several differences between FICO and VantageScore when it comes to how they name and categorize these factors, but all of their credit scoring models still look at basically the same data.

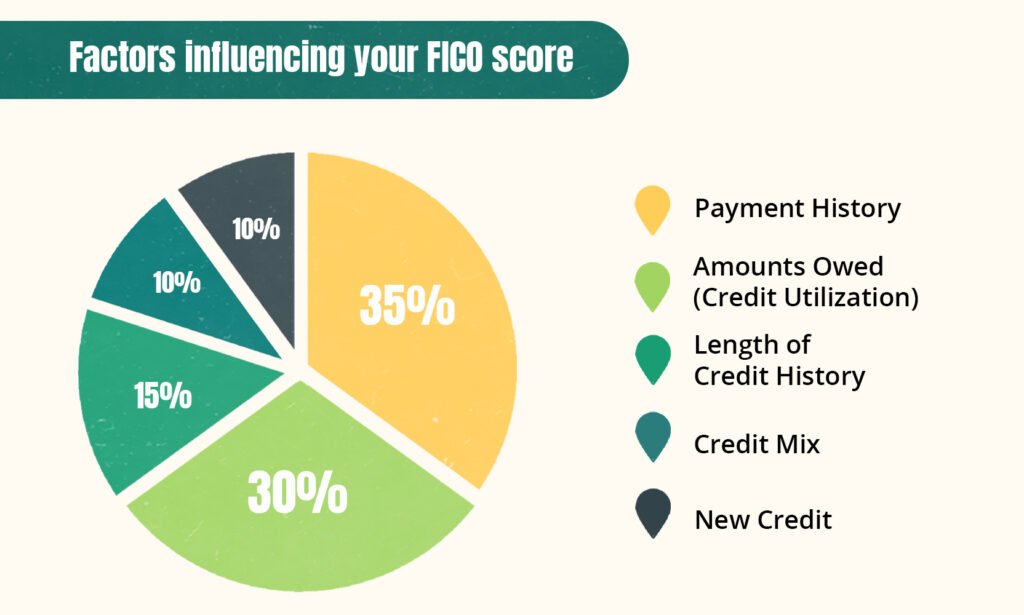

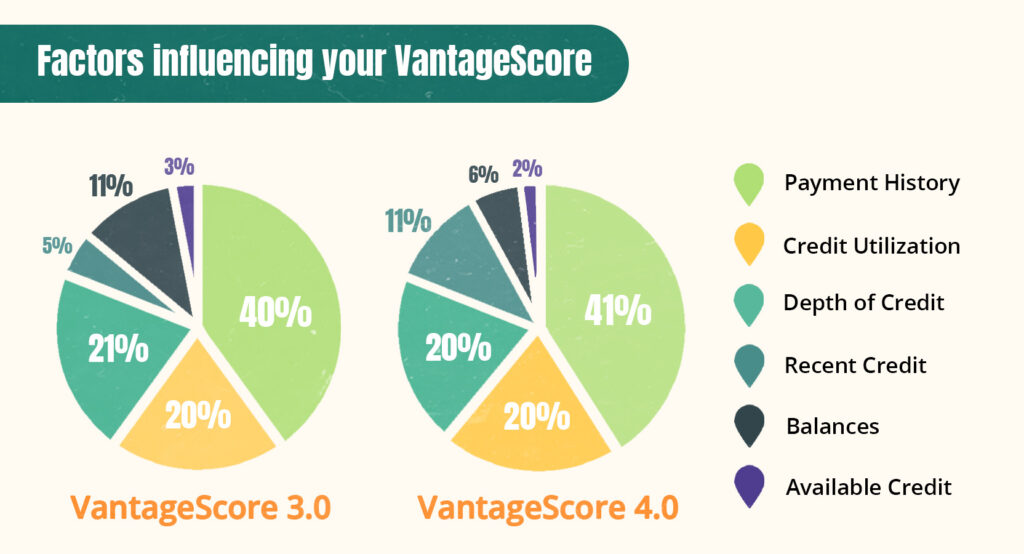

The graphs below show how much each factor counts in the major credit scoring models.

FICO Credit Score Breakdown

VantageScore Credit Score Breakdown

Significantly more lenders use FICO’s model for credit checks than VantageScore’s, so throughout the rest of the article, we’ll mainly focus on FICO’s scoring factors. However, we’ll discuss VantageScore when it differs from FICO in a notable way.

Breaking down the 5 credit scoring factors

We’ll take a closer look at what the 5 credit scoring factors mean and how they’re used to assess your creditworthiness.

1. Payment history

Your payment history is a track record of how consistently you’ve repaid your creditors the money you’ve borrowed. Since it’s the strongest predictor of how likely you are to repay your debts in the future, it’s the most important factor influencing your credit score.

Missing even one payment on one of your credit accounts can cause a substantial drop in your credit score and lead to stains on your credit report, such as:

- Late payments

- Charge-offs

- Collections

- Repossessions

- Foreclosures

It’s not just credit accounts that can influence your payment history. Other overdue bills (such as rent, taxes, and hospital bills) can also be sent to debt collectors and damage your credit.

2. Credit utilization

Your credit utilization rate (also known as your debt-to-credit ratio) reflects how much credit you’re using. In general, using less credit looks better to lenders because it suggests you’re financially stable.

The credit scoring models look at your credit utilization slightly differently.

How FICO calculates your credit utilization

The Amounts Owed category of FICO’s model looks at the following factors: 1

- How much of your credit limit you’re using across your revolving credit accounts (aka your credit cards)

- Amount of debt you owe on each individual account

- Number of accounts with outstanding debt

- Percentage of revolving credit accounts that you’re using

- Percentage of debt still owed on installment loans (i.e., mortgages)

How VantageScore calculates your credit utilization

VantageScore’s models, on the other hand, split up the same information into three categories (Credit Utilization, Balances, and Available Credit).

3. Length of credit history

The length of your credit history represents your credit age, or the amount of time you’ve been using credit. A longer credit history will get you a better credit score because it shows that you can manage debt over long periods.

FICO assesses the length of your credit history based on the following factors: 3

- The age of your oldest account

- The age of your newest account

- The average age of all your accounts

- How long each specific credit account has been open

- How long it’s been since you used each individual credit account

Every credit account you open will hurt your credit score in the short term by lowering the average age of your credit accounts. For this reason, it’s best to open new lines of credit as early in life as possible.

Credit age is one of the less influential factors contributing to your credit score. Although it’s treated as its own category in FICO’s models, it’s combined with credit mix in the VantageScore models to form the Depth of Credit category.

4. Credit mix

Credit mix represents how diverse your credit report is in terms of the types of credit you have. Having more than one type of credit is good for your credit score because it shows that you can successfully manage different kinds of debt.

Below are the three main types of credit:

- Installment loans: Most loans that you receive all at once and pay back over time, such as auto loans, mortgages, and student loans

- Revolving credit: Credit cards, retail store cards, and home equity lines of credit (HELOCs)

- Open accounts: Charge cards, utilities, and other services (e.g., internet, cable, and cell phone plans)

To get a good credit mix, maintain several credit cards and at least one installment loan. Some credit scoring models may further distinguish between different types of loans, such as by sorting mortgages and personal loans, but realistically, this isn’t something most people should worry about.

Most open credit accounts (e.g., utilities) don’t appear on your credit report unless you don’t pay them and they’re sent to collections, so they don’t affect your credit mix and aren’t relevant to this factor.

5. New credit

Credit scoring models take into account your search for new credit because applying for new accounts could be a sign that you’re financially unstable.

However, there are also plenty of innocuous reasons that people look for credit, so the New Credit and Recent Credit categories in the FICO and VantageScore models have a relatively small impact on your score.

This factor takes into account the following:

- The number of credit accounts you’ve recently opened

- How long it’s been since you opened your newest credit account

- How many hard inquiries (or hard pulls) you have from getting your credit checked

Overall, you don’t need to worry about this factor too much, unless you apply for new credit much more often than most people. There’s no clear point at which you’ll have too many hard inquiries—just limit yourself to applying for credit when you actually need it. Don’t apply for store cards just because you can.

Regardless of what you do, hard inquiries can only affect your credit score for up to 12 months. 4 What’s more, scoring models often won’t penalize you for submitting multiple credit applications if you’re rate shopping, as long as they’re triggered within a certain time frame (14 days or 45 days, depending on the model). 5

There are several ways to find out your FICO score for free

You might find your credit score provided with your credit card or loan billing statements since many creditors give customers free access to their credit scores. You can also find out your FICO score by paying for a credit-monitoring service or booking a consultation with a non-profit credit counseling agency.

What information goes into calculating your credit score?

Your credit score is determined using the information shown on your credit reports. This information can be either positive or negative, and it’ll affect your credit score accordingly.

Most of the information you have on your credit reports relates to your credit accounts. If you have an account that’s in good standing (meaning it’s fully paid up), it will contribute positively to your score, whereas accounts that you’ve missed payments on count as “negative marks” and hurt your score.

In addition to information about your credit accounts, certain public records—primarily bankruptcies—can also appear on your credit reports. As you’d expect, bankruptcies have a negative effect on your credit score.

Factoring rent and utility payments into your credit score

You can add alternative data to your credit reports. For example, even though rent and utility bills generally don’t typically appear on your reports, there are services that allow you to add them, such as Experian Boost (which is free) and other paid services like LevelCredit.

Adding your regular payments to your credit report will allow you to build credit by having them factored into your credit score.

Boost your credit for FREE with the bills you're already paying

Boost your credit for FREE with the bills you're already paying

- Experian Credit Report and FICO® Score updated every 30 days on sign in

- Instantly increase your credit scores for FREE with Experian Boost™

- Daily Experian credit monitoring and alerts

Factors that don’t affect your credit score

The following factors never affect your score, either because the models don’t incorporate this information, your credit reports don’t show it, or US law prohibits it from being used for credit scoring purposes (to prevent unfairly rigged credit scores): 6 7

- Race/ethnicity

- Religious views

- Nationality

- Sex

- Age

- Place of residence

- Marital status

- Disabilities

- Political beliefs or affiliations

- Bank balance

- Medical information

- Information about your buying habits or transactional data

- Criminal records

- Education level

Checking your own credit score also doesn’t lower it because it’s considered a soft inquiry. Pre-approved offers from loan and credit card companies are also soft inquiries.

Lenders can still consider information that’s not factored into your credit score

Some types of information aren’t factored into your credit score but can still be considered by lenders during the application review process. For example, prospective lenders may look at your current job, your income, and how long you’ve been doing your current job to determine how likely you are to repay a loan. 8 However, they still can’t consider “protected” classes, such as your race or sex.

What’s considered a good credit score?

What counts as a good credit score depends on who you ask. FICO and VantageScore have their own criteria, and lenders may also set their own standards when you’re applying for a loan or credit card.

The tables below show what each company considers to be a good or excellent credit score.

FICO Credit Scoring Ranges

| Poor | Fair | Good | Very Good | Exceptional |

|---|---|---|---|---|

| 300 to 579 | 580 to 669 | 670 to 739 | 740 to 799 | 800 to 850 |

VantageScore Credit Scoring Ranges

| Very Poor | Poor | Fair | Good | Excellent |

|---|---|---|---|---|

| 300 to 499 | 500 to 600 | 601 to 660 | 661 to 780 | 781 to 850 |

Ultimately, what matters is that you manage your debts responsibly, including:

- Always paying your bills on time

- Only applying for credit when you need it

- Not spending beyond your means

Since your credit score represents your reliability as a borrower, a high credit score will quickly follow.

Takeaway: Your credit score is calculated based on your credit activity and other information in your credit reports.

- FICO and VantageScore calculate your credit score based on five key factors: payment history, credit utilization, length of credit history, new credit, and credit mix.

- Payment history and credit utilization are the main contributors to your credit score, so to increase your score, focus on paying bills on time and spending less on credit cards.

- Credit scores are based only on the information contained in your credit reports. This includes your credit activity, collection accounts, and bankruptcies.

- Your credit score doesn’t take into account certain demographic information, such as your race, skin color, religion, nationality, sex, or marital status.

- You have multiple credit scores because there are multiple credit scoring companies and you have multiple credit reports that may contain different information.