It’s common knowledge that paying your credit card and loan bills can boost your credit score, but what about your utility bill payments?

The bad news is that utilities aren’t treated quite the same way as other payments, and they don’t normally build your credit. The good news is that it’s possible for you to change this. Read on to learn exactly how to use your utility bills to boost your credit.

Table of Contents

Do utility bills show up on your credit reports?

Utility providers don’t usually report your account information to the three credit bureaus (Experian, Equifax, and TransUnion). This means that by default, utility payments aren’t included in the information that shows up on your credit reports, which is why they don’t normally affect your credit score.

However, utility bills are considered a type of alternative credit data. This means that they technically can be included in your credit reports, even though this doesn’t usually happen.

If your utility bills do appear on your credit report, they can be used by lenders to evaluate your creditworthiness, and they can contribute to your FICO and VantageScore credit scores. 1 2

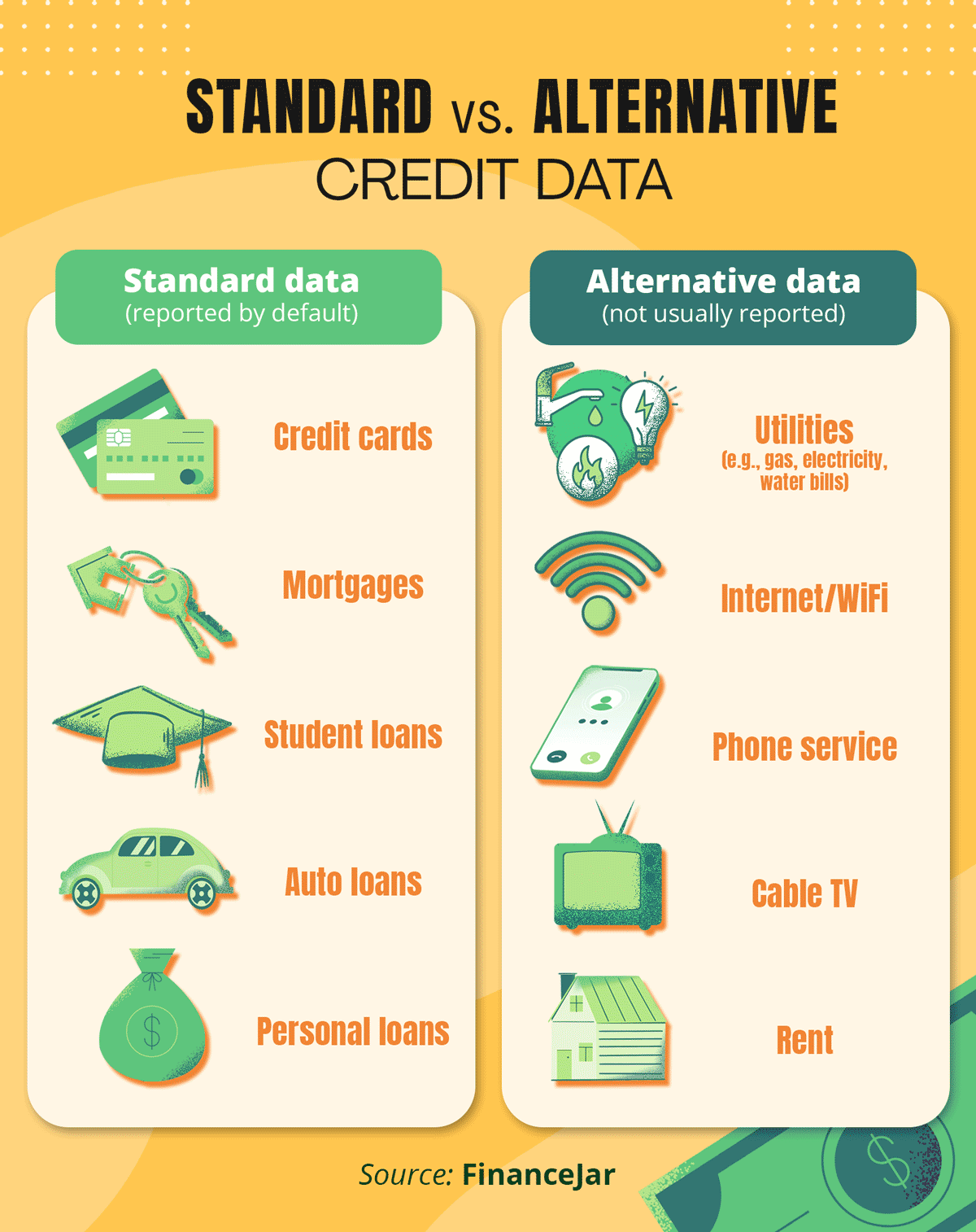

The table below lists several types of alternative data, alongside the standard data that is almost always included on your credit report.

Standard Credit Data vs. Alternative Data

As you can see, loans and credit cards are all added to your credit reports by default. Most of your other regular bills are not.

How utility bills can damage your credit score

Although we’ve said that utility bills (and other bills considered alternative data) don’t normally affect your credit score, this is actually an oversimplification. The truth is that it’s possible for utilities to have a negative effect on your score if you fail to pay them.

If you go long enough without paying your utility provider, they may charge off your debt (formally write it off as a loss) and send it to a debt collector.

Although utility companies don’t generally furnish information to the credit bureaus, debt collection agencies usually do. Once they receive your debt, they’ll probably add a negative mark called a collection account to your credit reports, which can severely damage your credit.

The upshot is that by default, utility bills can hurt your credit if you fail to pay them, but they never help it, even when you pay them on time. This obviously isn’t ideal. However, there are ways you can actually improve your credit score by having your utility payments added to your credit report—you just have to do a little extra work.

How to add utility bills to your credit report

There are four ways you can get your utility payments reported to the credit bureaus:

1. Ask your utility provider to report your payments

Although it’s rare, some utility providers offer credit-reporting services. Try calling a customer service representative on the phone and ask them whether they’re able and willing to start reporting your on-time payments to the credit bureaus.

Make sure to take into account any service fees they charge and which credit bureaus they report to. Some companies only report to one or two credit reporting agencies instead of all three. If your provider reports to TransUnion and Equifax, for instance, but not Experian, then your bills will improve your credit score with the first two bureaus but won’t affect your Experian credit score.

2. Use Experian Boost

An easy way to get credit for paying your utility bills is to self-report your payments by using one of the most popular free credit builder apps—Experian Boost.

Experian Boost is free to use. It allows you to add your phone, cable, internet, and other utility bills to your Experian credit report. You can add up to 24 months of payment history to your account, which can immediately increase your credit score.

Boost your credit for FREE with the bills you're already paying

Boost your credit for FREE with the bills you're already paying

- Experian Credit Report and FICO® Score updated every 30 days on sign in

- Instantly increase your credit scores for FREE with Experian Boost™

- Daily Experian credit monitoring and alerts

How to use Experian Boost to report your utilities

To use this service, you first connect your bank account to Experian Boost, and the app will automatically search for qualifying bill payments to add to your credit file.

Experian Boost ignores late payments, so you don’t have to worry about negative information being added to your credit report. You can also change your mind at any time and remove any payments that you’ve decided you don’t want on your report. 3

However, bear in mind that Experian Boost will only add your utility payments to your Experian credit report and not your Equifax or TransUnion credit reports.

3. Sign up for a paid bill-reporting service

If you want your utility bills to contribute to more than just your Experian credit score, then you can sign up for a paid bill-reporting service that reports your payments to TransUnion and/or Equifax as well.

Here are some companies that add utility bills to your credit reports:

- LevelCredit: Adds rent, cell phone, electric, gas, and water payments to your credit reports. It reports rent payments to all three credit bureaus, but only reports utility payments to TransUnion.

- eCredable: Adds up to eight utility accounts (power, water, gas, waste, mobile phone, cable TV, satellite TV, internet, or landline phone bills) to your TransUnion credit report.

- SimpleBills: Adds various utility bills to your Equifax credit report and combines all of your utility bills so that you only need to make a single payment.

As mentioned, all of these services cost money, but they’re quite affordable. You can usually get your utilities reported for under $10 per month, and sometimes for substantially less than that (eCredable’s cheapest plan costs just under $25 per year, or around $2 per month).

4. Pay your utility bills with a credit card

If you don’t like any of the methods above, you can always just pay your utility bills with a credit card. Credit card companies almost always report to the credit bureaus, so a record of your payments will show up on your credit reports.

Provided that you pay your credit card bills on time every month, you can boost your credit because timely payments benefit your payment history—the most important factor affecting your credit score.

However, make sure to only use a small fraction of your credit limit on the card you use to pay, or else your credit score may suffer. A good rule of thumb is to keep the amount you spent on the card (known as your credit utilization rate or your debt-to-credit ratio) below 30% of your limit, although under 10% is ideal. 4

You should also make sure that your utility provider won’t charge you steep processing fees for paying by credit card. Call them to make sure.

Other ways to build credit without reporting your utility payments

Don’t worry if none of the methods above work for you. There are several other ways to build credit that don’t involve having your utility bills reported to the credit bureaus:

- Become an authorized user: Get someone with good credit to add you as an authorized user on their credit card Being an authorized user can boost your credit score, assuming they use the account responsibly and the credit card company reports authorized users to the credit bureaus.

- Get a credit-builder loan: Unlike a traditional installment loan, you can get a credit-builder loan with no credit or a bad credit score. However, you won’t get access to the funds you borrow until you’ve made all your payments.

- Report your rent payments: In addition to getting credit for your utility bill payments, you can get credit for your rent payments. Ask your landlord to report them or sign up for a rent-reporting service like Rental Kharma, PayYourRent, or RentReporters.

- Get a secured credit card: Secured cards are credit cards that require a security deposit, which means they don’t require good credit. Using them allows you to build credit by establishing a strong credit history and increasing your available credit without the risk of spending beyond your means. We’ve listed a few secured credit cards that are suitable for credit-building in the table below.

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Secured Overall | 300–669 | $0 | Cashback Match | ||

| No Credit Check | 300–669 | $35 | |||

| Beginners | 300–669 | $25 | |||

| No Annual Fee | 300–669 | $0 | |||

| Bad Credit | 300–669 | $49 | |||

| Rebuilding Credit | 300–669 | $0 | |||

Regardless of whether you’re trying to start building your credit at 18 or you’re looking for ways to rebuild your credit after a few slip-ups somewhere along the line, there are many ways to build up a strong credit profile.

Make sure to always pay your utilities and other bills on time, be proactive about exploring your options, and you’ll be well on your way.

Takeaway: Paying your utility bills can help you build credit if you get your payments added to your credit reports.

- Utility bill payments aren’t usually reported to the credit bureaus, meaning they won’t automatically appear on your credit reports or contribute to your credit score.

- Not paying utility bills can hurt your credit score if your utility provider sends your account to collections.

- To get utility payments added to your credit report, ask your utility provider to report your payments, sign up for a bill-reporting service, or pay your bills with a credit card.

- Other ways to build credit include becoming an authorized user, getting a credit-builder loan, applying for a secured credit card, or reporting your rental payments.