Most of the time, your relationship with your landlord is fairly simple: you pay your rent, and in return, they let you live on their property. But what happens if you miss a rent payment or bail on your lease without paying all your move-out fees?

If you’ve got an angry landlord chasing you for money, they may threaten to report you to the credit bureaus. Here’s what you need to know about what landlords can and can’t do to impact your credit score and how you can fight back if they try to destroy your credit.

Table of Contents

What rental information can appear on your credit report?

Generally speaking, rental contracts don’t appear on consumer credit reports. That means that your rental payments (and other rent-related expenses) will usually have no effect on your credit score, either positive or negative.

However, this isn’t always true. There are several situations in which rental information can end up on your credit report:

Your landlord reports your payments or you signed up for a rent-reporting service

A small minority of landlords do report rental payments to the credit bureaus. It’s also possible for you to voluntarily sign up for a rent-reporting service because you want to build credit by paying rent.

Only 0.3% of people who live in rental housing actually have a rental tradeline on their credit report, which means if your rent payments are affecting your credit score, the likeliest scenario is that you yourself took steps to add them to your credit report. 1

If you signed up for a rent-reporting service like Rental Kharma, be extra sure to always pay your rent on time so that your payments help your credit score instead of hurting it.

You failed to pay past rent or move-out fees

If you left your last apartment without making sure all your bills and rent were covered, then there’s a chance your landlord will hire a third-party debt collection agency to collect the money you owe. If this happens, a collection account may appear on your credit report.

Collections are incredibly damaging to your credit score, and they can stay in your credit history for 7 years. Thankfully, you can negotiate with debt collectors to remove collections from your credit report (which we’ll cover in more depth later).

Your landlord checked your credit with a hard inquiry

When you apply to rent a property, the landlord will probably run a credit and background check on you. They’ll do this for reassurance that you’ll be a reliable tenant and pay your rent on time each month. Many landlords even have a minimum credit score required to rent an apartment.

A rental credit check can cause a small drop in your credit score if it’s classed as a hard credit check. However, it’s more common for rental credit checks to be classed as soft credit checks, which don’t affect your credit.

To know for sure whether a tenant credit check will affect your credit score, just ask the landlord or property manager whether they’ll run a hard or soft credit check.

Rental actions that (almost) never affect your credit

Even if you’re in deep trouble financially or you’ve made decisions that go against the terms of your lease, you can have peace of mind knowing that there are several things that won’t impact your credit score.

There’s one exception to that: if they leave you saddled with debts that you fail to pay, those (like past move-out fees, as mentioned above) may be sent to a debt collector, which will hurt your credit.

However, none of the following situations ever directly lead to credit score damage.

Breaking your lease

Contrary to popular belief, breaking your lease won’t hurt your credit. With that said, breaking a lease agreement can have implications like penalty fees, which, again, can hurt your credit if you leave them unpaid and they get sent to collections.

Some rental agreements also specify that after you’ve given notice that you’re moving out, you’re responsible for paying rent for a certain number of months while your landlord finds a new tenant. Through the same mechanism, this could eventually damage your credit if you refuse to pay—i.e., your landlord may get frustrated and send your unpaid debt to a collector.

Paying your rent a few days late

Unless you’re actively having your rent payments reported to the credit bureaus through a rent-reporting service, late rent payments won’t appear on your credit report and won’t affect your credit score.

Here again, months of unpaid rent can transform into credit-destroying collection accounts if you don’t catch up on your payments quickly or work out an agreement with your landlord. However, the act of missing a rental payment won’t directly affect your credit score.

Getting evicted

Eviction records never show up on credit reports. 2 Since the credit score calculation process is based on the information shown on your credit report, this means that evictions won’t hurt your credit score.

With that said, evictions do appear on another type of consumer credit report known as a tenant screening report. We’ll cover these in depth below.

Tenant screening reports: where rental records WILL show up

When you apply for your next rental, the landlord will probably run a background check through a tenant screening company.

Unlike credit reports, which are designed to help lenders predict the risk that you won’t repay a loan, tenant screening reports are designed to help landlords predict the risk that you’ll break your lease or stop paying rent.

What information is included in a tenant screening report?

Tenant credit reports can contain the following information: 3 4

- Credit history

- Court judgments

- Eviction warrants

- Unlawful detainers

- Property damage records

- Employment information

- Criminal history

- Sex offender registries

- Entries on the national terrorist watchlist

- Entries on FBI and police wanted lists

- A risk score or recommendation based on criteria selected by the landlord

In other words, tenant reports include credit information in addition to a variety of other details that aren’t included in regular consumer credit reports. Negative rental items like evictions can stay on your tenant credit report for up to 7 years.5

Landlords must tell you if they reject you based on your tenant report

By law, landlords are required to inform you if the information contained in a consumer credit report or tenant screening report caused them to take “adverse action” against you, such as rejecting your application to rent an apartment or charging you a higher rental deposit. 6

How to fight a landlord who’s threatening to ruin your credit

Whether your landlord is threatening to report you to the credit bureaus or you’re already dealing with damaged credit, there are steps you can take to fight back and set the record straight.

Dispute rental collections on your credit report

You always have the right to dispute information on your credit report free of charge. All you need to do is send a dispute letter to the relevant credit reporting agency.

This is a good way to get mistaken information off your credit reports (e.g., if your history shows an unpaid rental debt that you actually paid on time, or that belongs to someone else with a similar name).

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus (Experian, Equifax, or TransUnion). You can use this to get illegitimate rental collection accounts off your credit report.

It should take the credit bureaus no more than 30–45 days to process your dispute. If they can’t confirm the validity of the collection account you’re disputing, then they’ll have to remove it.

Dispute rental collections

If you feel that your debt was wrongfully sent to collections and you don’t actually owe your landlord any money, then in addition to disputing the collection account on your credit report, you should dispute the collections themselves with the debt collection agency handling the debt.

To do this, find out which debt collection agency you supposedly owe and then send them a debt verification letter asking them to prove that you really owe the debt:

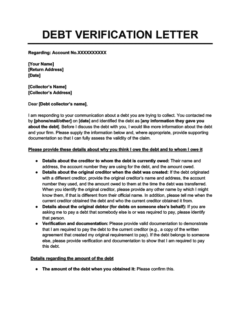

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

In accordance with the Fair Debt Collection Practices Act (FDCPA), the debt collection agency won’t be allowed to contact you for payment until they’ve verified your debt. 7

Dispute an item on your tenant screening report

If you were rejected for an apartment due to a negative rental history or evictions, you can also dispute the negative items on your tenant report. You’ll go through the same process you would to dispute information on your credit report.

Here’s what you need to do:

- Find out which tenant screening company the landlord got your tenant report from

- Request a free copy of your tenant screening report

- Identify the items you want to dispute

- Send a dispute letter and supporting evidence to the tenant screening company

- Wait for a response

If your dispute is unsuccessful, then not all hope is lost. Since you know what information is on your tenant screening report, you’ll have the chance to explain your side of the story to future landlords.

Takeaway: The main way landlords can affect your credit score is by sending unpaid rental debt to collections.

- Rental payments (and late payments) don’t usually appear on credit reports or affect credit scores unless you’re enrolled in a rent-reporting program.

- Rental credit checks may cause a small drop in your credit score if they’re treated as a hard inquiry, but they can also be considered a soft inquiry, which won’t hurt your credit.

- Collection accounts can appear on your credit report and cause a large drop in your credit score if you have a lot of unpaid rent or apartment fees.

- Broken leases and evictions won’t appear on your credit report. However, future landlords may be able see your past rental activity on a tenant screening report.

- If a landlord has taken action against you to hurt your credit, you can fight back by disputing items on your credit report or tenant screening report or disputing collections.