We all have to start somewhere when it comes to credit, but trying to get a credit card or loan can feel like you’re hitting a brick wall if your applications keep getting rejected due to “insufficient credit history.”

Thankfully, having an insufficient credit history isn’t as bad as it seems, and it’s easy to fix. You can still apply for starter loans and credit cards and begin generating a positive credit history that will unlock access to the very best credit options out there.

Table of Contents

What does insufficient credit history mean?

“Insufficient credit history” is a term that lenders use when explaining why they denied you credit. While getting denied a credit card doesn’t hurt your credit score on its own, applying for multiple credit cards does. So it’s important to understand why your application was rejected and how you can amend it.

If you applied for a credit card or loan and your application was rejected for insufficient credit history, it probably means that your credit report has an insufficient number of credit accounts (such as loans or credit cards) or that you haven’t had your accounts for long enough.

The reason lenders care about your credit history is because it’s one of the main tools they have for assessing how likely you are to repay your debts. If your credit reports don’t contain a lot of information about how you’ve handled bills in the past (or don’t contain any information at all), then lenders will have a hard time assessing your risk as a borrower and will be more likely to reject your credit applications.

Why you may be labeled as having insufficient credit history

Generally speaking, if you have an insufficient credit history, then it can mean one of three things: you’re “credit invisible,” you’re “unscorable,” or you simply have a thin credit file. It’s important to make a distinction between these definitions because they have different implications:

- You’re credit invisible: The Consumer Financial Protection Bureau defines credit invisibles as consumers who “do not have a credit history with one of the nationwide credit reporting companies.” 1 In other words, if you’re credit invisible, it means you have no credit reports whatsoever because you have no credit accounts on file with any of the major credit reporting agencies.

- You’re unscorable: Unlike being credit invisible, being unscorable means that you do have a credit report and credit account information on file—it’s just not enough information to generate a credit score. This could be because you don’t have any credit accounts that are at least 6 months old or because no updates have been made to any of your accounts in the past 6 months (FICO’s criteria). 2

- You have a thin credit file: Unlike being credit invisible or unscorable, having a thin credit file means that you do have a credit report containing account information, but the lender reviewing your application considers the number and/or types of credit accounts you have to be insufficient to qualify you for a particular loan or credit account.

According to a 2015 report published by Consumer Financial Protection Bureau (CFPB), the age group with the highest percentage of people who are credit invisible or unscorable is young people aged 18 to 19 years old. 3 This percentage is significantly lower among young adults in their 20s, probably because this is the age at which many people take their first steps toward financial independence.

The following chart from the CFPB illustrates that point clearly:

However, young people aren’t the only ones who struggle with an insufficient credit history. In particular, you may be more likely to be credit invisible or unscorable if you fall into one of the following groups:

- Immigrants (since credit scores vary by country)

- Retirees

- Formerly incarcerated individuals

Is an insufficient credit history the same as bad credit?

If lenders are rejecting your credit applications because of your limited credit history, then it might seem like having no or limited credit is the same thing as having bad credit. Fortunately, this isn’t the case—insufficient credit history and bad credit are two different things.

Think of it this way: your credit report is a track record of how well you manage your debts.

- Having a thin or nonexistent credit file makes it hard for lenders to verify your trustworthiness (meaning you have insufficient credit history).

- Having a long history of negative information, on the other hand, gives lenders firm evidence that you can’t be trusted to repay your debts (meaning you have bad credit).

It’s much better to have an insufficient credit history than a bad credit history—and it’s much easier to fix as well.

What happens if you don’t have enough credit history?

If you have a short or unsatisfactory credit history, four things can happen:

- Your credit applications will get rejected: Lenders check your credit report to assess whether you’re likely to repay your debts. If you have a short credit history, they might not have enough information to make that decision, so they’re more likely to reject your application.

- You’ll pay more interest on loans and credit accounts: Lenders might also offer you higher interest rates if you have a short credit history.

- You’ll struggle to get an apartment, utilities, or insurance: Unfortunately, having limited credit experience can also cause landlords, utility contractors, and insurers to reject your applications. Similarly, landlords will usually check your credit report (and sometimes specify a minimum credit score required to rent an apartment or house).

- You’ll struggle to get a job: Many employers run credit checks when making decisions on who to hire. In particular, if you’re applying for a position with financial responsibilities, then your prospective employer may be reluctant to hire you over someone whose credit report shows that they have extensive experience managing credit accounts.

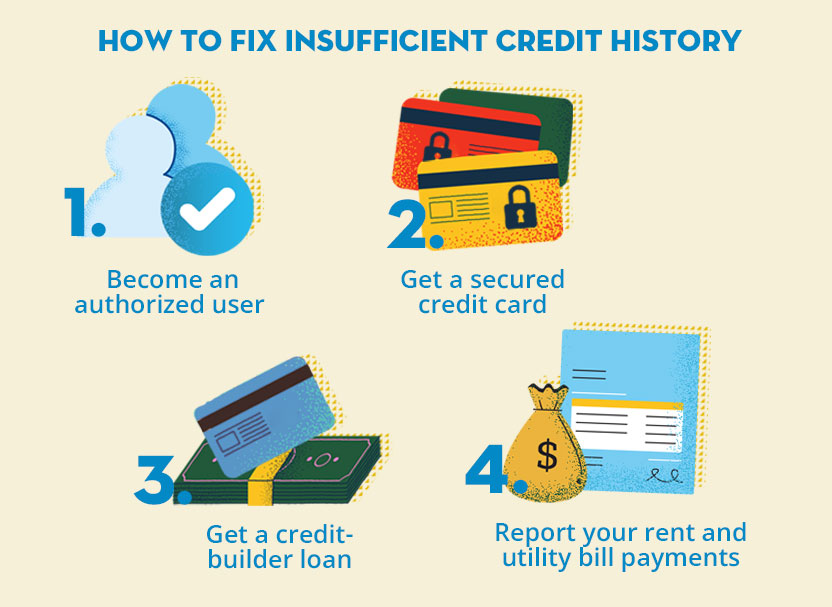

How to fix an insufficient credit history

The only way to fix an insufficient credit history is to add information to your credit reports. There are several ways of doing this—with some, you’ll see immediate improvement, whereas others will require some time and commitment.

1. Open a new credit account

The most straightforward approach to strengthening your credit history is to open a new credit account. This can be either an installment loan (like an auto loan) or revolving credit account (like a credit card account). Although you may have some difficulty finding a creditor who will approve your application, there are several loans and credit cards for no credit borrowers, which we’ll go over in the next section.

2. Become an authorized user

When you become an authorized user on someone else’s credit card (like a family member’s, for instance), the card issuer adds the primary cardholder’s full account history onto your credit report. This approach will give you immediate results. Just make sure to pick someone who’s got a positive payment history and double-check that the card issuer will actually report to the credit bureaus, so being an authorized user can positively affect your credit score.

3. Apply for a credit-builder loan

Many banks and credit unions offer credit-builder loans to people with no credit or limited credit histories.

Unlike a traditional loan, your lender will deposit your credit-builder loan into a savings account, and you won’t be able to access the funds until you’ve paid the loan off (usually after 6 to 24 months). 4

It’s better to choose a loan with a longer term so that it contributes to your payment history for longer. You can usually pay less interest if you pay off most of the debt early and make smaller monthly payments for the rest of the loan’s repayment schedule. This will also benefit your credit utilization rate, further boosting your score.

4. Report your rent and utility bill payments

Lenders aren’t the only ones who can report your bill payments—you can also build credit by paying your rent and utility bills. Try signing up for a bill or rent reporting service to have your payments added to your credit report. Some companies, like Rental Kharma, will even report your past payments for an additional fee.

Alternatively, you can sign up for Experian Boost and have your payments toward utilities and streaming services instantly added to your Experian credit report free of charge. This approach can immediately strengthen your credit history and help you gain some control over the information on your credit reports.

Boost your credit for FREE with the bills you're already paying

Boost your credit for FREE with the bills you're already paying

- Experian Credit Report and FICO® Score updated every 30 days on sign in

- Instantly increase your credit scores for FREE with Experian Boost™

- Daily Experian credit monitoring and alerts

How long will it take to fix an insufficient credit history?

Thankfully, it usually doesn’t take long to fix an insufficient credit history. With the approaches mentioned above, you’ll see results either instantly or after 1–6 months (the amount of time it takes for a new credit account to be added to your credit report and start contributing to your credit score).

With that said, the exact timeline depends on a couple of important factors:

- Lender requirements: Your prospective creditor might have specific requirements regarding the number/type of credit accounts you have or the amount of time you’ve had them, so you may need to wait longer than 6 months or open more accounts to qualify for a particular loan or credit card.

- Which approach you take: As mentioned, if you become an authorized user or self-report past payments you’ve made toward your rent or other bills, then your credit history could immediately go from insufficient to satisfactory. By contrast, approaches that involve opening a new credit account will take longer to contribute to your credit history.

Getting credit cards and loans with an insufficient credit history

It may seem counterintuitive, but the reality is that lenders usually won’t want to give you a credit account unless you already have one. However, this isn’t always the case. While you may not be able to qualify for all the best credit card and loans right away, you do have several option that can get you access to credit right now and help you get on track to establishing a good credit history.

How to get a credit card with insufficient credit history

If your credit history is limited or nonexistent, then don’t worry—you can still get a credit card. While you may find it difficult to find a standard unsecured credit card that you qualify for, these are some good alternatives:

- Secured credit cards: Secured credit cards are designed for people who want to build or repair their credit. A secured card is a type of credit card that requires a security deposit (which also serves as your credit limit). This makes these cards lower risk for card issuers.

- Student credit cards: As the name implies, student credit cards are specially made for students, who often haven’t had the chance yet to establish a good credit history. However, you may need to meet certain income requirements to qualify.

- Retail/store credit cards: Retail credit cards are often easier to get than traditional unsecured credit cards (especially closed-loop store cards, which can only be used with the relevant retailer) because your card issuer stands to benefit more from your purchases. 5

- Cosigned credit cards: These are typical unsecured credit cards, the distinction being that you have a cosigner (or coapplicant), such as a family member or close friend, who uses their good credit to help you qualify. Bear in mind that your cosigner will be responsible for repaying your debt if you stop making payments, so don’t make this decision lightly.

If you have a thin credit file but enough history generate a credit score, then it may be worth looking into credit cards for bad credit. Some companies don’t have any credit score requirements or rely more heavily on non-credit factors, such as income.

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| No Credit Overall | 300–669 | $0 | Cashback Match | ||

| Starters | 300–669 | $49 | |||

| Students | 580–739 | $0 | Cashback match | ||

| No Credit Check | 300–669 | $35 | |||

| No Annual Fee | 300–669 | $0 | |||

| Unsecured (No Deposit) | 300–669 | $75 for the first year ($48 after) | |||

| High Credit Limit | 300–669 | $39 ($0 for the first year if you set up autopay) | |||

| Instant Approval | 300–669 | $75–$99 the first year, then $99 annually | |||

| Beginners | 300–669 | $0 | |||

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Bad Credit Overall | 300–669 | $0 | Cashback Match | ||

| Secured | 300–669 | $0 | |||

| Unsecured (No Deposit) | 300–669 | $0 | |||

| No Interest | 300–669 | $0 | |||

| No Credit Check | 300–669 | $35 | |||

| No Fees | 300–669 | $0 | |||

| High Credit Limit | 300–669 | $39 ($0 for the first year if you set up autopay) | |||

| Rewards | 300–669 | $0 | |||

| Building Credit | 580–739 | $0 | |||

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Secured | 300–669 | $0 | Cashback Match | ||

| Unsecured (No Deposit) | 300–669 | $39 ($0 for the first year if you set up autopay) | |||

| Beginners | 300–669 | $49 | |||

| Students | 580–739 | $0 | Cashback match | ||

| No Annual Fee | 300–669 | $0 | |||

| High Approval Odds | 300–669 | $35 | |||

| Building Credit | 300–669 | $0 | |||

| Credit Card | Best For | Credit Score | Annual Fee | Welcome Bonus | |

|---|---|---|---|---|---|

| Secured Overall | 300–669 | $0 | Cashback Match | ||

| No Credit Check | 300–669 | $35 | |||

| Beginners | 300–669 | $25 | |||

| No Annual Fee | 300–669 | $0 | |||

| Bad Credit | 300–669 | $49 | |||

| Rebuilding Credit | 300–669 | $0 | |||

How to get a loan with insufficient credit history

While there are lenders who offer loans specially designed for people with bad credit (such as bad-credit car loans or bad-credit personal loans), getting a loan with little to no credit history can be trickier. Nevertheless, these are some approaches you can try to boost your chances of success:

- Apply for a secured loan: Secured loans are often easier to get than unsecured loans because they’re backed by some form of collateral that your lender can seize if you stop making payments. You may be able to find no-credit auto loans or secured personal loans that you qualify for.

- Find a cosigner: Lenders will be more willing to issue you a loan if you have a cosigner because your cosigner is agreeing to repay the loan for you if you can’t make your payments. This makes it a good option for getting a car with no credit history. However, carefully weigh up all the pros and cons before getting someone to cosign a loan for you.

- Put down a large deposit: A large deposit can help you get approved for a loan because it’ll mean less risk for your prospective lender. Other evidence that your finances are in order can also help, such as proof of a stable income.

Takeaway: Insufficient credit history means there’s not enough information on your credit report

- To get a credit score, you need an account that’s at least one month old (in the VantageScore models) and six months old (in the FICO models).

- If you have a short credit history, you’re more likely to be rejected for loans, jobs, apartments, utility contracts, and insurance.

- The length of your credit history makes up 15% of your FICO score and a similar percentage of your VantageScore credit score.

- Your credit score usually increases as your accounts age because the scoring models reward consumers with more credit experience.

- To fix a limited credit history, become an authorized user on someone else’s card, get a secured credit card, or take out a credit-builder loan.