If you recently applied for or received an auto loan, that would explain TBOM/TFC being on your credit report. The damage it’s doing to your credit is small (or nonexistent), but it’s still important to double check that it belongs on your credit report.

If it doesn’t, there are ways to get it removed. Here’s what you need to know.

Table of Contents

What is TBOM/TFC on my credit report?

TBOM/TFC stands for The Bank of Missouri/Tidewater Finance Company.

Tidewater Finance is a company that provides indirect consumer and commercial financing for subprime borrowers. They have two branches:

- Tidewater Credit Services: This branch provides retail financing for businesses.

- Tidewater Motor Credit: This branch offers auto financing (i.e., car loans) to consumers in partnership with their network of affiliated dealerships. 1

Since 2018, Tidewater Finance Company has contracted with the Bank of Missouri to issue their loans. 2

If you see TBOM/TFC on your credit report, you probably applied for an auto loan at a dealership partnered with Tidewater Finance Company.

The Bank of Missouri’s other affiliates

If TBOM appears on your credit report but you don’t have an account associated with Tidewater Finance Company, then you may have an account with one of the Bank of Missouri’s other affiliates. The Bank of Missouri issues consumer and commercial loans, as well as co-branded cards for businesses.

The Bank of Missouri Contact Information

If you want to remove TBOM/TFC from your credit report, write to The Bank of Missouri's address:

Address: 18 West Sainte Marie Street, PO Box 309

Perryville, MO 63775

Phone Number: (888) 547-6541

Website: www.bankofmissouri.com

Disputing an incorrect entry on your credit report can be stressful and difficult. Consider working with a professional.

Is TBOM/TFC a scam?

No, seeing TBOM/TFC on your credit report doesn’t mean you’ve been scammed—Tiderwater Finance is a legitimate company. If you see their name, it probably indicates that you have an account with them or they checked your credit.

If you’re certain that there’s activity on your credit report under TBOM/TFC that shouldn’t be there, it’s possible you’ve been the victim of identity theft.

We’ll discuss the reasons (both legitimate and fraudulent) that TBOM/TFC might be on your credit report in more detail in the next section.

Why is TBOM/TFC on my credit report?

TBOM/TFC can appear on your credit report for a number of reasons, some negative and some harmless. Here are the four most common reasons why TBOM/TFC might appear on your credit report:

1. Tiderwater Finance checked your credit

You’ll see TBOM/TFC on your credit report if Tiderwater Finance ran a credit check to determine your eligibility for a car loan. This type of check can appear as a hard inquiry or as a soft inquiry.

- Hard inquiries: These generally appear on your credit report when you apply for new lines of credit, credit cards, store cards, rewards cards, or installment loans. For example, TBOM/TFC will show up on your credit report if you actually applied for a car loan from Tiderwater Finance.

- Soft inquiries: These show up on your credit report when someone checks your credit but you’re not actually looking to open a new account. For example, if Tiderwater Finance prequalified you for an auto loan, then they may have triggered a soft inquiry during the prequalification process.

Thankfully, soft inquiries won’t affect your credit score. Hard inquiries will usually lower your credit score by a few points, but the effect won’t last more than a year, and the inquiry will fall off your credit report entirely after two years. 3 Note that you usually can’t remove a hard inquiry early unless the bureau added it to your report by mistake.

2. You have an auto loan issued by Tiderwater Finance

TBOM/TFC will appear on your credit report if you currently have or previously had an auto loan issued by Tiderwater Finance. This is because lenders usually report your monthly loan payments to at least one of the three major credit bureaus.

Even if you’ve paid off your loan, your account information can stay on your credit report for 7 years (for negative marks like late payments) or 10 years (for accounts in good standing). 4

3. You’re a cosigner on someone else’s auto loan

TBOM/TFC can show up on your credit report if you cosigned an auto loan for someone else, like a spouse, child, or friend. When you cosign a loan, you’re taking responsibility for paying off the loan if the primary borrower stops making payments.

Their payments toward the loan can also affect your credit score, for better or for worse. 5 If the primary borrower responsibly manages their payments, then being their cosigner can improve your credit score by helping you establish a positive payment history. On the other hand, missed payments might cause a drop in your credit score.

4. You’re a victim of identity theft

If you see TBOM/TFC on your credit report but you’re sure you didn’t apply for an auto loan issued by Tiderwater Finance, it could be a sign of identity theft.

If you suspect that someone’s trying to fraudulently open accounts in your name, take these steps:

- Contact Tiderwater Finance and tell them you’ve never applied for or taken out one of their auto loans. Ask them for details about the loan application, such as when it was submitted and under what circumstances the inquiry was authorized.

- Report the identity theft to the Federal Trade Commission (FTC). Go to www.identitytheft.gov and answer the questions to generate an identity theft report and recovery plan.

- Contact any of the three main credit bureaus (Equifax, Experian, or TransUnion) and have a fraud alert placed on your credit report. You only need to contact one of the bureaus; they’ll coordinate with the others, and your fraud alert will be acknowledged by all three. 6

You may also want to freeze your credit (or get a credit lock, which is very similar).

Carefully monitor your credit reports over the next few months for further signs of fraudulent activity.

How does TBOM/TFC affect my credit score?

There are several ways that TBOM/TFC can affect your credit score, depending on whether it’s been reported as an inquiry or an account.

Hard inquiries

As mentioned, a single hard inquiry will have a small, short-term effect on your credit, usually lowering your FICO score by up to five points and your VantageScore credit score by 5–10 points. 7 8

This effect is usually cumulative, so too many hard inquiries can really hurt your score. However, a single inquiry isn’t something to worry about—your credit score ranges from 300 to 850, which means 5 points in either direction isn’t significant.

What’s more, to avoid penalizing consumers for shopping around for the best interest rates on loans, both FICO and VantageScore have a shopping window (14 or 45 days, depending on the model) in which they treat multiple hard inquiries as a single inquiry. 9 10

This means that if you have several TBOM/TFC inquiries on your credit report that were added within a short time frame because you applied for different financing options with Tidewater Finance, your credit score will only drop by the number of points you’d lose for a single hard inquiry.

Open and closed accounts

If you have an auto loan from Tiderwater Finance on your credit report, then it’s contributing to your credit score by influencing the following factors:

To learn how your auto loan will affect your credit score, familiarize yourself with the factors that make up your FICO score and VantageScore.

How to remove TBOM/TFC from my credit report

If you want to delete TBOM/TFC from your credit report, then try one of the following approaches.

1. Send a dispute letter

If you see an item listed under TBOM/TFC on your credit report that you suspect is a mistake, then you can dispute it by sending a dispute letter to Tiderwater Finance and/or the credit bureaus.

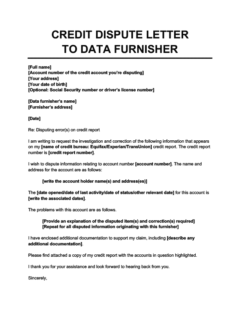

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else. Use this credit dispute letter template to file a dispute with a creditor or debt collector. If you recognize a credit account but it's listed with the wrong balance or incorrect status (e.g., if you settled the debt and it's still listed as unpaid), the error may have originated with your data furnisher.

Credit Dispute Letter to a Credit Bureau

Credit Dispute Letter to a Data Furnisher

Send your letter to Tiderwater Finance if you believe the error originated with them (e.g., they reported a late payment that you actually paid on time). Send it to the credit bureaus if you believe they made the mistake (e.g., they confused you with someone with a similar name or Social Security number).

Either way, it’s usually a good idea to send copies of the letter to both parties (the bureaus and Tiderwater Finance). They may contact each other as they investigate the matter, and it’s important to make sure everybody has received the relevant information.

Once you’ve filed your dispute, the credit bureau will be required to investigate and correct any inaccurate information on your report, usually within 30–45 days. 11

2. Use a credit repair company

A credit repair company will act as a middleman between yourself and whoever you need to communicate with, such as your lender and the credit bureaus. They might be able to get a hard inquiry or other TBOM/TFC item off your credit report by helping you gather evidence and handling all the required communication.

However, be wary of scammers. By law, credit repair companies are not allowed to charge you before they’ve helped you. 12 If they ask for payment upfront, hire a different company.

Although hiring a credit repair company can save you some time and hassle in disputing items on your credit report, bear in mind that they can’t do anything for you that you can’t do yourself.

They also won’t necessarily be able to erase valid negative information or turn a bad credit score into a good credit score overnight. Think carefully before hiring a third-party company to get TBOM/TFC off your credit report.

Takeaway: TBOM/TFC can appear on your credit report as an inquiry or account.

- TBOM/TFC can appear on your credit report as a hard or soft inquiry or as an auto loan, either belonging to you or someone you cosigned a loan for.

- How TBOM/TFC affects your credit score depends on your credit history and the status of the account.

- You can get TBOM/TFC off your credit report by sending a dispute letter to the credit bureaus and/or Tiderwater Finance, or by working with a credit repair company.

- If you think that TBOM/TFC is on your credit report because your identity has been stolen, file a report with the Federal Trade Commission.