Checking your credit report for errors could be a simpler task—after all, seeing a strange abbreviation like TBOM/Fortiva on it doesn’t exactly provide you with much insight.

In fact, all it likely did was make you anxious about whether it’s hurting your credit score. We’ll put you at ease (it doesn’t hurt it by much, if at all), and explain how to get rid of it if it’s there by mistake.

Table of Contents

What is TBOM/Fortiva on my credit report?

TBOM/Fortiva stands for The Bank of Missouri/Fortiva. Fortiva is a financial company that helps consumers with damaged credit get access to loans and credit cards, and they’ve been in partnership with the Bank of Missouri since 2018. 1

Financial technology company Atlanticus Holdings Corporation owns the Fortiva brand, which includes retail and consumer credit cards, but Fortiva credit products are all issued by The Bank of Missouri. 2 3

If you see TBOM/Fortiva on your credit report, you probably applied for or currently have a Fortiva® Credit Card or a personal loan from Fortiva.

The following other names also refer to TBOM/Fortiva:

- Tbom/Atls/Fortiva

- Fortiva/Atlanticus/Tbom

- Tbom/Atls/Fortiva Thd

The Bank of Missouri’s other affiliates

If TBOM appears on your credit report but you don’t have a Fortiva credit account, then you may have an account with another company affiliated with The Bank of Missouri. They issue private label and co-branded credit cards as well as consumer loans to financial services companies.

Here are some other affiliates of The Bank of Missouri:

- SoFi

- Ollo Card Services

- Continental Finance

- Genesis Financial Solutions

- Tidewater Finance Company

- Curae

- Koalafi

The Bank of Missouri Contact Information

If you want to remove TBOM/Fortiva Services from your credit report, write to The Bank of Missouri's address:

Address: 434 State Hwy Y

St. Robert, MO 65584

Phone Number: (888) 547-6541

Website: www.bankofmissouri.com

Disputing an incorrect entry on your credit report can be stressful and difficult. Consider working with a professional.

Is TBOM/Fortiva a scam?

No, TBOM/Fortiva isn’t a scam—Fortiva is a legitimate organization. If their name is on your credit report, it probably indicates that you have an account with them or they checked your credit.

If you’re certain that there’s activity on your credit report under TBOM/Fortiva that shouldn’t be there, it’s possible you’ve been the victim of identity theft.

We’ll discuss the reasons (both legitimate and fraudulent) that TBOM/Fortiva might be on your credit report in more detail in the next section.

Why is TBOM/Fortiva on my credit report?

TBOM/Fortiva can appear on your credit report for a number of reasons, some negative and some harmless. Here are the four most common reasons why TBOM/Fortiva might appear on your credit report:

1. Fortiva checked your credit

You’ll see TBOM/Fortiva on your credit report if Fortiva ran a credit check to determine whether or not to extend you a loan or a line of credit. This type of check can appear as a hard inquiry or as a soft inquiry.

- Hard inquiries: These generally appear on your credit report when you apply for new credit, such as credit cards or installment loans. For example, TBOM/Fortiva will show up on your credit report if you applied for a line of credit from Fortiva.

- Soft inquiries: These show up on your credit report when someone checks your credit but you’re not actually looking to open a new account. For example, if you received an unsolicited offer letter in the mail for a credit card issued by Fortiva, then they may have triggered a soft inquiry during the prequalification process.

Thankfully, soft inquiries don’t affect your credit score. On the other hand, hard inquiries usually lower your credit score by a few points, but the effect won’t last more than a year, and the inquiry will fall off your credit report entirely after two years. Note that you usually can’t remove a hard inquiry early unless the bureau added it to your report by mistake.

2. You have a Fortiva credit account

TBOM/Fortiva will appear on your credit report if you currently have or previously had a Fortiva credit account. Even if you closed your account, TBOM/Fortiva can stay on your credit report for 7 years (if the account was delinquent due to missed payments) or 10 years (if the account was in good standing).

You might find your Fortiva credit account marked as closed even if you never took any active steps to close it. This can happen due to account inactivity—it’s common for lenders to close credit accounts if they haven’t been used for a while.

3. You’re an authorized user on someone else’s Fortiva credit account

TBOM/Fortiva can show up on your credit report if someone else added you as an authorized user to their own Fortiva credit account.

You might have been named as an authorized user by your:

- Spouse

- Child

- Parent

- Friend

- Business partner

If someone designated you as an authorized user on their Fortiva credit card, their activities on the account could affect your credit score.

If the primary cardholder is a responsible person and a reliable borrower, being an authorized user on their account will probably improve your credit score by helping you build a positive payment history. On the other hand, you might see a small drop in your credit score if the primary cardholder neglects their payments or cancels their account with unpaid debt.

Similarly, your use of someone else’s credit will affect their credit score, so take care when acting as an authorized user.

4. You’re a victim of identity theft

If you see a TBOM/Fortiva hard inquiry on your credit report but you’re sure you didn’t apply for a Fortiva credit account, it could be a sign of identity theft.

If you suspect that someone’s trying to fraudulently open accounts in your name, take these steps:

- Contact the company that made the hard inquiry (Fortiva). Tell them you didn’t authorize the inquiry. Ask them for details (i.e., when and under what circumstances their records show the inquiry was authorized).

- Report the identity theft to the Federal Trade Commission (FTC). Go to www.identitytheft.gov and answer the questions to generate an identity theft report and recovery plan.

- Contact any of the three main credit bureaus (Equifax, Experian, or TransUnion) and have a fraud alert placed on your credit report. You only need to contact one of the bureaus; they’ll coordinate with the others, and your fraud alert will be acknowledged by all three.

You may also want to freeze your credit (or get a credit lock, which is very similar).

Carefully monitor your credit reports over the next few months for further signs of fraudulent activity.

How does TBOM/Fortiva affect my credit score?

There are several ways that TBOM/Fortiva can affect your credit score, depending on whether it’s been reported as an inquiry or an account.

Hard inquiries

As mentioned, a single hard inquiry will have a small, short-term effect on your credit, usually lowering your FICO score by up to five points and your VantageScore credit score by 5–10 points.

This effect is usually cumulative, so too many hard inquiries can really hurt your score. However, a single inquiry isn’t something to worry about—your credit score ranges from 300 to 850, which means 5 points in either direction isn’t significant.

Open and closed accounts

If you have an open or closed Fortiva account on your credit report, then it’s contributing to your credit score by influencing the following factors:

If the account is open, then it’s also contributing to your credit utilization rate (also known as your debt-to-credit ratio).

To learn how your Fortiva account will affect your credit score, familiarize yourself with the factors that make up your FICO score and VantageScore.

Don’t rush to close your Fortiva account.

Closing an account can hurt your credit score by reducing your available credit (which will increase your credit utilization rate). Use the account occasionally to prevent your creditor from closing it due to inactivity, and only close it if keeping it open will jeopardize your finances.

How to remove TBOM/Fortiva from my credit report

If you want to delete TBOM/Fortiva from your credit report, then try one of the following approaches.

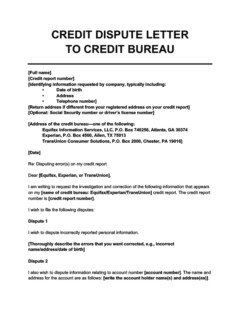

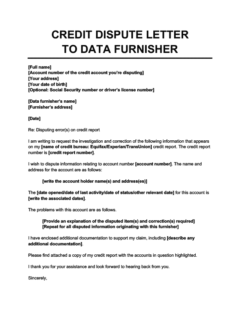

1. Send a dispute letter

If you see an item listed under TBOM/Fortiva on your credit report that you suspect is a mistake, then you can dispute it by sending a dispute letter to Fortiva and/or the credit bureaus.

Send your letter to Fortiva if you believe the error originated with them (e.g., they reported a late payment when you actually paid on time). Send it to the credit bureaus if you believe they made the mistake (e.g., they confused you with someone with a similar name or Social Security number).

Either way, it’s usually a good idea to send copies of the letter to both parties (the bureaus and Fortiva). They may contact each other as they investigate the matter, and it’s important to make sure everybody has received the relevant information.

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else. Use this credit dispute letter template to file a dispute with a creditor or debt collector. If you recognize a credit account but it's listed with the wrong balance or incorrect status (e.g., if you settled the debt and it's still listed as unpaid), the error may have originated with your data furnisher.

Credit Dispute Letter to a Credit Bureau

Credit Dispute Letter to a Data Furnisher

Once you’ve filed your dispute, the credit bureau will be required to investigate and correct any inaccurate information on your report, usually within 30–45 days.

2. Use a credit repair company

A credit repair company will act as a middleman between yourself and your creditors (and the credit bureaus). They might be able to get a hard inquiry or other TBOM/Fortiva item off your credit report by helping you gather evidence and handling all the required communication.

However, be wary of scammers. By law, credit repair companies are not allowed to charge you before they’ve helped you. If they ask for payment upfront, hire a different company.

Although hiring a credit repair company can save you some time and hassle in disputing items on your credit report, bear in mind that they can’t do anything for you that you can’t do yourself.

They also won’t necessarily be able to erase valid negative information or turn a bad credit score into a good credit score overnight. Think carefully before hiring a third-party company to get TBOM/Fortiva off your credit report.

Takeaway: TBOM/Fortiva stands for Fortiva, and it can appear on your credit report as an inquiry or account.

- TBOM/Fortiva can appear on your credit report as a hard or soft inquiry or as an open or closed credit account, either belonging to you or someone who has authorized you to use it.

- How TBOM/Fortiva affects your credit score depends on your credit history and the status of the account.

- You can get TBOM/Fortiva off your credit report by sending a dispute letter to the credit bureaus and/or Fortiva or by working with a credit repair company.

- If you think that TBOM/Fortiva has appeared on your credit report because your identity has been stolen, file a report with the Federal Trade Commission.