Table of Contents

What is pay for delete?

Pay for delete is an offer you make as a debtor to pay off a debt in collection in exchange for getting the collection account removed from your credit report.

Pay for delete can only be used for debts that you haven’t paid yet because it requires an outstanding balance that you can use as leverage. To remove late payments or other negative marks associated with an account you’ve already paid, send a goodwill letter instead.

You can negotiate pay for delete by sending a pay-for-delete letter to either the debt collection agency assigned to your account or to your original creditor, depending on whether your creditor has sold or transferred it to a collection agency yet.

Does pay for delete actually work?

The short answer is that pay-for-delete sometimes works, but you shouldn’t count on it.

Because pay for delete entails removing accurate information (legitimate negative items) from your credit report, it undermines the integrity of credit reporting.

The credit bureaus have taken steps to discourage pay for delete, including emphasizing in their service guidelines that all reported information must be complete and accurate.1 2

This means that many debt collection agencies are reluctant to engage in pay for delete.

With that said, the strategy can still work—it just depends on your circumstances and who you’re negotiating with. Your odds are better if you’re sending a pay-for-delete letter to a debt collection agency (particularly a small agency) rather than your original creditor. This is because pay for delete tends to work best on older debts that you’re less likely to pay otherwise, and those debts are likely to have already been sold to debt collectors.

You’ll also have a better chance if your debt is relatively large because you’ll have more leverage. For obvious reasons, collectors are more interested in having larger debts paid off.

Is pay for delete still worth it?

Yes, for the time being, negotiating pay for delete might still be worth it, although this will change in the future.

Pay for delete is quickly becoming obsolete. VantageScore 3.0 and 4.0 ignore paid collection accounts, and the new FICO 9 model does the same.3 4

In these models, although collection accounts remain on your credit report after you pay them off, doing so is enough to stop them from bringing your score down. Removing them doesn’t benefit your score.

However, not all lenders use these models yet. FICO 8 is still the most widely used scoring model.5 6

This means that negotiating pay for delete may still be worthwhile. There’s also no repercussions if it doesn’t work, which means there’s no harm in trying.

If you’re set on negotiating pay for delete, follow the steps below for the best chance of success.

Consider using pay for delete as part of a debt settlement

If you want to negotiate a debt settlement (where you pay less than the original amount owed), then you can include pay for delete as one of your terms. If collectors have already sent you a settlement offer, you can send a counteroffer agreeing to make the payment if they remove the collection from your records.

How much does pay for delete cost?

The amount that pay for delete costs depends on how large your debt is.

If you offer to pay your debt in full, pay for delete will obviously cost exactly the amount that you owe. On the other hand, if you pursue the debt settlement approach mentioned above, you might be able to pay just a fraction of what you owe. For instance, if your debt in collection is worth $500, you might be able to erase your bad credit for $250 or even less.

How to negotiate pay for delete

To negotiate pay for delete, follow these four steps:

Step 1: Find out who owns your debt

Your first step should be to contact your creditor and find out whether they’ve sold your debt to a collection agency. If they have, then you’ll have to negotiate with your debt collectors instead.

However, if your creditor still owns the debt—for instance, if you’re dealing with the company’s internal collectors or a contingency debt collection agency that they’ve hired to collect it on their behalf—then your original creditor is still the one to speak to about coming up with a repayment plan and removing the debt’s negative marks from your credit report.

Step 2: Send a pay-for-delete letter

Use a pay-for-delete letter template to write your letter and send it to the company that owns your debt.

If you’re sending the letter to your original creditor, then you should explain why you couldn’t make your payments on time, especially if there were circumstances outside your control that led to the delinquent account (like unexpected medical bills or a sudden layoff). If you previously had a strong payment history, point that out too.

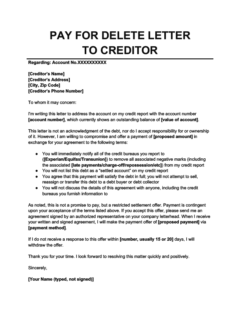

Pay for Delete Letter to Creditor

Use this pay for delete letter template to ask your original creditor to remove another type of negative mark, such as a late payment or a charged-off account that they haven't sold to a debt collector yet. Creditors tend to be less receptive to pay for delete letters than debt collectors.

Pay for Delete Letter to Collector

Use this pay for delete letter template to ask a debt collection agency to remove a collection account from your credit report. Pay for delete works best on old debts in collection, so this is the scenario the strategy is most suited to.

Step 3: Make sure to get the agreement in writing

If you get the debt collection agency or your creditor to agree to your pay-for-delete request, make sure to get their confirmation in writing before you make any payments. If you have a signed contract with them stating that they will remove a negative item from your credit report, it may help later on to ensure that they hold up their end of the bargain.

Step 4: Check your credit reports

The only way to know if pay for delete has worked is to check your credit report after it’s been updated (which usually happens every 30 to 45 days) and make sure the collection account has been removed.7

After that, you should monitor your credit reports because even if your creditor or the debt collection agency removes your collection account, they might later add it back in as a paid collection account (referred to as reinsertion).

If this happens, then you can send the debt collection agency a letter notifying them that they are in breach of their contract with you if they do not permanently remove the collection from your credit report. (If you’re dealing with your original creditor instead of a debt collector, then you might want to take a softer approach to maintain good relations by simply reminding them of their agreement with you.)

Pay for delete exists in somewhat of a legal gray area, so you probably won’t be able to enforce your written agreement in court. However, you can use it to file complaints with organizations like the Federal Trade Commission (FTC), the Better Business Bureau (BBB), and your state’s attorney general, which will put pressure on your debt collector to follow through with the arrangement.

Is pay for delete legal?

Pay for delete isn’t entirely legal—but it isn’t strictly illegal either.

When data furnishers (like creditors and debt collection agencies) report debts and payments to the credit bureaus, they’re required under the Fair Credit Reporting Act (FCRA) to only report complete and accurate information. 8 However, they’re not actually obligated to report debts in the first place—credit reporting has always been voluntary. 9

When a creditor or lender deletes a legitimate debt that they already reported, it’s ambiguous whether that counts as “declining to report a debt” (which is legal) or as “failing to provide complete and accurate information” (which is illegal).

Can you get in trouble for trying pay for delete?

No, you probably won’t face any legal repercussions for sending a pay-for-delete letter or trying to negotiate to have a negative item removed from your credit report.

However, if a debt collector agrees to your pay-for-delete offer, they’re doing so knowing that they may face legal consequences for violating the FCRA and potentially lose their right to access consumer credit records for breaching their terms of service agreements with the credit bureaus.

This means that you’ll probably have difficulty getting debt collectors on board. Moreover, because of the ambiguous legal status of pay for delete, you’ll have trouble enforcing the agreement if they don’t follow through with the deletion after the fact since illegal contracts are not enforceable.

Fortunately, you almost certainly won’t face any legal consequences for trying to negotiate pay for delete. Even though it’s a long shot, there are really no downsides, so it’s still worth trying.

Takeaway: Pay for delete is when you offer payment in exchange for having a collection removed from your credit report.

- You can negotiate pay for delete by sending a pay-for-delete letter to the debt collection agency handling your debt or to your original creditor.

- Pay for delete sometimes works, and your chances are better if you’re negotiating with small debt collection agencies.

- Pay for delete isn’t totally legal because it requires collection agencies or creditors to omit information when reporting to credit bureaus.

- New credit scoring models overlook paid collection accounts, so pay for delete may not be worthwhile because you can simply pay off the debt to stop it from hurting your credit score.

- Paid collections will stay on your credit report for seven years unless they’re disputed, but their effect on your credit score will diminish over time.