If you’ve discovered that you have bad credit, it’s understandable that you want to fix it immediately. With $250 on hand, you may hope that you can just pay off a lender or creditor, erase whatever issue is dragging down your credit, and get yourself back in good standing. But can this really work?

The short answer is yes, it’s possible to erase bad credit with $250 using a method called pay for delete. But it’s unlikely this approach will work, and it also depends on your unique situation.

Table of Contents

How can I erase bad credit with $250?

When you ask if you can “erase bad credit,” what you’re really asking is whether you can pay to wipe your credit history clean of negative items like collection accounts or late payments. These items (especially collection accounts) severely damage your credit score.

As stated, it’s possible to pay to remove a derogatory mark by using a method called pay for delete, but this usually only works when you’re dealing with collections companies (as opposed to your original creditor).

If collections are weighing down your credit score, there’s no harm in trying the pay-for-delete method. Essentially, it means asking a debt collector to erase a collection account from your credit report in exchange for you paying them a portion or all of the amount owed.

If your credit is bad for reasons other than collection accounts on your report, you should skip to the end of the article, where we give other suggestions for what you can do with your $250.

How to negotiate pay for delete for $250

You can negotiate pay for delete in just four steps. You need to:

1. Find out which collector owns your debt

If you owe money to a collection company, it’s likely that they’ve already contacted you. However, if you’re not sure who owns your debt, you can find out by doing one of the following:

- Checking your credit report: You can get a credit report for free once a year from each credit bureau (Equifax, Experian, and TransUnion) from AnnualCreditReport.com. Your report(s) will have the name of the collection company that currently owns your debt.

- Contacting your original creditor: Your original creditor should also have a record of who they sold or transferred the debt to.

2. Send a pay-for-delete letter

Next, it’s time to write a pay-for-delete letter. To save time, download our pay-for-delete letter template and modify it with your details. As mentioned, pay for delete is more effective when you’re dealing with debt collectors than creditors, but we’ve provided templates for both scenarios below.

Pay for Delete Letter to Collector

Use this pay for delete letter template to ask a debt collection agency to remove a collection account from your credit report. Pay for delete works best on old debts in collection, so this is the scenario the strategy is most suited to.

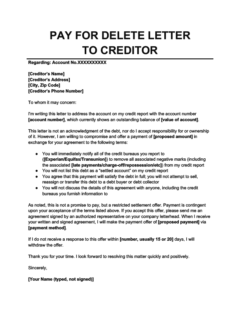

Pay for Delete Letter to Creditor

Use this pay for delete letter template to ask your original creditor to remove another type of negative mark, such as a late payment or a charged-off account that they haven't sold to a debt collector yet. Creditors tend to be less receptive to pay for delete letters than debt collectors.

Your letter should include:

- A statement saying that you aren’t guaranteeing you’ll pay the debt: If your debt is time-barred (meaning that it’s so old that you can no longer be sued for it), agreeing to pay the debt will reset the timer, opening you to liability. Make sure to clearly state that the purpose of your letter is to negotiate whether or not you’ll pay the debt—not to confirm that you owe it or guarantee that you’ll pay it.

- The amount you’re offering to pay: In your case, offer $250. If you owe more than that amount, be aware that you’re also effectively asking for a debt settlement as well as pay for delete, which the company will be less likely to accept.

- Your request to remove the negative item in exchange for payment: Say that in exchange for paying the debt, the company must remove the associated mark from your credit report and cease all further collection efforts. This is what makes your letter “pay for delete.”

3. Get an agreement in writing

If your creditor or debt collection agency accepts your offer, ask for confirmation in writing before you pay anything. Don’t accept a verbal agreement over the phone. They’ll probably be more likely to follow through with their agreement later on if there’s a clear paper trail.

4. Check your credit reports

Remember to check your credit report after it’s been updated (which usually happens every 30–45 days) to make sure your creditor or the debt collection agency actually removed the negative mark from your credit report. If it’s gone, you’ll still need to keep monitoring your credit reports for a while because it’s possible that the item will reappear.

When a deleted item reappears on your credit report (e.g., if you removed a collection account and it shows up later as a paid collection), this is known as reinsertion. If this happens, you’ll have to contact the company and remind them of their agreement to get them to delete it again.

Will pay for delete work?

Pay for delete sometimes works, but there are no guarantees. Your odds of success depend on how much you owe and how desperate your collector is to get repaid.

Even though pay for delete doesn’t always work, there’s no harm in asking—it can’t get you in legal trouble. The Fair Credit Reporting Act (FCRA), which is a law that regulates credit reporting, doesn’t explicitly forbid the use of pay for delete. 1

If it doesn’t work, there are other approaches you can try to remove late payments or other negative items from your credit report. Be aware that even if pay for delete does work for you, its positive effects may be minimal if you have lots of other marks that are also dragging down your score, so you should take steps to fix your credit in other ways as well.

Can I pay off a bigger debt with as little as $250?

Yes, you might be able to pay off a bigger debt with less than you owe, even if all you have to offer is $250. According to a 2018 report, consumers who participated in debt settlement on average settled their debts for less than 50% of the total amount they owed. 2

In other words, if you owe $500 to a lender or debt collector, and they agree to let you pay off the debt for 50%, you’ll be paying $250 to settle your debt. If you owe more than $500, you’ll probably need to pay more than $250.

How much exactly you’ll have to pay depends on the amount you owe and the age of your debt. In general, the older the debt, the lower the amount your debt collector will be willing to settle for.

To reiterate, there’s no guarantee that your debt collector will accept pay for delete at all, regardless of whether you can only make a partial payment or you’re willing to pay the entire amount. Still, there’s no harm in asking—the worst they can do is say no.

What if a lender or debt collector breaks a pay-for-delete agreement?

If your lender or debt collector breaks their pay-for-delete agreement, there might not be much you can do. An unscrupulous collection agency might not follow through with removing the negative items from your credit report despite having accepted your $250 payment.

If a creditor or debt collection agency violates your contract with them, you can send them a letter to notify them that they’re in breach. If they ignore that, you could try to sue them.

However, bear in mind that pay for delete falls in a legal gray area, meaning that your written agreement probably won’t hold much weight in court. Technically, only records that are incomplete or inaccurate can be removed from your credit report, which means that pay for delete (an agreement to remove a legitimate negative mark) is legally ambiguous.

If filing a lawsuit doesn’t seem worth it, you can also file a formal complaint with the Federal Trade Commission (FTC), the Better Business Bureau (BBB), and your state’s Attorney General.

Pay for delete is becoming obsolete

Paid collection accounts still harm your score in the FICO 8 model, which remains the most popular scoring model. But newer credit score models (like FICO 9 and VantageScore 3.0 and 4.0) ignore paid collection accounts. In other words, using $250 to pay off collections can improve your score in some cases, as long as the account is reported as paid in full, not settled.

Alternatives to pay for delete

There are several other ways to remove collections from your credit report aside from pay for delete:

- If the debt is invalid: Send a dispute letter to the credit bureaus or your creditor or debt collector

- If you’ve already paid the debt: Ask for a goodwill deletion (i.e, for your creditor or collector to remove the item from your report as an act of goodwill)

- If all else fails: Wait for the debts to fall off your credit report after seven years

By law, collections can only stay on your credit reports for seven years. Although waiting out this time period can be excruciating, at the very least, it’s comforting to know that everything on your credit report is temporary. Ultimately, you’ll be able to escape any negative marks and rebuild your credit.

How can I put my $250 to good use if pay for delete doesn’t work out?

If pay for delete doesn’t work out, you can still put your $250 to use in other ways.

After pay for delete, the fastest way to fix your credit is to pay off your current debts and pay your bills on time in the future. If you’re deep in debt, it can be hard to know which debts to start paying off first.

You can take a look at the following ideas for where to best spend your $250.

- Debt consolidation: With this strategy, you get a loan (ideally with a low interest rate) and use it to pay off other high-interest debts. This lets you organize multiple debts into a single payment and potentially lower your monthly payments.

- Credit counseling: This is a service provided by professional non-profit credit counselors who help you evaluate your financial situation and handle your debt, typically free of charge. Your credit counselor can help you figure out where your $250 will do the most good.

- Debt management: With this service, a credit counselor helps you create a financial plan to repay your debts and negotiates with your creditors for more favorable agreements (for instance, they might waive certain fees). These agreements are mostly applicable to credit card debt, but if that’s the bulk of what you owe, this can be a great option.

Takeaways: You can pay $250 to erase negative accounts from your credit report, but it's not likely to work.

- You can remove negative items from your credit report by sending a pay-for-delete letter to a lender or collection company. This isn't guaranteed to work, but it sometimes does.

- Depending on how much you owe and the debt collector you’re negotiating with, you may be able to delete a negative item for just $250. However, you may end up needing to pay more.

- Some credit collectors may accept a payment without following through on their pay-for-delete agreement with you. Pay for delete isn’t entirely legal, so even if you have a written agreement, it holds little weight in court.

- Collection accounts fall off your credit report automatically after 7 years, so if your pay-for-delete negotiation isn't successful, you can still wait for your credit to recover.