Having a credit account charged off is every debtor’s worst nightmare. Charge-offs are some of the most damaging derogatory marks you can receive on your credit report. They can damage your credit score for several years and stay on your report for up to 7 years if you don’t get them removed. 1

Fortunately, by taking the right steps, you can sometimes wipe charge-offs from your credit report and completely reverse their negative effects. It’s even possible to do this without paying the debt in question.

Table of Contents

When you break it down, removing a charge-off really only involves two steps:

1. Gather details on the charged-off account

Before you do anything else, check all three of your credit reports for charge-offs. You can get your reports for free at AnnualCreditReport.com.

This is an important step because your creditors won’t necessarily report your account information to all three credit bureaus. This means you could have one or two credit reports that don’t show your charge-off at all, or one credit report that shows additional charge-offs that you didn’t even know about.

There are four important things you need to do before trying to remove a charge-off:

- Identify the charge-off: Figure out which credit account the charge-off came from. Check for accounts that have late payments and a $0 balance. The account status will be labeled as “charge-off,” “account charged off,” or something similar.

- Find out who owns your debt: Creditors often sell debts to debt buyers or debt collection agencies after they’ve been charged off. To find out whether you’re dealing with debt collection, check for a new collection account on your credit report or contact your creditor and ask if they still own your debt.

- Find out how much you owe: Take note of how much you owed on your credit account at the time it was charged off. You can also check the current balance on your collection account if your debt has already been sent to collections.

- Check for errors: If the charge-off is a mistake or the account details contain errors (e.g., the reported balance is incorrect or you think the debt never belonged to you in the first place), then it’ll be much easier to get the mark removed from your credit report.

Having this information at hand will help you understand your options by telling you how many charge-offs you have, whether your creditor still owns your debt, and whether you can afford to pay it.

What types of debt can get charged off?

Charge-offs are associated with unsecured debts (such as credit card debt or unsecured loans), but you can also have debt charged off from a secured loan (like an auto loan) if your vehicle was repossessed but its value wasn’t enough to cover the amount you owed. Depending on the type of credit account you failed to pay off, you’ll usually incur a charge-off after 120 or 180 days of missed payments. 2

2. Choose a method to remove the charge-off

Once you’re armed with the details about your account, you’ll need to choose a strategy for getting the charge-off removed. Try one of the methods below:

If the charge-off is a mistake: dispute it with the credit bureaus

Filing a credit dispute is one of the only ways to remove a charge-off without paying. You have the right to dispute information on your credit report at any time for free. All you need to do is send a dispute letter to the credit bureau that published the credit report containing the charge-off.

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

Make sure to clearly state what information you’re disputing and that you would like the credit reporting agency to delete the charge-off. Once the credit bureau has received your dispute letter, they’re required to process your dispute within 30 or 45 days. 3

If the account information is wrong, do not provide the correct details. If they can’t verify the validity of the information you’ve disputed and they don’t have the correct information available, then they’ll have no choice but to remove the charge-off from your credit report.

Will disputing your charge-off actually work?

Disputing your charge-off has an excellent chance of success if it really is a mistake. This is the best method for deleting genuine errors from your credit report, but it’s unlikely to succeed if the mark is legitimate.

You can still try disputing legitimate charge-offs, but it’s a long shot, and you shouldn’t count on it working.

If the charge-off is accurate: negotiate with your creditor

Your creditor is the one who reported your charge-off to the credit bureaus, so they’re the one you’ll need to convince to remove it if the mark is accurate. Depending on the payment status of the debt and who owns it, there are two ways you can try to persuade your creditor to erase your charge-off:

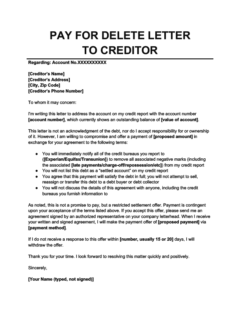

Pay for delete

If your creditor still owns your debt (meaning they haven’t sold it to a debt collection agency), then you may be able to persuade them to delete your charge-off in exchange for payment. This negotiation tactic is known as pay for delete. You can either offer to pay the full amount or include pay for delete as part of a debt settlement offer.

Either way, you’ll need to send your creditor a pay-for-delete letter:

Pay for Delete Letter to Creditor

Use this pay for delete letter template to ask your original creditor to remove a charged-off account from your credit report. This will only work if they haven't sold the debt to a debt collector yet.

This isn’t guaranteed to work, but the worst that can happen is your creditor says no. If they say yes, make sure to get the agreement in writing before you send any payments.

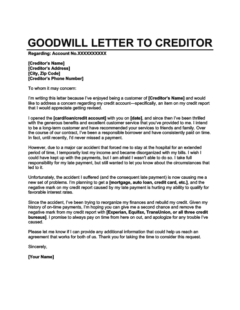

Goodwill deletion

If you already paid the charged-off debt or your creditor sold your debt to a debt collection agency, then you won’t have money as leverage for negotiating with your creditor. However, you do still have one other option: sending a goodwill letter.

With this approach, you’re asking your creditor to remove the charge-off out of kindness. It’s a long shot, but they might agree if you missed payments due to sudden financial hardship or other extenuating circumstances.

Goodwill Letter to Creditor

Use this goodwill letter template to ask for a goodwill deletion from one of your creditors. Remember to customize it to your circumstances for the best possible chance of success.

Should you ever hire a credit repair company to help you delete your charge-off?

If you’re not having much luck on your own or you just don’t have the time to send letters to the credit bureaus, then you can also just pay a credit repair expert to try and get the charge-off removed for you.

Credit repair companies use the same techniques described above. They won’t be able to do anything you can’t do to remove the negative items from your credit report by yourself. However, the extra experience and time they have to negotiate with the credit bureaus could help get the job done.

Professional credit repair can take several months to complete (sometimes upwards of half a year). The cost of professional credit repair varies from company to company, but note that it’s against the law for credit repair organizations to charge you for their services upfront. 4

Steer clear of companies that ask you to pay in advance or promise that they’ll be able to remove accurate charge-offs (which they can’t legally guarantee).

What should you do if you can’t remove the charge-off from your credit report?

It’s not the end of the world if you can’t delete a charge-off from your credit report. Although you’ll have to wait around 7 years for it to fall off your credit report automatically, it probably won’t hurt your credit score for that long.

Most negative items stop impacting your credit score after 2 years. 5 In the meantime, start looking into the other resources and options you have for fixing your credit.

How charge-offs affect your credit score

Charge-offs are one of the most damaging things that can happen to your credit (at least until their effects fade). Depending on how high your credit score was to begin with, a charge-off could cause your credit score to drop by up to 130 points. 5

Additionally, charge-offs can indirectly hurt your credit health in other ways. For example, even after the effects on your score fade, a charge-off can still make it more difficult for you to open new credit accounts because lenders will see it as a sign that you’re a risky borrower.

You can compensate for this by making sure your credit applications are spotless in other ways. Pay down your debts to maximize your debt-to-income ratio, and consider applying with a cosigner if you really need a credit card or loan and your charge-off is preventing you from qualifying.

Should you pay a charge-off even if it won’t get removed?

If your creditor charges off your debt, it doesn’t go away. They might transfer or sell the debt to a debt collection agency, but you still owe it.

Whether or not you pay your charged-off debt is up to you, but if you plan on refusing to pay, be prepared for the consequences of ignoring debt collectors when they eventually come knocking on your door. In extreme cases, they may sue you and, if they win, the debt collector can garnish your wages.

Because unpaid charge-offs are usually followed by collection accounts on your credit report, you should also look into ways of removing collections from your credit report and rebuilding your credit after collections.

What if you can’t afford to pay your charged-off debt?

If you’ve decided to pay your charged-off debt but you can’t afford to do so, don’t panic. Even if you’ve got no money to give them, there are ways to deal with debt collectors when you can’t pay.

Debt collectors don’t want to end up in court any more than you do, so filing a lawsuit almost certainly won’t be their first resort. They may be willing to help you set up a more manageable payment plan to clear your debt.

Takeaway: You may be able to remove a charge-off from your credit report by disputing it or persuading your creditor to delete it.

- Charge-offs occur when you go too long without paying your bills, and they’re incredibly damaging to your credit.

- The first step to removing a charge-off is gathering account information, like your balance, who you owe, and how many charge-offs you have on your three credit reports.

- Next, choose a charge-off removal approach that suits your circumstances. You can dispute it, negotiate with your creditor, or hire a credit repair company.

- If you can’t get the charge-off removed from your credit report, then explore options for rebuilding your credit and dealing with collections.