Table of Contents

How to write a goodwill letter

A goodwill letter, also called a forgiveness letter, is a letter you send to your creditor asking them to remove negative information from your credit report as an act of goodwill.

When you send a goodwill letter, you explain the circumstances that led to you missing payments on your credit account and ask your creditor to empathize with you.

The most successful goodwill letters are:

- Specific to your circumstances: Your goodwill letter shouldn’t seem generic or insincere. While we provide downloadable templates, you should modify them with your own unique circumstances and struggles.

- Courteous, polite, and humble: Take responsibility for the negative information caused by your missed payments. Remember that you’re asking for goodwill, not making demands.

Once you’ve drafted your letter, you need to send it to your creditor’s address, which will usually be listed on your credit report or on your creditor’s website.

Note that since creditors aren’t required to respond to goodwill letters, you may have to contact them multiple times to follow up. If they do respond to you, they’ll let you know whether they’re willing to make an adjustment to your account (and if so, which negative marks they’re willing to delete).

When to use a goodwill letter

Goodwill letters are most effective when you have a good and honest reason for falling behind on your bills, such as a medical emergency that strained your finances. It’s also much easier to delete negative marks that are relatively minor, such as late payments. It’s far harder to remove more serious marks, such as charge-offs and unpaid collection accounts.

You’ll have the best chance at succeeding if you have a strong credit history, a good track record of making payments on time, and a good relationship with your creditor.

You should know that even in the best of circumstances, goodwill letters have a low rate of success. However, it’s still worth your time and effort to try, and our templates will give you the best possible chance.

If a negative item is incorrectly reported on your credit report, you should dispute it instead

Note that goodwill letters are only designed to remove accurate information after you’ve paid off your debts. If you have a negative item that’s incorrectly reported, file a dispute instead. If you have an accurate item that you haven't paid yet, try to negotiate pay for delete.

Goodwill letter template to remove late payments

The following is a goodwill letter template designed to remove late payments that you’ve completely paid off.

As mentioned, late payments are the type of negative mark that you have the best chance of removing with a goodwill letter. Other types of marks are much harder to convince creditors and debt collectors to delete, but you can still follow our advice below to try.

Regarding: Account No.XXXXXXXXXX

[Creditor’s Name]

[Creditor’s Address]

[City, Zip Code]

[Creditor’s Phone Number]

To whom it may concern:

I’m writing this letter because I’ve enjoyed being a customer of [Creditor’s Name] and would like to address a concern regarding my credit account—specifically, an item on my credit report that I would appreciate getting revised.

I opened the [card/loan/credit account] with you on [date], and since then I’ve been thrilled with the generous benefits and excellent customer service that you’ve provided to me. I intend to be a long-term customer and have recommended your services to friends and family. Over the course of our contract, I’ve been a responsible borrower and have consistently paid on time. In fact, until recently, I'd never missed a payment.

However, due to a major car accident that forced me to stay at the hospital for an extended period of time, I temporarily lost my income and became disorganized with my bills. I wish I could have kept up with the payments, but I am afraid I wasn't able to do so. I take full responsibility for my late payment, but still wanted to let you know about the circumstances that led to it.

Unfortunately, the accident I suffered (and the consequent late payment) is now causing me a new set of problems. I’m planning to get a [mortgage, auto loan, credit card, etc.], and the negative mark on my credit report caused by my late payment is hurting my ability to qualify for favorable interest rates.

Since the accident, I’ve been trying to reorganize my finances and rebuild my credit. Given my history of on-time payments, I’m hoping you can give me a second chance and remove the negative mark from my credit report with [Experian, Equifax, TransUnion, or all three credit bureaus]. I promise to always pay on time from here on out, and apologize for any trouble I’ve caused.

Please let me know if I can provide any additional information that could help us reach an agreement that works for both of us. Thank you for taking the time to consider this request.

Sincerely,

[Your Name]

What should a goodwill letter say?

Below, we’ll explain what makes this goodwill letter template so effective.

To whom it may concern:

I’m writing this letter because I’ve enjoyed being a customer of [Creditor’s Name] and would like to address a concern regarding my credit account—specifically, an item on my credit report that I would appreciate getting revised.

I opened the [card/loan/credit account] with you on [date], and since then I’ve been thrilled with the generous benefits and excellent customer service that you’ve provided to me. I intend to be a long-term customer and have recommended your services to friends and family. Over the course of our contract, I’ve been a responsible borrower and have consistently paid on time. In fact, until recently, I’d never missed a payment.

However, due to a major car accident that forced me to stay at the hospital for an extended period of time, I temporarily lost my income and became disorganized with my bills. I wish I could have kept up with the payments, but I am afraid I wasn’t able to do so. I take full responsibility for my late payment, but still wanted to let you know about the circumstances that led to it.

Unfortunately, the accident I suffered (and the consequent late payment) is now causing me a new set of problems. I’m planning to get a [mortgage, auto loan, credit card, etc.], and the negative mark on my credit report caused by my late payment is hurting my ability to qualify for favorable interest rates.

Since the accident, I’ve been trying to reorganize my finances and rebuild my credit. Given my history of on-time payments, I’m hoping you can give me a second chance and remove the negative mark from my credit report with [Experian, Equifax, TransUnion, or all three credit bureaus]. I promise to always pay on time from here on out, and apologize for any trouble I’ve caused.

Please let me know if I can provide any additional information that could help us reach an agreement that works for both of us. Thank you for taking the time to consider this request.

In the goodwill letter above, a medical emergency prevented the writer from making on-time payments. Medical bills can severely disrupt your finances and are often impossible to anticipate, which makes this one of the best possible reasons for failing to pay your creditor on time.

However, there are other good reasons why you might have missed payments. We cover them in detail below and include some language that you can copy and paste into your template if any of them apply to you.

Other good reasons for missing payments

Mention if your late or missed payments were caused by any of the following:

Getting laid off

Getting laid off can cause severe budgetary stress, especially if you recently made a big purchase. If a layoff left you struggling financially, explain that.

If you had an emergency fund but you burned through it and found yourself unable to pay your bills, mention that too. Saving money for an emergency demonstrates financial responsibility (even if your savings weren’t enough in the end) and makes it clear that you were the victim of events outside your control.

Your letter will be especially convincing if you’re able to mention any dependents you had to take care of (and who you had to prioritize above your obligations to your creditors).

Use language like this:

In [month], [year] I was unexpectedly laid off from my job at [company]. Supporting myself and [dependents] quickly burned through my emergency savings, and unfortunately I was unable to maintain my payments while seeking new employment.

A divorce

Going through a divorce can also be extremely stressful, especially when there are costly legal proceedings involved. The financial settlement may also impact your ability to stay on top of your bills.

The stress and expenses of the separation and divorce left me struggling to stay on top of my financial obligations. Now, post-divorce, I am trying to rebuild my credit, as I plan on getting a [mortgage, auto loan, credit card, etc.]

A move

Moving can be overwhelming, and it’s easy for things to fall through the cracks, especially if you weren’t able to get all of your mail forwarded to your new address. If you missed bills because they went to your old home (or if the move itself strained your finances), explain that.

I was forced to move out of my home due to [reason] and neglected to promptly update my address with [creditor], causing me to miss their letters. The move also drained my savings and used up most of my recent paycheck.

A birth or death

Birth and death are both major life events that can bring financial hardship. Sometimes these events can happen very suddenly too, resulting in urgent expenses.

The recent death of a family member brought on extreme emotional and financial hardship. Their illness also led to a sudden increase in medical bills, which I was responsible for and which my income wasn’t sufficient to pay.

Disruption caused by COVID-19

If you, like millions of other people, had your finances thrown into disarray by the effects of the COVID-19 pandemic, be sure to mention that in your letter.

Be as specific as you can. Mention if the pandemic caused one of the other events mentioned above (e.g., you were laid off or hit with expensive medical bills) or if it caused something else entirely (e.g., you were forced to quit your job to provide childcare because the schools in your area closed). Tailor your language to the event in question.

Other goodwill letter examples

All of the goodwill letter examples above are meant to help you remove late payments from your credit report. It’s natural to wonder whether you can use goodwill letters to remove other negative marks, such as collection accounts, which are generally considered more serious.

The hard truth is that even with minor issues like single late payments, goodwill letters are hit or miss, and they’re even less likely to work for more major derogatory marks. However, we’ve addressed other circumstances below in case you want to give it a try. Sending a goodwill letter has no real downsides, so there’s no harm in making the attempt, even if your chances aren’t very good.

Can you send a goodwill letter to …

Remove a charge off?

You probably can’t get a charge-off removed from your credit report with a goodwill letter. You receive a charge-off when your original creditor gives up on you paying back your debt and sells it off to a debt collection agency. Your original creditor would need to be extremely generous to forgive you for never paying them back.

Remove a paid collection?

It’s unlikely that a goodwill letter will work on a debt collection agency, even if you’ve already paid the debt in full, which means you probably can’t get a paid collection removed with a goodwill letter. Debt collection agencies aren’t generally known for their goodwill.

However, there’s no harm in trying. You can use the following template, which is modified to address a debt collection agency instead of a creditor.

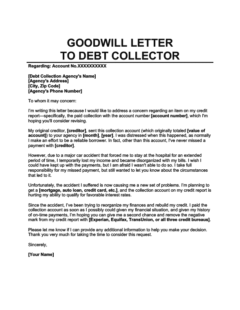

Goodwill Letter to Debt Collector

Use this letter template to ask for a goodwill deletion from a debt collection agency. Remember to customize it to your circumstances for the best possible chance of success.

Remove an unpaid collection?

You definitely can’t get an unpaid collection removed with a goodwill letter. What you’d really be asking for here is total debt forgiveness, which won’t happen even with the most heart-wrenching story. If you’re in a desperate financial situation, your options here are as follows:

- If you have some funds: You can try to negotiate pay for delete by sending something known as a pay-for-delete letter. You can also attempt debt settlement, which is a method that lets you clear your debts for less than they’re worth.

- If you have no funds, but some income: Contact a nonprofit credit counseling agency and ask for a debt management plan. (Note that despite the similar names, debt management and debt settlement are very different.)

- If you have no funds or income: You should still contact a credit counselor and set up a free consultation to discuss your options. However, it’s possible your best option will be declaring bankruptcy.

Remove a closed account?

Whether you can remove a closed account depends on whether it was closed in good standing (meaning all debts have been paid off) or if it was closed because it was delinquent.

If your account was closed in good standing, there’s no need to remove it from your credit report. In fact, because it demonstrates a positive payment history and adds to your credit age, keeping it will actually improve your credit score.

On the other hand, if the account was closed with outstanding balances that you’ve since paid off, then you can try to send a goodwill letter to remove the negative information from your credit report. If you haven’t paid the account off yet, opt to negotiate for pay for delete.

Remove a credit inquiry?

No, you can’t remove a hard inquiry with a goodwill letter. The way you should handle a hard inquiry on your report depends on the situation.

If the inquiry is:

- A mistake: You need to dispute the illegitimate item by sending a letter to the company that conducted it and the credit bureaus that reported it.

- Not a mistake: You can’t dispute or wish away a correctly reported inquiry. However, in most cases, it’ll only harm your credit score by five to ten points, and will naturally fall off your report after two years.

Essentials to mail with your goodwill letter

Be sure to send your goodwill letter with certified mail so that you’re positive they’ve received it. In your package, make sure the following information and documents are readily available:

- Account number: You can include this in your letter template

- Copy of your credit report: Circle the negative item in your credit report to make it easy for them to find