If you owe a debt that’s more than a few years old, then you’ll be happy to know that after a certain amount of time has passed, known as the statute of limitations, your debt will no longer be legally enforceable.

When deciding how to deal with debts—specifically, whether or not to pay them—it’s very important to know whether your debt is past the statute of limitations. Read on to find out what the statute of limitations is on different types of debt in your state.

Table of Contents

What is a statute of limitations on debt collection?

The statute of limitations on debt is defined as the amount of time before a creditor or debt collector can no longer sue you over a debt. After this period has passed, the debt is referred to as time-barred debt.

Before the time limit on debt collection has passed, debt collectors can take you to court and file a lawsuit to compel you to pay. If they win (which, if the debt is legitimate, they probably will), they may receive a judgment giving them the right to garnish your wages or bank savings, or seize your personal property.

Once the statute of limitations has passed, they’re not able to do this any longer. In most states, debt collectors can legally keep pursuing old debts even once they become time-barred, but it’s essentially up to you whether you want to pay or not—their collection efforts don’t have any teeth.

How long is the statute of limitations on debt collection?

Most debts have a statute of limitations in the range of 3 to 6 years, although some are legally enforceable for up to 15 years. We’ll go over how to determine the statute of limitations on a given debt below.

Don’t confuse the statute of limitations on debt with the credit reporting limit

The amount of time that you can be legally sued over a debt is different from the amount of time that a debt can be reported to the credit bureaus. Debts in collection generally remain on your credit reports for up to 7 years, regardless of whether that’s longer or shorter than the statute of limitations.

How to tell if your debt is time-barred

All consumer debts have a statute of limitations, including:

- Credit card debt

- Personal loans

- Mortgages

- Car loans

- Medical debts

However, not all debts become time-barred after the same amount of time. That’s because the statute of limitations depends on three factors:

- The state you live in

- The type of debt it is

- Whether your original contract specifies that the debt falls under another state’s jurisdiction

The only way to tell when your debt will become time-barred is to check the statute of limitations on debts of that type in the relevant state.

Statute of limitations on debt by state

The table below lists all 50 states and their respective statutes of limitations for different types of debts.

Statute of Limitations on Debt Collection by State

| State | Open-Ended Accounts | Written Contracts | Promissory Notes | Oral Contracts | Source |

|---|---|---|---|---|---|

| Alabama | 3 | 6 | 6 | 6 | § 6-2-37 |

| Alaska | 3 | 6 | 3 | 6 | § 09.10.053 |

| Arizona | 6 | 6 | 5 | 3 | § 12-543 |

| Arkansas | 5 | 5 | 3 | 3 | § 4-3-118 |

| California | 4 | 4 | 4 | 2 | § 337 |

| Colorado | 6 | 6 | 6 | 6 | § 13-80 |

| Connecticut | 6 | 6 | 6 | 3 | § 52-576 |

As mentioned, it’s possible that the statute of limitations on your debt isn’t the same as the limit in your state. This is because some creditors specify in their contracts that they follow the statute of limitations in a different state.

To make sure the statute of limitations in your state applies to your debt, review the terms of your original agreement.

Statutes of limitations for different types of debt

As you can see from the table above, state laws distinguish between four types of debt obligations. The statute of limitations varies depending on the type of credit account or debt agreement you had.

Here’s an overview of these four types of debt:

- Open-ended contracts: Agreements for open-ended credit accounts (i.e., credit cards and retail cards, which are also known as revolving credit accounts).

- Written contracts: Contracts that have been made in writing and signed by both the lender and the debtor, such as loan agreements and medical bills.

- Promissory notes: Written agreements promising that you’ll repay your lender a specific amount by a certain date, often used with loans (e.g., mortgages and student loans).

- Oral contracts: Verbal contracts made between the debtor and creditor without any written confirmation.

Some debt obligations fall into multiple categories. If you’re unsure which type of contract you have, check the terms of your original contract and consider consulting an attorney.

When does the statute of limitations start for debt?

Generally speaking, the statute of limitations starts on the date that your credit account first became delinquent. 1 However, in some states, it can begin from the date of the most recent payment.

For this reason, it’s important to be careful when making payments on a collection account so that you avoid accidentally restarting the statute of limitations on your debt.

What to do if your debt is past the statute of limitations

If debt collectors are calling you about time-barred debt, then you have three options for how to proceed.

1. Ignore it

Since you can’t be forced to pay a debt that’s passed the statute of limitations, you can simply choose to ignore your debt collectors.

To get debt collectors to stop contacting you, simply send them a letter asking them to cease all communications. In accordance with the Fair Debt Collection Practices Act (FDCPA), they’ll be forced to comply. 2

This isn’t normally a good idea, since it can provoke debt collectors into suing you. However, if your debt is time-barred, they’re not allowed to do this, which means it really has no downsides.

What to do if your debt collector tries to sue you anyway

If your debt collector (illegally) sues you over a time-barred debt, it’s important not to ignore the lawsuit. If you’re not there to tell the judge that the debt is time-barred, they may rule in favor of the debt collection agency by default.

Just show up to court and point out that the debt has passed its statute of limitations. If you have any documentation (such as the initial debt validation letter your collector sent you), bring that along.

2. Negotiate a settlement

If you decide to pay the debt even though it’s time-barred, there’s a good chance you’ll be able to clear it for a partial payment.

With time-barred debts, you have a great deal of negotiating power. This is because debt collectors no longer have any legal recourse to force you to pay the debt, so any payment at all is probably more than they’re expecting to get from you.

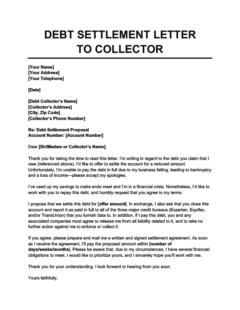

If you can get your debt collectors to agree to a debt settlement, your debt will be cleared for less than the full amount you owe. All you need to do is send the debt collection agency a debt settlement letter offering your proposed amount.

Debt Settlement Letter to Collector

Use this debt settlement letter template to ask your debt collector to clear a debt for less than you owe. This isn't guaranteed to work, but it's a good option if you simply can't afford to pay the debt in full.

3. Pay it

You can always simply pay off your debts in collection. If you have the money to do so, paying off collections can improve your credit score, put a stop to debt collection efforts once and for all, and give you some peace of mind.

However, avoid making partial payments unless you actually plan on repaying the full debt. Doing so could restart the statute of limitations and expose you to lawsuits.

Takeaway: The statute of limitations on debt collection is a limit to how long you can be sued over a debt.

- The statute of limitations on debt depends on the type of debt you have, the state you live in, and the state specified in your agreement with your original creditor.

- Most debts have a statute of limitations in the range of 3 to 6 years, although some are legally enforceable for up to 15 years.

- Once the statute of limitations on debt has passed, your debt becomes time-barred, and debt collectors can no longer sue you and force you to pay.

- The statute of limitations usually starts from the date an account first became delinquent, although it can also start from the date of the most recent payment in some cases.

- If you have time-barred debt, you can ignore debt collectors, pay the debt in full, or negotiate a debt settlement to pay less than the full amount you owe.