Every day, many Americans get phone calls from debt collectors over debts they don’t owe and sometimes don’t even recognize. In fact, in 2017, the Consumer Financial Protection Bureau found that 53% of people contacted by debt collectors either didn’t owe the debt in question or were asked to pay the wrong amount. 1

If this sounds like the situation you’re in right now, you’ll be happy to know that you have the right to fight back against debt collectors. We’ll give you all the tools and resources you need to dispute collections and win.

Table of Contents

Understanding your right to dispute collections

You have the right to dispute any debt that a third-party debt collector asks you to pay. This right is guaranteed by the Fair Debt Collection Practices Act (FDCPA), a federal law designed to protect consumers like you from debt collector harassment and unfair, aggressive, or deceptive debt collection activities.

One of your main rights under the FDCPA is the right to dispute a debt within 30 days of your debt collector sending you a debt validation notice—one of the first communications they have to send you.

How debt validation works under the FDCPA

Debt collectors are required to provide you with information about your debt (known as debt validation) within 5 days of first contacting you. 2

In their debt validation letter, debt collectors must include key information about your debt, such as who it originally belonged to before it was sent to collections. They also must inform you of your rights when it comes to disputing the debt: 3

- If you don’t dispute the debt within 30 days, the debt collector will assume the debt is valid.

- If you do dispute the debt in writing within 30 days, the debt collector must stop trying to collect payments until they’ve provided you with verification of the debt.

- The debt collector must give you the name and address of the original creditor (if different from the debt’s current owner) if you request that information within 30 days.

If it’s been more than 30 days since you received notification that the debt was sent to collections, then don’t worry—you can still dispute the debt. However, your debt collectors won’t be obligated to stop calling you or respond to your dispute (though they might do so anyway).

Fight back against abusive or fraudulent debt collectors

If a debt collector violates your rights, make sure to stand up for yourself. You can sue them, file a complaint with the Consumer Financial Protection Bureau, and/or report them to your state attorney general or the Federal Trade Commission (FTC).

How to dispute a collection account in 4 steps

There are four things you need to do to dispute a debt in collections. If you follow these steps successfully, not only will your debt collector have to stop pursuing you for the debt, they’ll also have to remove the collection account from your credit report (which will benefit your credit score).

Follow these steps:

1. Find out who owns your debt

Before you do anything else, find out who your debt collector is. Old debts are often transferred from one debt collection agency to another, so keeping track can be difficult.

Figuring out which company you’re dealing with also helps you confirm whether your debt collector is legit. Unfortunately, debt collection scams are common, and making sure that you’re not being targeted by fraudsters is important for protecting your credit and identity.

Here’s what you can do to verify that debt collector calling you is the one you actually owe:

- Contact your original creditor and ask who they transferred your debt to

- Review your credit reports

- Check your caller ID when they call you

- Check what name they provide on letters addressed to you

You can also search the debt collector in this comprehensive list of major debt collection agencies to find out more information about them, including their contact information so that you can send in your dispute.

2. Gather evidence

To make sure that your dispute is taken seriously and not dismissed as “frivolous,” you’ll need to provide hard evidence proving the debt is invalid.

The documents you’ll need depend on why you’re disputing the debt:

- You’ve already paid it: If the debt is real but you believe you already paid it off, provide account statements from your creditor and transaction records proving you paid it.

- The debt is fraudulent: Provide a police or fraud report showing that the charges are the result of identity theft.

- The debt belongs to someone else: Send records showing that you’re not the debtor (e.g., showing differences in name, date of birth, address, etc).

- The debt was covered by insurance: Attach payment records from your insurance company if you’re dealing with medical bills in collections that were sent to collections even though your insurance covered them.

More is always better when it comes to disputing a debt, so gather as much documentation as you can.

3. Send a debt verification letter to your debt collectors

The most important step in disputing collections is sending a debt dispute letter, also known as a debt verification letter, to the debt collection agency handling your debt.

If you received a debt validation letter by mail, then it should have included a “tear-off” slip for disputing the collection account. If not, then you can just use a debt dispute letter template (provided below).

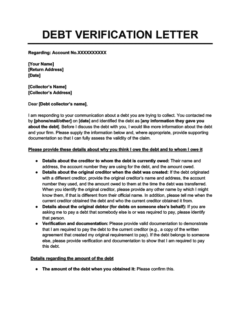

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

When mailing your dispute letter, be sure to include your supporting documentation and request a return receipt so that you have proof of delivery.

You may also be able to dispute the debt on the agency’s website or over the phone, but doing it in writing (and by certified mail) is the best way to ensure that your rights are protected under the FDCPA and that the debt collection agency can’t claim that they never received notice of your dispute. As a rule, you always want to create as much of a paper trail as possible.

4. Wait for a response

Once you’ve sent your debt collection dispute letter, all you need to do is wait for a response. The debt collection agency will be required under the FDCPA to stop all collection efforts until they’ve provided you with proof that you owe the debt. 2

If they never respond, it probably means that they couldn’t verify your debt. In this case, you’ve successfully disputed your collections and won.

However, it’s important that you also check all three of your credit reports (which you can do for free at AnnualCreditReport.com) to ensure that the debt collection agency has stopped reporting the debt to the credit bureaus. If they haven’t, then you may need to take additional steps to get the collection account deleted from your credit reports (described below).

How to file a credit dispute to get collections off your credit report

Debt collection agencies aren’t always cooperative, which means that disputing your debt might not be enough to get the collection account removed from your credit report—even if your dispute is clearly legitimate.

If the collector refuses to remove the collection account from your credit report, you’ll need to take your own steps to remove the negative mark by contacting the credit bureaus (Experian, Equifax, and TransUnion), which are the companies that produce your credit reports.

Disputing items with the credit bureaus

Just as the FDCPA guarantees your right to dispute collections with debt collectors, another federal law (called the Fair Credit Reporting Act, or FCRA) guarantees your right to dispute any item on your credit report with the credit bureaus.

To get the collection removed from your credit reports, you’ll need to send the credit bureaus a separate credit dispute letter using the template below (or a sample dispute letter for medical collections if you’re disputing medical bills).

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

The credit bureaus will have 30–45 days to respond to your dispute. 4 If you provide them with enough evidence that the debt isn’t yours or they can’t confirm it’s valid, then they’ll automatically erase the collections from your credit report.

In your letter, make sure to note that you disputed the debt with the collection agency (per your rights under the FDCPA) and they either accepted your dispute or failed to respond. This will strengthen your case.

How to know when disputing collections is the right move

You can dispute any debt in collections at any time. Technically, you can dispute a debt even if you actually do owe it—your odds of success aren’t great, but disputing it doesn’t have any real downsides.

Disputing a debt in collections won’t cost you any money, get you into any legal trouble, or hurt your credit score. It’ll also put the brakes on your collector’s efforts to pursue you for the money (at least for a little while), and there’s always a chance they lost your paperwork and will have to give in.

The upshot is that disputing a debt in collections is never a bad move. However, there are some circumstances where it’s not just a good idea—it’s practically necessary.

Below are some examples of situations in which you should definitely dispute your collections.

You don’t recognize the debt

If a debt collection agency contacts you about a debt, you might not recognize the agency’s name because in many cases they’re just working for your original creditor (the company, person, or organization you owed money to in the first place).

However, if the agency gives you details about who your original creditor was and the debt still doesn’t ring any bells, then this could be a sign that the debt doesn’t belong to you.

Unfortunately, mistakes happen all the time in the world of debt collection. If debt collectors have confused you for someone else, it’s important to dispute the debt ASAP so that they’re aware of their error and don’t take legal action against you.

The debt was sent to collections by mistake

It’s possible that your creditor made a clerical error and sent your debt to collections before it was overdue. Alternatively, maybe your debt was previously in collections but you already paid it off.

Disputing these types of errors could help you get back in good standing with your creditor and spare your credit from major damage.

You’re a victim of identity theft

If debt collectors are contacting you about accounts opened in your name but you don’t recognize them, then it’s possible that you’ve been targeted by identity theft.

In this case, it’s very important to dispute the debt with your debt collectors, original creditor, and the credit reporting agencies to set the record straight and clear your credit file.

Before you dispute the debt, file a police report and identity theft report with the FTC. Include copies of the reports when you send your dispute letters.

How to deal with time-barred debts

If you’re asked to pay a debt that’s too old to be legally collected (i.e., it’s past the statute of limitations on debt), then you can’t be forced to pay it. In this case, instead of disputing the time-barred debt, you can send the debt collectors a written request to stop all communications with you, and they’ll have to comply. 2

Mistakes to avoid when dealing with debt collectors

Debt collection can be tricky, legally speaking. Make sure you know what not to say to debt collectors so that you don’t accidentally sabotage your efforts when disputing a collection account.

Here are a few things you should avoid at all costs:

- Acknowledging that the debt is yours

- Agreeing to pay the debt

- Making a partial payment on an old debt

- Providing additional contact information

To avoid saying anything you shouldn’t, it’s best to keep all your communications with your debt collector in writing if you possibly can. This also creates a paper trail, which will be very useful if your debt collector tries to violate your rights and your dispute ends up in the courtroom.

Takeaway: To dispute collections, send your debt collector a debt verification letter asking for proof that you owe the debt.

- Your right to dispute debts in collection is guaranteed by a federal law known as the Fair Debt Collection Practices Act (FDCPA).

- To protect your rights under the FDCPA, you must dispute collections in writing within 30 days of receiving notification that your debt was sent to collections.

- To dispute your debt, identify your debt collector, gather evidence that you don’t owe the debt, and send a debt verification letter to the debt collector.

- Good reasons to dispute collections include if the debt isn’t yours, it was mistakenly sent to collections, you already paid it, the amount is wrong, or your identity was stolen.

- When dealing with debt collectors, be careful not to acknowledge that you owe the debt, agree to making any payments, or provide them with additional means of contacting you.