When debt collectors contact you, they’re required to abide by certain rules. One of these rules states that they must provide you with something known as debt validation.

The best way to fight collections and ensure that you don’t pay debts you don’t owe is to educate yourself on how debt validation works and how to ask for it.

Table of Contents

What is debt validation?

Debt validation is proof that you actually owe a debt. Debt collectors are legally obligated to validate all the debts that they try to collect so that you can verify that the debts are real and they actually belong to you (i.e., your debt collector isn’t carelessly confusing you with someone else).

It’s your legal right to receive this validation, as guaranteed by the Fair Debt Collection Practices Act (FDCPA), which outlines rules put in place to prevent debt collectors from harassing consumers or using other predatory practices to collect debts.

Before you pay a debt collector or debt collection agency any money, make sure that you get confirmation that the debt is yours.

What’s in a debt validation letter?

A debt validation notice must include the following: 1

Basic information about the debt

- A statement that the notice is from a debt collector.

- The name and mailing address of both the person who owes the debt and the debt collector.

- The name of the creditor or debt buyer the debt is owed to.

- Any account numbers associated with the debt.

- The current amount of the debt at the time the validation information is provided.

- A breakdown of how the debt collector calculated the current amount of the debt, including any interest, fees, and payments or other credits added to your account since the “itemization date” (a reference date, which could be the last date you made a payment toward the debt or the date you made the purchase that got you into debt).

A list of your rights

- A statement informing you that the debt will be assumed valid within 30 days of the initial communication unless you dispute it.

- A statement informing you that you can dispute the debt in writing within 30 days to get verification from the debt collector and that the debt collector must stop trying to collect the debt until they give you this verification.

- Information about how to dispute the debt, including a “tear-off” form that you can return to the debt collector to tell them that you’re disputing the debt or to take other actions.

- A statement informing you that the debt collector will provide the name and address of the original creditor (if different from the current owner of the debt) upon request within 30 days.

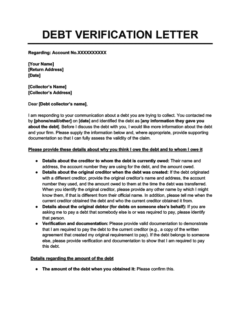

If you receive debt validation information in writing, it will look a bit like this model debt validation notice from the Consumer Financial Protection Bureau.

Debt validation notices were expanded after changes to the FDCPA on November 30, 2021

Before November 30, 2021, debt validation notices were required to contain much less information. The new requirements mean that debt collectors have to give you much more information to confirm that the debt is yours and that they have the right to collect it.

Receiving a debt validation notice: how does it work?

Debt collectors can provide their debt validation notice in various forms:

- A written letter

- An electronic communication (e.g., a file attached to an email)

- Orally, over the phone.

If your debt collector delivers the validation information orally, there’s obviously no way for them to deliver the tear-off form that they’d normally have to include, and they’re not required to do so. However, legally, they do have to give you the information at a reasonable speed and volume—they can’t rattle it off faster than you’re able to take notes.

If a debt collector doesn’t give you validation information immediately, they must do so within five days of their initial communication with you. 1

If they don’t send a debt validation notice to you within 5 days, you can request one. If you still don’t receive one, ask again the next time they contact you.

What to do after you receive a debt validation letter

After you receive a debt validation letter, carefully review it to ensure that all of the information is correct. If any of the details regarding your debt or your personal identifying information are incorrect, it’s important to dispute the debt as soon as possible. The best way of doing so is by sending a formal letter, known as a dispute letter or debt verification letter (not to be confused with a debt validation letter).

Debt validation vs. debt verification: what’s the difference?

Debt validation and debt verification are often used interchangeably, but they’re very different. Here’s a summary of what these two terms mean and how they’re distinct:

- Debt validation letter: This is the initial notice that a debt collector sends you outlining where a debt comes from, how much it’s for, and when and how you can dispute it.

- Debt verification letter: This is a letter you can send to your debt collector in response. It disputes the information in the debt validation notice that they sent you. This is also referred to as a dispute letter.

Debt collectors are required to respond to debt verification letters with more comprehensive info than they included in their initial validation notice. Specifically, they must respond with verification from your original creditor—for example, a document such as a credit card bill or signed contract.

Their response must also include the following information:

- Why they think you owe the debt

- Why they have authority to collect the money

- Whether the debt has exceeded the time limit within which a debt collector can sue you for it (known as the “statute of limitations”)

When should you dispute the debt with a verification letter?

If you notice any errors in your debt validation notice or you don’t believe that the debt is yours, you should send a debt verification letter to dispute the debt. In fact, even if you think that the debt is yours, it’s probably worth sending this letter anyway—there’s always the chance that the collector won’t be able to dig up enough evidence, even if the debt is legit.

You can dispute collections by using a debt verification letter template or the tear-off slip on your debt validation notice and sending it to your debt collectors. You can create a letter with the template below.

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

Provided you send your letter within the 30-day time limit (which starts ticking after you receive your debt validation notice), the debt collector won’t be allowed to contact you until they respond with proof of your debt. 2 The credit bureaus are also required to update their records so that your credit report will show that the debt is being disputed. 3

What happens if you miss the deadline to dispute

If it’s been more than 30 days since you received a debt validation notice and you haven’t sent a debt verification letter or returned the tear-off slip from your validation notice, then don’t worry—you can still dispute the debt. However, the debt collector is no longer legally obligated to provide proof of the debt or stop trying to collect money from you (though they might do so anyway). 4

What if the collection agency fails to validate or verify the debt?

If a debt collector refuses to send a validation notice, won’t provide verification, or keeps chasing a debt they can’t verify, you can file a complaint with the Consumer Financial Protection Bureau (CFPB).

You can also report them to the Federal Trade Commission (FTC) for violating the FDCPA, and can even sue them in a federal or state court for up to $1,000 plus legal costs. 2

What if you do owe the money?

If your collector is able to validate and verify the debt—in other words, if it turns out to be yours—the unfortunate reality is that you’ll probably have to pay it. However, depending on your situation, you may have a bit of leeway.

Specifically, you have three options:

- Pay the debt in full: If you can afford it, paying off the debt is your best option in terms of minimizing the damage that the collection account will do to your credit.

- Settle the debt: With a debt settlement, you pay a portion of the debt and the debt collection agency waives the rest. Debt collectors may agree to a debt settlement if they think they won’t be able to get any money otherwise. Your credit report will show the collection account as “settled,” which is better for your credit score than “unpaid” but not as good as “paid in full.”

- Wait until the debt is no longer valid: After a certain number of years (typically 3–6, depending on your state), the debt will become time-barred, meaning that debt collectors will no longer be able to take you to court to make you pay it. 5 To find out how long you’d have to wait, check what the statute of limitations on debt is in your state.

Why debt validation is important

Debt validation is important because it helps you avoid making the following mistakes that can damage your credit and finances:

- Paying invalid debts: Reporting errors are common, so debt validation helps you avoid paying debts that aren’t legitimate, such as debts belonging to someone else or ones you’ve already paid. It also helps ensure that you’re paying the right collector for the right debt.

- Reviving time-barred debts: Certain actions like making a partial payment or acknowledging that you owe a debt can restart the statute of limitations on time-barred debts, exposing you to lawsuits. The information in a debt validation notice can help you confirm how old your debts are to prevent this from happening.

- Falling for debt collection scams: All debt collection agencies have to abide by the FDCPA. A good way of telling whether your debt collector is legit is seeing whether they can provide you with debt validation.

- Damaging your credit: Because the debt validation process allows you to identify errors in the records that a debt collector has of your debts, it gives you the opportunity to file a credit dispute with the credit bureaus to remove inaccurate information associated with your collection account (even if you’re outside of the 30-day FDCPA debt validation window).

Takeaway: A debt validation notice is information that debt collectors must send you when pursuing payment for a debt.

- Debt collectors must give you a debt validation notice verbally or in writing either when they first contact you or within five days after first contacting you.

- A debt validation notice must tell you the amount you owe, when you incurred the debt, who your debt collector is, and how to dispute the debt.

- Debt validation can help you avoid being scammed, paying invalid debts, or unwittingly paying debts that are past the statute of limitations.

- Your right to a debt validation notice is legally guaranteed by the Fair Debt Collection Practices Act (FDCPA).