A debt settlement letter outlines an agreement between you and your creditor or debt collector to pay less than the amount you owe in exchange for having the debt forgiven. If you’re distressed about debts that you can’t afford to repay, it’s no wonder you’re thinking about debt settlement as an answer.

It’s a nice idea: you can simply mail your creditor and collector and ask for a discount on your bill. Of course, the reality is more complex—but it is doable.

Table of Contents

Before you download these debt settlement templates

We offer debt settlement letter template downloads here. But before you download and customize these letters, it’s important to know what you’re getting into, especially if you’re dealing with a collections agency.

If you’re dealing with a collections agency

If you’ve recently been contacted by a debt collection agency (within the past 30 days), it’s time to get into gear and force them to prove that you owe the debt. Never take ownership of or settle a debt you don’t owe.

To avoid that, follow these steps:

- Request a debt validation letter: By law, debt collection agencies are supposed to send you a debt validation letter within five days of contacting you. If they haven’t yet, request one to get details about how much money you owe, which creditor they’re representing, and what your rights are. If it turns out that you do owe this debt, you can skip the next steps.

- Send a debt verification letter: If the validation letter seems fishy, send a debt verification letter disputing the debt within 30 days of receiving it. (If you wait beyond that point, the debt is assumed to be yours, and you lose a lot of the legal protections that would otherwise have applied when you disputed it.)

- Review the collector’s response: The debt collector is legally required to respond to your debt verification letter and must provide you with more information about the debt.

Think twice about trying to settle old debts

If your debt has passed a time limit called the statute of limitations, it becomes time-barred debt, meaning collections companies can't sue you for it, although in most states they can still try to collect it from you. But beware: you can accidentally reset the clock on your debt (opening yourself up to lawsuits) if you admit you owe it or pay back any part of it. Sending a debt settlement letter may stand as an admission that you owe the debt.

Downloadable debt settlement letters

Debt Settlement Letter to Creditor

Use this debt settlement letter to offer a creditor less than the amount they claim you owe. In exchange for your payment, this letter asks the creditor to agree to discontinue pursuit of the debt, and to label the debt as "paid in full" on your credit reports.

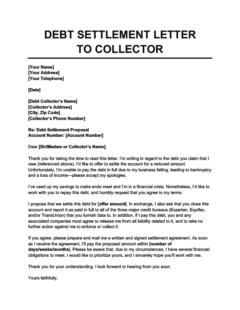

Debt Settlement Letter to Collector

Use this letter to ask your debt collector (instead of your original creditor) to settle a debt for less than you owe and report the debt as "paid in full" on your credit reports. Collectors are actually more likely to agree to this than creditors because they acquire debts for less than they're worth, which means they can agree to a settlement and still turn a profit.

How much should I offer to settle a debt?

To propose a settlement agreement, you should consider offering at least 30% of what you owe.

The exact amount your debt collector will settle for depends on how much you owe and how old your debt is. However, a 2018 report found that on average, consumers were able to settle their debt by paying less than 50% of the amount they originally owed. 1

You can hire a debt settlement company to help settle your debt

Working with a debt settlement company can make the settlement process less stressful, but they generally charge a fee (around 20%–25% of your settled debt). 2 Note that there’s nothing a debt settlement company can do for you that you can’t do yourself.

Can I request pay for delete?

As you may have noticed, the debt settlement letters above request that the creditor or collector update your credit report to say that the debt has been paid in full. You may have seen other letters that request they remove the negative mark from your credit report entirely (a negotiation strategy known as pay for delete). If you’re wondering how these strategies are different or which you should use, here’s how to think about it.

On your credit report, if your settled debt is:

- Reported as settled: This will still hurt your credit, but it’s better than not paying at all. This is the easiest outcome to achieve when you propose a debt settlement.

- Reported as paid in full: While this is better than a debt being reported as settled, it’s not as good as a complete removal, at least in the main VantageScore and FICO scoring models that are most widely used by lenders. This is an unlikely outcome.

- Removed entirely: This is the best possible outcome as far as your credit is concerned, but it’s extremely unlikely.

Creditors and collection agencies are required by law to report accurately to the credit reporting agencies. So if you’re asking for your debt to be labeled as anything but settled, you’re not only asking to pay less than you owe, you’re also asking them to fudge the facts. Bear this in mind during your negotiation—while your creditor or collector may be desperate to recoup your debt, don’t be too greedy if they’re not willing to budge when it comes to your credit report.

The upshot is that you can request pay for delete when you ask for a debt settlement, but it’s unlikely to work. However, you can give it a try with the following pay for delete letter templates:

Debt Settlement Letter Requesting Pay for Delete (Creditor)

Use this letter to ask your original creditor to settle a debt and remove any and all associated negative marks (late payments, charge-offs, etc) from your credit report. This is a lot to ask for, so it's a long shot and you should be prepared to negotiate if your creditor writes back with a counteroffer.

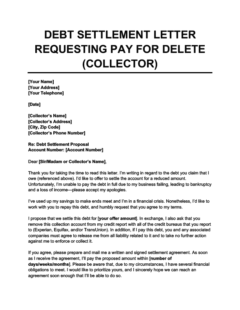

Debt Settlement Letter Requesting Pay for Delete (Collector)

Use this letter to ask a debt collector to clear a debt for less than it's worth and completely remove the associated negative mark (i.e., the collection account) from your credit report. As with the letter above, your odds of success aren't particularly good with this approach, but it's worth a try.

How to write a debt settlement letter (with examples)

A good debt settlement letter will ask your creditor or debt collector to empathize with you regarding the financial hardships or honest mistakes that resulted in your unpaid debt. Here’s an example debt settlement offer letter with an explanation of how to write each section, what it should say, and why it’s needed.

Debt settlement letter example

The following is a debt settlement letter example written to a creditor. A debt settlement letter to a collector is very similar.

Thank you for taking the time to read this letter. I’m contacting you to open a negotiation regarding the debt you claim I owe with the account number [account number]. I’d like to settle this account, but I recently lost my job after I was forced to stay at the hospital for three months due to a fire that injured me and destroyed my home.

Unfortunately, I spent most of my savings recovering from that incident. I’ve tried my best to repay my debts, but my resources are limited. I’m facing severe financial hardship, and I’m afraid that I may not be able to pay back some of what I owe.

Bearing that in mind, I hope you’ll be willing to work with me to settle this debt for [offer amount]. In exchange for settling this debt, I’d also request that you close this account and report it as paid in full to all of the three major credit bureaus (Experian, Equifax, and/or TransUnion) that you furnish data to. In addition, if I pay this debt, you and any associated companies must agree to release me from all liability related to it, and to take no further action against me to enforce or collect it.

I’ll pay the amount offered within [number of days/weeks/months] provided you send a signed settlement agreement that satisfies all of my requests. Please be aware that, due to my situation, I have many other financial obligations that may take priority if we’re unable to come to an agreement.

I sincerely hope we can come to an agreement: I’ve had a great experience being a customer of [creditor’s name], and have recommended your services to friends and family. Please let me know if you have any questions regarding this offer. Thank you for your understanding and cooperation during this difficult time.

Sincerely,

[Your Name]

In the debt settlement letter above, the writer experienced a sudden layoff that caused them severe financial hardship, leading to unpaid debts. However, there are other good reasons you might not have been able to pay back your debts.

Other reasons for having unpaid debts

Here’s some language you can copy and paste into your debt settlement letter template if any of these situations apply to you:

A medical emergency

Any sort of medical emergency can cause unexpected budgetary stress. Say this in your letter:

I recently suffered a major medical emergency that cost me most of my savings. Unexpected medical bills prevented my from paying my debts during this difficult time.

A divorce

Going through a divorce can be extremely stressful, and if the process involves costly legal proceedings or a financial settlement, it can put a real strain on your budget. A divorce can even affect your credit by making it hard to stay on top of your bills. Explain this with the following language:

I recently went through a stressful and financially draining divorce that caused me to miss payments. Now, post-divorce, I hope to settle my debts, rebuild my life, and restructure my finances.

A move

Relocating to a new home can be overwhelming. It’s easy for important messages (such as bills from your creditors) to fall through the cracks if you weren’t able to get all your mail forwarded to your new address.

I recently moved to a new address for [your reasons here]. Unfortunately, some wires got crossed and my address didn’t update properly, leading me to miss payments. While I take full accountability for this, the move also drained my savings and used up my income.

A birth or death

If you recently became a parent—or if someone close to you passed away—it’s understandable if staying on top of your bills wasn’t the first thing on your mind. Sometimes, these events happen suddenly (making it hard to plan for them), and can be accompanied by expensive medical bills.

Birth: I was recently blessed by the birth of my child. As you can imagine, we also faced a steep increase in medical bills, necessities, and stress, causing me to miss payments.

Death: Unfortunately, my father recently passed. The cost of the funeral drained my savings and the emotional toll of losing my father caused me to miss payments I’d otherwise have paid responsibly.

Disruption caused by COVID-19

If you laid off, were hit with expensive medical bills, had to quit your job to provide childcare, or were affected some other way by the COVID-19 pandemic, mention that prominently in your settlement letter. Millions of people are in very similar situations, and there’s a reasonably good chance your creditor or debt collector will be sympathetic and willing to work with you.

The language you should use depends on the type of disruption you experienced.

What to do after writing your debt settlement letter

Once you’ve drafted your letter, you’ll need to:

- Attach documentation: Creditors may ask for evidence of your hardship. Sending evidence right away backing up your claims may give you more credibility. (This is also a good reason not to exaggerate or lie in your letter.) For example, you could send copies of hospital bills or a notice of termination from your company.

- Send your letter via certified mail: Send your letter to your creditor or collector’s address, which will usually be listed on your credit report or on their company website. Use certified mail and pay for a return receipt.

- Await a response or follow up: Creditors and collection agencies aren’t obligated to respond to letters, so you may have to follow up with them a few times. It’s also possible they’ll promptly send a counter-offer, so monitor your incoming mail carefully.

Debt settlement counter-offer letters

Your creditor or debt collector might not agree to your initial settlement offer but they may be willing to negotiate with you. In this case, you can make a counteroffer to their proposal for a lower amount.

Debt Settlement Counteroffer

If your creditor or debt collector is willing to negotiate but sends you an offer that's more than you're willing or able to pay, you can use this letter to send a counteroffer. You may be able to make your offer more attractive by not asking them to update your debt to read "paid in full," which will require modifying this template.

Pros and cons of debt settlement

It’s important to consider the pros and cons before sending a debt settlement letter:

Pros

- Clears your debt: A debt settlement letter can prevent you from sliding further into debt, which is a serious concern. Your debt continues to accrue interest even if it’s been charged off and sold to a debt collection agency. Depending on the state you live in, they may even have the right to raise your interest rate if the original agreement with your creditor gave them that right. 3

- Minimizes impact on your credit score: Settling a debt puts you on a path to rebuilding your credit, although it won’t be a fast journey.

Cons

- It’s not a guarantee and can get costly: Your creditor or debt collector isn’t obligated to accept your debt settlement offer. If you aren’t able to reach an agreement quickly, you may end up owing more than you originally did due to the accumulation of missed payments and late fees. Working with a debt settlement company will also cost you various fees with no guarantee of success.

- It’ll hurt your credit score: Settling debt hurts your credit more than paying it off in full, although it’s still better than not paying it at all. If you have settled debt bringing down your credit score, it’ll be more difficult to apply for a new credit card, secure a loan, or rent an apartment until you rebuild your credit.

Takeaway: You can use a debt settlement letter to clear your debts for less than you owe

- When you write your debt settlement letter, explain the situation that led to your account becoming delinquent. Try to get your creditor or debt collector to empathize with you.

- However, if you owe the debt to a debt collection agency (instead of your original creditor), send them a debt verification letter first.

- You can try to negotiate pay for delete when you propose a debt settlement, but this isn't particularly likely to work. Less ambitiously, you can ask for your debt to be recorded on your credit report as "paid in full."

- There's no guarantee that debt settlement will work. If it does, it will hurt your credit score, although not as much as most other negative marks (such as unpaid collection accounts).