Table of Contents

What is IQ Data International?

IQ Data International, Inc. is a debt collection agency that specializes in collecting overdue rent. The company is headquartered in Bothell, WA, and they also go by the following names: 1

- Assurant Recovery Solutions

- RentCollect Global

- Rent Collect Global

- Q. Data International, Inc.

- RentCollect Global

IQ Data has also been doing business as Assurant Recovery Solutions since 2015, when they were acquired by Assurant, Inc. 2

Who does IQ Data International collect for?

IQ Data International, Inc. is a debt collections agency that specializes in collecting past-due rent. They primarily collect debt on behalf of property managers and companies working in the property management industry. 3

Is IQ Data International a scam?

No, IQ Data International, Inc. isn’t a scam. They’re a legitimate and licensed debt collection agency. 4 However, this doesn’t mean that IQ Data International won’t behave unethically. For example, the company has faced litigation for violating consumer rights. 5

What’s more, scammers may impersonate IQ Data International, Inc. representatives to try to collect money from you. For this reason, it’s important to verify the validity of any debts you’re contacted about before you make a payment. To do so, contact IQ Data International directly using the contact information below.

IQ Data International Contact Information

If you want to remove IQ Data International from your credit report, write to their address:

Address: P.O. Box 340

Bothell, WA 98041-0340

Phone Number: (888) 248-2509

Website: www.iqdata-inc.com

Disputing an incorrect entry on your credit report can be stressful and difficult. Consider working with a professional.

VIDEO: IQ Data International in 2 Minutes—Fix Your Credit Report & Know Your Rights

How to stop IQ Data International from calling you

IQ Data International will call you, email you, or send you letters if they believe you have an unsettled debt. The reason they’re calling you is simple—they want to pressure you into paying up.

Unfortunately, IQ Data International representatives will keep trying to contact you unless you pay the debt, prove that it doesn’t belong to you, or reach an agreement with them (or with your landlord or property management company).

However, you can get IQ Data International to stop calling you—at least temporarily—by sending them something called a debt verification letter.

Send a debt verification letter

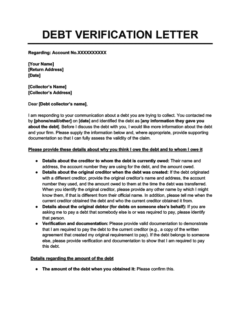

A debt verification letter is a formal request that obligates a debt collector to provide evidence of a debt. You must send it within 30 days of them first contacting you.

Debt Verification Letter

Use this debt verification letter template if IQ Data International has contacted you about a debt and you want to dispute it. If you send this within 30 days, they're legally obligated to respond with evidence of the debt and can't contact you until they do.

Benefits of sending a debt verification letter

Sending a debt verification letter has three benefits:

- You’ll prevent IQ Data International from calling you during this period: When you send a debt verification letter, third-party debt collection agencies like IQ Data International are required by law to stop contacting you until they can provide evidence that you actually owe the debt they’re trying to collect.

- You’ll get more information about the debt: You should never pay a debt that you don’t recognize. Forcing IQ Data International to provide documentation will help you determine whether this is a legitimate debt that you actually need to pay.

- You may successfully disown the debt: If IQ Data International can’t provide more information about the debt (which is frequently the case), then they have no choice but to delete it from your records.

Beware of the statute of limitations

The verification materials that you receive may show that your debt has passed the statute of limitations. This is a legal limit to the amount of time that IQ Data International has to sue you over a debt, after which point it becomes time-barred debt.

If this is the case, you can send IQ Data International a letter telling them to stop contacting you. Legally, they’ll have to abide by that.

The statute of limitations on most debts is between 3 and 6 years, but the exact amount of time depends on several factors, including the state you live in. The best approach is to check your state attorney general’s website and email their office if the information you’re looking for isn’t available online.

How to remove IQ Data International from your credit report

If your credit score is suffering as a result of IQ Data International debt, there are two ways to recover:

1. Dispute the debt with all three credit bureaus

If you think the debt that IQ Data International is trying to collect isn’t yours, dispute the item on your credit report. You can also dispute debts that are older than 7 years (measured from the date of your first missed payment)—by law, they’re supposed to fall off your credit report by then.

To dispute a debt for free, send a credit dispute letter to the credit bureaus that are showing IQ Data International on your credit report.

Credit Dispute Letter

If IQ Data International is on your credit report by mistake, the credit bureaus have to remove it from your report. Use this credit dispute letter template to file a dispute about IQ Data International directly with any of the credit bureaus.

To find out which credit bureaus you need to send the letter to, request your free credit report from each of the major credit bureaus (Experian, Equifax, and TransUnion) at AnnualCreditReport.com. If they don’t respond to your dispute within 30–45 days, then they’re legally obligated to remove the item in question.

2. Negotiate with IQ Data International

Unfortunately, if the debt is legitimate and it’s less than 7 years old, removing IQ Data International from your credit report will be very difficult (although not impossible).

Your best move at this point is to simply pay the debt. Newer credit scoring models ignore paid-off collection accounts, which means paying off your collection will boost your credit score even if you can’t remove the item.

However, when you pay, there are two negotiation strategies you can try as a last-ditch attempt to remove IQ Data International from your credit report:

- Pay for delete: You might be able to convince IQ Data International to remove the negative mark in exchange for paying off the debt. You can open these negotiations by sending them a pay-for-delete letter.

- Goodwill deletion: This is an alternate strategy you can try after paying your debt. Once the account is paid off, you can send IQ Data International a goodwill letter template asking them to empathize with your situation and remove the mark from your credit report as an act of kindness.

If you can’t afford to pay off your debt, try negotiating a debt settlement

If your debt is fairly old, then there’s a chance that IQ Data International will accept less than the full amount you owe (a practice known as debt settlement) to minimize their losses. You can negotiate a debt settlement with IQ Data International over the phone or by sending a debt settlement letter.

How to deal with IQ Data International harassment

Unless you tell them not to, IQ Data International will keep contacting you until you pay off or settle your debt. However, there are restrictions on how they can go about doing this.

Restrictions on IQ Data International

When attempting to collect payments from you, IQ Data International must adhere to the regulations specified in the Fair Debt Collection Practices Act. This is a federal law that prevents debt collectors from engaging in predatory behavior, such as lying to you or calling you incessantly or at unreasonable hours.

IQ Data International representatives also need to follow the rules set out in the Telephone Consumer Protection Act. It’s a good idea to familiarize yourself with these laws so that you can take action against IQ Data International if they do something illegal.

Keep records of letters and phone calls

If you think that IQ Data International may be violating your rights, then it’s a good idea to record your phone calls, save any letters they send you, and keep records of when they’ve contacted you. This will make things much easier if you need to take legal action against them in the future.

Can I sue IQ Data International for harassment?

Yes, you can sue IQ Data International for harassment. If you can show that they’ve violated your rights under the Fair Debt Collection Practices Act, then you can collect $1,000 in statutory damages for each violation as well as payment for any damages that you’ve sustained as a result of their violation. IQ Data International will also have to pay your attorney fees and court costs.

How to file a complaint against IQ Data International

If a debt collector violates your rights under the Fair Debt Collection Practices Act or does something illegal, then you can report them to the Federal Trade Commission, the Consumer Financial Protection Bureau, or your state attorney general. From there, you’ll be able to find out whether you can also sue IQ Data International.

Another option is filing a complaint on the Better Business Bureau (BBB) website, but this might not have the outcome you’re hoping for. Bear in mind that the BBB is actually a private organization that has no affiliation with the US government. They’ll forward your complaint to IQ Data International, but there’s no guarantee that the agency will address it in a satisfactory manner. What’s more, if your dispute is sent to an arbitrator, then you may give up your right to take IQ Data International to court.

Takeaway: IQ Data International is a legitimate debt collection agency

- IQ Data International is a debt collection agency, which means they collect severely delinquent debts that lenders have charged off and transferred or sold.

- IQ Data International probably isn’t a scam, but you should make sure to avoid scammers by verifying your debts and only making payments once you're sure they're legitimate.

- You have rights under the Fair Debt Collection Practices Act that prohibit debt collectors from harassing you. You can sue for harassment, and you won’t need to pay the legal fees if you win.

- There are several ways of removing IQ Data International debt from your credit report, but if these approaches fail, then you should consider seeking advice from a credit repair professional.