If you’ve been getting calls or letters from Ford Credit Collections claiming that you owe them money, it may have been giving you sleepless nights.

Before you do anything else, demand evidence that the debt is real and belongs to you. If Ford Credit Collections can’t do this satisfactorily, you may not even have to pay the debt in question.

Keep reading to find out how debt verification works and what else you should do when debt collectors contact you.

Table of Contents

What is Ford Credit Collections?

Ford Credit Collections is the debt collection division of Ford Motor Credit Company, LLC, which is the financing arm of the automobile manufacturer Ford Motor Company. Ford Credit was founded in 1959 and is currently headquartered in Dearborn, Michigan. 1

Ford Credit Collections collects outstanding debt on auto loans owed by Ford customers.

Other names for Ford Credit Collections

You may see collections items on your credit report with the names of other Ford-owned brands—these are the same as Ford Credit Collections.

The following names also refer to Ford Credit: 2

- Jaguar Credit

- Lincoln Automotive Financial Services

- Mazda American Credit

- Primus Automotive Financial Services

- Primus Financial Services

- Primus Financial

- Land Rover Capital Group

- Volvo Car Finance North America

Who does Ford Credit Collections collect for?

As a first-party debt collector, Ford Credit Collections only collects debts owed by Ford customers. They don’t collect on behalf of other companies.

Ford Credit Collections collects debt incurred on retail sales contracts and leases of their vehicles. In addition to collecting from individual customers, they collect debts owed by government agencies, auto rental and leasing companies, and other companies that manage fleets of vehicles. 3

If you see Ford Credit Collections on your credit report, you probably financed a vehicle and failed to repay your loan as agreed.

Is Ford Credit Collections a scam?

No, Ford Credit Collections isn’t a scam. They’re a legitimate auto finance company and debt collector. That being said, they may still behave unethically, so it’s important to remain vigilant in your interactions with them.

Scammers may also pose as Ford Credit Collections to trick you. Verifying your debt with Ford Credit Collections directly ensures that you know what you truly owe. To confirm your debts, contact Ford Credit Collections directly using the contact information below.

Ford Credit Collections Contact Information

If you want to remove Ford Credit from your credit report, write to their address:

Address: PO Box 542000

Omaha, NE 68154-8000

Phone Number: (800) 727-7000

Website: www.ford.com

Disputing an incorrect entry on your credit report can be stressful and difficult. Consider working with a professional.

Understand your rights

Because Ford Credit Collections is a first-party debt collector (meaning they collect debts on their own behalf), they don’t have to abide by the same laws that apply to third-party debt collection agencies (which collect debts for other companies and individuals).

Specifically, Ford Credit Collections isn’t required to adhere to the Fair Debt Collection Practices Act, which means that (depending on the laws in your state) there may be fewer restrictions on how and when they can contact you.

However, you still have several options for fighting Ford Credit Collections and getting the collection account off your credit report, which we’ll describe below.

Keep records of letters and phone calls

If you think that Ford Credit Collections may be violating your rights, then it’s a good idea to record your phone calls, save any letters they send you, and keep records of when they’ve contacted you. This will make things much easier if you need to take legal action against them in the future.

Beware of the statute of limitations on debt

Depending on how long it’s been since you failed to repay Ford Credit Collections, it’s possible that your debt is old enough that it’s passed the statute of limitations. This is a legal limit on how long Ford Credit Collections can sue you over the debt. After this period passes, it’s known as time-barred debt.

The statute of limitations on most debts is between 3 and 6 years, but the exact amount of time depends on several factors, including the state you live in and the type of debt that it is.

To find the statute of limitations on your debt, check your state attorney general’s website and email their office if the information you’re looking for isn’t available online.

How to remove Ford Credit Collections from your credit report

If your credit score is suffering as a result of Ford Credit Collections debt, there are two ways to recover:

1. Dispute the debt

If you think the debt that Ford Credit Collections is trying to collect isn’t yours, dispute the item on your credit report. You can also dispute it if it’s older than 7 years (measured from the date of your first missed payment)—by law, collection accounts are supposed to fall off your credit report by then.

To dispute a debt for free, send a credit dispute letter to the credit bureaus that are showing Ford Credit Collections on your credit report. You should also send a dispute letter to Ford Credit Collections.

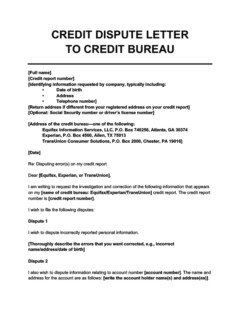

If Ford Credit Collections is on your credit report by mistake, the credit bureaus have to remove it from your report. Use this credit dispute letter template to file a dispute about Ford Credit Collections directly with any of the credit bureaus.

Credit Dispute Letter

To find out which credit bureaus you need to send the letter to, request your free credit reports from Experian, Equifax, and TransUnion at AnnualCreditReport.com. If they don’t respond to your dispute within 30–45 days, then they’re legally obligated to remove the item from your credit report.

2. Negotiate with Ford Credit Collections

Unfortunately, if the debt is legitimate and it’s less than 7 years old, removing Ford Credit Collections from your credit report will be very difficult (although not impossible).

Your best move at this point is to simply pay the debt. Newer credit scoring models, such as FICO 9 and VantageScore 3.0, ignore paid-off collection accounts, which means paying off your collection will boost your credit score even if you can’t remove the item from your credit report.

However, when you pay, there are two negotiation strategies you can try as a last-ditch attempt to remove Ford Credit Collections from your report:

- Pay for delete: You might be able to convince Ford Credit Collections to remove the negative mark in exchange for paying off the debt. You can open these negotiations by sending them a pay-for-delete letter.

- Goodwill deletion: This is an alternate strategy you can try after paying your debt. Once the account is paid off, you can send Ford Credit Collections a goodwill letter template asking them to empathize with your situation and remove the mark from your credit report as an act of kindness.

If you can’t afford to pay off your debt, try negotiating a debt settlement

If your debt is fairly old, then there’s a chance that Ford Credit Collections will accept less than the full amount you owe (a practice known as debt settlement) to minimize their losses. You can negotiate a debt settlement with Ford Credit Collections over the phone or by sending a debt settlement letter.

How to file a complaint against Ford Credit Collections

If you’re unhappy with how Ford Credit Collections is treating you, then you can file a complaint on the Better Business Bureau (BBB) website.

However, bear in mind that the BBB is a private organization that has no affiliation with the US government. The BBB will forward your complaint to Ford Credit Collections, but there’s no guarantee that Ford Credit Collections will address it in a satisfactory manner.

Alternatively, if Ford Credit Collections has done something illegal, then you can report them to the Federal Trade Commission, the Consumer Financial Protection Bureau, or your state attorney general.

Can I sue Ford Credit Collections for harassment?

No, you can’t sue Ford Credit Collections for harassment. You may have heard that you can sue debt collectors for harassing you, but this doesn’t apply to Ford Credit Collections since they’re a first-party debt collector and they’re not required to abide by the Fair Debt Collection Practices Act.

However, you may be able to sue Ford Credit Collections if they violate the Telephone Consumer Protection Act when calling you. You may also be able to press charges if a representative threatens you.

How to stop Ford Credit Collections from calling you

Ford Credit Collections will contact you by whatever means they see fit if they believe you have an unsettled debt, and they won’t stop unless you pay the debt or reach an agreement with them.

Ordinarily, debt collection agencies have to stop calling you if you send them a debt verification letter. However, Ford Credit Collections isn’t obligated to do so because they’re a first-party debt collector—they collect their own debts, not debts owed to other companies. This means that many of the normal laws on debt collection, such as the Fair Debt Collection Practices Act (FDCPA), don’t apply to them.

Nevertheless, you can try these approaches to get them to stop calling you:

- Send them a letter: Although this isn’t guaranteed to work, you can try sending Ford Credit Collections a letter asking them to stop calling you and only communicate with you in writing. They may be more likely to agree to your request if you previously had a good relationship with them.

- Block their calls: You can set up a call-blocking service by contacting your phone service provider or downloading a blocking app onto your mobile phone. However, bear in mind that this comes with risks—for example, they may be more inclined to sue you over the debt.

Note that, depending on where you live, it’s possible that stricter laws actually do apply to Ford Credit Collections. Several states have their own laws (often modeled off of the FDCPA) that place more stringent restrictions on first-party debt collectors. Look up your local legislation and consider consulting with an attorney to learn more.

Takeaway: If Ford Credit Collections is contacting you, they probably think you owe them a debt

- Ford Credit Collections is a legitimate debt collector, and they collect delinquent debts that consumers owe them.

- Ford Credit Collections isn’t a scam, but you should make sure to avoid scammers by verifying your debts and only making payments once you're sure they're legitimate.

- Because Ford Credit Collections is a first-party debt collector, they don’t need to abide by the Fair Debt Collection Practices Act, and there are fewer restrictions on how they contact you (unless your state has its own laws governing first-party debt collectors).

- There are several ways of removing Ford Credit Collections debt from your credit report. If these approaches fail, then consider seeking advice from a credit repair professional.