If you’ve recently been told you owe a debt to AcceptanceNOW, you may be feeling confused or scared, especially if you’ve never even heard of the company before.

To protect yourself from scams and avoid damage to your credit and finances, you’ll need to learn what AcceptanceNow does and how to deal with them.

Table of Contents

What is AcceptanceNOW?

AcceptanceNOW was formerly a Texas-based rent-to-own company specializing in furniture leasing and financing, but they don’t go by that name anymore.

In 2020, AcceptanceNOW merged with Merchant Preferred to form Preferred Lease, which is part of the larger company Rent-A-Center. 1 2

Is AcceptanceNOW a debt collection agency?

No, AcceptanceNOW isn’t a debt collection agency, and it never was. Instead, they were a company that offered rent-to-own financing and leasing options to consumers through third-party retailers.

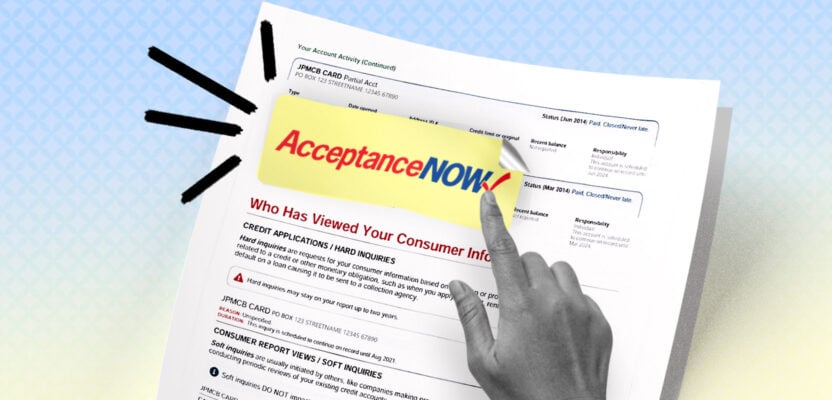

If you see AcceptanceNOW or Preferred Lease on your credit report, it’s probably because you currently have or previously had a lease-to-own agreement with AcceptanceNOW, Preferred Lease, or Rent-A-Center.

Having one of these names on your credit report isn’t necessarily a bad thing. Preferred Lease claims that they can help consumers build credit through lease-to-own solutions, which means that your payments may be improving your credit score (if you made them all on time). 3

What debts does AcceptanceNOW deal with?

AcceptanceNOW offered rent-to-own financing options on behalf of third-party retailers, with the vast majority of contracts being for furniture. Below is an overview of the types of products they helped finance: 4

AcceptanceNOW debt distribution

- Furniture & accessories: 76%

- Appliances: 11%

- Consumer electronics: 10%

- Computers: 3%

Is AcceptanceNOW a scam?

No, AcceptanceNOW isn’t a scam, and neither is Preferred Lease. They’re a legitimate company that offers retail financing for consumers with bad or no credit.

However, you should never send anyone money or share sensitive personal information with them before first verifying their identity. Scammers may be posing as AcceptanceNOW to try to trick you into paying them. You can confirm your balance by contacting AcceptanceNOW directly using the contact information below.

How to stop AcceptanceNOW from hurting your credit

If you see a derogatory mark on your credit report from AcceptanceNOW (such as a late payment), you should take steps to stop them from hurting your credit. You can start with disputing the item on your credit report, which you can do by sending a letter to the relevant credit bureau.

You can also try asking AcceptanceNOW to remove negative items from your credit history in one of two ways:

- Pay for delete: Use a pay-for-delete letter template to offer AcceptanceNOW payment in exchange for the removal of negative marks. You can also use pay for delete as part of a debt settlement agreement.

- Goodwill deletion: Use a goodwill letter template to ask AcceptanceNOW to remove negative marks out of kindness. This is less likely to work, but it’s worth a shot.