You might have heard that there’s a 11-word phrase that you can say to immediately stop debt collectors from contacting you ever again. If that sounds too good to be true, your instinct is correct—unfortunately, this magical phrase doesn’t actually exist.

Receiving endless phone calls from debt collectors can put a huge strain on your mental health, so it’s disappointing to learn that you can’t make them go away so easily. The good news is, there are things you can do to stop debt collectors from contacting you, although they take a little more effort. We’ll explain what to do, as well as why it’s not always a good idea.

Table of Contents

What is the 11-word phrase to stop debt collectors from contacting you?

Again, there’s no 11-word phrase that will always stop debt collectors from contacting you. You might have read other articles that claim the phrase is something like, “Please cease and desist all calls and contact with me, immediately,” but there’s nothing special about this phrase and it won’t necessarily work.

Origins of the 11-word phrase myth

The 11-word phrase to stop debt collectors was first mentioned in an interview on Larry King’s show in which credit guru John Ulzheimer was promoting the book “Credit Secrets,” which was written by Scott and Alison Hilton.

Ulzheimer claimed that on page 43 of the book, there’s a “simple 11-word phrase you can use that makes it so no bill collector can ever contact you again.” He went on to say that “this one single phrase makes it illegal for a debt collector to even dial your phone number.”

This isn’t true. In fact, the purported 11-word phrase doesn’t even show up anywhere in the book.

His comment on the interview triggered swarms of debtors to search in vain for the exact 11-word phrase. In actuality, it was just a marketing ploy to boost the book’s sales.

Why the 11-word phrases you’ve read online won’t work

Spiraling off the incident, several blog posts popped up on finance sites claiming to provide the infamous 11-word phrase. Their phrases are variations on the one we gave at the top of this section—”Please cease and desist all calls and contact with me, immediately.”

It is true that you have the right to tell debt collectors to stop contacting you, but you don’t need to use any particular wording (that phrase or any others) to do so.

What’s more, legally, debt collectors only have to abide by your request if you deliver it in writing. If you tell your debt collector to cease and desist over the phone, they don’t have to listen, regardless of whether you use the 11-word phrase or not.

Fortunately, there are other ways you can stop debt collectors from contacting you, and they’re only a little more complicated than saying the 11-word phrase.

How to actually stop debt collectors from contacting you

Debt collectors and debt collection agencies are governed by a law called the Fair Debt Collection Practices Act (FDCPA), which places significant restrictions on when and how they can contact you. For instance, the FDCPA forbids collectors from calling you incessantly or at odd hours (before 8 am or after 9 pm).

The FDCPA also gives you the right to tell debt collectors not to contact you, both temporarily and permanently. Here’s how to do it.

To temporarily stop debt collectors: ask for debt verification

When a debt collector first contacts you, you have 30 days to respond with something called a debt verification letter.

This is a letter that forces the debt collector to provide evidence that you actually owe the debt they’re contacting you about (such as records from the company you originally owed it to). Once the debt collector receives your verification letter, they can’t contact you or take any other measures to collect the debt until they provide this.

Assuming you do owe the debt and it’s not a mistake, this won’t permanently get the collector to stop contacting you. However, it will give you a temporary break that you can use to scrape together money to pay it—or to gather evidence of your own, if you believe you don’t owe the debt and you’re planning to dispute it.

Creating and sending a debt verification letter

To protect your rights, make sure to send your debt verification letter within 30 days of receiving your debt validation notice (the initial communication that debt collectors are required to send you).

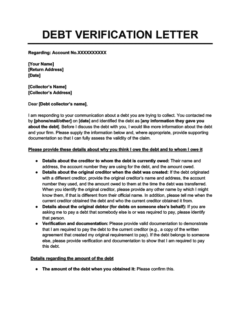

You can create your letter using the template below:

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

To permanently stop debt collectors: write a cease and desist letter

Per the FDCPA, debt collectors must stop contacting you entirely if you ask them in writing not to. You can do so by sending them a cease and desist letter.

Once they receive your letter, they can no longer contact you for any reason, with just two exceptions:

- Acknowledging your request: Debt collectors can send a single reply to your cease and desist letter confirming that they received it and that they won’t contact you again.

- Notifying you about a lawsuit: If your debt is legitimate, your debt collector can still sue you over it, and they’re allowed to contact you to tell you that they’re doing so.

If you decide to send a cease and desist letter, send it by certified mail with a return receipt so that you can prove your debt collector received it. Once they do, barring the situations above, you won’t hear from them again.

Is using this method a good idea?

As you’ve probably gathered, sending a cease and desist letter stops your debt collector from contacting you, but that’s all it does. It won’t wipe out debts that you actually owe or prevent the collector from suing you (any more than the 11-word phrase will).

Given this, is shutting down communication from your debt collector actually a good idea? That depends on your situation.

If you’re confident your debt collector won’t file a lawsuit against you, sending a cease and desist letter has no real downside. For example, if your debt is illegitimate (meaning you don’t actually owe it) or if it’s so old that it’s passed its statute of limitations and become time-barred, your collector can’t sue you over it (and if they try, they won’t win).

However, if your debt is legitimate and recent, it’s better to leave your debt collector with some way to contact you. Otherwise, suing you is the only way they’ll have to get their money, which might force them to escalate things more than they otherwise would have.

Is there anything you can say to prevent debt collectors from suing you?

You can stop debt collectors from contacting you, but there’s no way to prevent them from suing you over legitimate debts. The 11-word phrase won’t prevent that, and neither will the methods listed above.

Here are the only ways to protect yourself from debt-related lawsuits:

- Prove you don’t owe the debt: If you already paid the debt or it was never yours to begin with, you don’t have to pay it. If you challenge the debt with a verification letter and the collector continues trying to collect it or threatens a lawsuit, get in touch with an attorney.

- Wait for the debt to become time-barred: As mentioned, all debts have “statutes of limitations”—time limits on how long you can be sued over them. If your debt is nearing the statute of limitations, all you have to do is hang in a little while longer and you’ll be protected from lawsuits.

- Pay the debt: Of course, the simplest way to protect yourself is to simply pay your debt in collections. This is your most realistic path forward unless your debt is very old or you’re certain you don’t owe it.

However, even if you decide to pay, you don’t necessarily need to deal with your debt collector personally, and you certainly don’t need to put up with debt collector harassment.

Per the FDCPA, if you tell a debt collector that you have an attorney, all of their communications must go through them. You can also hire a credit counselor to negotiate with your debt collector on your behalf and set up a payment plan. This makes it possible to pay what you owe without ever talking to your collector directly.

Takeaway: You can’t make debt collectors stop contacting you by saying a 11-word phrase

- The 11-word phrase that stops debt collectors is a myth (unfortunately). It came from an interview to promote a book about credit.

- However, there are other ways to stop debt collectors and collection agencies from contacting you.

- By law, debt collectors can no longer contact you if you send them a cease and desist letter.

- If you send your debt collector a debt validation letter, they also can’t get in touch with you until they prove you owe the debt.