Buying a house is exciting. You’re not only gaining ownership of a place you can call home, you’re also acquiring a major financial asset and probably making a dramatic alteration to your credit profile by taking out a home loan.

Just how much can a mortgage improve your credit score, though, and will it make it easier or harder to get access to new lines of credit in the future?

Table of Contents

What happens to your credit score after you buy a house?

Immediately after you take out a mortgage to buy a house, you can expect your credit score to drop slightly. This happens after you take out any new credit account, not just mortgages.

As time goes on, your score will recover and gradually improve. After a year or two, the net effect of your mortgage will be positive, provided you always pay your bills responsibly.

The illustration below provides a quick guide to how mortgages usually affect your score over time.

Short and Long-Term Effects of Taking Out a Mortgage

As you can see, ultimately your mortgage will benefit your score (assuming you never miss any payments on it). It’s hard to say exactly how many points your score will go up in the end, but mortgages contribute significantly to your credit profile.

Depending on what your score is right now, it’s possible that after a few years, it will have increased by dozens or even hundreds of points (although it’s hard to tell how much of this will be directly due to your mortgage and how much will be influenced by your other actions in that period).

How mortgages improve your credit score over time

Once your mortgage is finalized and you’ve officially bought a home, your new mortgage will appear in your credit history and begin factoring into the credit score calculation process.

It’ll take around 30–60 days for it to appear on your credit report. 1 At this point, the mortgage will officially begin contributing to five key factors that make up your credit score:

- Payment history: How many on-time and late mortgage payments you have.

- Credit utilization: How much you currently owe on your mortgage compared to the amount you originally borrowed.

- Length of credit history: How long you’ve had the mortgage compared to how long you’ve had your other credit accounts.

- Credit mix: How many mortgages and loans you have and whether they’re balanced out by other types of credit like revolving credit (e.g., credit cards).

- New credit: How recently you applied for and opened your mortgage account. You’re lightly penalized for opening new credit accounts, which is part of why your score will drop when you first apply for a mortgage.

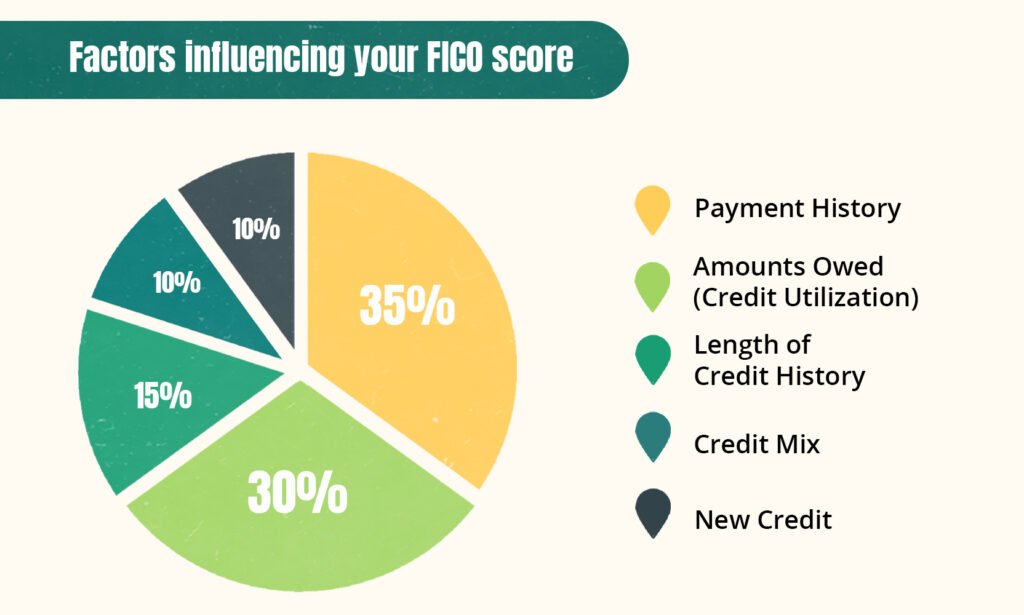

It’s worth bearing in mind that these factors aren’t all weighted equally. Some play a more important role in determining your credit score, which is partly why your mortgage will influence your score differently throughout the repayment period.

How Mortgages Affect Your FICO Score

Below, we’ll dive a little deeper into how mortgages can improve your credit score by strengthening these credit score categories and enriching your credit file.

Lowering your debt-to-credit ratio

Each time you make a mortgage payment (or miss a payment), it’ll be recorded on your credit report and impact your credit score. Your credit score will gradually increase as long as you make all your mortgage payments on time and in full.

In addition to building up a good payment history, paying down your mortgage balance will raise your credit score by lowering the amount of debt you have and your debt-to-credit ratio (every major scoring model will reward you for having less outstanding debt).

Not only is this good for your credit score, it’ll also show future lenders that you can manage your debts well and that you can afford to take on new financial commitments.

Increasing your credit age

Credit scoring models will award you more points for having a longer history of using credit because it demonstrates that you’re a lower-risk borrower.

When you first take out your mortgage, it will bring down the average age of your credit accounts, which will temporarily lower your score. However, once you’ve had the home loan on your credit report for a few years, it will start benefiting your score, and this effect will get stronger over time.

Boosting your credit mix

If you’ve just taken out your first mortgage, your credit score will benefit from the added diversity to your credit mix. This is especially true if you have no other types of loans.

However, since credit mix accounts for a small percentage of your credit score, the boost you’ll get from your mortgage probably won’t become apparent until your score has recovered from the initial drop that came with taking out the mortgage in the first place.

When mortgages won’t raise your credit score

Home loans don’t always improve your credit score. Your mortgage can actually damage your credit through the following mechanisms:

- Initial credit score damage: Mortgage applications can cause a small dip in your credit score due to hard inquiries, which show up on your credit report when mortgage lenders check your credit. As mentioned, your score will also take a temporary drop when you open it because it will lower your average credit age.

- Missed payments, default, foreclosures, and short sales: As you’d expect, missing mortgage payments will have a negative impact on your credit score. The damage to your credit will be more severe the longer you go without making payments. Even a short sale, which might seem better than a foreclosure on the surface, can do serious damage to your credit.

- Forbearance: While it may seem harmless, forbearance can hurt your credit score by allowing more interest to accumulate and add to your mortgage balance. In a FICO simulation, people who saw a score change during forbearance lost 6.9 points after 6 months and 10.9 points after 12 months, on average. 2

- Damage after paying off your mortgage: Your credit score can drop when you finish paying off debt, whether it’s a mortgage or another type of loan. This is mainly because of the difference in how scoring models weight open vs. closed accounts and how paying off your mortgage will affect your debt-to-credit ratio.

The main point is that mortgages are generally good for your score, but can cause a minor drop when you first open or close the credit account. You can also severely damage your credit if you fail to make your payments on time.

The graph shows how much your score might drop when you violate the terms of your mortgage, according to FICO. 3

How Many Points a Mortgage Can Drop Your Credit Score

| Starting FICO Score | ~680 | ~720 | ~780 |

| Drop in FICO Score after negative events | |||

| 30 day late payment | 60–80 | 70–90 | 90–100 |

| 90 day late payment | 60–80 | 90-110 | 90–110 |

| Short sale (with no deficiency balance) | 50–70 | 95–115 | 130–150 |

| Short sale (with deficiency balance) | 85–105 | 130–150 | 140-160 |

| Foreclosure | 85–105 | 130–150 | 140-160 |

As you can see, the better your score to begin with, the worse it will suffer if you damage your payment history on your mortgage.

How soon after getting a mortgage can you apply for new credit?

It’s important to avoid applying for any new credit accounts (including credit cards and loans) until you’ve completed your mortgage application and actually own the house. Submitting new credit applications in the interim could slow down or even halt the mortgage closing process.

Once you’ve got the house keys in your hands, you’re free to apply for as many new lines of credit as you want. Before you do, however, there are a couple of drawbacks you should consider:

- Your credit score may be lower: Always check your credit score before applying for new credit to avoid rejection. You may no longer qualify for the best interest rates and credit limits if taking out the mortgage temporarily lowered your score, in which case it may be worth waiting until your credit has had some time to recover.

- Putting move-in costs on a credit card is expensive: If you’re tempted to get new credit cards so that you can cover the cost of moving, furnishing, and redecorating your new home, be careful. Credit cards tend to have high interest rates that can further strain your finances.

With that said, if you apply for a new credit card or loan immediately after your mortgage has closed, there’s a chance that the mortgage won’t be on your credit report yet. In this case, you may get access to better rates and terms than you would if you waited a few months to apply.

How to raise your credit score after taking out a mortgage

After buying a house, there are several steps you can take to help your credit score recover more quickly and take advantage of the benefits of having a mortgage on your credit report:

- Make all your mortgage payments on time: The main way that a mortgage will improve your credit score is by helping you establish a long and positive payment history. Prioritize always paying your mortgage bill on time and in full to maintain a gradual increase in your credit score.

- Pay off as much debt as possible: Your debt amount skyrockets when you take out a mortgage. Although paying off your mortgage is a long process, you can help offset the negative effects of your high mortgage balance by taking steps to keep your balances as low as possible on other credit accounts (especially credit cards).

- Let your accounts age: Avoid closing old credit accounts, and only apply for new credit accounts when necessary. This will help ensure that your credit age is always increasing and allow your credit score to gradually increase over time.

Your new home loan will give you a great foundation for achieving an excellent credit score or even the highest possible score of 850. The best thing you can do is continue managing your credit accounts responsibly and give it time.

Takeaway: A mortgage can help you achieve better credit than ever before, but it takes time and dedication.

- Right after a mortgage is added to your credit report, your credit score will probably be lower than it was before you bought your house.

- By repaying your mortgage as agreed, your credit score will gradually increase from on-time payments, a lower loan balance, a longer credit history, and a stronger credit mix.

- Mortgages can hurt your credit by causing hard inquiries, initially reducing your credit age, and increasing your debt. Falling behind on payments is especially damaging.

- Wait until after mortgage closing before applying for new credit. You should then submit your credit applications before the mortgage appears in your credit file.

- The best thing you can do to ensure that your credit score increases after you buy a home is do your best to pay down your debts and allow your credit accounts to age.