Having a good credit score has obvious advantages—you have more loan options and can qualify for lower interest rates and better credit cards.

If you’re preparing to open a new credit account, then you may be looking for ways to build credit fast, particularly if your credit score isn’t very good right now. But how long will it take to improve your score?

Table of Contents

How long does it take to build or repair your credit?

How long it’ll take to raise your credit score depends on the current state of your credit file. It could take as little as one month or up to a couple of years, depending on whether you’re:

- Building credit for the first time: If you’ve never used credit before and you’re starting from scratch, it won’t take as long to raise your credit score because new information that’s added to your credit report will carry more weight.

- Repairing damaged credit: If you’re trying to repair your credit after damaging it, it’ll take significantly longer to improve it.

If you’re a new borrower, building credit is simple. Open a credit card for first-time borrowers, use it regularly and responsibly, and follow all the standard advice for building credit for the first time. You can expect to see a noticeable boost in your score in 1–6 months.

On the other hand, if you’re trying to repair a damaged credit score, things are a little more complicated. The time it will take to improve your score depends on several factors.

What affects how long it takes to improve a damaged credit score?

There are four factors that influence the time it will take to increase your credit score:

- Your current credit score: The lower your score is, the faster you’ll be able to make initial gains. If your score is below 500, for instance, you might be able to raise it by 100 points or more in under a year, but your gains will level off after a certain point. You probably won’t be able to keep that pace in your second year.

- Your original credit score: Similarly, the higher your score was before you damaged it, the longer it will take for it to recover. If you had a very good credit score of 780 to start with and then a series of mishaps knocked it down, it will be harder to get back to where you were than if you started with a fairly average 670 credit score.

- The severity of the negative items in your credit history: As you might expect, it takes longer to recover from more serious derogatory marks. For example, your score will recover from hard inquiries within 6–12 months, but it could take years to bounce back from extreme items like charge-offs or bankruptcies.

- The methods you use to improve your credit score: Some credit repair methods are more effective than others. For example, if negative items are removed from your credit report, your credit score could increase by 100 points overnight, whereas this kind of increase would take much longer to achieve if you simply wait for your score to improve naturally.

The table below shows data from a study by FICO on how long it will take your score to recover from various negative marks. The data specifically relates to mortgages, so items related to other types of credit may be a bit different, but will still follow this basic pattern.

How Long It Will Take Your Credit Score to Recover from Different Events

| Negative item | Original score: 680 | Original score: 720 | Original score: 780 |

|---|---|---|---|

| 30-day late mortgage payment | 9 months | 2.5 years | 3 years |

| 90-day late mortgage payment | 9 months | 3 years | 7 years |

| Short sale, deed-in-lieu of foreclosure, or foreclosure | 3 years | 7 years | 7 years |

| Bankruptcy | 5 years | 7–10 years | 7–10 years |

What is the maximum time it will take for your score to improve?

Black marks can stay on your credit report for up to 7 years (10 years for some bankruptcies). This means that a damaged credit score will take a maximum of 7–10 years to fully recover, provided you don’t incur any more negative items in the intervening time.

In practice, your credit score will improve more quickly than that because the effect that negative items have on your credit score diminishes over time. As the table above shows, in many cases, you can expect your score to recover within 2–3 years.

What can delay an increase in your credit score?

Your credit score won’t instantly increase every time you do something good for your credit. Credit scores are calculated based on the information in your credit reports, and credit reports are usually only updated when creditors report new information (typically once every 30–45 days).

This means that it’ll usually take at least a month to see the results of any positive steps you take to boost your credit score.

How to quickly raise your credit score

Ultimately, your credit score is in your hands. There are several things you can do to ensure that your score rises as quickly as possible.

Know where to focus your efforts

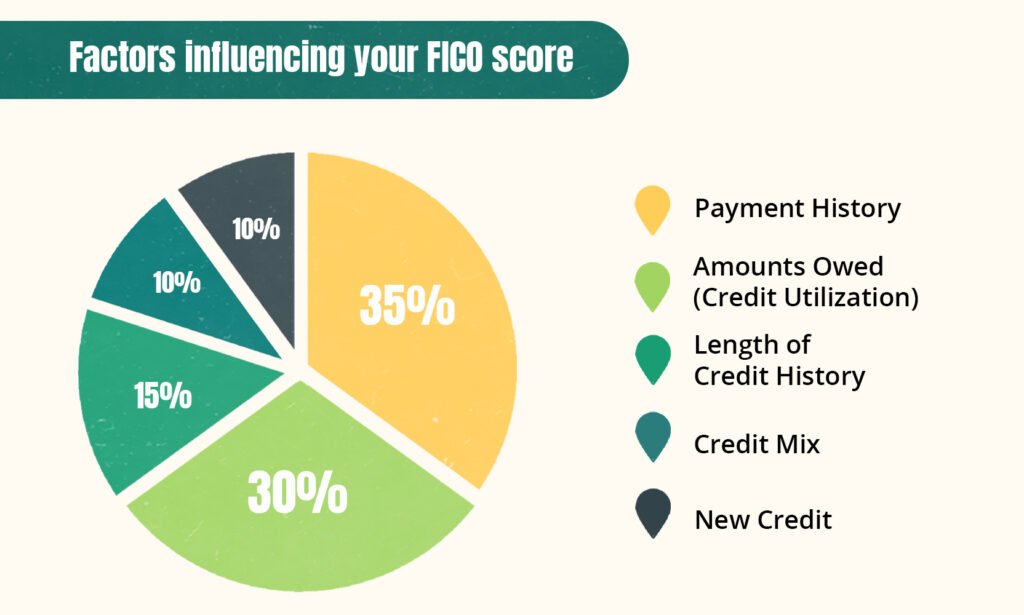

Not all credit scoring factors are weighted equally. For example, as you can see from the chart below, two factors make up a full 65% of your score:

- Payment history: The most important scoring factor, this is a record of your payments on your credit accounts. If your record shows a lot of late payments or other negative marks, your score will suffer.

- Credit utilization: Your credit utilization represents how much you spend on revolving credit accounts (aka credit cards). Keep your credit card spending as low as possible for the best results.

FICO Scoring Factors

Don’t waste time focusing on the wrong scoring factors. Follow these tips to quickly and efficiently improve your payment history and credit utilization:

- Ask your creditors to delete late payments: If you have any delinquencies, try negotiating pay for delete or sending a goodwill letter asking your creditor to remove them from your credit report. Otherwise, late payments will stay on your credit report for 7 years and drag your score down.

- Lower your spending on credit cards: The easiest way to lower your credit utilization and boost your score is to simply spend less on your cards. Aim to spend no more than 30% of your credit limit, and under 10% if at all possible.

- Request a credit limit increase: Getting an increase in your credit limit is another way of reducing your credit utilization rate. With this approach, you could see a quick score increase without changing your spending habits.

Explore credit hacks for a rapid score increase

Try using the credit hacks below to quickly increase your credit score:

- Become an authorized user: Having a relative or friend who has a good credit score add you as an authorized user on their credit card could immediately add all of the primary cardholder’s credit history to your credit report, giving your score a quick boost.

- Report your rent payments: Landlords don’t usually report rental payments to the credit bureaus, but you can still build credit by paying rent by signing up for a rent-reporting service like Rental Kharma or RentReporters. Some even let you add past rent payments to your credit report so you don’t have to wait to see your score increase.

- Use Experian Boost: Signing up for Experian Boost will allow you to add various bill payments to your Experian credit report that wouldn’t otherwise be there, such as bills for utilities, your cell phone, and even streaming services like Netflix.

Boost your credit for FREE with the bills you're already paying

Boost your credit for FREE with the bills you're already paying

- Experian Credit Report and FICO® Score updated every 30 days on sign in

- Instantly increase your credit scores for FREE with Experian Boost™

- Daily Experian credit monitoring and alerts

Dispute errors on your credit report

Roughly 1 in 5 people have errors on their credit reports, and you’d be surprised how often these errors can affect your credit score.

Checking your credit reports and correcting any errors you find may make a big difference to your credit and the amount of time it takes you to improve your score. You can request your credit reports for free from all three credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com.

If you find any errors or accounts that don’t belong to you, then file a credit dispute with the credit bureau that published the report to have them corrected. To save time and effort, simply use the letter template below:

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

Each credit reporting agency will have 30–45 days to investigate your dispute. After this period is over, they’ll be required to remove the information you disputed if they can’t confirm it.

When you’re working on your credit, it’s important not to get impatient. Building credit is a long journey and it can take years for your credit score to go up as much as you want it to, but with the right strategies, you’ll be able to make at least some gains fairly quickly. Just make sure you’re prepared to stay the course.

Takeaway: Improving your credit score may take a while, but the exact amount of time depends on several factors.

- How long it’ll take you to raise your credit score depends on whether you have a thin credit file you’re trying to build up or a bad credit history you’re trying to recover from.

- It’ll probably take you longer to improve your credit score if you have multiple or severe derogatory items on your credit report.

- If your score is low because you have a thin credit file, then you may be able to increase your credit score very quickly by adding information to your credit reports.

- You can speed up your progress by focusing on the most influential factors contributing to your credit score, using credit hacks, and checking your credit reports for errors.