It’s natural to assume that there’s a connection between your income and your credit score. After all, both play a major role in your financial health.

The truth is that there’s actually no direct relationship between your income and your credit score. However, your income can affect your score in indirect ways, and lenders often look at your income when considering your applications for credit.

Table of Contents

Why your income won’t directly affect your credit score

Your income can’t possibly affect your credit score because the credit bureaus don’t include it on your credit reports, and the information in your credit report is the only information used in the calculation of your credit score. 1

The credit bureaus don’t include your income for a simple reason—they know the amount of money you make isn’t necessarily a reflection of how well you can manage your debts, which is what your credit score is supposed to show.

For the same reason, your taxes don’t affect your credit score either (because your taxes are tied to your income). In general, the credit bureaus are interested in how you’ve handled debt that you voluntarily took on, not in circumstances that might be outside your control.

Your income can indirectly affect your credit score

Although there's no direct relationship, research suggests that high income is still correlated with having a good credit score. 2 This makes sense—if you don’t have much money coming in, it’s harder to pay your bills on time. At the bottom of this article, we'll outline the factors that determine your credit score and give a few examples of how your income can affect them.

Can you have a high credit score with a low income?

Yes, since income isn’t a factor that influences your credit score, you can definitely establish good credit even with a low income as long as you manage your finances well and develop habits that build credit.

Using your credit responsibly means doing the following:

- Paying your bills on time: This is the key to having a good credit score. Paying your bills regularly and on time boosts your credit score. Conversely, missing payments damages it.

- Minimizing the amount you spend on credit cards: Using less of your available credit (i.e., having a low debt-to-credit ratio) will improve your score.

- Regularly reviewing your credit reports: It’s important to monitor your credit to make sure there are no errors on your credit reports and you haven’t had your identity stolen. You can easily get a free copy of your credit report from each of the three major credit bureaus at AnnualCreditReport.com or by signing up for credit monitoring services.

Does your income affect your chances of getting approved for credit?

Yes, your income can affect your chances of approval when you apply for a new credit card or loan. Even though your income doesn’t contribute to the credit score that your lender sees when they review your application, they can review it separately and factor it into their decision.

When lenders review your credit application, they consider two things:

- Your reliability as a borrower: Lenders want to know whether you’ll hold up your end of the bargain and actually pay your debts back as agreed. To assess your creditworthiness, they’ll check your credit score and find out whether you have a history of late payments.

- Whether you can afford to repay your debt: Even if your credit score shows you take your debts seriously, lenders will still only offer you funds that they think you can afford to pay back.

For this reason, it’s common for lenders to require proof of income as part of the application process for loans and credit cards. This can be in the form of a pay stub or tax return.

Your debt-to-income (DTI) ratio is crucial in mortgage applications

In addition to evaluating whether your credit score is high enough to buy a home, mortgage lenders will usually look at your debt-to-income ratio, which represents how much of your income is already going toward repaying debts. Most lenders will want to see a DTI below 43% so that they know you’ll be able to make your payments. 3

How does your income affect your credit limit?

Your creditor will consider your income when determining your credit limit (the amount you’re allowed to spend on your credit card).

Card issuers usually set your credit limit based on these factors:

- Your income

- Your debt-to-income ratio

- Your credit score

- The information on your credit report

If you have a low income but a good credit score, you might still get approved for a high credit limit. However, the reverse is also true—if you have a strong income but a poor credit history and a bad credit score, you might still have trouble getting the credit limit you want.

How changes in your income can affect your credit limit

If you get a raise at work and notify your credit card issuer, there’s a chance they’ll offer you a credit limit increase. Generally speaking, requesting a credit limit increase won’t hurt your credit. In fact, if your request is approved, it could give your credit score an immediate boost by increasing the amount of available credit you have, which is good for your score.

Credit card issuers sometimes increase your credit limit without you even needing to ask. Most companies review cardholder accounts every 6–12 months, and if you’ve provided them with updated income information or your credit score has improved, they may automatically increase your limit for you. 4

What factors impact your credit score?

Now that you know your income doesn’t directly impact your credit score, you might be wondering what factors actually do affect it.

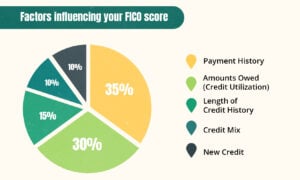

There are five main factors that contribute to your credit score. Here’s a look at how these factors are weighted in the FICO scoring models, which 90% of lenders in America use. 5

How Your FICO Score Is Calculated

- Payment history: The record of your payments (or lack thereof) on your credit accounts is the most important factor in determining your credit score. You can improve your payment history by paying your bills on time and bringing your accounts current.

- Credit utilization: Credit utilization is the amount of debt you have compared to your available credit. In general, a lower credit utilization rate (which you can get by using less credit) means a better credit score

- Length of credit history: This factor considers the average age of your credit accounts as well as the age of your oldest account. You’re considered a lower-risk borrower if you have old accounts that show you have a lot of experience using credit.

- Credit mix: Credit mix is the variety in the types of credit accounts you have. It’s good to have a diverse credit portfolio, which includes a combination of installment accounts (which are loans you pay back in fixed amounts, like mortgages, auto loans, or student loans) and revolving credit accounts (like credit cards or store cards).

- New credit: Credit scoring models also consider the number of recent credit applications you’ve made. One of the reasons why opening a new credit card hurts your credit is that credit applications trigger hard inquiries, which take a few points off your credit score.

Looking at those factors, it’s easy to see that even though your income doesn’t directly contribute to any of them, it can have a strong indirect impact.

For instance, if you lose your job and are suddenly without a source of income, it might be harder to pay your bills on time, which will damage your payment history. Similarly, with no money coming in, you might be forced to use your credit cards more heavily, which will hurt your credit utilization rate.

To protect your credit, it’s a good idea to make sure you have an emergency fund (most financial experts advise saving enough money to pay for 6 months of expenses) so that you can deal with temporary hits to your income.

Takeaway: Your income doesn’t directly affect your credit score, but it can still affect your credit applications.

- Your salary, along with certain other types of demographic information like marital status and ethnicity, isn’t included in your credit report or factored into your credit score.

- It’s possible to have a high credit score with a low income as long as you manage your credit accounts responsibly.

- Your income can affect your eligibility for loans and credit cards because many lenders require proof of income to assess your ability to repay the funds you borrow.

- Lenders assess your proof of income along with your credit report, credit score, and DTI when setting your credit limit.

- The factors that do contribute to your credit score are your payment history, credit utilization, length of credit history, credit mix, and number of new credit applications.